- Strong sales growth, all activities

and geographies up

- Solid performance and active

business development

- Airgas synergies ahead, to be

reached in H1 2019

Regulatory News:

Air Liquide (Paris:AI):

Key Figures (in millions of euros) H1 2018

2018/2017 as published 2018/2017

comparable (1) Group Revenue 10,162

-1.3% +5.8% Gas & Services Revenue

9,769 -2.1% +5.0%

Operating Income

Recurring 1,617 -2.3%

+6.2% Group OIR Margin 15.9%

Variation excluding energy -10bps

Gas & Services OIR Margin 17.8%

Variation excluding energy +30bps

Net Profit (Group Share) 1,040

+12.1% Net Cash Flow from Operating Activities

(2) 1,770 +11.1% Net Debt on 06/30/2018

14,217

(1) Comparable growth excluding the currency, energy (natural

gas and electricity), and significant scope impacts; see

reconciliation in appendix.(2) Cash flow from operating activities

after changes in working capital requirements and other

elements.

Commenting on the first six months of 2018, Air Liquide Chairman

and CEO Benoît Potier said:

“The positive dynamic observed during the 1st

quarter of 2018 was further confirmed in the 2nd

quarter, in the context of a customer centric strategy and a

globally more supportive economic environment. This is reflected in

sustained growth in Group revenue, which came to 10.2 billion euros

for the 1st half of this year, driven by higher sales

in Gas & Services, as well as in

Engineering & Construction, and Global

Markets & Technologies.

“All Gas & Services activities grew significantly, in

particular Industrial Merchant, Electronics, and Healthcare.

Geographically, our activities progressed in every region in the

world, and more particularly in Asia, the Americas, and in the

Middle East & Africa.

“Along with global sales growth, Group performance benefited

from an increased operating margin in Gas & Services, excluding

energy impact. The Group is performing well in terms of operational

efficiency gains and will reach Airgas synergies one year ahead of

plan. The Group’s net profit, which exceeded 1 billion euros, rose

by more than +12.1%.

“Cash flows from operations increased significantly, up

+11.1%. The Group’s balance sheet is solid.

“Investment opportunities 12 months out are at their highest

level in the last three years. The dynamic accelerated over the

course of the 1st half of this year. Decisions

are up +30%, to 1.4 billion euros. Investment backlog stood at

2.3 billion euros as of June 30, 2018, and will contribute to

future growth.

“We are in line with the objectives set forth in the NEOS

2016-2020 strategic plan. Accordingly, assuming a comparable

environment, Air Liquide is confident in its ability to deliver net

profit growth in 2018, calculated at constant exchange rate and

excluding 2017 exceptionals1.”

1 2017 exceptionals: exceptional non-cash items having a net

positive impact on 2017 net profit.

2018 Highlights

- Start-up of the world’s largest

air gas production unit, in South Africa for Sasol (€200M) and

commissioning of 4 new biogas production units, in the United

States, in France, and in the United Kingdom.

- Signature of new long-term

contracts: construction of hydrogen units for KMCI (€100M) in

South Korea and for Covestro (€80M) in Belgium, and of 2 air gas

units for Evraz (€130M) in Russia; oxygen supply to LyondellBasell

from our network in the United States.

- Multiyear contracts for the

supply of xenon and krypton for the aerospace and electronics

industries (€50M).

- Acquisitions in Home Healthcare

in Saudi Arabia. Investment in EOVE, a French start-up that

specializes in connected portable ventilators.

- Digital transformation of our assets

to increase operational efficiency: inauguration of a remote

operation center in Malaysia, optimizing the production of 18 of

Air Liquide’s Large Industries production units in Southeast

Asia.

- Hydrogen energy: first meeting

of the Hydrogen Council in China. Equity stake acquired in a

Chinese start-up, participation in the creation of a new consortium

in Japan bringing together the major players in hydrogen for

mobility. In France, inauguration of a hydrogen charging station in

Paris-Saclay.

- First bond issue on the Chinese

domestic market (“Panda”) for around €280M.

The half year benefited from strong growth in markets globally

well oriented. Group revenue totaled 10,162 million

euros in the 1st half of 2018, up +5.8% on a comparable

basis, and close to the high end of the NEOS target range. This was

supported by high Gas & Services sales, an improvement in

Engineering & Construction and the strong growth of Global

Markets & Technologies. The currency impact was strongly

negative over the half year at -6.8%, mainly due to the

appreciation of the euro against the US dollar, but eased slightly

during the 2nd quarter. The energy impact was slightly positive at

+0.4%. The sale of the Airgas Refrigerants business at the end of

2017 led to a significant scope impact of -0.7%. Published Group

revenue variation was therefore down -1.3% over the half year.

Gas & Services revenue reached

9,769 million euros during the 1st half, up

+5.0% on a comparable basis, with a strong contribution from

developing economies (+12.3%).

- Gas & Services revenue in the

Americas zone stood at 3,874 million euros over

the half year, up +4.6%. This reflects a high level of

activity in Industrial Merchant (+4.5%), in particular in the

United States. Large Industries posted solid growth (+3.1%)

despite customer maintenance turnarounds during the

2nd quarter. Healthcare sales were up markedly (+8.9%) across

the zone.

- Revenue in the Europe zone

totaled 3,464 million euros in the 1st half, up

+2.3%. Growth stabilized at a solid level in Industrial

Merchant (+2.6%). Large Industries posted higher sales over the

half year (+2.2%) despite several customer maintenance turnarounds

during the 2nd quarter. Healthcare continued its steady growth

(+4.5%) marked by stronger growth in the 2nd quarter and despite a

limited contribution from bolt-on acquisitions.

- Revenue in the Asia-Pacific

zone totaled 2,107 million euros in the 1st

half. This represented an increase of +8.8%, driven notably

by strong momentum in China (>+10%). All business lines posted

strong growth in the zone and accelerated in the 2nd quarter

(+10.8%). In Large Industries, higher sales (+6.4%) were due to the

ramp-up of units started up in the 3rd quarter of 2017 coupled with

strong demand. Industrial Merchant was up markedly in the zone

(+6.8%), with very strong growth in China. Double-digit Electronics

sales growth (+14.1%) benefited from thriving demand for new

molecules and exceptionally high sales of

Equipment & Installation.

- Revenue in the Middle East and

Africa zone amounted to 324 million euros, up

+16.6%. Sales benefited from the start-up at the end of 2017

of the largest air separation unit in the world in South Africa,

favorable business momentum in Egypt, and the launch of the

Home Healthcare activity in Saudi Arabia through an

acquisition.

All business lines contributed to growth over the half year. In

Industrial Merchant, sales growth was robust (+4.3%),

supported in particular by the manufacturing sector, metal

fabrication and construction. The price impact stood at +1.9%.

Large Industries (+5.2%) benefited from the ramp-up of

units, including a major unit in South Africa. Air gases volumes

were up markedly, driven by the chemicals sector, whereas hydrogen

volumes were penalized by a higher number of customer maintenance

turnarounds compared to last year. In Healthcare, growth was

dynamic (+5.9%) in particular in Home Healthcare where the number

of diabetic patients and patients treated for sleep apnea continued

to increase. Demand was also very dynamic in Electronics,

with revenue up +6.7%, driven by Carrier Gases, new molecules and

exceptionally high Equipment & Installation sales during the

2nd quarter.

Engineering & Construction revenue totaled

180 million euros, up +29.8% compared to the 1st

half of 2017, benefiting from the gradual improvement in order

intake seen in 2017.

Global Markets & Technologies sales were up

+29.2% at 213 million euros. These were

particularly dynamic in the biogas sector, which benefited from the

start-up of a major landfill biogas purification unit in the United

States and three small farm waste biogas purification units in

France and in the United Kingdom.

