Copper Prices Slip as China Data Disappoints

16 Ottobre 2018 - 1:24PM

Dow Jones News

By David Hodari

Copper prices slipped, dragged down by nagging anxieties about

the state of the Chinese economy after a slew of negative data

Tuesday.

The base metal was down 0.5% at $6,209 a metric ton in

midmorning trade in London, extending its week-to-date losses to

1.2%.

Gold was up 0.1% at $1,228.28 a troy ounce, its early week gains

having stalled amid gentle rallying across global equities

indexes.

With gold's price nearing $1,230 an ounce, a move above that

psychologically important level could spark more haven metal

buying, said Carlo Alberto De Casa, chief analyst at

ActivTrades.

Base metals failed to show similar optimism Tuesday after the

highest Chinese inflation reading in seven months and the release

of figures showing a 49% year-on-year drop in house sales in

China's 10 major cities during this year's Golden Week--typically a

time for big-ticket purchases.

On top of that, car sales fell in September for the third

straight month, putting China on course for its first annual slip

in passenger-car sales in almost three decades.

Elsewhere in the market, indications of rising supply added to

the pressure from the suggestions of sagging Chinese demand.

Rio Tinto PLC (RIO)'s third-quarter-production results put

copper front and centre, with output improving 6% at Escondida--the

world's largest copper mine--and at other Rio mines as well.

Looking ahead, market participants were keeping an eye on

stories affecting the broader commodities sector.

The White House and Saudi Arabia traded barbs and threats of

sanctions Monday over the suspected killing of dissident Saudi

journalist Jamal Khashoggi, testing the Trump administration's

efforts to make the kingdom the focal point of its Middle East

policy.

Base metals "will continue to see choppy price action amidst

this ongoing macro uncertainty," said Alastair Munro, a broker at

Marex Spectron. That said, "any ratchet higher in trade war

tensions is likely to result in China resorting to infrastructure

stimulus to support growth," a move which would be positive for

copper prices, Mr. Munro said.

Among precious metals, silver was up 0.34% at $14.74 a troy

ounce, palladium was down 0.17% at $1,086 a troy ounce and platinum

was up 0.15% at $843.75 a troy ounce.

Among base metals, zinc was up 0.56% at $2,609 a metric ton, tin

was down 0.1% at $19,140 a metric ton, nickel was down 0.9% at

$12,470 a metric ton and lead was up 0.41% at $2,088 a metric

ton.

Write to David Hodari at David.Hodari@wsj.com

(END) Dow Jones Newswires

October 16, 2018 07:09 ET (11:09 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

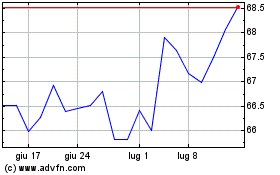

Grafico Azioni Rio Tinto (NYSE:RIO)

Storico

Da Mar 2024 a Apr 2024

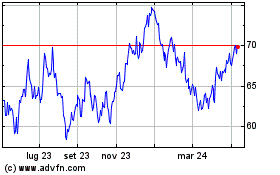

Grafico Azioni Rio Tinto (NYSE:RIO)

Storico

Da Apr 2023 a Apr 2024