Clichy, 26 July 2018 at 6.30 p.m.

First-half 2018 results

Strong pace of growth continues: +6.6%

[1]

combined with quality results

-

Sales: 13.39 billion

euros

-

Double-digit growth at L'Oréal

Luxe and Active Cosmetics

-

Very strong growth of the New

Markets and gradual improvement of

North America

-

Further improvement in

profitability: +30 basis points

Commenting on these figures, Mr

Jean-Paul Agon, Chairman and Chief Executive Officer of L'Oréal,

said:

"In a beauty

market which remains dynamic and is becoming more premium, L'Oréal

is continuing to achieve strong growth. In lively markets, the

L'Oréal Luxe and Active Cosmetics Divisions have both recorded

double-digit growth, driven by the power of their brand portfolios

and the quality of their innovations. The Consumer Products

Division, especially with a robust performance at L'Oréal Paris,

has recorded moderate growth, held back by an environment that is

very difficult in some markets. The Professional Products Division,

meanwhile, has posted a slight increase in sales.

Across the

geographic Zones, the New Markets accelerated once again,

especially in Asia. North America is gradually improving, while

Western Europe is affected by persistent difficulties in France,

and by the slowdown in the United Kingdom.

The Group's

digital lead is continuing, particularly in e-commerce [2], which

posted +36.4% growth in the first half and represents 9.5% of

sales. L'Oréal also reaffirms its leadership in Travel Retail,

which grew by +27.3% [1].

The Group has delivered quality results paving the

way for the future. The strong growth in gross profit indeed

enables the Group at the same time to increase profitability,

support investments in Research and Innovation, and raise the

business drivers to further develop our brands. Net earnings per

share has increased by +5.3% [3] and by

+10.7% at constant exchange rates.

The good sales growth and the quality of the

first-half results reinforce our confidence in our ability to once

again outperform the cosmetics market in 2018, and to achieve

significant like-for-like [1] sales

growth and an increase in our profitability."

First-half 2018 sales

Like-for-like, i.e. based on a comparable structure and

identical exchange rates, sales growth of the L'Oréal group was

+6.6%.

The net impact of changes in the scope of

consolidation was +0.4%.

Currency fluctuations had a negative impact of

-7.2%. If the exchange rates at 30 June 2018, i.e.

€1 = $1.164, are extrapolated until 31 December 2018, the impact of

currency fluctuations on sales would be approximately -4.3% for the

whole of 2018.

Based on reported figures, the Group's sales

at 30 June 2018 amounted to 13.39 billion euros, i.e. -0.2%.

Sales by operational Division and geographic

Zone

| |

2nd quarter

2018 |

1st half

2018 |

| |

|

Growth |

|

Growth |

| |

€m |

Like-for-like |

Reported |

€m |

Like-for-like |

Reported |

| By operational Division |

|

|

|

|

|

|

|

Professional Products |

834.2 |

+1.4% |

-5.3% |

1,631.5 |

+1.6% |

-6.2% |

| Consumer

Products |

3,066.4 |

+2.3% |

-3.0% |

6,136.8 |

+2.5% |

-4.0% |

| L'Oréal

Luxe |

2,138.9 |

+13.0% |

+7.4% |

4,391.4 |

+13.5% |

+5.9% |

| Active

Cosmetics |

572.6 |

+12.9% |

+7.7% |

1,231.0 |

+11.4% |

+8.5% |

| Group total |

6,612.1 |

+6.3% |

+0.7% |

13,390.7 |

+6.6% |

-0.2% |

| By geographic Zone |

|

|

|

|

|

|

| Western

Europe |

2,009.3 |

-2.0% |

-2.8% |

4,134.1 |

-0.8% |

-1.6% |

| North

America |

1,828.7 |

+3.5% |

-4.1% |

3,564.4 |

+3.0% |

-6.8% |

| New

Markets, of which: |

2,774.1 |

+15.4% |

+7.1% |

5,692.2 |

+15.2% |

+5.7% |

| - Asia, Pacific |

1,709.6 |

+22.9% |

+16.8% |

3,548.1 |

+22.0% |

+13.2% |

| - Latin America |

456.1 |

+1.0% |

-10.6% |

882.7 |

+0.6% |

-10.4% |

| - Eastern Europe |

421.9 |

+9.7% |

-1.2% |

899.4 |

+8.1% |

-1.0% |

| - Africa, Middle East [4] |

186.5 |

+6.8% |

-1.2% |

362.1 |

+12.2% |

+1.9% |

| Group total |

6,612.1 |

+6.3% |

+0.7% |

13,390.7 |

+6.6% |

-0.2% |

PROFESSIONAL

PRODUCTS

At the end of

June, the Professional Products Division posted +1.6% like-for-like

growth and -6.2% based on reported figures.

All the geographic Zones are growing, except for Western Europe,

still impacted by the sluggishness of some markets. The United

States and the Asia Pacific Zone continue to grow, while Latin

America is maintaining its good growth rate.

Hair colour is benefiting from the strong growth of Shades EQ at Redken and the

dynamic contribution of SoColor by Matrix and Dialight by L'Oréal Professionnel. In haircare, Kérastase is being boosted by the new Résistance Extentioniste line and the continuing

success of Fusio-Dose, the customised in-salon

haircare treatment. At L'Oréal Professionnel,

the Source Essentielle natural haircare range

has made a promising start.

CONSUMER PRODUCTS

In the first

half, the Division posted growth of +2.5% like-for-like, and -4.0%

based on reported figures.

L'Oréal Paris is maintaining its growth

momentum, thanks to the good performance in facial skincare and

particularly its Revitalift anti-ageing

franchise, but also the success of new launches such as Dream Lengths in haircare and Color

Riche Shine in makeup. Maybelline New York

is posting good growth thanks to its foundations and especially

Fit me, but also to the strong success of

Superstay Matte Ink lipstick and the new

Total Temptation mascara.

