China Says It Isn't to Blame for Failure of NXP-Qualcomm Deal -- WSJ

30 Luglio 2018 - 9:02AM

Dow Jones News

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 30, 2018).

BEIJING -- Chinese antitrust regulators weighed in on Qualcomm

Inc.'s busted acquisition of Dutch chip maker NXP Semiconductors

with their own statement: Don't blame us.

China's State Administration for Market Regulation -- the last

of nine regulators around the world needed to green-light the deal

-- said Friday that Qualcomm's latest proposal failed to address

competition concerns. The regulator said it had extended its own

deal-review deadline to Oct. 14.

"Qualcomm and NXP decided to abandon the deal as the deadline

the two parties agreed on expired. [We] regret this," the regulator

said, adding that it had hoped to continue communicating with

Qualcomm and resolve the remaining issues within the review

period.

Qualcomm and NXP didn't immediately respond to requests for

comment.

Qualcomm ditched its $44 billion bid Wednesday, the latest

deadline it had set for completing the acquisition. It cited the

stalled process in China, having extended the deadline in April

while awaiting Chese approval. The acquisition had been announced

in October 2016.

The San Diego-based chip maker will pay a $2 billion termination

fee to NXP.

Chinese officials have publicly insisted that the delay had

nothing to do with escalating trade friction with the U.S., but

people with knowledge of the situation have told the Journal that

the friction is the main reason for it. China can't keep pace with

the U.S. on retaliatory tariffs -- it imports far less from the

U.S. than the U.S. imports from China -- but it has other weapons

including holding up U.S. M&A deals and business license

approvals, these people say.

For Beijing, seeking to develop its own semiconductor industry,

blocking the NXP acquisition pays an added dividend: It hinders the

growth of Qualcomm, which has a commanding position in cutting-edge

chip technology, longtime China economist Christopher Balding has

pointed out.

With NXP, Qualcomm would have gained a company that reported

$9.26 billion in revenue last year and employs some 30,000 people.

Qualcomm itself had $22.29 billion in sales in its latest fiscal

year, and a similar number of employees.

In its statement, China's antitrust authority said it treats

companies of home and abroad on an equal footing and will ensure

fair competition for all.

"[We] welcome companies from all countries, including Qualcomm

and NXP, to invest and do business in China."

Liyan Qi

(END) Dow Jones Newswires

July 30, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

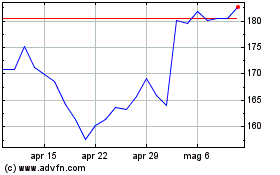

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Mar 2024 a Apr 2024

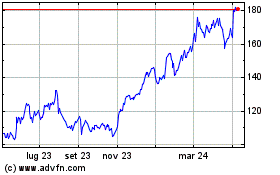

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Apr 2023 a Apr 2024