Johnson & Johnson Adds Zarbee's Naturals to Bolster Consumer Brands -- Update

30 Luglio 2018 - 7:20PM

Dow Jones News

By Nishant Mohan and Jaewon Kang

Johnson & Johnson's consumer-health arm reached a deal to

buy children's cough-syrup maker Zarbee's Naturals, a move that

could help the company better reach health-conscious millennial

parents and bolster sales from the unit.

The New Jersey-based medical-products giant and private-equity

firm L Catterton, the majority owner of Zarbee's, didn't disclose

the price of the deal Monday.

Natural products are a new addition to J&J's U.S. market,

said Katie Devine, global president for over-the-counter products

with J&J's consumer business.

"We recognize that in health and wellness, natural products are

growing at twice the rate of traditional OTC medicine in retail

sales," Ms. Devine said. "Millennial parents, even more so than

previous generations, are increasingly interested in trying natural

solutions first."

Sales of J&J's consumer brands have seen paltry growth,

particularly in the U.S., with over-the-counter consumer-product

sales growing 1.1% during the first six months of 2018 compared

with a year earlier. The company cited Nielsen data showing that

overall sales of U.S. natural products grew 7.2% in 2017 compared

with traditional over-the-counter drugs, which grew 3.4%.

Zarbee's, founded in 2008 by pediatrician Zak Zarbock, markets

its health-care products as healthier alternatives to traditional

over-the-counter medicines since they don't contain alcohol, gluten

or dyes. J&J's portfolio of consumer brands includes Tylenol,

Motrin, Listerine and Band-Aid.

Zarbee's in April launched a line of children's gummy

multivitamins, a product J&J doesn't currently sell.

Ms. Devine said that outside the U.S., J&J markets natural

products such as Dr. Mom herbal cough syrup and lozenges.

L Catterton is expecting to garner about a 10-times return on

its exit of Zarbee's, said a person familiar with the situation.

The private-equity firm invested in the health-products maker in

2011 through its growth fund.

Consumer-focused L Catterton was formed in 2016 by

private-equity firm Catterton; Groupe Arnault, the family holding

company of Bernard Arnault; and LVMH Moët Hennessy Louis Vuitton

SE. Among its portfolio companies are restaurant chain Chopt

Creative Salad Co. and cosmetic brand Cover FX Skincare Inc.

J&J shares rose 0.3% to $131.95 in Monday trading. Shares

are down 5.6% so far this year.

Write to Nishant Mohan at nishant.mohan@wsj.com and Jaewon Kang

at jaewon.kang@wsj.com

(END) Dow Jones Newswires

July 30, 2018 13:05 ET (17:05 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

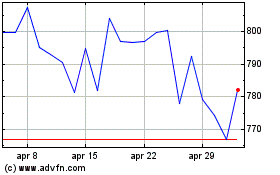

Grafico Azioni Lvmh Moet Hennessy Louis... (EU:MC)

Storico

Da Mar 2024 a Apr 2024

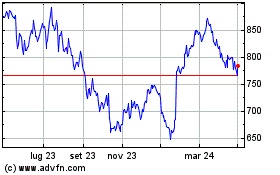

Grafico Azioni Lvmh Moet Hennessy Louis... (EU:MC)

Storico

Da Apr 2023 a Apr 2024