For Sale: As Much As Half of Universal -- WSJ

31 Luglio 2018 - 9:02AM

Dow Jones News

By Nick Kostov in Paris and Anne Steele in Los Angeles

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 31, 2018).

Universal Music Group's parent will try to sell up to 50% of the

world's biggest music company in an attempt to cash in on a

resurgent recording industry.

Vivendi SA said it would look for one or more strategic buyers

for the Universal stake. The French media conglomerate said it

would hire banks soon to assist in the sales process it plans to

kick off in the fall and aim to complete it within 18 months.

"Our goal is to determine a list of potential partners that

would help us to obtain the best valuation for Universal while

accelerating its growth," Vivendi Chief Executive Arnaud de

Puyfontaine said.

The move is a stark turnaround for Vivendi, which three years

ago rebuffed an activist investor's call to sell some or all of

Universal and use the funds to boost cash returns. At the time,

Vivendi placated U.S. hedge fund P. Schoenfeld Asset Management LP

by boosting its dividend. It also turned down an $8.5 billion offer

from SoftBank Corp. for Universal in 2013.

Mr. de Puyfontaine last year suggested the company could float a

minority stake in Universal. The company Monday said it had

scrapped plans for the initial public offering, saying it was

proving too complex.

Universal Music has been a bright spot for Vivendi. It has

benefitted from subscription-based streaming services like Spotify

Technology SA and Apple Inc.'s Apple Music, which have emerged as

revenue growth drivers for the once-beleaguered music industry.

Their growth is outpacing declines in physical music sales and

digital downloads.

Spotify, which sold shares to the public via direct listing in

April, has rekindled investor interest in the music business. Even

though it has never reported an annual profit, the listing valued

the company at $26.54 billion. Universal, meanwhile, reported a

13.4% operating margin last year.

Universal and its rivals -- Warner Music Group Corp. and Sony

Corp.'s Sony Music Entertainment -- rake in royalty payments

whenever listeners access their songs through the streaming

services.

In 2017, the industry's global revenue from recorded music grew

by 8.1%, to $17.3 billion, according to the International

Federation of the Phonographic Industry. That was the third

consecutive year of growth following 15 years of declining revenue

amid plummeting physical and digital format sales.

The rise was almost entirely due to a 41% surge in streaming

revenue -- which now amounts to the single largest sales source for

the industry -- thanks to 176 million users of paid services like

Spotify.

While revenue for 2017 was still just 68% of the market's peak

in 1999, industry watchers say the upside for streaming could be

much larger with mobile-phone penetration in developing markets and

as more people become familiar with the service.

Universal's performance in the first half was "very good,"

Vivendi Chief Financial Officer Hervé Philippe said on a call with

analysts, adding that he is "confident for the rest of the year"

despite uncertainty over the level of new releases and CD

sales.

Universal is Vivendi's biggest unit, and accounted for more than

half of the company's core earnings in the first half. Its

second-biggest unit, French pay-TV group Canal Plus, has been

struggling from competition for sports rights and online video

services.

Universal is the largest music company in the world by revenue

and market share, and alone it took in nearly 30% of all

music-industry revenue in 2017, according to MIDiA Research. Last

year, Goldman Sachs boosted Universal Music's valuation 16% to

$23.5 billion.

Mr. Philippe said Vivendi hasn't decided on the size of the

stake to be sold or the floor price for a deal. Vivendi would use

the proceeds from the sale to make a "significant" share

repurchase, he said, or for bolt-on acquisitions.

(END) Dow Jones Newswires

July 31, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

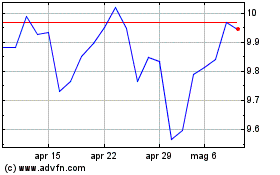

Grafico Azioni Vivendi (EU:VIV)

Storico

Da Mar 2024 a Apr 2024

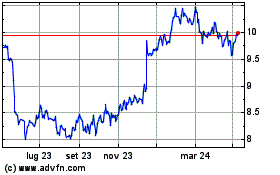

Grafico Azioni Vivendi (EU:VIV)

Storico

Da Apr 2023 a Apr 2024