Efficiencies amounted to 174 million euros during

the first six months of the year, ahead of the annual target of

over 300 million euros from the NEOS program. They include a

contribution of 14 million euros from Airgas for the first

time.

Airgas synergies represented a cumulated

260 million US dollars since the acquisition of Airgas

in May 2016 and 45 million US dollars over the first six

months of 2018. The 300 million US dollar target will be

reached in H1 2019, i.e., 12 months earlier than initially

forecasted.

The Group’s operating income recurring (OIR) reached

1,617 million euros in the 1st half of 2018, down -2.3%

as published, but up +4.8% excluding the currency impact and

+6.2% on a comparable basis over the 1st half of 2017. The

operating margin (OIR to revenue) stood at 15.9% and

16.0% excluding the energy impact, which corresponds to a

slight decrease of -10 basis points compared with the 1st half of

2017. This was mainly due to the negative operating income

recurring generated by Engineering & Construction still under

loaded. Moreover, the disposal of the Airgas Refrigerants business

had a dilutive impact on the margin; excluding the disposal, the

operating margin would have been stable.

The Gas & Services operating margin stood

at 17.8%, up + 30 basis points excluding energy

compared with the 1st half 2017.

Net profit (Group share) amounted to

1,040 million euros in the 1st half of 2018, an

increase of +12.1% or more than +20% excluding the currency

impact.

Net cash after changes in working capital requirement (and

other items) was 1,770 million euros, an increase

of +11.1% compared with the 1st half of 2017, largely

exceeding the change in sales (published change of -1.3%).

Net indebtedness at June 30, 2018 reached

14,217 million euros.

The 12-month portfolio of opportunities totaled

2.5 billion euros at the end of June 2018, up

200 million euros compared with March 2018. Industrial

and financial investment decisions reached 1.4 billion

euros in the 1st half of 2018, up more than +30% compared

with the 1st half of 2017. Net capital expenditure

totaled 1,133 million euros and represented 11.1% of

sales, in line with the NEOS strategic plan.

The Air Liquide Board of Directors met on July 27, 2018.

During this meeting, the Board reviewed the consolidated financial

statements for the first half ending June 30, 2018. Limited review

procedures were completed with respect to the consolidated interim

financial statements, and an unqualified review report is in the

process of being issued by the statutory auditors.

Table of

contents of the activity report

H1 2018 PERFORMANCE 6

Key Figures

6

Income Statement

6

Change in Net Indebtedness

14

INVESTMENT CYCLE 15 RISK FACTORS 17 2018

OUTLOOK 17 APPENDIX 17

Currency, energy and significant scope

impacts (Semester)

18

Currency, energy and significant scope

impacts (Quarter)

19

2nd quarter 2018 revenue

20

Geographic and segment information

20

Consolidated income statement

21

Consolidated balance sheet

22

Consolidated cash flow statement

23

Return on Capital Employed – ROCE

25

H1 2018 PERFORMANCE

Except where indicated, all revenue and

operating income recurring growth discussed below are made on a

comparable basis, excluding the currency, energy and

significant scope impacts. The reference to Airgas

corresponds to the Group’s Industrial Merchant and Healthcare

activities in the United States.

Key Figures

(in

millions of euros)

H1 2017 H1 2018

2018/2017 published change 2018/2017

comparable change

Total Revenue 10,293

10,162 -1.3% +5.8% Of

which Gas & Services 9,978 9,769 -2.1%

+5.0% Operating income recurring 1,656 1,617

-2.3% +6.2% Operating income recurring (as % of

revenue) 16.1% 15.9%

Variation excluding energy - 10 bps

Other non-recurring operating income and

expenses (2) (30) Net

profit (Group share) 928 1,040 +12.1%

Adjusted earnings per share (in euros) (a)

2.18 2.44 +12.1%

Net cash flows from operating activities (b) 1,593

1,770 +11.1% Net capital expenditure

(c) 1,162 1,133 Net debt

15,610 14,217

Debt-to-equity ratio (d) 90.0% 78.6%

Return On Capital Employed – ROCE after tax

(e) 7.4 % 8.5 %

Recurring ROCE (f) 7.4 %

8.0 % + 60bps

(a) 2017 figure restated for the impact of the free share

attribution on October 4, 2017.(b) Cash flow after changes in

working capital requirements and other items.(c) Net cash flows

used in investing activities including transactions with minority

shareholders.(d) Adjusted to spread the dividend payment in H1 out

over the full year.(e) Return on capital employed after tax: see

definition and reconciliation in appendix(f) Excluding 2017

exceptional items and the impact of the US tax reform that had no

impact on cash flow.

Income Statement

REVENUE

Half-Year Revenue

(in millions of euros)

H1 2017 H1 2018 2018/2017

published change 2018/2017 comparable change

Gas & Services 9,978 9,769 -2.1%

+5.0% Engineering & Construction 146 180

+23.6% +29.8% Global Markets & Technologies

169 213 +26.3% +29.2%

TOTAL

REVENUE 10,293 10,162

-1.3% +5.8% Revenue by quarter

(in millions of euros)

Q1 2018 Q2 2018

Gas & Services 4,831 4,938

Engineering & Construction 85 95 Global Markets

& Technologies 94 119

TOTAL REVENUE

5,010 5,152 2018/2017 Group published

change -3.2% +0.7% 2018/2017

Group comparable change +6.0% +5.6%

2018/2017 Gas & Services comparable change

+5.0% +5.1%

Group

The half year benefited from strong growth in markets globally

well oriented. Group revenue totaled 10,162 million

euros in the 1st half of 2018, up +5.8% on a comparable

basis, and close to the high end of the NEOS target range. This was

supported by high Gas & Services sales, an improvement in

Engineering & Construction and the strong growth of Global

Markets & Technologies. The currency impact was strongly

negative over the half year at -6.8%, mainly due to the

appreciation of the euro against the US dollar, but eased slightly

during the 2nd quarter. The energy impact was slightly positive at

+0.4%. The sale of the Airgas Refrigerants business at the end of

2017 led to a significant scope impact of -0.7%. Published Group

revenue variation was therefore down -1.3% over the half year.

Gas & Services

Gas & Services revenue reached 9,769 million

euros during the 1st half, up +5.0% on a comparable

basis. This was driven by a strong contribution from all business

lines and a sustained increase in base business. Industrial

Merchant growth was robust (+4.3%), in particular in Asia and the

Americas. Large Industries (+5.2%) benefited from a major start-up

in South Africa at the end of the 4th quarter of 2017, but growth

was penalized by customer maintenance turnarounds in Europe and the

Americas in the 2nd quarter of 2018. Growth in Healthcare was

dynamic (+5.9%) despite a limited contribution from bolt-on

acquisitions. Demand remained very dynamic in Electronics, with

revenue up +6.7%, driven in particular by high

Equipment & Installation sales. Published sales were

down -2.1% due to unfavorable currency and scope impacts (at -6.8%

and -0.7% respectively), which were only partially offset by a

positive energy impact of +0.4%.

Revenue by geography and business line

(in millions of euros)

H1 2017 H1 2018 2018/2017

published change 2018/2017 comparable change

Americas 4,251 3,874 -8.9% +4.6%

Europe 3,371 3,464 +2.8% +2.3%

Asia-Pacific 2,032 2,107 +3.7% +8.8%

Middle East & Africa 324 324 +0.0%

+16.6%

GAS & SERVICES REVENUE 9,978

9,769 -2.1% +5.0% Large

Industries 2,694 2,718 +0.9% +5.2%

Industrial Merchant 4,757 4,501 -5.4%

+4.3% Healthcare 1,690 1,714 +1.4%

+5.9% Electronics 837 836 -0.2% +6.7%

Americas

Gas & Services revenue in the Americas zone stood at

3,874 million euros over the half year, up

+4.6%. This reflects a high level of activity in Industrial

Merchant (+4.5%), in particular in the United States. Large

Industries posted solid growth (+3.1%) despite customer maintenance

turnarounds during the 2nd quarter. Healthcare sales were up

markedly (+8.9%) across the zone.

