European Finance Chiefs Struggle to Spend Cash

03 Settembre 2018 - 8:59AM

Dow Jones News

By Nina Trentmann

Finance chiefs at European, Middle Eastern and African companies

have a luxury problem: figuring out how to spend $1.1 trillion in

cash.

The top cash hoarders in the region are Total SA with EUR29.2

billion ($34.1 billion), Electricite de France SA with EUR28.3

billion and Volkswagen AG with EUR27.3 billion, according to a

report by Moody's Investors Service. The data covers 757

nonfinancial companies based in Europe, the Middle East and Africa

and showed cash levels reached a seven-year high at the end of

2017.

Many of these firms have started returning billions to investors

through stock buybacks and dividends, as well as plowing their

money into new capital projects and deals. Share buybacks by

companies in the S&P Europe 350 rose to EUR87.8 billion last

year, compared with EUR77.2 billion in 2016, while dividends crept

up to EUR278.5 billion, versus EUR262.6 billion the year before,

according to S&P Global Market Intelligence. Spending on

research and development increased to EUR146.9 billion in 2017,

from EUR140.2 billion in 2016.

The spending spree is unusual for European finance chiefs, who

are often more fiscally conservative than their American

counterparts. But Europe's negative interest rates make hoarding

the cash in bank deposits unprofitable. And investors are calling

on companies to use their cash wisely by balancing capital

allocations to new investments against returns to shareholders and

money set aside for a rainy day.

French oil giant Total launched a $5 billion share-buyback

program in February and in July said it would increase its interim

dividend by 3.2% to EUR0.64 a share. "We are delivering on our

commitment to share the oil price upside with our shareholders with

a buyback," CFO Patrick de La Chevardière said during an earnings

call in July.

Diageo PLC, the maker of Johnnie Walker whisky and Bailey's

Irish Cream, said in July it would buy back GBP2 billion ($2.6

billion) in shares to return money to shareholders. The company,

which is among the top 200 holders of cash in EMEA, completed an

earlier share-buyback program totaling GBP1.5 billion during the

fiscal year ended June 30. Diageo also raised its stake in Chinese

liquor maker Sichuan Shuijingfang Co. to 60% from about 40%.

"Investors really appreciate our overall approach" to capital

allocation, Kathryn Mikells, Diageo's CFO, said in an interview.

"We will continue to make sure we put our cash to work inside the

business," she added. Diageo's cash pile was down to GBP874 million

as of June 30, compared with GBP1.19 billion a year earlier.

Idle cash often attracts investor scrutiny. "It is not efficient

to hold large amounts of cash on the balance sheet if it is not

being put to use, " said William Coley, a senior vice president at

Moody's.

Akzo Nobel NV has held talks with shareholders concerning how to

distribute a large share of the EUR7.5 billion the Dutch paint

maker will receive from the sale of its specialty chemicals

business, said CFO Maarten de Vries.

The company last year came under pressure from activist investor

Elliott Management Corp. and wants to make sure its shareholders

are content. "It's all about making sure that we create credibility

with our investors," Mr. de Vries said.

Elliott Management, which holds 9.5% of Akzo's shares, declined

to comment.

Thomas Toepfer, finance chief at German plastics maker Covestro

AG, had EUR475 million in cash at the end of June, up from EUR300

million at the end of the prior-year period. He has increased his

budget for capital spending and could spend up to EUR1.2 billion

annually from 2019 onward, he said. Mr. Toepfer plans to use some

of that capital to increase the output of his factories, which are

operating at close to maximum capacity, and return the rest to

shareholders. Covestro spent more than EUR1 billion on dividends

and share repurchases in the first half of 2018, Mr. Toepfer

said.

Some executives are going even further. Kevin Entricken, CFO of

Dutch software company Wolters Kluwer NV, is raising Wolters's

interim dividend to 40% of last year's regular dividend, up from

25% in prior years. The firm through the end of July completed a

EUR300 million share repurchase and will buy back up to EUR550

million in stock later this year. Wolters's cash hoard has declined

to EUR654 million at the end of June, from EUR1 billion a year

earlier.

Many CFOs in the region reinvest substantial amounts of money

into the business and pay a special dividend, rather than buying

back their own stock like many of their U.S. peers do.

Engie SA, the French energy company, has only done a

"symbolical" share buyback of EUR150 million, said CFO Judith

Hartmann. "I do not see us doing more [share buybacks] because that

takes away capital for investments," Ms. Hartmann said in an

interview.

The company recently received more than EUR16 billion from asset

sales, but reinvested most of that money. Ms. Hartmann also paid

back some of Engie's debt and hopes to raise its dividend.

Write to Nina Trentmann at nina.trentmann@wsj.com

(END) Dow Jones Newswires

September 03, 2018 02:44 ET (06:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

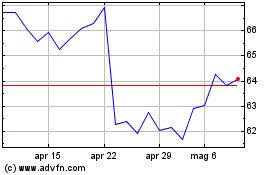

Grafico Azioni Akzo Nobel NV (EU:AKZA)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Akzo Nobel NV (EU:AKZA)

Storico

Da Apr 2023 a Apr 2024