The Division is still facing difficulties in France - where the

market trend is negative - and in Brazil, while growth has edged

down in the United Kingdom. It is growing in the other regions,

thanks to dynamic performances in Asia, especially in China and

India, and in Eastern Europe.

E-commerce sales are growing strongly.

L'ORÉAL LUXE

At the end of

June, L'Oréal Luxe posted growth of +13.5% like-for-like and +5.9%

based on reported figures, maintaining the dynamism it achieved at

the start of the year.

The Division's top four brands have all recorded double-digit

growth. Lancôme, thanks especially to

Génifique, and Kiehl's

with Line-Reducing Concentrate and the

Midnight Recovery range in particular, are

benefiting from accelerating skincare sales and the excellent

performance of their star franchises across all regions. Giorgio Armani is accelerating in fragrances, with the

success of Sì Passione following that of

Emporio You and Acqua di Giò

Absolu. Yves Saint Laurent is building up

its long-lasting product range in foundations with All Hours and in lip makeup with Tatouage Couture.

The Division is strengthening its positions worldwide, thanks to

strong growth in Asia, especially in China where L'Oréal Luxe is

confirming its leadership. The Division is also benefiting from the

fast growing pace of Travel Retail, and a solid performance in

Europe where it is also winning market share. The Division's

e-commerce is accelerating, with the successful launch of its

Yves Saint Laurent and Giorgio Armani brands on Tmall.

ACTIVE COSMETICS

The Active

Cosmetics Division continued to accelerate in the first half, with

growth of +11.4% like-for-like and +8.5% based on reported

figures.

All the major brands are contributing to the Division's growth.

La Roche-Posay remains very dynamic with

double-digit first-half growth, and excellent performances across

all Zones. The innovative Hyalu B5 and

Anthelios lines are the leading contributors

to this success story. Vichy is maintaining a

good growth rate, thanks to the acceleration of Minéral 89, now launched across all Zones, and the

excellent start in Asia. SkinCeuticals is

continuing its worldwide acceleration. CeraVe

is now a significant contributor to the Division's growth, thanks

to its excellent performance on its original home market, the

United States, and the start of its internationalisation drive in

25 countries.

The Division is growing and winning market share across all Zones.

The e-commerce distribution channel is continuing to grow very

strongly.

Summary by geographic Zone WESTERN

EUROPE

Western Europe posted growth of

-0.8% like-for-like and -1.6% based on reported figures. It is

being held back by the slowdown in the United Kingdom market and by

persistent difficulties in France. L'Oréal Luxe is winning market

share thanks to Kiehl's facial skincare and

Giorgio Armani fragrances. The Active

Cosmetics Division is also outperforming its market, with La Roche-Posay proving extremely dynamic. In a sluggish

mass market sector, the Consumer Products Division saw its skincare

market share edge slightly down in the first half, but is

strengthening its position as the makeup leader and posting very

promising results for the key haircare launches of Elsève Dream Lengths by L'Oréal

Paris and Fructis Hair Food by Garnier.

NORTH AMERICA

The Zone recorded growth of +3.0%

like-for-like and -6.8% based on reported figures. While the mass

market sector posted moderate growth, the Consumer Products

Division increased its market share in makeup, hair colour and

haircare, thanks to flagship brands L'Oréal

Paris and Maybelline New York. L'Oréal

Luxe is continuing to accelerate in skincare, thanks to Kiehl's and Lancôme in particular.

The men's fragrances of Yves Saint Laurent and

Giorgio Armani are outperforming the market.

Professional Products Division sales are growing, driven by a good

performance in hair colour. The Active Cosmetics Division is

continuing to record outstanding growth, with double-digit

increases for the CeraVe, SkinCeuticals, La

Roche-Posay and Vichy brands.

NEW MARKETS

Asia,

Pacific: Growth in this Zone came out at +22.0% like-for-like

and +13.2% based on reported figures. This strong growth is being

boosted by Chinese consumers, as reflected in the growth in China

and Hong Kong across all Divisions, especially for premium brands.

E-commerce and Travel Retail accelerated in the first half.

Southern Asia is extremely dynamic, with market share gains

particularly in India and Malaysia.

Latin

America: The Zone recorded growth of +0.6% like-for-like and

-10.4% based on reported figures. In Brazil, the Consumer Products

Division is continuing to face difficulties, whilst the other

Divisions are back to a good level of growth. In the rest of the

Zone, the Active Cosmetics Division has accelerated, particularly

thanks to Vichy and the launch of the

CeraVe brand. L'Oréal Luxe is continuing to

expand in Mexico and Chile. The Professional Products Division is

posting good performances, particularly in Argentina.

Eastern

Europe: In this Zone growth amounted to +8.1% like-for-like and

-1.0% based on reported figures. Growth is being driven by

Turkey and the countries of Central Europe, especially Ukraine and

Romania. Among the Divisions, Active Cosmetics posted strong

growth, thanks to the robust health of the La

Roche-Posay brand. L'Oréal Luxe and the Consumer Products

Division are growing.

So is e-commerce, which remains very dynamic.

Africa, Middle

East: The Zone recorded growth of +12.2% like-for-like

4 and +1.9%

based on reported figures. The Gulf states are growing, even

though the market contexts remain difficult. Trends are very

positive in Egypt and South Africa. The Consumer Products and

Active Cosmetics Divisions are driving growth in this

Zone.

Important events during the period 1/4/18 to

30/6/18 and post-closing events

-

On 17 April 2018, the L'Oréal Board of Directors

decided, in application of the authorisation approved by the Annual

General Meeting of 20 April 2017, to buy back L'Oréal shares for a

maximum amount of 500 million euros in the second quarter of

2018. 2,497,814 shares were bought back from 23 April to 29

May 2018. They were cancelled by the Board of Directors on 26 July

2018.