- Large Industries posted revenue

growth of +3.1%. It benefited from strong air gases sales

growth, driven by the start-up and ramp-up of units in

Latin America and by high prices in North America following

the storms at the beginning of the year. Growth was penalized in

the 2nd quarter by several customer maintenance turnarounds which

impacted cogeneration and hydrogen sales in the United States.

- Industrial Merchant sales were

up +4.5%. Growth was strong in the United States and

increased in the 2nd quarter driven by very solid cylinder gas and

hardgoods sales which benefited from higher demand in all end

markets, in particular manufacturing, metal fabrication and

construction. In Canada, cylinder gas and hardgoods sales were up

and offset weaker liquid nitrogen volumes, in particular in the oil

extraction sector. Growth in South America remained dynamic,

despite the impact of strikes in Brazil during part of the

2nd quarter. The price impact in the zone was

+2.2%.

- Healthcare revenue was up

+8.9%, with limited contribution from bolt-on acquisitions.

Growth was strong in Medical Gases in the United States and in Home

Healthcare in Canada, more specifically in sleep apnea. Activity

maintained its strong momentum in Latin America.

- Electronics revenue was up

+1.9%, with a decrease in the 1st quarter but a +5.0%

increase in the 2nd quarter, due notably to high

Equipment & Installation sales.

Europe

Revenue in the Europe zone totaled 3,464 million

euros in the 1st half, up +2.3%. Growth stabilized at a

solid level in Industrial Merchant (+2.6%). Large Industries posted

higher sales over the half year (+2.2%) despite several customer

maintenance turnarounds during the 2nd quarter. Healthcare

continued its steady growth (+4.5%) marked by stronger growth in

the 2nd quarter and despite a limited contribution from bolt-on

acquisitions.

- Large Industries revenue was up

+2.2% in the 1st half of 2018, following a year in decline

in 2017. Growth in the 1st quarter was driven by a marked increase

in hydrogen volumes due to good activity levels at refineries in

the Benelux and Germany. However, it was impacted during the 2nd

quarter by a high number of customer maintenance turnarounds in

hydrogen. Half-year growth was dynamic in Eastern Europe and

Turkey.

- Industrial Merchant sales were

up +2.6% over the half year, slightly impacted in the 2nd

quarter by a shortage of CO2 due to stoppages at several sources,

in particular in France and the Benelux. Liquid gas sales were up

markedly in Germany during the 2nd quarter and Italy confirmed

a high level of cylinder gas and liquid gas activity. Growth

continued at a fast pace in Eastern Europe, in particular in

Poland, Russia, and in Turkey. In the Europe zone, sales of liquid

gas increased twice as fast as those of cylinder gas in the

1st half. The manufacturing and small craftsmen sectors were

the most dynamic. The price impact continued to strengthen and

reached +1.0%.

- Healthcare pursued its steady

development posting sales growth of +4.5%; the growth was

stronger in the 2nd quarter compared to the 1st (+5.5% vs.

+3.4%) and marked by a limited contribution from bolt-on

acquisitions. Home Healthcare momentum was positive and the number

of diabetic patients and patients treated for sleep apnea continued

to increase, in particular in Northern Europe. Sales in

Specialty Ingredients grew significantly, in particular in

cosmetics and adjuvants for vaccines.

Asia-Pacific

Revenue in the Asia-Pacific zone totaled 2,107 million

euros in the 1st half. This represented an increase of

+8.8%, driven notably by strong momentum in China

(>+10%). All business lines posted strong growth in the zone and

accelerated in the 2nd quarter (+10.8%). In Large Industries,

higher sales (+6.4%) were due to the ramp-up of units started up in

the 3rd quarter of 2017 coupled with strong demand. Industrial

Merchant was up markedly in the zone (+6.8%), with very strong

growth in China. Double-digit Electronics sales growth (+14.1%)

benefited from thriving demand for new molecules and exceptionally

high sales of Equipment & Installation.

- Large Industries sales were up

+6.4% over the half year, driven by the ramp-up of units

started up in the 3rd quarter of 2017 in China. These additional

sales largely offset the loss of revenue from three isolated units

in Northern China which were sold at the end of 2017. Customer

demand was very high, in particular in China in chemicals and

steel, and in South Korea and Singapore in refining.

- Industrial Merchant sales were

up +6.8%, with performances varying greatly by country. In

China, growth continued to exceed +15%, driven in particular by a

strong increase in cylinder gas and liquid argon volumes as well as

by higher prices. Revenue in Japan was down due to high equipment

sales in 2017, in particular during the 1st quarter. Business

in Australia continued to improve. Price impacts stood at

+1.9% for the zone and remained high in China.

- Electronics revenue was up by a

high +14.1%. It benefited from the dynamic demand for new

molecules, in particular in Taiwan and South Korea, ramp-ups in

Carrier Gases, as well as exceptionally high

Equipment & Installation sales, which were up by more

than +50%.

Middle East and Africa

Revenue in the Middle East and Africa zone amounted to 324

million euros, up +16.6%. Large Industries sales

benefited from the start-up at the end of 2017 of the largest air

separation unit in the world in South Africa. Business momentum

remained favorable in Egypt, with the start-up of an air separation

unit during the 1st quarter and growing volumes in Industrial

Merchant. Healthcare continued to develop steadily, in particular

in South Africa and Saudi Arabia, where a recent bolt-on

acquisition led to the launch of the Home Healthcare

activity.

Engineering & Construction

Engineering & Construction revenue totaled

180 million euros, up +29.8% compared to the 1st

half of 2017, benefiting from the gradual improvement in order

intake seen in 2017.

Order intake reached 445 million euros, an increase

compared with 329 million euros in the 1st half of 2017. Air

separation units accounted for around 60% of orders. These included

Group projects and third-party customer orders, in particular in

Asia and Eastern Europe.

Global Markets & Technologies

Global Markets & Technologies sales were up +29.2% at

213 million euros. These were particularly dynamic in

the biogas sector, which benefited from the start-up of a major

landfill biogas purification unit in the United States and

three small farm waste biogas purification units in France and

in the United Kingdom.

Order intake was up compared with the 1st half of 2017 and

reached 227 million euros.

Focus

- Air Liquide and 10 large Japanese

companies, representing several industries and finance, announced

the creation in March of the “Japan H2 Mobility” consortium

for the purpose of accelerating the deployment in Japan of hydrogen

stations and fuel cell electric vehicles. The 11 founding companies

will contribute to the development of a large-scale hydrogen

infrastructure in order to build a network of 320 stations by 2025,

and 900 by 2030. Today, there are about 100 stations already in

operation in Japan. For its part, Air Liquide will install and

operate some 20 stations by 2021.

- In March, Air Liquide inaugurated a new

hydrogen station near Versailles in France. This station

will fuel two hydrogen-powered buses, scheduled for rollout

in 2019, and supplement the Paris hydrogen taxi fleet “Hype” which

is developing rapidly with 75 hydrogen-powered vehicles and plans

to deploy a total of 200 by the end of 2018. This is the third

station that has been installed by Air Liquide in the Greater Paris

Area.

- Air Liquide has commissioned three

new biomethane production units, in the United States, in France,

and in the United Kingdom in the 1st quarter 2018, doubling its

biomethane production capacity, which now stands at 60 MW, the

equivalent of 500 GWh for a full year of production. Over the

course of the last four years, the Group has decided around 100

million euros in investments in biomethane production. The

Group operates 10 production units around the world, designed to

purify biogas in order to transform it into biomethane and inject

it into the natural gas network.

