Facebook Leads Tech-Share Decline

26 Luglio 2018 - 5:56PM

Dow Jones News

By Michael Wursthorn and Ben St. Clair

-- Facebook stock leads S&P 500 lower

-- European autos gain ground

-- ECB leaves rates unchanged

Tumbling shares of Facebook pulled the S&P 500 lower

Thursday after disappointing earnings results rocked investor

confidence in one of Wall Street's most popular trades.

The social-media giant fell 19% in recent trading, putting it on

pace for its steepest decline since its shares started trading six

years earlier. The selloff started after Facebook said late

Wednesday that revenue grew slower than expected in the second

quarter and warned that it expected growth to decline over the rest

of the year.

Investors say the lackluster results have renewed concerns that

the massive growth in revenue and profits among some of tech's

stalwarts may not be sustainable -- and that could put another

hurdle in front of a stock market already grappling with trade

tensions and concerns of a possible policy misstep by the Federal

Reserve.

The frantic rise in growth stocks like Facebook in recent years

has "been a concern for a while," said Matthew Forester, chief

investment officer of BNY Mellon's Lockwood Advisors, who added

that Facebook's misstep could be another sign that the stock market

is nearing the end of its rally. "In a late cycle, you would

typically see concerns about momentum stocks, and I'd put a lot of

the technology names in that category."

Besides that, Facebook is a popular holding among investors and

fund managers, and the drop in share price is expected to be felt

widely, Mr. Forester added.

Facebook's plight was felt in some corners of the tech industry;

however, the broader market appeared to weather the selloff.

The S&P 500 fell 0.1% in recent trading, while the

tech-heavy Nasdaq Composite shed 0.8%. The Dow Jones Industrial

Average, however, added 152 points, or 0.6%, to 25568.

Shares of Amazon.com, which reports quarterly results after the

market closes Thursday, slipped 1.3% in recent trading, while

Netflix fell 0.9% to extend its decline so far this month to 8.2%.

Netflix, one of the best-performing stocks this year, has struggled

since it missed its own forecasts by more than a million

subscribers in the second quarter.

"We have continually expressed concern about such narrow

large-cap leadership, especially in the names where valuation is

not a consideration," said Mike O'Rourke, chief market strategist

with JonesTrading, in a research note after Facebook released

results late Wednesday. "This appears to be the beginning of the

end of the FANG era, " he added of the commonly known Wall Street

acronym representing Facebook, Amazon.com, Netflix and Google

parent Alphabet.

In Europe, markets posted gains as investors cheered an

agreement between the U.S. and the European Union to hold off on to

new tariffs. Asian stocks fell, dragged lower by declines in tech

companies.

The Stoxx Europe 600 added 0.8%, led by the auto sector.

European auto companies had been under pressure after President

Trump's threats to impose tariffs on imports. However, following

Wednesday's meeting between Mr. Trump and European Commission

President Jean-Claude Juncker, the two sides agreed to hold off on

such measures.

The two leaders also agreed they would talk through their

differences and begin discussions to ease existing tariffs as well,

although no schedule was set to complete talks.

However, analysts at Citigroup called the truce "more optics

than substance" in a note to investors Thursday, noting the

tentative nature of the agreement and the limited discussion of

autos.

In Asia, losses in the tech sector contributed to declines in

the Shanghai Composite Index and Hong Kong's Hang Seng, which were

down 0.7% and 0.5%, respectively. Japan's Nikkei Stock Average was

off 0.1%.

While trade tensions eased on the European front, worsening

U.S.-China trade relations hit another snag Wednesday, when

Qualcomm said it would abandon its $44 billion purchase of Dutch

chip maker NXP Semiconductors NV after failing to secure approval

in China. The deal had been approved by eight other regulatory

bodies, but was held up by China's antitrust authority.

Shares of Qualcomm rose 4.2% Thursday.

Qualcomm's decision to walk away from a planned NXP takeover

followed a round of last-minute lobbying on the company's behalf by

senior U.S. officials, including Treasury Secretary Steven Mnuchin

and Commerce Secretary Wilbur Ross.

Write to Michael Wursthorn at Michael.Wursthorn@wsj.com

(END) Dow Jones Newswires

July 26, 2018 11:41 ET (15:41 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

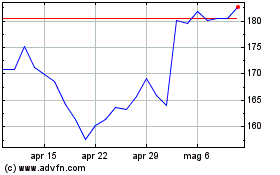

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Mar 2024 a Apr 2024

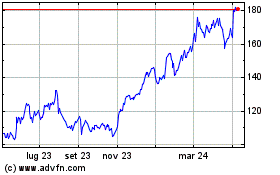

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Apr 2023 a Apr 2024