-

On 2 May 2018, L'Oréal announced the acquisition

of 100% of Nanda Co. Ltd., the Korean lifestyle makeup company

founded by Mrs Kim So-Hee in Seoul in 2004. The acquisition was

finalised on 20 June 2018.

-

On 15 May 2018, L'Oréal announced the launch of

its first Employee Share Ownership Plan, rolled out in 52

countries, representing a maximum of 500,000 shares. The scheme has

proven extremely successful, and gave rise to a capital increase on

24 July 2018.

-

On 25 May 2018, L'Oréal finalised the

acquisition of professional hair colour brand Pulp Riot, which,

under the leadership of its two founders David and Alexis Thurston,

has been creating industry-leading content and using social media

to inspire stylists.

-

On 28 May 2018, L'Oréal and Valentino announced

the signature of a long-term licence agreement for the creation,

development and distribution of fine fragrances and luxury beauty

products under the Valentino brand.

-

On 13 June 2018, L'Oréal acquired a stake of 49%

in the Tunisian company LiPP-Distribution which distributes the

Group's brands in Tunisia.

-

At 26 July 2018 and after allowing for the two

operations mentioned above, the share capital of L'Oréal amounts to

112,016,437.40 euros, divided into 560,082,187 shares, each with a

par value of 0.20 euros.

First-half 2018 results

The limited review procedures of the half-year

consolidated accounts have been completed. The limited review

report is being prepared by the Statutory Auditors.

Operating profitability at 19.2% of sales

Consolidated profit and loss

account: from sales to operating profit.

| In € million |

30/6/17 |

As % of sales |

31/12/17 |

As % of sales |

30/6/18 |

As % of sales |

Change

H1-2018 vs. H1-2017 |

| Sales |

13,411.9 |

100.0% |

26,023.7 |

100.0% |

13,390.7 |

100.0% |

-0.2% |

| Cost of sales |

-3,780.5 |

28.2% |

-7,359.2 |

28.3% |

-3,598.3 |

26.9% |

|

| Gross profit |

9,631.4 |

71.8% |

18,664.5 |

71.7% |

9,792.4 |

73.1% |

+1.7% |

| R&D expenses |

-425.1 |

3.2% |

-877.1 |

3.4% |

-447.2 |

3.3% |

|

| Advertising and promotion expenses |

-3,913.5 |

29.2% |

-7,650.6 |

29.4% |

-4,018.3 |

30.0% |

|

| Selling, general and administrative expenses |

-2,762.4 |

20.6% |

-5,460.5 |

21.0% |

-2,751.0 |

20.5% |

|

| Operating profit |

2,530.4 |

18.9% |

4,676.3 |

18.0% |

2,575.9 |

19.2% |

+1.8% |

Gross profit,

at 9,792 million euros, came out at 73.1% of sales, a strong

improvement of 130 basis points.

Research and

Development expenses, at 447 million euros, have risen by

+5.2%. Their relative level is slightly growing at 3.3% of

sales.

Advertising and

promotional expenses came out at 30.0% of sales, an increase of

80 basis points, demonstrating the support provided for our

brands.

Selling, general

and administrative expenses, at 20.5% of sales, have decreased

slightly by 10 basis points.

Overall, operating profit, at 2,575 million euros, amounted to

19.2% of sales, an increase of 30 basis points.

Operating profit by operational Division

|

|

30/6/17 |

31/12/17 |

30/6/18 |

|

|

€m |

% of sales |

€m |

% of sales |

€m |

% of sales |

| By operational Division |

|

|

|

|

|

|

|

Professional Products |

319.9 |

18.4% |

669.4 |

20.0% |

313.4 |

19.2% |

| Consumer

Products |

1,267.5 |

19.8% |

2,419.0 |

20.0% |

1,275.4 |

20.8% |

| L'Oréal

Luxe |

970.2 |

23.4% |

1,855.8 |

21.9% |

1,026.7 |

23.4% |

| Active

Cosmetics |

303.5 |

26.7% |

471.2 |

22.6% |

326.2 |

26.5% |

Total Divisions

before non-allocated |

2,861.1 |

21.3% |

5,415.4 |

20.8% |

2,941.7 |

22.0% |

| Non-allocated [5] |

-330.7 |

-2.5% |

-739.1 |

-2.8% |

-365.7 |

-2.7% |

| Group |

2,530.4 |

18.9% |

4,676.3 |

18.0% |

2,575.9 |

19.2% |

The L'Oréal group is managed on an

annual basis. This means that half-year operating profits cannot be

extrapolated for the whole year.

The profitability of the Professional Products Division increased from 18.4% to

19.2%.

The Consumer

Products Division's profitability went from 19.8% to 20.8%.

L'Oréal Luxe

maintained its profitability at 23.4%.

The Active

Cosmetics Division remains at a very high profitability level

at 26.5%, compared with 26.7% in the first half of 2017.

Net profit excluding non-recurring items

Consolidated profit and loss

account: from operating profit to net profit excluding

non-recurring items.

| In € million |

30/6/17 |

31/12/17 |

30/6/18 |

Change

H1-2018 vs. H1-2017 |

| Operating profit |

2,530.4 |

4,676.3 |

2,575.9 |

+1.8% |

Financial revenues and expenses

excluding dividends received |

-9.9 |

-22.9 |

+14.5 |

|

| Sanofi

dividends |

350.0 |

350.0 |

358.3 |

|

Profit

before tax and associates

excluding non-recurring items |

2,870.5 |

5,003.3 |

2,948.7 |

+2.7% |

| Income tax excluding non-recurring items |

-687.5 |

-1,250.5 |

-646.7 |

|

Net profit excluding non-recurring items

of equity consolidated companies |

- |

-0.1 |

-0.1 |

|

| Non-controlling interests |

2.8 |

- 3.9 |

-1.4 |

|

Net profit excluding non-recurring items,

after non-controlling interests [6] |

2,185.8 [7] |

3,748.7 7 |

2,300.6 |

+5.2% |

| EPS [8]

(€) |

3.88 |

6.65 |

4.08 |

|

| Diluted average number of shares |

563,423,701 |

563,528,502 |

563,242,060 |

|

Overall financial

revenues are positive at 14.5 million euros.