OPERATING INCOME RECURRING

Operating income recurring before depreciation and

amortization totaled 2,496 million euros, down

-2.4% as published compared to the 1st half of 2017 due to a

highly negative currency impact over the half year.

Purchases were up +1.1%, in particular those of materials

and equipment, more specifically for the

Equipment & Installation business in Electronics and

for Engineering & Construction with projects moving

forward. Moreover, attention paid to costs helped decrease

personnel costs and other expenses and income at a

faster pace than sales (-2.7% and -3.1% respectively, compared with

as published sales down -1.3%).

Depreciation and amortization reached 879 million

euros, down -2.4% due to the currency impact. Excluding the

currency impact, depreciation and amortization growth nevertheless

remained lower than revenue growth despite the impact of start-ups

and ramp-ups.

Efficiencies amounted to 174 million euros during

the first six months of the year, ahead of the annual target of

over 300 million euros from the NEOS program. They include a

contribution of 14 million euros from Airgas for the first time.

Excluding Airgas, they represent savings on cost base of 2.9%.

Almost 50% of these efficiencies related to industrial projects

targeting in particular a decrease in logistic costs and the

optimization of the operation of production units, for example with

a step up in the roll-out of remote operation centers (Smart

Innovative Operations, SIO). Almost one third of efficiencies

related to purchasing gains, principally for the purchase of

molecules in Electronics, equipment in Home Healthcare, and energy

in Large Industries. The remaining efficiencies mainly related

to administrative efficiencies and realignment plans in several

countries and business lines, notably Engineering &

Construction.

Focus

- One year after the launch of the first remote operation

center in France, Air Liquide inaugurated in January in

Malaysia its Smart Innovative Operations (SIO) Center for

the Southeast Asia Pacific region. The SIO Center enables the

remote management of production for 18 Air Liquide Large

Industries production units spanning eight countries across the

region, as well as optimizing energy consumption and improving

reliability at these sites. Air Liquide invested 20 million

euros in this project.

Airgas synergies represented a cumulated

260 million US dollars since the acquisition of Airgas

in May 2016 and 45 million US dollars over the first six

months of 2018. The share of growth synergies continued to

rise and now represents more than 40% of the half year’s synergies.

These come from the roll-out of cross-selling offers in the United

States, such as small onsite generators using Air Liquide

technology offered to Airgas customers and cylinder gases and

hardgoods now available to Air Liquide customers. They also come

from accompanying Airgas customers in their expansion in Canada and

Mexico. At the end of the 1st half, cumulated cost synergies

stood at around 215 million US dollars. In total, cumulated

synergies at end-2018 will exceed 280 million

US dollars and the 300 million US dollar target

will be reached in H1 2019, i.e., 12 months earlier than initially

forecasted.

The Group’s operating income recurring (OIR) reached

1,617 million euros in the 1st half of 2018, down -2.3%

as published, but up +4.8% excluding the currency impact and +6.2%

on a comparable basis over the 1st half of 2017. The operating

margin (OIR to revenue) stood at 15.9% and 16.0% excluding

the energy impact, which corresponds to a slight decrease of

-10 basis points compared with the 1st half of 2017. This was

mainly due to the negative operating income recurring generated by

Engineering & Construction still under loaded. Moreover, the

disposal of the Airgas Refrigerants business had a dilutive impact

on the margin; excluding the disposal, the operating margin would

have been stable.

Gas & Services

Gas & Services operating income recurring totaled

1,741 million euros, down -1.1% as published compared

with the 1st half of 2017 due to a negative currency impact. The

operating margin as published was 17.8%. Excluding the

energy impact, it stood at 17.9%, representing a +30 basis

point increase compared with the 1st half of 2017.

In a context of limited global inflation, selling prices were up

+1.2% over the half year, due in particular to Industrial Merchant

(+1.9%). Prices were down slightly in Electronics and almost

flat in Healthcare.

Gas & Services efficiencies totaled

155 million euros in the 1st half of 2018.

Gas & Services Operating margin (a)

H1

2017 H1 2018

Americas 15.8% 16.4% Europe 18.9%

18.8% Asia-Pacific 19.7% 19.3% Middle-East

& Africa 16.4% 14.3%

TOTAL

17.6% 17.8%

(a) Operating income recurring/revenue, as published

figures.

Operating income recurring for the Americas zone stood at

636 million euros in the 1st half of 2018, down

-5.2% as published due to the appreciation of the euro

against the US dollar. Excluding the energy impact, the operating

margin stood at 16.4%, representing a +60 basis point

increase compared with the 1st half of 2017. This was driven by the

high level of activity in Industrial Merchant and the Airgas

synergies. In Large Industries, the positive impact on the margin

of high prices in the United States following the storms at the

beginning of the year was partially offset by customer maintenance

turnarounds in the 2nd quarter. Finally, the high level of

Equipment & Installation sales in Electronics had a

dilutive effect on the margin.

Operating income recurring in the Europe zone reached

651 million euros, an increase of +2.3%.

Excluding the energy impact, the operating margin was 19.1%, up

+20 basis points. Despite a large number of customer

maintenance turnarounds in hydrogen and an unfavorable mix in

Industrial Merchant, the operating margin improved thanks to

stronger price effects in Industrial Merchant and efficiencies

generated across all business lines in the zone.

Operating income recurring in the Asia-Pacific zone stood

at 407 million euros, an increase of +1.6%. Excluding

the energy impact, the operating margin was 19.5%, down -20

basis points. In Electronics, the exceptionally high level of

Equipment & Installation sales and, in Large

Industries, temporary shutdowns of units in Japan and the ramp-up

of units in China, had a dilutive impact on the margin. The

Industrial Merchant operating margin improved thanks to

efficiencies and price impacts.

Operating income recurring for the Middle East and Africa

zone amounted to 46 million euros, a decrease of

-12.5% compared with the 1st half of 2017. Excluding the

energy impact, the operating margin was 13.4%, down

-300 basis points. After a transitional period in

relatively exceptional operating conditions, the hydrogen

production units in Yanbu, Saudi Arabia, have now reached their

nominal operating mode marked by a structural adjustment of the

operating margin.

Engineering & Construction

Operating income recurring for Engineering & Construction

stood at -15 million euros, penalized by a still

insufficient activity level. Nonetheless, increased order intake

throughout 2017 should allow a gradual return to the Group’s

mid-term target of maintaining a margin between 5% and 10%.

Global Markets & Technologies

Operating income recurring for Global Markets & Technology

amounted to 18 million euros. The operating margin, at

8.6%, was down compared with the 1st half of 2017 (10.6%) due

notably to the dilutive impact on the margin of biogas production

unit start-ups. Moreover, part of Global Markets & Technologies

activities is currently being launched and the level of margin,

which depends on the nature of projects carried out during the

period, can vary significantly.

Research & Development and Corporate costs

Research & Development expenses and Corporate costs totaled

127 million euros, up +8.6% compared with the

1st half of 2017 due to the development of research and the

Group’s growing digital transformation.

NET PROFIT

Other operating income and expenses showed a net

balance of -30 million euros. This was mainly related to

costs for realignment plans in various countries and business

lines, in particular in Engineering & Construction,

and Airgas integration costs.

The financial result of -145 million euros was down

compared with the 1st half 2017 (-259 million euros). Net

finance costs, at -122 million euros, were down -45.2%, mainly

due to a non-recurring gain of around 55 million euros

generated by the unwinding of hedging instruments relating to the

debt reorganization in the United States. Excluding this impact,

the average cost of net indebtedness, at 3.0%, was

slightly down by -10 basis points compared with end-June 2017

(3.1%).

