Rueil Malmaison, 23 October 2018,

5.45pm CET

Quarterly

information at 30 September 2018

- Strong

revenue growth, up 7.7% to €31.4 billion in the first nine months

of 2018, including a 9.5% increase in the third

quarter

-

Concessions revenue up

5.6%, buoyant passenger numbers at VINCI Airports and robust

traffic at VINCI Autoroutes

-

Contracting revenue up

8.4%, with growth in all three business lines (VINCI Energies,

Eurovia and VINCI Construction); sustained activity in the third

quarter (organic growth of 4.9%)

-

VINCI Immobilier revenue

up 4.3%

- Good

commercial momentum, with increases in order intake (up 5% at

end-September) and order book (up 7%)

- VINCI is

entering the final quarter of 2018 with confidence and confirms its

full-year forecasts

| Consolidated

revenue |

|

|

|

| |

First nine

months |

2018/2017 change |

|

| (in € millions) |

2018 |

2017 |

Actual |

Like-for-like[1] |

|

|

Concessions |

5,619 |

5,318 |

+5.6% |

+4.8% |

|

| VINCI Autoroutes |

4,202 |

4,058 |

+3.6% |

+3.6% |

|

| VINCI Airports |

1,200 |

1,068 |

+12.3% |

+10.0% |

|

| Other

concessions |

217 |

192 |

+12.7% |

+1.3% |

|

|

Contracting |

25,571 |

23,595 |

+8.4% |

+3.1% |

|

| VINCI Energies |

8,976 |

7,674 |

+17.0% |

+4.3% |

|

| Eurovia |

6,454 |

5,873 |

+9.9% |

+8.2% |

|

| VINCI

Construction |

10,141 |

10,048 |

+0.9% |

-0.7% |

|

|

VINCI Immobilier |

614 |

589 |

+4.3% |

+2.9% |

|

| Eliminations and adjustments |

(364) |

(319) |

|

|

|

|

VINCI Group total* |

31,440 |

29,183 |

+7.7% |

+3.3% |

|

| of

which: France |

18,062 |

17,232 |

+4.8% |

+4.1% |

|

|

International |

13,378 |

11,951 |

+11.9% |

+2.3% |

|

| Europe excl. France |

8,383 |

7,375 |

+13.7% |

+3.9% |

|

|

International excl. Europe |

4,995 |

4,576 |

+9.2% |

-0.5% |

|

| |

|

|

|

|

|

|

Order intake (in € billions) |

28.4 |

26.9 |

5% |

|

|

| Order book** (in €

billions) |

32.8 |

30.6 |

7% |

|

|

|

Net financial debt** (in €

billions) |

(16.1) |

(14.6) |

-1.5 |

|

|

* Excluding concession subsidiaries' revenue from

works done by non-Group companies (see glossary).

** Period-end.

I. Business activity in the

first nine months of 2018: key consolidated figures

VINCI had a

strong third quarter, with consolidated revenue of €11.7

billion, up 9.5% on an actual basis and up 4.3% like-for-like

compared with the third quarter of 2017. Business activity remained

buoyant in Concessions (up 4.7%) and accelerated in Contracting (up

11.0% on an actual basis and 4.9% like-for-like).

Consolidated

revenue in the first nine months of 2018 came to €31.4

billion[2], up 7.7% on

an actual basis compared with the year-earlier period or 3.3%

like-for-like, with changes in the consolidation scope having a

5.5% positive effect and exchange-rate movements a 1.1% negative

effect.

-

In France (57% of the

total), revenue was €18.1 billion, up 4.8% on an actual basis or

4.1% like-for-like, reflecting the good momentum in Contracting's

business activities.

-

Outside France (43% of the

total), revenue was €13.4 billion, up 11.9% on an actual basis or

2.3% like-for-like. Changes in scope boosted revenue by 12.2%.

Currency movements had a 2.6% negative impact on revenue because of

the euro's rise against certain currencies.

Order intake in

the Contracting business in the first nine months of 2018

totalled €28.4 billion, 5% more than in the first nine months of

2017. It increased by 21% outside France in the first nine months

but fell 8% in France, due in particular to a high base for

comparison after some major contract wins relating to the Grand

Paris Express project in 2017.

The order book at

30 September 2018 amounted to €32.8 billion, up 7%

year-on-year, and represents over 11 months of average

business activity in the Contracting business.

