NXP Charts Post-Qualcomm Future

10 Settembre 2018 - 9:41PM

Dow Jones News

By Stu Woo

NXP Semiconductors NV Chief Executive Rick Clemmer, facing

investors for the first time since his deal to sell the company to

Qualcomm Inc. fell apart, said he plans to give cash back to

shareholders, as part of the Dutch chip maker's new go-it-alone

strategy.

NXP received a $2 billion breakup fee from Qualcomm after its

failure to win approval from Chinese regulators for the proposed

$44 billion deal. Aside from rewarding shareholders, Mr. Clemmer

said he didn't plan to significantly alter his company's predeal

strategy, which focused on leading the market for chips for

automobiles.

"We hadn't gone through the strategy a lot in the 21-month

period of time" that the company was waiting for regulatory

approval, Mr. Clemmer said in an interview Monday. "As soon as I

realized there was a chance the deal would break, I said we'd dust

off our strategy, not reformulate strategy."

NXP's investor day in New York on Tuesday marks the first time

the company has seriously engaged investors and analysts since

Qualcomm announced the proposed merger in October 2016. Qualcomm

had asked NXP to keep quiet during the transaction process, so Mr.

Clemmer didn't hold conference calls or meet with investors or

analysts during that time.

Mr. Clemmer said he planned to tell investors that his is a

functioning company that doesn't need major changes. He said he

would focus on explaining some recent moves: removing a layer of

management, combining two divisions and entering the

electric-vehicle market with a new product.

He said he also hoped to persuade investors that he and his

management team are engaged. NXP has already committed $200

million, taken from the breakup fee, to offer incentives to entice

the company's management team to stay for three years.

Mr. Clemmer said he met Qualcomm CEO Steve Mollenkopf at a March

2016 conference to pitch selling NXP's digital-networking division

to him. He said Mr. Mollenkopf countered by asking for the whole

company.

"I said, 'Wait, that's not the purpose of our discussion,' " Mr.

Clemmer said.

The two sides announced the deal in October 2016 for $39

billion; Qualcomm later raised its bid to $44 billion. Mr. Clemmer

said he and Mr. Mollenkopf held weekly calls, and that the two and

their wives spent a weekend this year at Mr. Clemmer's house in

Cabo San Lucas, Mexico, to bond during nonwork hours.

An intensifying trade spat between the U.S. and China weighed on

the deal's prospects. On May 14, NXP stock jumped 12% after

President Trump said he was working with Chinese President Xi

Jinping to extend a reprieve to ZTE Corp., the Chinese

telecommunications company that Washington had punished for

breaking terms of a sanctions-busting settlement. A month later,

Mr. Clemmer joined a Dutch delegation at the White House and left

with the impression that U.S.-China trade tensions were easing and

that the Qualcomm-NXP deal would no longer be a negotiating

chip.

Still, in May, he asked his strategy team to create a Plan B in

case the deal fell through. "We thought it was wasted effort," Mr.

Clemmer said, "but we thought it was too critical to not have a

backup plan in place because of the trade tension."

Mr. Clemmer didn't give up on the deal until the midnight

deadline passed in July.

A North Texas native who spent his teenage summers managing his

father's lumberyard, Mr. Clemmer had planned on taking a vacation

in the south of France this summer and then starting a tech startup

with friends. He had sold $400 million of NXP shares in 2017

because, he said, his tax rate was changing from 30% to 52%.

Instead, he said he has spent the past weeks meeting with

skeptical analysts and investors, including Bernstein Research's

Stacy Rasgon. "I didn't feel like they were just spinning in their

chairs for two years," Mr. Rasgon said. Still, he said Mr.

Clemmer's challenges will be running NXP after it lost top managers

during the merger process, and providing a clear corporate

strategy.

(END) Dow Jones Newswires

September 10, 2018 15:26 ET (19:26 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

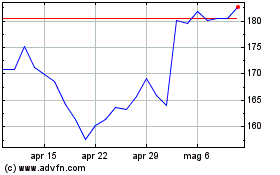

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Mar 2024 a Apr 2024

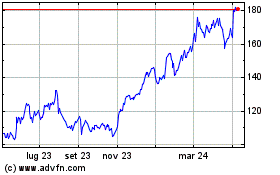

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Apr 2023 a Apr 2024