Income tax expense stood at 360 million euros, a

decrease of -29 million euros compared with the 1st half of

2017, i.e., an effective tax rate of 24.9%, which represents

a 300 basis point improvement. This decrease was mainly due to the

US tax reform which was enacted at the end of 2017. Over

2018, the US tax reform should decrease the Group’s income tax

expense by between 50 and 70 million US dollars

corresponding to a reduction of the Group’s effective tax rate by

around 200 recurrent basis points.

The share of profit of associates was 3 million

euros compared with 1 million euros in the 1st half of

2017. Minority interests in net profit totaled

46 million euros, a decrease of -6.4% due mainly to a

negative currency impact.

For the record, net profit from discontinued operations

for the 1st half of 2017 (-30 million euros) reflected the

impact of the disposal of Air Liquide Welding.

Net profit (Group share) amounted to

1,040 million euros in the 1st half of 2018, an

increase of +12.1% and of more than +20% excluding the

currency impact.

Published net earnings per share, at 2.44 euros,

were up +12.1% compared with the 1st half of 2017, in line

with the increase in net profit (Group share). The average number

of outstanding shares used for the calculation of net earnings per

share as of June 30, 2018 was 426,482,436.

Change in the number of shares

H1 2017 H1 2018

Average number of outstanding shares (a)

426,503,349 426,482,436

(a) Restated in 2017 for the impact of the free share

attribution on October 4, 2017.

Change in Net

Indebtedness

Cash flow from operating activities before changes in working

capital totaled 2,000 million euros. This amount

corresponded to a high level of 19.7% of sales.

Net cash after changes in working capital requirement (and

other items) was 1,770 million euros, an increase

of +11.1% compared with the 1st half of 2017, largely

exceeding the change in sales (published change of -1.3%).

The increase in working capital requirement (WCR) was

limited to 196 million euros, compared with

317 million euros in the 1st half of 2017. The WCR to sales

ratio, excluding taxes, decreased to 8.3% compared with 9.0%

at June 30, 2017. The Gas & Services WCR to sales

ratio was down as well, from 9.1% on June 30, 2017 to

8.0% at the end of the 1st half 2018. This improvement

came primarily from the Americas zone where inventory and trade

receivables decreased, mainly through a reduction in payment delays

of certain customers and factoring measures.

Gross industrial capital expenditure reached

1,096 million euros, down -1.0% due to the

currency impact. Financial investments totaled 75 million

euros, slightly lower than the 86 million euros made in the

1st half of 2017. Gross capital expenditure in the 1st half of 2018

amounted to 1,171 million euros. Net cash flow used

in investing activities including transactions with minority

shareholders totaled 1,133 million euros and represented

11.1% of sales, in line with the NEOS strategic plan.

Net indebtedness at June 30, 2018 reached

14,217 million euros, a significant decrease of

-1,393 million euros compared with June 30, 2017. The

robustness of cash flow allowed the financing of capital

expenditures and increased dividends linked with the free share

attribution of October 2017. The debt-to-equity ratio,

adjusted for the seasonal effect of the dividend payment, stood at

78.6%, down slightly compared with end-December 2017

(80.0%).

Focus

- In March, Air Liquide successfully completed a first bond

issuance on the Chinese mainland market (“Panda”) for an

aggregate nominal amount of 2.2 billion Renminbi

(approximatively 280 million euros), becoming one of the first

European companies to issue on this market. This transaction bears

coupons of 5.95% and 6.40% for a 3-year and a 5-year

maturity respectively. The 5-year issuance, the longest

maturity ever achieved by a European company on the Panda market,

reflects the long-term dimension of the Group’s activities. The

proceeds of this issue will be used to finance new investments in

China and to refinance debt related to previous investments in

China.

The return on capital employed after tax (ROCE) stood at

8.0% in the 1st half of 2018, up +30 basis points

compared with the recurring level of end-2017 (7.7%). The

improvement excluding the currency impact was +60 basis

points.

INVESTMENT CYCLE

The upturn in activity witnessed in investment projects in

recent months continued and was reflected at the end of June 2018

by another increase in the main indicators described below, in

particular the 12-month portfolio of opportunities, investment

decisions and the investment backlog.

PORTFOLIO OF OPPORTUNITIES

The 12-month portfolio of opportunities totaled

2.5 billion euros at the end of June 2018, up

+ 200 million euros compared with March 2018, with

new projects in the portfolio being higher than those signed by the

Group, awarded to the competition or delayed. This second

consecutive increase brought the portfolio of opportunities back to

a level that has not been reached since the end of 2015.

The share of developing economies in the 12-month portfolio of

opportunities was around 40%, down compared with

March 31, 2018 due mainly to strong activities in the Americas

zone, which remains the leading region within the portfolio.

Almost half of the portfolio of opportunities corresponded to

projects with investments below 50 million euros and only a

few projects were greater than 100 million euros. The

portfolio of opportunities included a few takeovers that have a

faster contribution to growth.

INVESTMENT DECISIONS AND INVESTMENT BACKLOG

Industrial and financial investment decisions reached

1.4 billion euros in the 1st half of 2018, up more

than + 30% compared with the 1st half of 2017.

Industrial decisions accounted for more than 90% of this

amount and included in particular five major contracts in Large

Industries, in Benelux, Eastern Europe and on the Gulf Coast of the

United States, as well as three ultra-pure nitrogen supply

contracts for Electronics in Asia.

Focus

- Air Liquide announced in April having signed a new long-term

contract with Covestro, a world-leading supplier of high-tech

polymer materials, for the supply of hydrogen to their new

production site in the port area of Antwerp. Air Liquide will

invest 80 million euros in the construction of a hydrogen

production unit fitted with a new proprietary technology that

improves energy efficiency and the overall environmental

footprint of the production process. By capturing carbon and

upgrading the recovered CO2, this model is part of a

circular economy system. The hydrogen produced will also enable

Air Liquide to supply customers in this industrial basin in

Europe.

- Air Liquide and Evraz, a world major steel producer, have

signed a long-term contract for the supply of oxygen,

nitrogen and argon in Novokuznetsk, Russian Federation. Air

Liquide will invest around 130 million euros for the

construction of two state-of-the-art Air Separation Units of

1,500 ton per day of oxygen each. These plants will improve

energy efficiency and the overall environmental footprint of the

production process.

- In April, Air Liquide announced having signed a new

long-term contract in the United States with LyondellBasell

to supply oxygen to their new petrochemical plant in Texas,

expected to be completed in 2021. This new propylene oxide/tertiary

butyl alcohol plant (PO/TBA) is expected to be the largest in the

world upon construction. The oxygen will be sourced from Air

Liquide’s pipeline system which spans more than 2,000 miles along

the coasts of Texas and Louisiana, part of the largest pipeline

system in the world.

Financial investment decisions reached some

100 million euros in the 1st half.

Focus

- With the acquisition of the respiratory division of

Thimar Al Jazirah Company (TAC) in Saudi Arabia, in

early January, Air Liquide enters the Home Healthcare market in

Saudi Arabia, where the Group already supplies medical gases to

hospitals. This division is specialized in the distribution of

respiratory equipment and related services. TAC is the main player

in this field, serving over 1,400 patients at home

throughout the country. In 2016, the Home Healthcare

division of TAC generated a revenue of over 5.5 million

euros.

- Air Liquide extends its service offering of Home Healthcare

activity via the acquisition at the beginning of April of the

start-up EOVE, a French company specialized in the design

and manufacture of ventilators for home-based patients

suffering from chronic respiratory failure. EOVE developed an

innovative solution: a connected portable ventilator that takes

into account the mobility needs of patients and facilitates the

practice of doctors.

- Airgas announced, in May, the acquisition of the assets and

operations of Weiler Welding Company, a full-service industrial

gas, beverage and gas welding supply business, based in Moraine,

Ohio. This transaction marks the 500th acquisition

in Airgas’ 36-year company history.