Sanofi

dividends amounted to 358 million euros.

Income tax

excluding non-recurring items came out at 646 million euros,

i.e. a tax rate of 22%, below that of the first half of 2017, which

was 24%.

Net profit

excluding non-recurring items after non-controlling interests

came out at 2,300 million euros, an increase of +5.2% compared with

the net profit of continuing operations excluding non-recurring

items reported on 30 June 2017.

Earnings per

share, at 4.08 euros, has risen by +5.3% compared with the

first half of 2017.

Net profit

Consolidated profit and loss account: from net

profit excluding non-recurring items to net profit.

| In € million |

30/06/17 7 |

31/12/17 7 |

30/06/18 |

Change

H1-2018 vs. H1-2017 |

Net profit excluding non-recurring items,

after non-controlling interests 6 |

2,185.8 |

3,748.7 |

2,300.6 |

+5.2% |

| Non-recurring items |

-148.3 |

-167.2 |

-25.4 |

|

Of

which:

- Impact of applying the IFRS 5 accounting rule relating to

discontinued operations on net profit after non-controlling

interests

- Other non-recurring items |

-29.1

|

-240.1 |

- |

|

|

|

-96.2 |

-276.3 |

-40.4 |

|

|

|

-22.8 |

+349.2 |

+15.0 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Net profit after non-controlling interests |

2,037.5 |

3,581.4 |

2,275.2 |

+11.7% |

Operating cash

flow and balance sheet

Gross cash

flow amounted to 2,779 million euros, up by +5.5% compared with

the first half of 2017.

The change in

working capital amounted to 431 million euros. As in the first

half every year, it increased noticeably, particularly because of

the impact of the seasonality of part of our business on trade

receivables.

Investments,

at 780 million euros, represented 5.8% of sales.

Operating cash

flow amounted to 1,568 million euros, that is -3.7%.

After payment of the dividend,

share buybacks and the costs of acquisitions, the residual cash flow came out at -1,490 million

euros.

At 30 June 2018, net cash amounted to 362 million euros, compared with a

net debt of 1,492 million euros at 30 June 2017.

"This news

release does not constitute an offer to sell, or a solicitation of

an offer to buy L'Oréal shares. If you wish to obtain more

comprehensive information about L'Oréal, please refer to the public

documents registered in France with the Autorité des Marchés

Financiers, also available in English on our Internet site

www.loreal-finance.com.

This news release may contain some forward-looking

statements. Although the Company considers that these statements

are based on reasonable hypotheses at the date of publication of

this release, they are by their nature subject to risks and

uncertainties which could cause actual results to differ materially

from those indicated or projected in these statements."

This a free

translation into English of the First-half 2018 results news

release issued in the French language and is provided solely for

the convenience of English-speaking readers. In case of

discrepancy, the French version prevails.

Contacts at L'ORÉAL

(Switchboard: +33 1 47 56 70 00)

Individual shareholders and

market authorities

Mr Jean Régis CAROF

Tel: +33 1 47 56 83 02

jean-regis.carof@loreal.com

Financial analysts and

Institutional investors

Mrs Françoise LAUVIN

Tel: +33 1 47 56 86 82

francoise.lauvin@loreal.com

Journalists

Mrs Stephanie CARSON-PARKER

Tel: +33 1 47 56 76 71

stephanie.carsonparker@loreal.com

For more information, please

contact your bank, broker or financial institution (I.S.I.N. code:

FR0000120321), and consult your usual newspapers, and the Internet

site for shareholders and investors, www.loreal-finance.com or the

L'Oréal Finance app, alternatively, call +33 1 40 14 80 50.

Appendices

Appendix 1: L'Oréal group sales

2017/2018 (€ million)