II. Revenue

by business line (figures at end-September 2018)

- CONCESSIONS: €5,619 million

(up 5.6% actual; up 4.8% like-for-like)

VINCI

Autoroutes: €4,202 million (up 3.6% both actual and

like-for-like)

Traffic levels continued to grow

at a good pace. Traffic on the intercity networks rose 1.4% in the

third quarter of 2018, with growth of 1.3% for light vehicles and

2.7% for heavy vehicles. In the first nine months of 2018, traffic

levels grew 1.9% (1.7% for light vehicles and 3.3% for heavy

vehicles).

VINCI

Airports: €1,200 million

(up 12.3% actual; up 10.0% like-for-like)

Revenue for the first nine months

of the year benefited from the integration of Salvador airport in

Brazil on 1 January 2018 and the Airports Worldwide portfolio

at the end of August 2018. The growth momentum in the VINCI

Airports network's passenger numbers continued in the third quarter

of 2018, rising 6% excluding Japan, which was affected by

exceptional weather conditions. Over the first nine months of 2018,

they increased 8% (excluding Japan). Passenger numbers were up in

most of VINCI Airports' facilities and exceeded 180 million on a

rolling 12-month basis to end-September 2018.

Other

concessions: €217 million (up 12.7% actual, up 1.3%

like-for-like)

Peruvian company Lamsac,

concessionaire of the Lima ring road, contributed €66 million to

VINCI Highways' revenue. Since the opening of Section 2 in June,

traffic levels have been rising more quickly than expected.

- CONTRACTING: €25,571

million (up 8.4% actual, up 3.1% like-for-like)

VINCI

Energies: €8,976 million (up 17.0% actual, up 4.3%

like-for-like)

In France (47% of the total),

revenue was €4,195 million, up 5.1% on an actual basis or up 4.3%

like-for-like. Each business area (building/services sector,

infrastructure, industry and ICT) posted firm growth during the

period. In the third quarter, organic growth was almost 4%.

Outside France (53% of the total),

revenue was €4,781 million, up 30% on an actual basis or up 4.4%

like-for-like. The main scope effects during the period relate to

acquisitions made in 2017, particularly in Northern Europe, and

those made in 2018 (mainly PrimeLine in the United States and Wah

Loon Engineering in Singapore). Those transactions contributed more

than €1 billion of additional revenue in the first nine months of

2018. In geographical terms, business levels were buoyant in most

of VINCI Energies' markets, and particularly in Germany,

Switzerland, Scandinavia and West Africa.

Order intake was up 18% at VINCI

Energies. The order book at 30 September 2018 amounted to €8.6

billion, up 20% over 12 months. It represents almost nine months of

VINCI Energies' average business activity.

Eurovia:

€6,454 million (up 9.9% actual; up 8.2% like-for-like)

In France (57% of the total),

consolidated revenue was €3,666 million, up 10.4% on an actual

basis or up 9.4% like-for-like. After several years of recession,

the recovery in traditional roadworks markets that started in 2017

is confirming in 2018.

Outside France (43% of the total),

consolidated revenue was €2,787 million, up 9.2% on an actual basis

or up 6.7% like-for-like. Business levels rose in the German and UK

markets after a tough start to the year caused by poor weather

conditions. They remained strong in Central Europe (Poland and the

Czech Republic), Canada and Chile.

Order intake rose 10% at Eurovia.

The order book at 30 September 2018 amounted to €6.5 billion, up 7%

over 12 months, and represents nine months of Eurovia's average

business activity.

VINCI

Construction: €10,141 million (up 0.9% actual; down 0.7%

like-for-like)

In France (53% of the total),

revenue was €5,380 million, up 1.8% like-for-like. This increase

confirms the strength of the building and public works market,

particularly in the Paris region.

Outside France (47% of the total),

revenue was €4,761 million, down 1.1% on an actual basis or 3.4%

like-for-like. Revenue grew in Central Europe, Asia and Oceania,

but declined in Africa, the United Kingdom and business areas

related to the oil and gas industry. Business levels at VINCI

Construction Grands Projets were down due to the completion of

several large projects.

Order intake fell 6% at VINCI

Construction, because of a more selective approach to taking on new

business and a high base for comparison after it won some large

contracts relating to the Grand Paris Express project in 2017. The

order book at 30 September 2018 amounted to €17.7 billion, up 2%

over 12 months, and represents more than 15 months of VINCI

Construction's average business activity.

VINCI

Immobilier: €614 million

(up 4.3% actual; up 2.9% like-for-like)

VINCI Immobilier's consolidated

revenue increased 4%. In the residential segment, reserved revenue

rose 4.5% despite stability in the number of reservations (4,225

housing units). The subsidiary Ovelia, managing seniors residences,

was consolidated in January 2018.

III.

