By Eliot Brown and Bob Davis

Qualcomm Inc. scrapped its $44 billion purchase of Dutch chip

maker NXP Semiconductors NV after a Wednesday deadline to gain

approval in China passed, making the deal one of the most prominent

victims of spiraling U.S.-China trade tensions and derailing a

central part of the U.S. chip giant's strategy.

China was the last of nine markets that needed to approve the

deal, which would have been among the biggest ever between

technology companies. The acquisition was announced in October 2016

and extended in April as the chip makers sought approval from

China's competition regulators.

Instead, the deal became mired in Beijing's trade fight with

Washington.

Qualcomm said Thursday it terminated the agreement with NXP

after it expired late Wednesday. NXP is due to collect a $2 billion

breakup and announced plans for a $5 billion share buyback.

Qualcomm's decision to walk away follows a round of last-minute

lobbying on the company's behalf by senior U.S. officials including

Treasury Secretary Steven Mnuchin and Commerce Secretary Wilbur

Ross, who tried to persuade their Chinese counterparts to separate

the deal's approval process from broader trade tensions, U.S.

industry executives said.

Chief Executive Steve Mollenkopf told analysts Qualcomm's

decision was "a difficult one," but that the company didn't believe

"a change in the current geopolitical environment" was likely in

the near future.

The deal's demise puts a leading U.S. technology company atop a

list of those affected by the trade battle, which has produced

tit-for-tat tariffs by the U.S. and China on billions of dollars of

goods across a range of industries.

"It's not just a trade war anymore," said Eswar Prasad, a

Cornell University economist who was a senior International

Monetary Fund China specialist. "It's becoming a more open economic

conflict between the two countries." The deal's collapse, he said,

"certainly is a strong signal that China is going to use every

available lever."

The Chinese Embassy didn't respond to a request to comment, but

a Chinese Ministry of Commerce spokesman rejected suggestions that

China's inaction was influenced by the bilateral trade fight.

"As far as I know, the case is a matter of antitrust law

enforcement," the spokesman said. "It has nothing to do with

China-U.S. trade frictions."

Qualcomm said it plans to spend up to $30 billion buying its own

stock to placate shareholders, replacing an existing $10 billion

buyback plan. The collapse of the planned merger also requires the

San Diego chip maker to pay a $2 billion termination fee to NXP,

based on their renewed agreement in April.

The deal's termination came as Qualcomm said profit jumped 41%

in its latest quarter on a 4% gain in revenue. The big jump in

profit partly reflects a comparison to a year-earlier quarter that

was the first in years to not include patent royalties from Apple

Inc. devices.

Qualcomm executives also told analysts they expect their modems

wouldn't be used in the next iPhone, a move expected by

investors.

The end of the NXP pursuit caps a remarkable period of tumult

for Qualcomm, the world's top producer of communications chips used

in smartphones and other gear.

Just four months ago, the Trump administration intervened to

save Qualcomm from a $117 billion hostile takeover by Broadcom Ltd.

on the grounds that Qualcomm's technology was vital to U.S.

national security. Qualcomm is a U.S. leader in the development of

so-called fifth-generation, or 5G, cellular technology that will

help connect a slew of new devices to wireless networks, and the

White House's intervention effectively designated Qualcomm a

national champion essential to battling China's rising might in

5G.

Qualcomm had billed the NXP deal, announced 12 days before

Donald Trump was elected president, as transformational, expanding

its reach beyond smartphones into areas such as automobiles and

smart-home devices. The deal would have added a company with $9.26

billion in revenue last year and some 30,000 employees to Qualcomm,

which had $22.29 billion in sales in its latest fiscal year and a

similar number of employees.

Qualcomm shares rose more than 5% in after-hours trading to

nearly $63, though they remain below the nearly $69 level they

traded at in January, when Broadcom pursued it. NXP, meanwhile,

fell more than 3% as it now faces a future as a standalone

company.

Originally expected to close by the end of last year, the NXP

deal was approved by eight other regulatory bodies, including in

the U.S. and Europe. But it dragged with China's antitrust

authority, which has broad reach to claim say over deals in which

at least one party has a significant presence in the Chinese

market.

As the deal languished, trade tensions between the U.S. and

China escalated from bellicose rhetoric to tariffs by each side

that are aimed at $50 billion of imports from the other. Mr. Trump

has threatened to put tariffs on all $505 billion of Chinese

imports into the U.S.

With the clock ticking down to Wednesday's expiration, Mr.

Mnuchin spoke with Chinese Vice Minister Liu He to push for

approval, and Mr. Ross did the same with China's ambassador to the

U.S., Cui Tiankai, according to the U.S. industry executives.

The U.S. officials argued the Qualcomm decision should be made

on the merits of the deal. Spokesmen for the Treasury and Commerce

departments declined to discuss the U.S. government's efforts.

Their moves came after President Trump worked to ease U.S.

penalties on ZTE Corp. so that the Chinese telecommunications giant

could continue to operate after it was found to have violated U.S.

sanctions on North Korea and Iran. Some U.S. government and

industry officials had expected the ZTE efforts would prompt China

to reciprocate and approve the Qualcomm-NXP deal.

Qualcomm reported $1.22 billion in net income for its fiscal

third quarter. Revenue came in at $5.6 billion. The results were

buoyed by a $500 million partial settlement in a patent dispute

with an unnamed company that licenses Qualcomm technology. The

company has previously been identified as Huawei Technologies Co. A

Huawei spokesman didn't respond to a request to comment.

Still, the NXP deal's collapse adds pressure on Qualcomm and Mr.

Mollenkopf, who failed to win majority support from shareholders in

a March board-election vote. Closing the NXP deal was seen as an

important step toward restoring investor confidence after

Qualcomm's shares lost over a quarter of their value in the past

four-plus years, while the PHLX Semiconductor Index has more than

doubled.

--Yoko Kubota contributed to this article.

Write to Eliot Brown at eliot.brown@wsj.com and Bob Davis at

bob.davis@wsj.com

(END) Dow Jones Newswires

July 26, 2018 08:16 ET (12:16 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

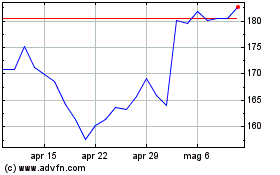

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Mar 2024 a Apr 2024

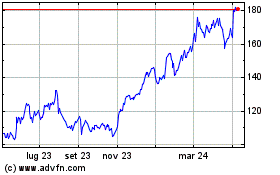

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Apr 2023 a Apr 2024