| |

2017 [9] |

2018 |

| First

quarter: |

|

|

|

Operational Divisions |

6,847.8 |

6,778.6 |

| The Body

Shop |

197.2 |

|

| First quarter total |

7,045.0 |

6,778.6 |

| Second

quarter: |

|

|

|

Operational Divisions |

6,564.2 |

6,612.1 |

| The Body

Shop |

|

|

| Second quarter total |

6,564.2 |

6,612.1 |

| First

half: |

|

|

|

Operational Divisions |

13,411.9 |

13,390.7 |

| The Body

Shop |

|

|

| First half total |

13,411.9 |

13,390.7 |

| Third

quarter: |

|

|

|

Operational Divisions |

6,097.9 |

|

| The Body

Shop |

|

|

| Third quarter total |

6,097.9 |

|

| Nine

months: |

|

|

|

Operational Divisions |

19,509.9 |

|

| The Body

Shop |

|

|

| Nine months total |

19,509.9 |

|

| Fourth

quarter: |

|

|

|

Operational Divisions |

6,513.8 |

|

| The Body

Shop |

|

|

| Fourth quarter total |

6,513.8 |

|

| Full

year: |

|

|

|

Operational Divisions |

26,023.7 |

|

| The Body

Shop |

|

|

| Full year total |

26,023.7 |

|

Appendix 2: compared consolidated

income statements

| € millions |

1st

half 2018 |

1st half

2017 |

2017 |

| Net sales |

13,390.7 |

13,411.9 |

26,023.7 |

| Cost of

sales |

-3,598.3 |

-3,780.5 |

-7,359.2 |

| Gross profit |

9,792.4 |

9,631.4 |

18,664.5 |

| Research

and development |

-447.2 |

-425.1 |

-877.1 |

| Advertising

and promotion |

-4,018.3 |

-3,913.5 |

-7,650.6 |

| Selling,

general and administrative expenses |

-2,751.0 |

-2,762.4 |

-5,460.5 |

| Operating profit |

2,575.9 |

2,530.4 |

4,676.3 |

| Other

income and expenses |

-40.4 |

-96.2 |

-276.3 |

| Operational profit |

2,535.5 |

2,434.2 |

4,400.0 |

| Finance

costs on gross debt |

-11.3 |

-18.1 |

-35.5 |

| Finance

income on cash and cash equivalents |

33.5 |

21.3 |

38.5 |

| Finance costs, net |

22.2 |

3.2 |

3.1 |

| Other

financial income (expenses) |

-7.7 |

-13.1 |

-26.0 |

| Sanofi

dividends |

358.3 |

350.0 |

350.0 |

| Profit before tax and

associates |

2,908.3 |

2,774.3 |

4,727.0 |

| Income

tax |

-631.6 |

-710.3 |

-901.3 |

| Share of

profit in associates |

-0.1 |

-0.2 |

-0.1 |

| Net profit from continuing

operations |

2,276.6 |

2,063.8 |

3,825.6 |

| Net profit from discontinued

operations |

|

-29.1 |

-240.1 |

| Net profit |

2,276.6 |

2,034.7 |

3,585.5 |

|

Attributable to: |

|

|

|

|

- owners of the company |

2,275.2 |

2,037.5 |

3,581.4 |

|

- non-controlling interests |

1.4 |

-2.8 |

4.1 |

| Earnings

per share attributable to owners of the company (euros) |

4.07 |

3.65 |

6.40 |

| Diluted

earnings per share attributable to owners of the company (euros) |

4.04 |

3.62 |

6.36 |

Earnings

per share of continuing operations attributable to owners

of the company (euros) |

4.07 |

3.70 |

6.83 |

Diluted

earnings per share of continuing operations attributable

to owners of the company (euros) |

4.04 |

3.67 |

6.78 |

Earnings

per share of continuing operations attributable to owners

of the company, excluding non-recurring items (euros) |

4.11 |

3.91 |

6.70 |

Diluted

earnings per share of continuing operations attributable

to owners of the company, excluding non-recurring items (euros) |

4.08 |

3.88 |

6.65 |

Appendix 3: consolidated

statement of comprehensive income

| € millions |

1st half

2018 |

1st half

2017* |

2017** |

| Consolidated net profit for the period |

2,276.6 |

2,034.7 |

3,585.5 |

| Financial assets available-for-sale |

- |

811.0 |

-597.1 |

| Cash flow hedges |

-6.6 |

83.6 |

88.9 |

| Cumulative translation adjustments |

46.8 |

-653.4 |

-824.8 |

| Income tax on items that may be reclassified to profit or

loss (1) |

1.0 |

-57.8 |

4.5 |

| Items that may be reclassified to profit or loss |

41.2 |

183.4 |

-1,328.5 |

| Financial assets at fair value through profit or

loss |

-378.3 |

- |

- |

| Actuarial gains and losses |

- |

139.6 |

280.0 |

| Income tax on items that may not be reclassified to profit

or loss (1)

(2) |

10.8 |

-40.4 |

-107.9 |

| Items that may not be reclassified to profit or

loss |

-367.5 |

99.2 |

172.1 |

| Other comprehensive income |

-326.3 |

282.6 |

-1,156.5 |

| Consolidated comprehensive income |

1,950.3 |

2,317.2 |

2,428.9 |

|

Attributable to: |

|

|

|

|

- owners of the company |

1,948.9 |

2,319.6 |

2,424.8 |

|

- non-controlling interests |

1.4 |

-2.4 |

4.1 |

*

Half-year 2017 as reported including The Body Shop.

** Including The Body Shop over

eight months in 2017.

(1) Including, in 2017, €20.4 million

and - €21.5 million respectively from the revaluation of deferred

tax in France following the change in the tax rate by 2022, and

deferred tax in the USA following the change in the tax rate at 1

January 2018.

(2) The tax effect is as

follows:

| € millions |

1st half

2018 |

1st half

2017 |

2017 |

| Financial assets available-for-sale |

- |

-28.1 |

37.3 |

| Cash flow hedges |

1.0 |

-29.7 |

-32.8 |

| Items that may be reclassified to profit or loss |

1.0 |

-57.8 |

4.5 |

| Financial assets at fair value through profit or

loss |

11.8 |

- |

- |

| Actuarial gains and losses |

-1.0 |

-40.4 |

-107.9 |

| Items that may not be reclassified to profit or

loss |

10.8 |

-40.4 |

-107.9 |

| TOTAL |

11.8 |

-98.2 |

-103.4 |

Appendix 4:

compared consolidated balance sheets

| € millions |

30.06.2018 |

30.06.2017

(1) |

31.12.2017

(1) |

| Non-current assets |

24,981.3 |

26,010.1 |

24,320.1 |

|

Goodwill |

9,551.0 |

9,064.4 |

8,872.3 |

| Other

intangible assets |

2,884.8 |

2,694.4 |

2,579.1 |

| Property,

plant and equipment |

3,582.0 |

3,591.8 |

3,571.1 |

| Non-current

financial assets |

8,390.3 |

10,128.4 |

8,766.2 |

| Investments

in associates |

9.9 |

1.0 |

1.1 |

| Deferred

tax assets |

563.3 |

530.1 |

530.3 |

| Current assets |

10,506.9 |

11,271.8 |

11,019.0 |

| Current assets excluding assets held for sale |

10,506.9 |

9,994.6 |

11,019.0 |

|

Inventories |

2,689.4 |

2,638.4 |

2,494.6 |

| Trade

accounts receivable |

4,334.4 |

4,237.8 |

3,923.4 |

| Other

current assets |

1,400.6 |

1,381.5 |

1,393.8 |

| Current tax

assets |

69.0 |

50.9 |

160.6 |

| Cash and

cash equivalents |

2,013.5 |

1,686.0 |

3,046.6 |

| Assets held for sale |

- |

1,277 |

- |

| TOTAL |

35,488.2 |

37,281.9 |

35,339.1 |

| € millions |

30.06.2018 |

30.06.2017

(1) |

31.12.2017

(1) |

| Equity |

24,349.8 |

24,594.5 |

24,818.5 |

| Share

capital |

112.4 |

112.0 |

112.1 |

| Additional

paid-in capital |

2,977.7 |

2,889.4 |

2,935.3 |

| Other

reserves |

16,382.4 |

14,684.8 |

14,752.2 |

| Other

comprehensive income |

3,521.9 |

5,173.3 |

3,904.7 |

| Cumulative

translation adjustments |

-366.9 |

-242.7 |

-413.5 |

| Treasury

stock |

-555.9 |

-56.4 |

-56.5 |

| Net profit

attributable to owners of the company |

2,275.2 |

2,037.5 |

3,581.4 |

| Equity attributable to owners of the company |

24,346.9 |

24,597.9 |

24,815.7 |

|

Non-controlling interests |

2.9 |

-3.4 |

2.8 |

| Non-current liabilities |

1,219.6 |

1,682.7 |

1,347.2 |

| Provisions

for employee retirement obligations and related benefits |

327.4 |

544.4 |

301.9 |

| Provisions

for liabilities and charges |

295.8 |

367.8 |

434.9 |

| Deferred

tax liabilities |

583.5 |

756.0 |

597.0 |

| Non-current

borrowings and debt |

12.9 |

14.5 |

13.4 |

| Current liabilities |

9,918.8 |

11,004.7 |

9,173.4 |

| Current liabilities excluding liabilities relating to

assets held for sale |

9,918.8 |

10,759.3 |

9,173.4 |

| Trade

accounts payable |

4,396.7 |

3,996.8 |

4,140.8 |

| Provisions

for liabilities and charges |

948.5 |

816.5 |

889.2 |

| Other

current liabilities |

2,682.0 |

2,543.9 |

2,823.9 |

| Income

tax |

254.0 |

238.6 |

158.5 |

| Current

borrowings and debt |

1,637.6 |

3,163.5 |

1,161.0 |

| Liabilities relating to assets held for sale |

- |

245.4 |

- |

| TOTAL |

35,488.2 |

37,281.9 |

35,339.1 |

(1)

The balance sheets at 30 June 2017 and 31 December 2017 have been

restated to reflect the change in accounting policies resulting

from the application of IFRS 9 "Financial

Instruments".

