Pound Slides After U.K. GDP Data

28 Settembre 2018 - 8:50AM

RTTF2

The pound slipped against its most major counterparts in the

European session on Friday after a data showed the U.K. economy

grew by 0.5 percent in the first half of this year, marking the

weakest half-year growth since 2011.

Data from the Office for National Statistics showed that gross

domestic product grew 0.4 percent in the second quarter, unrevised

from the previous estimate. The growth rate for the first quarter

was revised down to 0.1 percent from 0.2 percent.

On a yearly basis, the economy expanded 1.2 percent, which was

revised down slightly from 1.3 percent.

Due to higher visible trade deficit and primary income

shortfall, the current account deficit widened by GBP 4.6 billion

to GBP 20.3 billion in the second quarter. This was equivalent to

3.9 percent of GDP.

Further undermining the currency was falling European shares, as

Italy's new government offered a budget with a deficit target three

times as big as the previous administration's goal, putting the

country at odds with the European Union.

The currency was trading mixed against its major opponents in

the Asian session. While it held steady against the euro and the

franc, it rose against the greenback and the yen.

The pound slipped to 1.3034 against the greenback, its lowest

since September 13, and marked a 0.4 percent decline from a high of

1.3090 hit at 2:00 am ET. The pound is poised to find support

around the 1.27 region.

After rising to 148.64 against the Japanese currency at 1:00 am

ET, the pound reversed direction and weakened to 147.84. The pound

is seen finding support around the 145.00 level.

Data from the Ministry of Land, Infrastructure, Transport and

Tourism showed that Japan's housing starts increased for the first

time in three months in August.

Housing starts advanced 1.6 percent in August from last year,

reversing a 0.7 percent drop in July. Orders were forecast to climb

0.4 percent.

The pound reached as low as 1.2732 against the franc, a 0.4

percent slide from a high of 1.2783 seen at 5:45 pm ET. On the

downside, 1.25 is seen as the next likely support for the

pound.

Data from the KOF Swiss Economic Institute showed that an

indicator measuring the trends in the Swiss economy rose in

September, suggesting that the downward trend in the economy may

have come to a halt.

The KOF Economic Barometer climbed by 3.3 points to a new

reading of 102.2. Economists had forecast a score of 100.

On the flip side, the pound strengthened to a weekly high of

0.8880 against the euro, after having risen to 0.8912 at 4:30 am

ET. The next possible resistance for the pound is seen around the

0.87 region.

Flash data from Eurostat showed that Eurozone inflation

accelerated in September on food and energy prices.

Inflation rose marginally to 2.1 percent, in line with

expectations, from 2 percent a month ago.

Looking ahead, Canada industrial product price index for August

and GDP data for July, as well as U.S. personal income and spending

data for August and University of Michigan's final consumer

sentiment index for September are set for release in the New York

session.

At 9:20 am ET, the Bank of England Deputy Governor David Ramsden

speaks at the Society of Professional Economists Annual Conference,

in London.

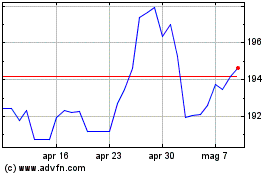

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Mar 2024 a Apr 2024

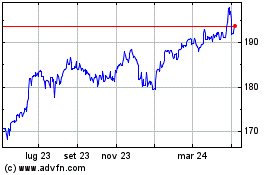

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Apr 2023 a Apr 2024