2018 guidance confirmed

The Group is confident going into

the final part of 2018. Strong performance in the first nine months

of the year confirms the previously announced trends.

In full-year 2018, VINCI expects

to see growth in revenue, operating income and net income.

- In Concessions, traffic growth at VINCI Autoroutes is

expected to be similar to that seen in 2017 provided that fuel

prices do not rise further. VINCI Airports' passenger numbers

should continue growing in 2018, although at a slower pace than in

2017 because of the high base for comparison.

- In Contracting, business levels are expected to

continue growing in all business lines, driven by favorable French

economy and international development, and Ebit margin should

improve further.

IV.

Financial position

Consolidated net

financial debt at 30 September 2018 amounted to €16.1 billion,

up €1.5 billion over 12 months. The increase was mainly due to

financial investments made by the Group.

At 30 September 2018, VINCI had

total liquidity of €10.5 billion, consisting of €4.5 billion of net

cash managed and €6.0 billion of unused credit facilities due to

expire in 2021.

In mid-September, VINCI - rated A-

by Standard & Poor's and A3 by Moody's - placed €1.75 billion

of bonds with investors, i.e. €0.75 billion of bonds maturing in

September 2025, with a coupon of 1.00% and €1 billion of bonds

maturing in September 2030, with a coupon of 1.75%. This bond, the

largest ever issued by the Group, confirms that investors are

confident in VINCI's credit quality.

V.

Third-quarter highlights

- Developments in

Concessions

On 29 August 2018, VINCI Airports

completed the acquisition of Airports Worldwide, which manages

eight airports in the United Kingdom, the United States, Costa Rica

and Sweden: two under freehold, two under concession and four under

full management contracts.

Motorway investment plan: decrees

were published for Cofiroute in late August 2018 but are still

pending for ASF and Escota. A total of €385 million will be

invested for this plan. The works will be financed jointly by the

local authorities concerned and VINCI Autoroutes, in return for

additional tariff increases between 2019 and 2021.

On 20 August 2018, Eurovia signed

an agreement to acquire the Asphalt Plants and Paving business of

Lane Construction in the United States, which operates in 10 states

on the East Coast and Texas. The acquisition remains subject to

approval by the US authorities.

- VINCI Immobilier,

offering extended in French growth regions

On 10 September 2018, VINCI

Immobilier announced that it was in exclusive talks to acquire

URBAT Promotion, a specialist homebuilder operating in the south of

France. The transaction is subject to the signature of final

agreements between the parties.

In October 2018, Eurovia, working

with VINCI Autoroutes, built the world's first 100% recycled road,

consisting of a 1 km section of the A10 motorway in the Gironde

département.

Eurovia is testing new types of

asphalt for the Paris municipality with the aim of reducing sound

pollution and combating urban heat islands.

Conference call

The Group will comment on its

revenue and business activities in the period ended 30 September

2018 in a conference call to be held in English today (Tuesday 23

October 2018) at 18.15 Paris time.

To take part, please dial one of

the following numbers from 18.05

In French: +33 (0)1 72 72 74 03 -

PIN: 89250494#

In English: +44 (0)20 7194 3759 -

PIN: 89250494#

Playback number

(available within two hours):

In French: +33 (0)1 70 71 01 60 -

PIN: 418795913#

In English: +44 (0)20 3364 5147 -

PIN: 418795913#

**********

| Diary |

| 6

November 2018 |

2018

interim dividend ex-date |

|

| 8

November 2018 |

Payment of

2018 interim dividend (€0.75 per share) |

|

| 20-21

November 2018 |

Eurovia

Investor Day in Marseille |

|

| 6

February 2019 |

Publication of full-year 2018 results before stock market

opening |

|

**********

INVESTOR RELATIONS

Grégoire Thibault

Tel: +33 (0)1 47 16 45 07

gregoire.thibault@vinci.com

Alexandra Bournazel

Tel: +33 (0)1 47 16 33 46

alexandra.bournazel@vinci.com

PRESS CONTACT

Paul-Alexis Bouquet

Tel: +33 (0)1 47 16 31 82

media.relations@vinci.com

About

VINCI

VINCI is a global player in

concessions and contracting, employing more than 190,000 people in

some 100 countries. We design, finance, build and operate

infrastructure and facilities that help improve daily life and

mobility for all. Because we believe in all-round performance,

above and beyond economic and financial results, we are committed

to operating in an environmentally and socially responsible manner.

And because our projects are in the public interest, we consider

that reaching out to all our stakeholders and engaging in dialogue

with them is essential in the conduct of our business activities.