- In June 2018, Air Liquide announced the acquirement of a

minority stake of around 10 million euros in the Chinese startup

STNE (Shanghai Sinotran New Energy Automobile Operation CO.,

LTD) to accelerate the rollout of hydrogen-powered electric

truck fleets in China. This agreement fits in the Chinese

government’s 13th five-year-plan, which aims notably to support the

development and sale of hydrogen-powered electric vehicles serving

clean mobility.

The total investment backlog amounted to

2.3 billion euros, an increase of almost

+ 100 million euros compared with the end of March 2018.

The investment backlog should represent a future contribution to

annual sales of approximately 0.9 billion euros per year after

a full ramp-up of the units.

START-UPS

Seven new units started up during the 1st half of 2018.

These include three Large Industries sites in Colombia, Egypt and

the United States, two Global Markets & Technologies units (one

of which is a landfill biogas purification unit in the United

States), one ultra-pure nitrogen unit in Asia and one CO2

purification unit in Canada. The start-up of the OCI unit in the

United States at the end of the 2nd quarter will start contributing

to sales in the 3rd quarter 2018.

Over the half-year, the contribution to sales of unit

start-ups and ramp-ups totaled 136 million euros. This

mainly included the start-up of a major air separation unit in

South Africa at the end of December 2017 and the ramp-up of several

units which started up in China during the 3rd quarter of 2017. The

contribution of unit ramp-ups and start-ups to 2018 sales is still

estimated at between 250 and 300 million euros and will depend on

the commercial start-up date of the contract with Fujian Shenyuan

in China. The Air Liquide units have started-up and are in testing

period but discussions are still ongoing with the customer on the

date of the commercial start-up.

Focus

- Air Liquide has recently started-up the world’s largest

oxygen production unit for Sasol, an international

integrated energy and chemicals company. Air Liquide invested

around 200 million euros for the construction of this unit,

with a total production capacity of 5,000 tonnes of oxygen per

day in Secunda (around 140 km East of Johannesburg). Owned and

operated by Air Liquide, it is the first time that Sasol has chosen

to outsource its oxygen needs to a specialist of industrial gas

production at this site.

- The start-up of this major unit in South Africa is also a new

source of rare gases. Since the beginning of 2018, several new

multi-year contracts worth a total of more than 50 million euros

supplying xenon and krypton have been signed by Air Liquide and

the semiconductor and the satellite industries in three

geographies: Europe, U.S. and Asia. The semiconductor

industry uses xenon or krypton in its new processes to produce

high-end flash memories at a lower cost. The all-electric

propulsion satellites also use xenon, enabling significant

launching costs reduction.

RISK FACTORS

There was no change in risk factors during the first half. Risk

factors are described in the 2017 Reference Document on pages 26 to

30.

2018 OUTLOOK

The positive dynamic observed during the 1st quarter of 2018 was

further confirmed in the 2nd quarter, in the context of a customer

centric strategy and a globally more supportive economic

environment. This is reflected in sustained growth in Group

revenue, which came to 10.2 billion euros for the 1st half of this

year, driven by higher sales in Gas & Services, as

well as in Engineering & Construction, and Global

Markets & Technologies.

All Gas & Services activities grew significantly, in

particular Industrial Merchant, Electronics, and Healthcare.

Geographically, activities progressed in every region in the world,

and more particularly in Asia, the Americas, and in the Middle East

& Africa.

Along with global sales growth, Group performance benefited from

an increased operating margin in Gas & Services, excluding

energy impact. The Group is performing well in terms of operational

efficiency gains and will reach Airgas synergies one year ahead of

plan. The Group’s net profit, which exceeded 1 billion euros, rose

by more than +12.1%.

Cash flows from operations increased significantly, up +11.1%.

The Group’s balance sheet is solid.

Investment opportunities 12 months out are at their highest

level in the last three years. The dynamic accelerated over the

course of the 1st half of this year. Decisions are up +30%, to

1.4 billion euros. Investment backlog stood at

2.3 billion euros as of June 30, 2018, and will contribute to

future growth.

The Group is in line with the objectives set forth in the NEOS

2016-2020 strategic plan. Accordingly, assuming a comparable

environment, Air Liquide is confident in its ability to deliver net

profit growth in 2018, calculated at constant exchange rate and

excluding 2017 exceptionals1.

1 2017 exceptionals: exceptional non-cash items having a net

positive impact on 2017 net profit.

APPENDIX

Currency, energy and significant scope

impacts (Semester)

Applied method

In addition to the comparison of published figures, financial

information is given excluding currency, natural gas and

electricity price fluctuation and significant scope

impacts.

- Since industrial and medical gases are

rarely exported, the impact of currency fluctuations on activity

levels and results is limited to euro translation impacts with

respect to the financial statements of subsidiaries located outside

the euro zone. The currency effect is calculated

based on the aggregates for the period converted at the exchange

rate for the previous period.

- In addition, the Group passes on

variations in the cost of energy (electricity and natural gas) to

its customers via indexed invoicing integrated into their medium

and long-term contracts. This indexing can lead to significant

variations in sales (mainly in the Large Industries Business Line)

from one period to another depending on fluctuations in prices on

the energy market.

An energy impact is calculated based on the sales of each

of the main subsidiaries in Large Industries. Their consolidation

allows the determination of the energy impact for the Group as a

whole. The foreign exchange rate used is the average annual

exchange rate for the year N-1.

Thus, at the subsidiary level, the following formula provides

the energy impact, calculated for natural gas and electricity

respectively:

Energy impact = Share of sales index to energy year (N-1) x

(Average energy price over the year (N) - Average energy price over

the year (N-1))

This indexation effect of electricity and natural gas does not

impact the operating income recurring.

- The significant scope effect

corresponds to the impact on sales of all acquisitions or disposals

of a significant size for the Group. These changes in scope of

consolidation are determined:

- for acquisitions during the period, by

deducting from the aggregates for the period the contribution of

the acquisition,

- for acquisitions during the previous

period, by deducting from the aggregates for the period the

contribution of the acquisition between January 1 of the

current period and the anniversary date of the acquisition,

- for disposals during the period, by

deducting from the aggregates for the previous period the

contribution of the disposed entity as of the anniversary date of

the disposal,

- for disposals during the previous

period, by deducting from the aggregates for the previous period

the contribution of the disposed entity.

(in millions of euros)

H1 2018 H1 2018/2017

Published Growth Currency impact

Natural gas impact Electricity impact

Significant scope impact H1 2018/2017 Comparable

Growth Revenue

Group

10,162 -1.3% (685) 16 19

(71) +5.8% Impacts in %

-6.8% +0.2% +0.2% -0.7% Gas

& Services 9,769 -2.1% (671) 16

19 (71) +5.0% Impacts in %

-6.8% +0.2% +0.2% -0.7%

Operating Income Recurring

Group 1,617 - 2.3 % (118)

- - (22) + 6.2 % Impacts in %

-7.1%

-1.4% Gas & Services 1,741 -

1.1 % (117) - - (22) + 6.8 %

Impacts in % -6.7%

-1.2%

The operational margin excluding energy impact corresponds to

the operating income recurring on sales excluding energy. For the

1st semester and at Group level it stands at 16.0% = 1,617 /

(10,162 – 16 –19).