Appendix 5: consolidated statements of changes in

equity

| € millions |

Common shares

outstanding |

Share capital |

Additional paid-in capital |

Retained

earnings

and net

profit |

Other

compre-

hensive

income |

Treasury stock |

Cumulative translation adjustments |

Equity

attributable

to owners

of the

company |

Non-controlling interests |

Total

equity |

| At 31.12.2016 |

560,098,396 |

112.4 |

2,817.3 |

17,057.3 |

4,237.6 |

-133.6 |

410.9 |

24,501.9 |

2.1 |

24,504.0 |

| Changes in

accounting policies at 01.01.2017 |

|

|

|

10.3 |

-10.3 |

|

|

- |

|

- |

| At 01.01.2017 (1) |

560,098,396 |

112.4 |

2,817.3 |

17,067.6 |

4,227.3 |

-133.6 |

410.9 |

24,501.9 |

2.1 |

24,504.0 |

|

Consolidated net profit for the period |

|

|

|

3,581.4 |

|

|

|

3,581.4 |

4.1 |

3,585.5 |

| Financial assets available-for-sale |

|

|

|

|

-559.7 |

|

|

-559.7 |

|

-559.7 |

| Cash flow hedges |

|

|

|

|

55.5 |

|

|

55.5 |

0.4 |

55.9 |

| Cumulative translation adjustments |

|

|

|

|

|

|

-824.5 |

-824.5 |

-0.3 |

-824.8 |

Other comprehensive income that may

be reclassified to profit and loss |

|

|

|

|

-504.2 |

|

-824.5 |

-1,328.7 |

0.1 |

-1,328.6 |

| Actuarial gains and losses |

|

|

|

|

172.1 |

|

|

172.1 |

|

172.1 |

Other comprehensive income that may

not be reclassified to profit and loss |

|

|

|

|

172.1 |

|

|

172.1 |

- |

172.1 |

| Consolidated comprehensive income |

|

|

|

3,581.4 |

-332.2 |

|

-824.5 |

2,424.8 |

4.1 |

2,428.9 |

| Capital

increase |

1,509,951 |

0.3 |

118.0 |

|

|

|

|

118.3 |

|

118.3 |

|

Cancellation of Treasury stock |

|

-0.6 |

|

-498.6 |

|

499.2 |

|

- |

|

- |

| Dividends

paid (not paid on Treasury stock) |

|

|

|

-1,857.7 |

|

|

|

-1,857.7 |

-3.5 |

-1,861.2 |

| Share-based

payment |

|

|

|

128.8 |

|

|

|

128.8 |

|

128.8 |

| Net changes

in Treasury stock |

-1,860,384 |

|

|

-77.2 |

|

-422.0 |

|

-499.2 |

|

-499.2 |

| Purchase

commitments for non-controlling interests |

|

|

|

|

|

|

|

- |

|

- |

| Changes in

scope of consolidation |

|

|

|

-1.3 |

|

|

|

-1.3 |

|

-1.3 |

| Other

movements |

|

|

|

0.3 |

|

|

|

0.2 |

|

0.2 |

| At 31.12.2017 (1) |

559,747,963 |

112.1 |

2,935.3 |

18,343.3 |

3,895.0 |

-56.5 |

-413.5 |

24,815.7 |

2.8 |

24,818.5 |

| Changes in

accounting policies at 01.01.2018 |

|

|

|

-11.6 |

|

|

|

-11.6 |

-0.8 |

-12.4 |

| At 01.01.2018 (2) |

559,747,963 |

112.1 |

2,935.3 |

18,331.7 |

3,895.0 |

-56.5 |

-413.5 |

24,804.1 |

2.0 |

24,806.1 |

|

Consolidated net profit for the period |

|

|

|

2,275.2 |

|

|

|

2,275.2 |

1.4 |

2,276.6 |

| Cash flow hedges |

|

|

|

|

-5.4 |

|

|

-5.4 |

-0.2 |

-5.6 |

| Cumulative translation adjustments |

|

|

|

|

|

|

46.6 |

46.6 |

0.2 |

46.8 |

Other comprehensive income that may

be reclassified to profit and loss |

|

|

|

|

-5.4 |

|

46.6 |

41.2 |

- |

41.2 |

| Financial assets at fair value through profit or

loss |

|

|

|

|

-366.6 |

|

|

-366.6 |

|

-366.6 |

| Actuarial gains and losses |

|

|

|

|

-0.9 |

|

|

-0.9 |

|

-0.9 |

Other comprehensive income that may

not be reclassified to profit and loss |

|

|

|

|

-367.5 |

|

|

-367.5 |

- |

-367.5 |

| Consolidated comprehensive income |

|

|

|

2,275.2 |

-372.9 |

|

46.6 |

1,948.9 |

1.4 |

1,950.3 |

| Capital

increase |

1,582,725 |

0.3 |

42.4 |

-0.2 |

|

|

|

42.5 |

|

42.5 |

|

Cancellation of Treasury stock |

|

|

|

|

|

|

|

- |

|

- |

| Dividends

paid (not paid on Treasury stock) |

|

|

|

-2,006.6 |

|

|

|

-2,006.6 |

-3.7 |

-2,010.3 |

| Share-based

payment |

|

|

|

57.6 |

|

|

|

57.6 |

|

57.6 |

| Net changes

in Treasury stock |

-2,497,814 |

|

|

|

|

-499.4 |

|

-499.4 |

|

-499.4 |

| Purchase

commitments for non-controlling interests |

|

|

|

|

|

|

|

- |

0.3 |

0.3 |

| Changes in

scope of consolidation |

|

|

|

-2.9 |

|

|

|

-2.9 |

2.9 |

- |

| Other

movements |

|

|

|

2.8 |

-0.2 |

|

|

2.6 |

|

2.6 |

| AT 30.06.2018 |

558,832,874 |

112.4 |

2,977.7 |

18,657.6 |

3,521.9 |

-555.9 |

-366.9 |

24,346.9 |

2.9 |

24,349.8 |

(1)

Taking into account the change in accounting policies resulting

from the application of IFRS 9 "Financial

Instruments".

(2) Taking into account the change in

accounting policies resulting from the application of IFRS 15

"Revenue from contracts with customers".

CHANGES IN FIRST-HALF 2017

| € millions |

Common shares

outstanding |

Share capital |

Additional paid-in capital |

Retained

earnings

and net

profit |

Other

compre-

hensive

income |

Treasury stock |

Cumulative translation adjustments |

Equity

attributable

to owners

of the

company |

Non-controlling interests |

Total

equity |

| At 31.12.2016 |

560,098,396 |

112.4 |

2,817.3 |

17,057.3 |

4,237.6 |

-133.6 |

410.9 |

24,501.9 |

2.1 |

24,504.0 |

| Changes in

accounting policies at 01.01.2017 |

|

|

|

10.3 |

-10.3 |

|

|

- |

|

- |

| At 01.01.2017 (1) |

560,098,396 |

112.4 |

2,817.3 |

17,067.6 |

4,227.3 |

-133.6 |

410.9 |

24,501.9 |

2.1 |

24,504.0 |

|

Consolidated net profit for the period |

|

|

|

2,037.5 |

|

|

|

2,037.5 |

-2.8 |

2,034.7 |

| Financial assets available-for-sale |

|

|

|

|

782.9 |

|

|

782.9 |

|

782.9 |

| Cash flow hedges |

|

|

|

|

53.6 |

|

|

53.6 |

0.3 |

53.9 |

| Cumulative translation adjustments |

|

|

|

|

|

|

-653.6 |

-653.6 |

0.2 |

-653.4 |

Other comprehensive income that may

be reclassified to profit and loss |

|

|

|

|

836.5 |

|

-653.6 |

182.9 |

0.5 |

183.4 |

| Actuarial gains and losses |

|

|

|

|

99.2 |

|

|

99.2 |

|

99.2 |

Other comprehensive income that may

not be reclassified to profit and loss |

|

|

|

|

99.2 |

|

|

99.2 |

- |

99.2 |

| Consolidated comprehensive income |

|

|

|

2,037.5 |

935.7 |

|

-653.6 |

2,319.6 |

-2.4 |

2,317.2 |

| Capital

increase |

958,123 |

0.2 |

72.1 |

|

|

|

|

72.3 |

|

72.3 |

|

Cancellation of Treasury stock |

|

-0.6 |

|

-498.8 |

|

499.4 |

|

- |

|

- |

| Dividends

paid (not paid on Treasury stock) |

|

|

|

-1,857.7 |

|

|

|

-1,857.7 |

-3.3 |

-1,861.0 |

| Share-based

payment |

|

|

|

63.6 |

|

|

|

63.6 |

|

63.6 |

| Net changes

in Treasury stock |

-1,860,384 |

|

|

-77.2 |

|

-422.2 |

|

-499.4 |

|

-499.4 |

| Purchase

commitments for non-controlling interests |

|

|

|

|

|

|

|

- |

0.2 |

0.2 |

| Changes in

scope of consolidation |

|

|

|

-1.3 |

|

|

|

-1.3 |

|

-1.3 |

| Other

movements |

|

|

|

-1.1 |

|

|

|

-1.1 |

|

-1.1 |

| AT 30.06.2017 (1) |

559,196,135 |

112.0 |

2,889.4 |

16,732.6 |

5,162.9 |

-56.4 |

-242.7 |

24,597.9 |

-3.4 |

24,594.5 |

(1)

Taking into account the change in accounting policies resulting

from the application of IFRS 9 "Financial Instruments".