VINCI's goal is to create long-term value for its customers,

shareholders, employees and partners, and for society at

large.

www.vinci.com

APPENDICES

APPENDIX A: ADDITIONAL

INFORMATION ON CONSOLIDATED REVENUE

Consolidated

revenue* in the first nine months of the year - Breakdown by region

and business line

| |

Nine months to 30 Sept. |

Nine

months to 30 Sept. |

2018/2017 change |

| (in €

millions) |

2018 |

2017 |

Actual |

Like-for-like |

|

FRANCE |

|

|

|

|

|

Concessions |

4,543 |

4,377 |

+3.8% |

+3.8% |

| VINCI Autoroutes |

4,202 |

4,058 |

+3.6% |

+3.6% |

| VINCI Airports |

260 |

243 |

+6.8% |

+6.8% |

| Other

concessions** |

81 |

76 |

+6.6% |

+6.6% |

|

Contracting |

13,241 |

12,546 |

+5.5% |

+4.6% |

| VINCI Energies |

4,195 |

3,993 |

+5.1% |

+4.3% |

| Eurovia |

3,666 |

3,321 |

+10.4% |

+9.4% |

| VINCI

Construction |

5,380 |

5,232 |

+2.8% |

+1.8% |

|

VINCI Immobilier |

611 |

587 |

+4.1% |

+2.7% |

|

Eliminations and adjustments |

(334) |

(278) |

|

|

| Total France |

18,062 |

17,232 |

+4.8% |

+4.1% |

| |

|

|

|

|

|

INTERNATIONAL |

|

|

|

|

|

Concessions |

1,076 |

941 |

+14.3% |

+9.4% |

| VINCI Airports |

940 |

825 |

+13.9% |

+11.0% |

| Other

concessions** |

135 |

116 |

+16.8% |

-2.5% |

|

Contracting |

12,330 |

11,049 |

+11.6% |

+1.6% |

| VINCI Energies |

4,781 |

3,682 |

+29.9% |

+4.4% |

| Eurovia |

2,787 |

2,552 |

+9.2% |

+6.7% |

| VINCI

Construction |

4,761 |

4,816 |

-1.1% |

-3.4% |

|

Eliminations, adjustments and other |

(27) |

(39) |

|

|

|

Total International |

13,378 |

11,951 |

+11.9% |

+2.3% |

* Excluding concession subsidiaries' revenue from

works done by companies outside the Group.

** Including VINCI Highways, VINCI Railways and

VINCI Stadium.

Consolidated

revenue for the third quarter

| |

Third quarter |

Third

quarter |

2018/2017

change |

| (in €

millions) |

2018 |

2017 |

Actual |

Like-for-like |

|

Concessions* |

2,193 |

2,095 |

+4.7% |

+3.2% |

| VINCI

Autoroutes |

1,659 |

1,605 |

+3.4% |

+3.4% |

| VINCI Airports |

458 |

404 |

+13.5% |

+8.6% |

| Other

concessions** |

75 |

86 |

-12.3% |

-25.9% |

|

Contracting |

9,427 |

8,491 |

+11.0% |

+4.9% |

| VINCI

Energies |

3,120 |

2,613 |

+19.4% |

+6.2% |

|

Eurovia |

2,728 |

2,379 |

+14.7% |

+11.0% |

|

VINCI Construction |

3,579 |

3,498 |

+2.3% |

-0.3% |

|

VINCI Immobilier |

221 |

201 |

+10.2% |

+8.6% |

|

Eliminations and adjustments |

(159) |

(117) |

|

|

|

Total revenue* |

11,682 |

10,670 |

+9.5% |

+4.3% |

of

which:

France |

6,582 |

6,258 |

+5.2% |

+4.6% |

|

International |

5,100 |

4,412 |

+15.6% |

+3.9% |

* Excluding concession

subsidiaries' revenue from works done by companies outside the

Group.

** Including VINCI Highways, VINCI Railways and VINCI Stadium.

APPENDIX B:

CONTRACTING ORDER BOOK AND ORDER INTAKE

|

At 30 September |

Change |

|

At |

Change |

Order book

(in € billions) |

2018 |

2017 |

over 12 months |

|

31 Dec.

2017 |

vs. 31 Dec 2017 |

| VINCI Energies |

8.6 |

7.1 |

+20% |

|

6.7 |

+27% |

| Eurovia |

6.5 |

6.1 |

+7% |

|

5.7 |

+15% |

| VINCI

Construction |

17.7 |

17.4 |

+2% |

|

16.9 |

+5% |

|

Total Contracting |

32.8 |

30.6 |

+7% |

|

29.3 |

+12% |

| of

which: |

|

|

|

|

|

|

| France |

15.6 |

16.0 |

-3% |

|

15.5 |

+0% |

| International |

17.2 |

14.6 |

+18% |

|

13.8 |

+25% |

| Europe excl.

