Pound Advances As UK Services Growth Remains Strong

03 Ottobre 2018 - 8:00AM

RTTF2

The pound climbed against its major counterparts in the early

European session on Wednesday, as a data showed that British

service sector activity maintained strong growth momentum in

September.

Survey data from IHS Markit showed that the services Purchasing

Managers' Index dropped to 53.9 in September from 54.3 in August.

The index was forecast to fall to 54.0.

However, any reading above 50 indicates expansion in the

sector.

European stocks rebounded after reports that Italy plans to

reduce budget deficit by 2.0 percent in 2021.

The Italian newspaper Corriere della Sera reported that the

government estimates a budget deficit of 2.4 percent of GDP for

2019, and then slash it to 2.2 percent for 2020.

Italian bond yields fell after the report, helping lift banking

stocks.

The currency has been trading higher against its major

counterparts in the Asian session, with the exception of the

euro.

The pound advanced to 0.8885 against the euro, after having

dropped to a 6-day low of 0.8918 at 10:30 pm ET. The pound is

likely test resistance around the 0.87 area.

Survey data from IHS Markit showed that the euro area private

sector expanded at the slowest pace in four months in September on

weak manufacturing activity.

The final composite output index dropped to 54.1 in September

from 54.5 in August and slightly below the flash estimate of

54.2.

The pound climbed to 1.3017 against the greenback, compared to

1.2979 hit late New York on Tuesday. If the pound rises further,

1.32 is likely seen as its next resistance level.

The U.K. currency edged up to 1.2832 against the Swiss franc,

from a low of 1.2763 seen at 5:45 pm ET. The pound is poised to

find resistance around the 1.32 mark.

The pound reversed from an early low of 147.27 against the yen,

reaching as high as 148.22. The pound is seen finding resistance

around the 151.00 level.

The latest survey from Nikkei showed that Japanese services

sector continued to expand in September, but at a sharply slower

pace, with a two-year low score of 50.2.

That's down from 51.5 in August, although it remains barely

above the boom-or-bust line of 50 that separates expansion from

contraction.

Looking ahead, Federal Reserve Bank of Richmond President Thomas

Barkin will give a speech titled "The Outlook for Tomorrow: Five

Numbers to Watch" at the West Virginia Economic Outlook Conference

at 8:05 am ET.

At 8:15 am ET, ADP private sector employment data for September

is scheduled for release.

In the New York session, U.S. ISM non-manufacturing composite

index for September will be out.

At 2:00 pm ET, Federal Reserve Governor Lael Brainard speaks

about the payment system at the FedPayments Improvement Community

Forum in Chicago.

Fifteen minutes later, Federal Reserve Bank of Cleveland

President Loretta Mester will speak at the Community Banking in the

21st Century conference at the Federal Reserve Bank of St.

Louis.

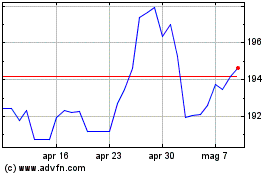

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Mar 2024 a Apr 2024

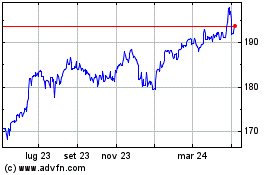

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Apr 2023 a Apr 2024