The sale of the Airgas refrigerants business, effective

in October 2017 generated a significant scope impact on 2018

revenue, the details of which is broken down per quarter below

(in millions of euros)

Q1 2018 Q2 2018

Q3 2018 Q4 2018

Airgas

refrigerants (35) (36) (26) (1) Impacts

in % -0.7% -0.7% -0.5% -0.0%

Currency, energy and significant scope

impacts (Quarter)

Consolidated 2018 2nd quarter revenue includes the following

impact:

(in millions of euros)

Q2 2018 Q2 2018/2017

Published Growth Currency impact

Natural gas impact Electricity impact

Significant scope impact Q2 2018/2017 Comparable

Growth Revenue

Group

5,152 +0.7% (263) 30 21

(36) +5.6% Impacts in %

-5.2% +0.6% +0.4% -0.7% Gas

& Services 4,938 +0.1% (258) 30

21 (36) +5.1% Impacts in %

-5.3% +0.6% +0.4% -0.7%

2nd quarter 2018

revenue

BY GEOGRAPHY

Revenue

(in millions of euros)

Q2 2017 Q2 2018 Published

change Comparable change

Americas

2,109 1,973 -6.5% +4.6% Europe 1,661

1,711 +3.0% +1.2% Asia-Pacific 1,008

1,091 +8.3% +10.8% Middle-East & Africa

154 163 +5.9% +16.3%

Gas &

Services Revenue 4,932 4,938

+0.1% +5.1% Engineering & Construction

93 95 +1.4% +4.3% Global Markets &

Technologies 92 119 +30.5% +33.2%

GROUP REVENUE 5,117 5,152

+0.7% +5.6%

BY WORLD BUSINESS LINE

Revenue

(in millions of euros)

Q2 2017 Q2 2018 Published

change Comparable change

Large industries

1,302 1,353 +4.0% +4.3% Industrial

Merchant 2,373 2,293 -3.4% +4.5%

Healthcare 840 864 +2.9% +6.9%

Electronics 417 428 +2.7% +7.6%

GAS

& SERVICES REVENUE 4,932 4,938

+0.1% +5.1%

Geographic and segment information

H1 2017

H1 2018 (in millions of euros and %)

Revenue

Operating income recurring OIR margin

Revenue Operating income recurring

OIR margin

Americas

4,250.7 670.3 15.8% 3,873.6 635.7

16.4% Europe 3,371.2 636.5 18.9%

3,464.4 651.4 18.8% Asia-Pacific 2,032.6

400.9 19.7% 2,107.5 407.2 19.3%

Middle-East and Africa 323.8 53.1 16.4%

323.7 46.4 14.3%

Gas and Services

9,978.3 1,760.8 17.6%

9,769.2 1,740.7 17.8%

Engineering and Construction 145.8 (5.6) -3.9%

180.1 (14.7) -8.2% Global Markets &

Technologies 168.6 17.9 10.6% 213.1

18.4 8.6% Reconciliation - (117.0)

- - (127.1) -

TOTAL GROUP

10,292.7 1,656.1 16.1%

10,162.4 1,617.3 15.9%

The OIR margin stood at 15.9% and 16.0% excluding the

energy impact, which corresponds to a slight decrease of -10

basis points compared with the 1st half of 2017. This was mainly

due to the negative operating income recurring generated by

Engineering & Construction. Moreover, the disposal of the

Airgas Refrigerants business had a dilutive impact on the margin;

excluding the disposal, the OIR margin would have been stable.

Consolidated income

statement

Considering the disposals of Aqua Lung and

Air Liquide Welding completed at the end of December 2016

and at the end of July 2017 respectively, “Other activities” have

been reallocated to “Net Profit from Discontinued Operations” in

the 2017 Income Statement, in accordance with IFRS 5.

(in millions of euros)

H1 2017 H1 2018

Revenue 10,292.7 10,162.4 Other

income 58.6 74.3 Purchases (3,907.9)

(3,949.0) Personnel expenses (2,098.4) (2,041.7)

Other expenses (1,788.5) (1,750.1)

Operating

income recurring before depreciation and amortization

2,556.5 2,495.9 Depreciation and amortization

expense (900.4) (878.6)

Operating income

recurring 1,656.1 1,617.3 Other

non-recurring operating income (0.3) 2.1 Other

non-recurring operating expenses (1.4) (32.5)

Operating income 1,654.4 1,586.9

Net finance costs (222.9) (122.2) Other financial

income 11.3 10.5 Other financial expenses

(47.7) (32.9) Income taxes (388.8) (359.6)

Share of profit of associates 0.6 3.1 NET PROFIT FROM

CONTINUING OPERATIONS 1,006.9 1,085.8 NET PROFIT FROM

DISCONTINUED OPERATIONS (30.4) - PROFIT FOR THE

PERIOD 976.5 1,085.8 - Minority interests 48.7

45.6 - Net profit (Group share) 927.8 1,040.2

Basic earnings per share (in

euros) 2.18 2.44 Diluted

earnings per share (in euros) 2.17

2.43 Basic earnings

per share from continuing operations (in euros)

2.25 2.44 Diluted earnings per share from

continuing operations (in euros) 2.24

2.43 Basic earnings

per share from discontinued operations (in euros)

(0.07) - Diluted earnings per share from

discontinued operations (in euros) (0.07)

-

Consolidated balance sheet

ASSETS (in millions of

euros) December 31, 2017 June 30,

2018

Goodwill 12,840.4 13,138.9 Other intangible assets

1,611.1 1,589.3 Property, plant and equipment

18,525.9 18,801.9

Non-current assets

32,977.4 33,530.1 Non-current financial assets

541.6 560.7 Investments in associates 128.2

138.9 Deferred tax assets 258.4 298.1 Fair

value of non-current derivatives (assets) 130.5 91.9

Other non-current assets 1,058.7

1,089.6 TOTAL NON-CURRENT ASSETS

34,036.1 34,619.7 Inventories and

work-in-progress 1,333.7 1,466.3 Trade receivables

2,900.0 3,066.9 Other current assets 863.5

790.9 Current tax assets 199.5 80.0 Fair value

of current derivatives (assets) 38.4 56.5 Cash and

cash equivalents 1,656.1 1,189.2

TOTAL CURRENT

ASSETS 6,991.2 6,649.8 TOTAL

ASSETS 41,027.3 41,269.5

EQUITY AND LIABILITIES (in millions of euros)

December 31, 2017 June 30, 2018

Share capital 2,356.2 2,355.5 Additional paid-in

capital 2,821.3 2,792.7 Retained earnings

9,077.3 10,320.6 Treasury shares (136.5)

(136.4) Net profit (Group share) 2,199.6 1,040.2

Shareholders' equity 16,317.9

16,372.6 Minority interests 400.5

396.8 TOTAL EQUITY 16,718.4

16,769.4 Provisions, pensions and other employee

benefits 2,593.3 2,493.7 Deferred tax liabilities

1,807.7 1,882.2 Non-current borrowings

12,522.4 12,520.7 Other non-current liabilities 238.5

242.0 Fair value of non-current derivatives (liabilities)

2.3 13.7

TOTAL NON-CURRENT LIABILITIES

17,164.2 17,152.3 Provisions, pensions and

other employee benefits 332.7 331.8 Trade payables

2,446.4 2,433.7 Other current liabilities

1,623.9 1,510.5 Current tax payables 194.2

145.0 Current borrowings 2,504.6 2,885.8 Fair value

of current derivatives (liabilities) 42.9 41.0

TOTAL CURRENT LIABILITIES 7,144.7

7,347.8 TOTAL EQUITY AND LIABILITIES

41,027.3 41,269.5

Consolidated cash flow statement

H1 2017

H1 2018 (in millions of euros)

Operating activities

Net profit (Group share) 927.8

1,040.2 Minority interests 48.7

45.6 Adjustments: • Depreciation

and amortization 903.9 878.6 • Changes in deferred

taxes(a) 71.3 20.1 • Changes in provisions

(79.3) (53.5) • Share of profit of associates 2.4

(3.1) • Profit/loss on disposal of assets 19.9

(11.5) • Net finance costs(b) 52.5 83.7

Cash flows

from operating activities before changes in working capital

1,947.2 2,000.1 Changes in working

capital (316.5) (196.0) Others (37.2)

(34.4)

