I'm Sorry': Qualcomm and NXP Chiefs Lament Failed Deal via Texts -- Update

26 Luglio 2018 - 7:09PM

Dow Jones News

By Stu Woo

NXP Semiconductors NV Chief Executive Rick Clemmer got the text

message at 8:30 p.m. Wednesday. It was Qualcomm Inc. CEO Steve

Mollenkopf, thanking him for working together even though the chip

maker was about to abandon its nearly two-year-old, $44 billion bid

to buy NXP.

Mr. Clemmer didn't respond until 12:01 a.m. He had a smidgen of

hope that Chinese regulators would approve the merger by the

midnight Eastern time deadline Qualcomm had set.

The green light never came. Now Mr. Clemmer must plot a new

future for NXP, a Dutch business that makes computer chips for

automobiles, as a stand-alone company.

"We were prepared for this," Mr. Clemmer said in an interview

Thursday. "We were very confident about the transaction closing

until a few months ago. We realized it was a flip of a coin."

The companies announced their deal in October 2016, but it

became entangled in the U.S.-China trade feud. NXP's consolation

was a $2 billion breakup fee, which it had received by Thursday

morning.

It will use the funds quickly. To ease investor anxiety, NXP on

Thursday announced a $5 billion share buyback.

The most immediate challenge, though, could be to assure

shareholders that NXP has a plan on what it does next. Mr. Clemmer

said NXP missed out on potential business opportunities during the

21-month limbo, and analysts worry whether the company's senior

management is engaged.

Mr. Clemmer exercised options and sold more than $400 million of

NXP shares last autumn when they were trading around $113. On

Thursday, the stock traded around $91. NXP Chief Financial Officer

Daniel Durn left a year ago for the same role at rival

semiconductor maker Applied Materials Inc. NXP brought back a

previous CFO as a replacement.

"You worry about losing the good people," said Stacy Rasgon, an

analyst at Bernstein, adding that NXP "likely needs a new senior

management team."

In a conference call with analysts Thursday, Mr. Clemmer said he

and his team were fully engaged. He said NXP has plenty of room to

grow, but didn't answer some specific questions. "You have to give

us time," he said. His most definitive pronouncement was that NXP

would focus on its business. "I don't think you'll see us try to do

any big merger," he said.

NXP must also confront the reality that the markets it competes

in are changing. Based in a leafy office park in the small city of

Eindhoven in the Netherlands, NXP is a leading maker of chips used

in cars, especially for infotainment systems and sensors.

It also makes chips for identification and public-transit cards.

On Thursday, NXP reported a 10% rise in second-quarter profit to

$54 million, compared with the same period last year, on revenue up

1% at $2.3 billion.

However, competition to supply the automotive sector with chips

is increasing. Intel Corp. last year agreed to buy Israel's

Mobileye NV to boost its expertise in self-driving vehicles, while

Samsung Electronics Co. in late 2016 agreed to buy U.S. automotive

technology provider Harman International Industries Inc.

NXP could find itself marginalized. "A lot of what they sell are

things like sensors and peripherals and infotainment-type stuff,

but in the long run, the premise is the car will become more and

more like a computer, and NXP doesn't that have expertise today,"

said Tore Svanberg, a Stifel Nicolaus analyst. He said Qualcomm has

that know-how, but not the auto-industry relationships that NXP

has, which made the marriage attractive.

Mr. Clemmer told analysts Thursday that NXP could still partner

with Qualcomm.

Mr. Clemmer said he and his finance chief spent Wednesday at

NXP's Austin, Texas, office to be in the same time zone as many of

its investors. Mr. Clemmer received the text from Qualcomm's Mr.

Mollenkopf after the California-based company said in the late

afternoon that it planned to abandon the bid by midnight, barring

11th-hour Chinese approval.

In the evening, Mr. Clemmer said he spoke to the sales team in

Austin about how to keep customers who were excited about the

Qualcomm deal happy. Then shortly after midnight, when the deal was

officially abandoned, he responded to Mr. Mollenkopf.

"Many thanks for the kind words," he wrote. "I'm sorry that we

didn't have a chance to work together."

Write to Stu Woo at Stu.Woo@wsj.com

(END) Dow Jones Newswires

July 26, 2018 12:54 ET (16:54 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

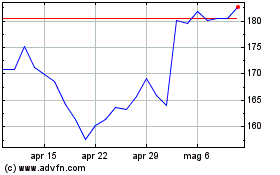

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Mar 2024 a Apr 2024

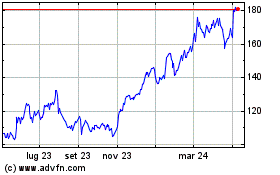

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Apr 2023 a Apr 2024