By Eliot Brown and Bob Davis

Qualcomm Inc. said it plans to scrap its $44 billion purchase of

Dutch chip maker NXP Semiconductors NV on Wednesday after failing

to secure approval in China, making the deal one of the most

prominent victims of spiraling U.S.-China trade tensions and

derailing a central part of the U.S. chip giant's strategy.

China was the last of nine markets that needed to approve the

deal, which would have been among the biggest ever between

technology companies. The acquisition was announced in October 2016

and extended in April as the chip makers sought approval from

China's competition regulators.

Instead, the deal became mired in Beijing's trade fight with

Washington.

Qualcomm said Wednesday it won't again extend the agreement,

which expires just shy of midnight ET, though it said its decision

was pending any new material developments.

Qualcomm's decision to walk follows a round of last-minute

lobbying on the company's behalf by senior U.S. officials including

Treasury Secretary Steven Mnuchin and Commerce Secretary Wilbur

Ross, who tried to persuade their Chinese counterparts to separate

the deal's approval process from broader trade tensions, U.S.

industry executives said.

The deal's demise puts a leading U.S. technology company atop a

list of those affected by the trade battle, which has produced

tit-for-tat tariffs by the U.S. and China on billions of dollars of

goods across a range of industries.

"It's not just a trade war anymore," said Eswar Prasad, a

Cornell University economist who worked in China while at the

International Monetary Fund. "It's becoming a more open economic

conflict between the two countries." The deal's collapse, he said,

"certainly is a strong signal that China is going to use every

available lever."

The Chinese embassy didn't immediately respond to a request for

comment. Chinese officials previously have said the deal presented

potentially negative issues that were difficult to resolve.

Qualcomm said it plans to spend up to $30 billion buying its own

stock to placate shareholders. The collapse of the planned merger

also requires the San Diego chip maker to pay a $2 billion

termination fee to NXP, based on their renewed agreement in

April.

The deal's planned termination, which came as Qualcomm reported

profit jumped 41% in its latest quarter on a 4% gain in revenue,

caps a remarkable period of tumult for the company, the world's top

producer of communications chips used in smartphones and other

gear.

Just four months ago, the Trump administration intervened to

save Qualcomm from a $117 billion hostile takeover by Broadcom Ltd.

on the grounds that Qualcomm's technology was vital to U.S.

national security. Qualcomm is a U.S. leader in the development of

so-called fifth-generation, or 5G, cellular technology that will

help connect a slew of new devices to wireless networks, and the

White House's intervention effectively designated Qualcomm a

national champion essential to battling China's rising might in

5G.

Qualcomm had billed the NXP deal, announced 12 days before

Donald Trump was elected president, as transformational, expanding

its reach beyond smartphones into areas such as automobiles and

smart-home devices. The deal would have added a company with $9.26

billion in revenue last year and some 30,000 employees to Qualcomm,

which had $22.29 billion in sales in its latest fiscal year and a

similar number of employees.

Originally expected to close by the end of last year, the NXP

deal was approved by eight other regulatory bodies, including in

the U.S. and Europe. But it dragged with China's antitrust

authority, which has broad reach to claim say over deals in which

at least one party has a significant presence in the Chinese

market.

As the deal languished, trade tensions between the U.S. and

China escalated from bellicose rhetoric to tariffs by each side

that are aimed at $50 billion of imports from the other. Mr. Trump

has threatened to put tariffs on all $505 billion of Chinese

imports into the U.S.

With the clock ticking down to Wednesday's expiration, Mr.

Mnuchin spoke with Chinese Vice Minister Liu He to push for

approval, and Mr. Ross did the same with China's ambassador to the

U.S., Cui Tiankai, according to the U.S. industry executives. The

U.S. officials argued the Qualcomm decision should be made on the

merits of the deal.

Spokesmen for the Treasury and Commerce departments declined

Tuesday to discuss the U.S. government's efforts.

Their moves came after President Trump worked to ease U.S.

penalties on ZTE Corp. so that the Chinese telecommunications giant

could continue to operate after it was found to have violated U.S.

sanctions on North Korea and Iran. Some U.S. government and

industry officials had expected the ZTE efforts would prompt China

to reciprocate and approve the Qualcomm-NXP deal.

Many Qualcomm shareholders had already lost faith that the NXP

deal would happen, and were eager for the company to move on. That,

combined with the strong quarterly results, helped send Qualcomm's

shares up more than 6% in after-hours trading to more than $63,

though they remain well below the nearly $69 level they traded at

in January, when Broadcom pursued the company.

Qualcomm reported $1.22 billion in net income for its fiscal

third quarter, up 41% from a year ago. Revenue came in at $5.6

billion. The results were buoyed by a $500 million partial

settlement in a patent dispute with an unnamed company that

licenses Qualcomm technology. The company has previously been

identified as Huawei Technologies Co. A Huawei spokesman didn't

immediately respond to a request for comment.

Still, the NXP deal's collapse adds pressure on Qualcomm and its

chief executive, Steve Mollenkopf, who failed to win majority

support from shareholders in a March board-election vote. Closing

the NXP deal was seen as an important step toward restoring

investor confidence after Qualcomm's shares lost over a quarter of

their value in the last four-plus years, while the PHLX

Semiconductor Index has more than doubled.

Qualcomm also is contending with a legal battle over patent

royalties with Apple Inc., long one of its biggest customers. And

Mr. Mollenkopf faces a looming challenge from former chairman and

CEO Paul Jacobs, son of Qualcomm co-founder Irwin Jacobs, who is

trying to raise funds to buy the company and take it private -- a

bid largely viewed as a long shot.

--Yoko Kubota contributed to this article.

Write to Eliot Brown at eliot.brown@wsj.com and Bob Davis at

bob.davis@wsj.com

(END) Dow Jones Newswires

July 25, 2018 17:43 ET (21:43 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

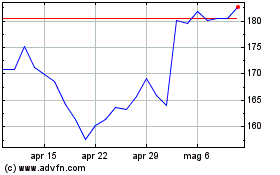

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Mar 2024 a Apr 2024

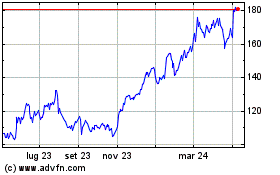

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Apr 2023 a Apr 2024