Net cash flows from operating activities

1,593.5 1,769.7 Investing activities

Purchase of property, plant and

equipment and intangible assets (1,107.8) (1,096.4)

Acquisition of consolidated companies and financial assets

(85.8) (74.5) Proceeds from sale of property, plant and

equipment and intangible assets 32.9 35.0 Proceeds

from sale of financial assets 3.0 0.2 Dividends

received from equity affiliates - 3.0

Net cash

flows used in investing activities (1,157.7)

(1,132.7) Financing activities

Dividends paid • L'Air

Liquide S.A. (1,061.7) (1,158.5) • Minority interests

(41.2) (54.2) Proceeds from issues of share capital

26.9 36.4 Purchase of treasury shares (158.4)

(63.5) Net financial interests paid - (78.7)

Increase (decrease) in borrowings (b) 138.5 220.3

Transactions with minority shareholders (4.4) (0.4)

Net cash flows from (used in) financing activities

(1,100.3) (1,098.6) Effect of exchange rate

changes and change in scope of consolidation (23.1)

30.0

Net increase (decrease) in net cash and cash

equivalents (687.6) (431.6) NET

CASH AND CASH EQUIVALENTS AT THE BEGINNING OF THE PERIOD

1,430.5 1,515.7 NET CASH AND CASH

EQUIVALENTS AT THE END OF THE PERIOD 742.9

1,084.1 (a) Changes in deferred taxes reported in the

consolidated cash flow statement do not include changes in deferred

taxes relating to disposals of assets. (b) The net finance costs of

the 1st half of 2017 only included the amount related to the

acquisition of Airgas.

The analysis of net cash and cash equivalents at the end of

the period is as follows:

(in millions of euros)

June 30,

2017

December 31,

2017

June 30,

2018

Cash and

cash equivalents 895.0 1,656.1 1,189.2 Bank

overdrafts (included in current borrowings) (152.1)

(140.4) (105.1)

NET CASH AND CASH EQUIVALENTS

742.9 1,515.7 1,084.1

Net indebtedness calculation

(in millions of euros)

June 30,

2017

December 31,

2017

June 30,

2018

Non-current

borrowings (13,914.6) (12,522.4) (12,520.7)

Current borrowings (2,590.5) (2,504.6)

(2,885.8)

TOTAL GROSS INDEBTEDNESS (16,505.1)

(15,027.0) (15,406.5) Cash and cash

equivalents 895.0 1,656.1 1,189.2

NET

INDEBTEDNESS AT THE END OF THE PERIOD (15,610.1)

(13,370.9) (14,217.3)

Statement of changes in net indebtedness

(in millions of euros)

June 30,

2017

December 31,

2017

June 30,

2018

Net

indebtedness at the beginning of the period

(15,368.1) (15,368.1) (13,370.9)

Net cash flows from operating activities 1,593.5

4,254.0 1,769.7 Net cash flows used in investing activities

(1,157.7) (1,845.7) (1,132.7) Net cash flows

used in financing activities excluding changes in borrowings

(1,238.8) (1,191.6) (1,240.2)

Total net cash

flows (803.0) 1,216.7

(603.2) Effect of exchange rate changes, opening net

indebtedness of newly acquired companies and others 613.5

886.2 (159.5) Restatement of net finance costs

(52.5) (105.7) (83.7)

Change in net

indebtedness (242.0)

1,997.2

(846.4) TOTAL NET INDEBTEDNESS AT THE END OF THE

PERIOD (15,610.1) (13,370.9)

(14,217.3)

Return on Capital Employed –

ROCE

Applied method

Return on capital employed after tax is calculated based on the

Group’s consolidated financial statements, by applying the

following ratio for the period in question:

For the numerator: net profit - net finance costs after taxes

for the period in question.

For the denominator: the average of (total shareholders' equity

+ net indebtedness) at the end of the past three half-years.

ROCE H1 2018 H1 2017 2017

H1 2018 ROCE

Calculation

(in millions of euros)

(a) (b)

(c) Numerator

((b)-(a))+(c)

Net profit after tax before deduction of minority interests

976.5 2,291.6 1,085.8 2,400.9 Net

finance costs -222.9 -421.9 -122.2

-321.2 Group effective tax rate(a) 27.9% 29.4%

25.2% - Net financial costs after tax -160.8

-297.9 -91.4 -228.5

Net profit after tax

before deduction of minority interests - Net financial costs after

tax 1,137.3 2,589.5 1,177.2

2,629.4 Denominator

((a)+(b)+(c))/3

Total equity 16,049.0 16,718.4 16,769.4

16,512.3 Net indebtedness 15,610.1 13,370.9

14,217.3 14,399.4

Average of (total equity + net

indebtedness)

30,911.7 Published ROCE

8.5% ROCE excluding the non-cash impacts of

the 2017 exceptional items

8.0%

(a) Group effective tax rate excluding

significant events.

ROCE H1 2017 H1 2016 2016 H1 2017

ROCE

Calculation

(in millions of euros)

(a) (b)

(c) Numerator

((b)-(a))+(c)

Net profit after tax before deduction of minority interests

853.0 1,926.7 976.5 2,050.2 Net finance costs

-151.7 -389.1 -222.9 -460.3 Group

effective tax rate(a) 23.8% 28.2% 27.9%

- Net financial costs after tax -115.7 -279.4

-160.8 -324.5

Net profit after tax before

deduction of minority interests - Net financial costs after tax

968.7 2,206.1 1,137.3

2,374.7

Denominator

((a)+(b)+(c))/3

Total equity 12,329.7 17,125.0 16,049.0

15,167.9 Net indebtedness 19,859.8 15,368.1

15,610.1 16,946.0

Average of (total equity + net

indebtedness)

32,113.9 ROCE

7.4%

The return on capital employed after tax (ROCE) stood at

8.0% in the 1st half of 2018, up +30 basis points

compared with the recurring level of end-2017 (7.7%). The

improvement excluding the currency impact was +60 basis points.

The slideshow that accompanies this release

is available as of 8:45 am (Paris time) at

www.airliquide.com.

Throughout the year, follow Air Liquide on

Twitter: @AirLiquideGroup.

UPCOMING EVENTS

2018 Third Quarter Revenue:October 24,

2018

Salon Actionaria, Paris, France:November

22-23, 2018

The world leader in gases, technologies

and services for Industry and Health, Air Liquide is present in 80

countries with approximately 65,000 employees and serves more than

3.5 million customers and patients. Oxygen, nitrogen and hydrogen

are essential small molecules for life, matter and energy. They

embody Air Liquide’s scientific territory and have been at the core

of the company’s activities since its creation in 1902.

Air Liquide’s ambition is to lead its

industry, deliver long term performance and contribute to

sustainability. The company’s customer-centric transformation

strategy aims at profitable growth over the long term. It relies on

operational excellence, selective investments, open innovation and

a network organization implemented by the Group worldwide. Through

the commitment and inventiveness of its people, Air Liquide

leverages energy and environment transition, changes in healthcare

and digitization, and delivers greater value to all its

stakeholders.

Air Liquide’s revenue amounted to 20.3

billion euros in 2017 and its solutions that protect life and the

environment represented more than 40% of sales. Air Liquide is

listed on the Euronext Paris stock exchange (compartment A) and

belongs to the CAC 40, EURO STOXX 50 and FTSE4Good indexes.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180729005012/en/

Air LiquideMedia Relations+33 (0)1 40 62 50

59orInvestor RelationsParis - France+33 (0)1 40 62 50

87Philadelphia - USA+1-610-263-8277

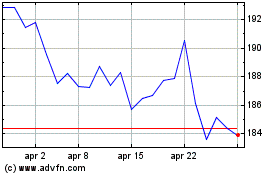

Grafico Azioni Air Liquide (EU:AI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Air Liquide (EU:AI)

Storico

Da Apr 2023 a Apr 2024