Societe Generale 2Q Net Profit Beat Expectations; Sells Albania, Bulgaria Businesses -- Update

02 Agosto 2018 - 9:17AM

Dow Jones News

(Updates with earnings details, divestments and information on

disputes)

By Pietro Lombardi

Societe Generale SA (GLE.FR) on Thursday reported

better-than-expected second-quarter net profit and said it has

agreed to sell businesses in Bulgaria and Albania to OTP Bank.

France's third-largest listed bank by assets reported a net

profit of 1.16 billion euros ($1.35 billion) for the period, up

from EUR1.06 billion a year earlier.

Net banking income--the bank's top-line revenue figure--was

EUR6.45 billion, compared with EUR5.20 billion a year earlier when

it was hit by a EUR963 million charge to settle a dispute related

to transactions involving Libyan counterparts. On an underlying

base, which strips out exceptional items, net banking income grew

1%, the bank said.

Analysts estimated Societe Generale's second-quarter net profit

at EUR924 million ($1.08 billion) on revenue of EUR6.21 billion,

according to a consensus forecast provided by FactSet.

The French bank said it has agreed to sell its majority stakes

in Bulgaria's Express Bank and Societe Generale Albania to OTP

Bank. It didn't disclose financial details of the deals, but said

they should have a positive impact on its CET1 ratio, a measure of

capital strength.

Societe Generale said an agreement with U.S. authorities over an

outstanding dispute regarding transactions that involve countries

subject to sanctions may be found in the "coming weeks." The bank

said it is "actively pursuing its discussions" with the

authorities, adding that "the timing and the financial impact of a

potential agreement remain uncertain."

Societe Generale booked a EUR200 million provision for

litigation in the quarter, which takes the bank's overall provision

for disputes to EUR1.43 billion as of June.

In June, the bank reached agreements with U.S. and French

authorities regarding its alleged manipulation of Libor rates and

transactions involving Libyan counterparts. As part of the

agreements, the bank said it would pay roughly $1.3 billion in

penalties.

The low-interest-rate environment kept weighing on SocGen's

French retail revenue, which fell 1.7% on year. The bank expects

the division's revenue to be between 1% and 2% lower in 2018. The

global banking and investor-solutions business, which includes

investment banking and asset management, reported a 0.5% increase

in revenue, supported by the resilience of its global-markets

business. Fixed income, currencies and commodities, or FICC,

revenue declined by 1% on year. As a comparison, French peer BNP

Paribas SA's (BNP.FR) second-quarter FICC revenue fell 17%.

"The return of volatility, especially around the Italian

elections, enabled flow activities to benefit from a good level of

client activity on rates and commodities, which offset a less

buoyant credit market," SocGen said.

The bank's core Tier 1 ratio, a key measure of capital strength,

fell to 11.1% from 11.2% in the previous quarter.

"Societe Generale posted good results and an increase in

profitability in 2Q 2018 due to a solid performance by all the

businesses, disciplined cost management and good risk control,"

Chief Executive Frederic Oudea said.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

August 02, 2018 03:02 ET (07:02 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

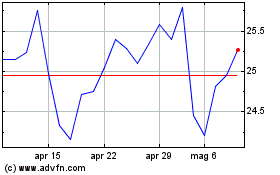

Grafico Azioni Societe Generale (EU:GLE)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Societe Generale (EU:GLE)

Storico

Da Apr 2023 a Apr 2024