Appendix 6:

compared consolidated statements of cash flows

| € millions |

1st half

2018 |

1st half

2017 |

2017 |

| Cash flows from operating activities |

|

|

|

| Net profit

attributable to owners of the company |

2,275.2 |

2,037.5 |

3,581.4 |

|

Non-controlling interests |

1.4 |

-2.8 |

4.1 |

| Elimination

of expenses and income with no impact on cash flows: |

|

|

|

|

- depreciation, amortisation and provisions |

467.3 |

556.9 |

1,218.5 |

|

- changes in deferred taxes |

-22.0 |

-46.9 |

-194.8 |

|

- share-based payment (including free shares) |

57.6 |

61.1 |

126.7 |

|

- capital gains and losses on disposals of assets |

0.1 |

-0.8 |

-3.9 |

| Net profit

from discontinued operations |

- |

29.1 |

240.1 |

| Share of

profit in associates net of dividends received |

0.1 |

0.2 |

0.1 |

| Gross cash flow |

2,779.7 |

2,634.3 |

4,972.2 |

| Changes in

working capital |

-431.2 |

-362.8 |

261.1 |

| Net cash

provided by discontinued operations activities |

- |

-24.9 |

-36.7 |

| Net cash provided by operating activities (A) |

2,348.5 |

2,246.6 |

5,196.6 |

| Cash flows from investing activities |

|

|

|

| Purchases

of property, plant and equipment and intangible assets |

-780.0 |

-641.9 |

-1,263.5 |

| Disposals

of property, plant and equipment and intangible assets |

1.8 |

2.6 |

8.2 |

| Changes in

other financial assets (including investments in non-consolidated

companies) |

-15.3 |

-18.0 |

-70.7 |

| Effect of

changes in the scope of consolidation |

-553.0 |

-1,240.0 |

-166.5 |

| Net cash

(used in) from investing activities from discontinued

operations |

- |

-18.4 |

-24.4 |

| Net cash (used in) from investing activities (B) |

-1,346.5 |

-1,915.7 |

-1,516.9 |

| Cash flows from financing activities |

|

|

|

| Dividends

paid |

-2,035.4 |

-1,899.7 |

-1,870.7 |

| Capital

increase of the parent company |

42.5 |

72.3 |

118.3 |

| Disposal

(acquisition) of Treasury stock |

-499.4 |

-499.4 |

-499.2 |

| Purchase of

non-controlling interests |

|

-1.9 |

-2.0 |

| Issuance

(repayment) of short-term loans |

457.5 |

1,980.1 |

-86.6 |

| Repayment

of long-term borrowings |

-2.1 |

-4.3 |

-7.0 |

| Net cash (used in)

from financing activities from discontinued operations |

- |

35.2 |

71.5 |

| Net cash (used in) from financing activities (C) |

-2,036.9 |

-317.7 |

-2,275.7 |

| Net effect

of changes in exchange rates and fair value (D) |

1.8 |

-52.2 |

-65.3 |

| Change in cash and cash equivalents (A+B+C+D) |

-1,033.1 |

-39.0 |

1,338.7 |

| Cash and cash equivalents at beginning of the period

(E) |

3,046.6 |

1,746.0 |

1,746.0 |

| Net effect

of changes in cash and cash equivalents of discontinued operations

(F) |

- |

-21.0 |

-38.1 |

| CASH AND CASH EQUIVALENTS AT THE END OF THE PERIOD

(A+B+C+D+E+F) |

2,013.5 |

1,686.0 |

3,046.6 |

www.loreal-finance.com -

Follow us on Twitter @loreal

[1] Like-for-like: based on a comparable structure and

identical exchange rates.

[2] Sales achieved on our brands' websites + estimated sales

achieved by our brands corresponding to sales through our

retailers' websites (non-audited data); like-for-like

growth.

[3] Diluted net profit per share of continuing operations,

excluding non-recurring items, after non-controlling

interests.

[4] The application of the IFRS 15 accounting rule from 1

January 2018 has resulted in the restatement of sales with

distributors when they operate as agents and not on their own

behalf. The impact of this restatement amounted to 11.6 million

euros on the sales of the Africa, Middle East Zone in the

2nd quarter and

the 1st half of

2018. The effect of this new accounting method on the profit and

loss account and the balance sheet is not material.

[5] Non-allocated expenses = Central Group expenses,

fundamental research expenses, stock options and free grant of

shares expenses and miscellaneous items. As a % of total Divisions

sales.

[6] Net profit excluding non-recurring items after

non-controlling interests, does not include capital gains and

losses on disposals of long-term assets, impairment of assets,

restructuring costs, tax effects and non-controlling

interests.

[7] Net profit from continuing operations, excluding

non-recurring items, after non-controlling interests.

[8] Diluted net profit per share of continuing operations,

excluding non-recurring items, after non-controlling

interests.

[9] In the first quarter 2017, reported Group sales included

The Body Shop sales, which amounted to 197.2 million euros.

Read the news release of 26 July

2018

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: L'ORÉAL via Globenewswire

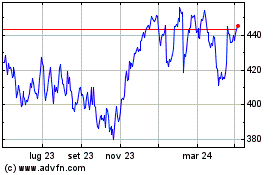

Grafico Azioni LOreal (EU:OR)

Storico

Da Mar 2024 a Apr 2024

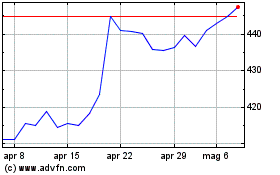

Grafico Azioni LOreal (EU:OR)

Storico

Da Apr 2023 a Apr 2024