Pound Drops On EU's Rejection Of Brexit Plan

21 Settembre 2018 - 8:29AM

RTTF2

The pound declined against its major counterparts in the

European session on Friday, as EU leaders turned down Theresa May's

Chequers blueprint at a summit in Salzburg, giving a major blow to

her chances of reaching a deal post-Brexit.

Following their meeting on Thursday, European Council president

Donald Tusk told that the leaders had unanimously agreed to refuse

May's plans to stay in a single market for goods.

"Everybody shared the view that while there are positive

elements in the Chequers proposal, the suggested element for

economic cooperation will not work, not least because it risks

undermining the single market," Tusk said.

May warned EU leaders that she would not make any more

compromises and is prepared for a no deal position.

Data from the Office for National Statistics showed that the UK

budget deficit increased in August.

Public sector net borrowing, excluding public sector banks, rose

by GBP 2.4 billion from last year to GBP 6.8 billion in August.

This was the largest August borrowing for two years.

The currency held steady against its major counterparts in the

Asian session, with the exception of the yen.

The pound slipped to 1.3179 against the dollar, after rising to

1.3277 at 12:00 am ET. Next key support for the pound is seen

around the 1.29 region.

The pound weakened to an 11-day low of 1.2596 against the franc,

from a high of 1.2728 at 6:00 pm ET. On the downside, 1.23 is

possibly seen as the next support level for the pound.

Having advanced to a 4-month high of 149.72 against the yen at

1:15 am ET, the pound edged down to 148.59. If the pound falls

further, it may find support around the 147.00 level.

Figures from the Ministry of Economy, Trade and Industry showed

that Japan's all industry activity remained stable in July.

The all industry activity index remained flat on month,

following a 0.9 percent fall in June. Economists had forecast a

marginal 0.1 percent rise.

The pound drifted lower to a 9-day low of 0.8936 against the

euro, reversing from a high of 0.8867 hit at 5:15 pm ET. The next

possible support for the pound is seen around the 0.91 level.

Survey data from IHS Markit showed that Eurozone private sector

grew at the second-weakest rate since late-2016 on subdued

manufacturing activity growth in September.

The composite output index fell to 54.2 in September from 54.5

in August. The score was forecast to remain unchanged at 54.5.

Looking ahead, Canada retail sales for July and consumer

inflation for August, as well as Markit's U.S. manufacturing PMI

for September are set for release in the New York session.

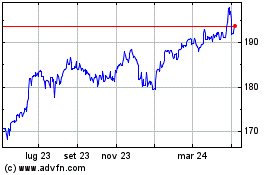

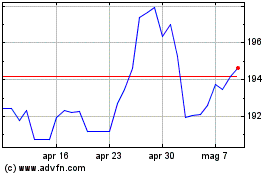

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Mar 2024 a Apr 2024

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Apr 2023 a Apr 2024