Luxury Shares Feel the Pinch -- WSJ

11 Ottobre 2018 - 9:02AM

Dow Jones News

By Matthew Dalton

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 11, 2018).

PARIS -- A mild slowdown at LVMH Moët Hennessy Louis Vuitton SE,

the world's biggest luxury goods company, sent a shudder across the

sector Wednesday, pushing down stock prices amid fears that a

pullback by China's big-spending shoppers could end a yearslong

boom for the industry.

LVMH shares traded down more than 7% in Paris after executives

detailed third-quarter sales, disclosed Tuesday evening on a call

with analysts. Gucci parent Kering SA fell 10%, Burberry Group PLC

dropped more than 8% and Hermes International SCA was down

5.5%.

Louis Vuitton, LVMH's biggest brand, reported slightly slower

sales from Chinese shoppers during the third quarter, LVMH Chief

Financial Officer Jean-Jacques Guiony told investors and analysts

Wednesday. "But we are really talking about going from high-teens

[growth rate] to midteens," Mr. Guiony said.

The French luxury-goods conglomerate reported third-quarter

revenue of EUR11.38 billion ($13.08 billion), up 10% when adjusting

for currency impacts and other factors. But the figure marked a

decline from 11% in the second quarter and 13% in the first

quarter.

Those third-quarter numbers roughly hit market forecasts, but

analysts say LVMH needed to do better than that to reassure

investors. China's economic slowdown has cast a cloud over the

sector in recent months, raising fears that the industry would be

hit hard if Chinese shoppers rein in their spending. They are the

luxury industry's most important clientele, representing roughly a

third of all purchases globally.

Geopolitical tensions are also roiling the sector. Investors

fear a widening trade dispute between the Trump administration and

China could become a full-fledged trade war, hurting Chinese

consumers. Investors appear to be betting that negotiations between

the two nations to end the dispute will reach an impasse, said Luca

Solca, an analyst at Exane BNP Paribas.

"If that's the case, it's only rational you price a less

favorable environment for luxury," Mr. Solca said.

Concerns about China have sent LVMH shares down around 15% since

the end of August, when they were trading near an all-time

high.

Still, Mr. Solca said, "in the current numbers there's very

little you can show in the way of bad news."

LVMH is viewed as a bellwether for the luxury goods sector, with

dozens of brands including high-fashion house Dior, cognac maker

Hennessy, watchmaker TAG Heuer and dozens of others.

Mr. Guiony also highlighted weakness at some of LVMH's other

businesses. The U.S. watch market was weak, particularly for

watches priced less than $3,000, he said. "It's really bad below

$3,000," he said.

"We are having a tough period with TAG Heuer in the U.S.," he

added.

On Tuesday, the company said its fashion and leather-goods

division, which includes Louis Vuitton and accounts for more than a

third of total revenue, posted 14% organic sales growth in the

third quarter.

Sales at its perfumes-and-cosmetics division were up 11% in the

three months and its watches-and-jewelry arm was up 10%.

Investor concerns about luxury stocks were compounded by a

research note from Morgan Stanley, in which the bank's analysts

said they believed Chinese consumer confidence -- traditionally a

leading indicator for European luxury companies -- has peaked, with

a weaker trend expected in the second half.

--Anthony Shevlin contributed to this article.

Write to Matthew Dalton at Matthew.Dalton@wsj.com

(END) Dow Jones Newswires

October 11, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

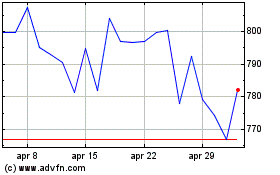

Grafico Azioni Lvmh Moet Hennessy Louis... (EU:MC)

Storico

Da Mar 2024 a Apr 2024

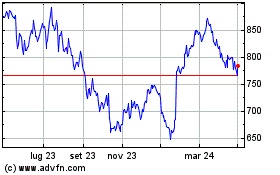

Grafico Azioni Lvmh Moet Hennessy Louis... (EU:MC)

Storico

Da Apr 2023 a Apr 2024