France |

9.4 |

8.2 |

+14% |

|

7.6 |

+23% |

| Rest of the

world |

7.9 |

6.4 |

+24% |

|

6.1 |

+28% |

Order

intake

|

At 30 September |

|

| (in €

billions) |

2018 |

2017 |

Change 2018/2017 |

| VINCI Energies |

10.3 |

8.7 |

+18% |

| Eurovia |

7.1 |

6.5 |

+10% |

| VINCI

Construction |

11.0 |

11.7 |

-6% |

|

Total Contracting |

28.4 |

26.9 |

+5% |

| of

which: |

|

|

|

| France |

13.5 |

14.7 |

-8% |

| International |

14.9 |

12.3 |

+21% |

APPENDIX C: VINCI

AUTOROUTES AND VINCI AIRPORTS INDICATORS

VINCI Autoroutes revenue

| Nine months to 30

Sept. 2018 |

VINCI Autoroutes |

Of which: |

|

| |

ASF |

Escota |

Cofiroute |

Arcour |

|

|

Total traffic - intercity

network |

+1.9% |

+2.1% |

+1.1% |

+1.9% |

+6.1% |

|

| Price effects |

+1.7% |

+1.6% |

+1.5% |

+1.6% |

+7.3% |

|

| A86

Duplex |

+0.1% |

|

|

+0.2% |

|

|

| Toll revenue (in € millions) |

4,128 |

2,392 |

589 |

1,096 |

50 |

|

| 2018/17 change |

+3.7% |

+3.7% |

+2.6% |

+3.7% |

+13.4% |

|

| Revenue (in € millions) |

4,202 |

2,439 |

598 |

1,111 |

51 |

|

| 2018/17 change |

+3.6% |

+3.6% |

+2.6% |

+3.6% |

+13.3% |

|

Traffic on

motorway concessions*

| |

Third

quarter |

Nine months to 30 Sept. |

(millions

of km travelled)

|

2018 |

Change |

2018 |

Change |

| VINCI Autoroutes |

16,660 |

+1.4% |

40,529 |

+1.9% |

| Light

vehicles |

14,950 |

+1.3% |

35,211 |

+1.7% |

|

Heavy vehicles |

1,710 |

+2.7% |

5,318 |

+3.3% |

| of

which: |

|

|

|

|

| ASF |

10,572 |

+1.4% |

25,366 |

+2.1% |

| Light

vehicles |

9,444 |

+1.2% |

21,842 |

+1.9% |

|

Heavy vehicles |

1,127 |

+2.5% |

3,524 |

+3.2% |

| Escota |

2,187 |

+0.8% |

5,673 |

+1.1% |

| Light

vehicles |

2,022 |

+0.7% |

5,164 |

+1.0% |

|

Heavy vehicles |

165 |

+1.9% |

510 |

+2.2% |

| Cofiroute (intercity network) |

3,786 |

+1.9% |

9,221 |

+1.9% |

| Light

vehicles |

3,380 |

+1.7% |

7,972 |

+1.6% |

| Heavy

vehicles |

405 |

+3.2% |

1,249 |

+3.7% |

|

Arcour |

115 |

+4.6% |

269 |

+6.1% |

| Light

vehicles |

103 |

+3.4% |

233 |

+4.5% |

|

Heavy vehicles |

12 |

+15.4% |

36 |

+18.5% |

* Excluding A86

duplex

VINCI

Airports' passenger traffic1

| |

|

|

|

|

(in thousands of passengers) |

Third

quarter |

Nine

months to 30 Sept. |

Rolling

12-month period |

| 2018 |

2018/2017 change |

2018 |

2018/2017 change |

2018 |

2018/2017 change |

Portugal

(ANA)

of which Lisbon |

17,262

8,532 |

+4.2%

+6.5% |

42,891

22,235 |

+7.0%

+10.3% |

54,596

28,755 |

+8.1%

+11.6% |

France

of which ADL |

5,474

3,166 |

+8.2%

+5.9% |

14,582

8,412 |

+9.0%

+6.9% |

18,554

10,833 |

+9.2%

+6.8% |

| Cambodia (Cambodia

Airports) |

2,444 |

+16.4% |

7,644 |

+21.3% |

10,128 |

+21.9% |

| United States |

2,376 |

+8.8% |

7,094 |

+9.8% |

9,402 |

+10.6% |

| Brazil |

2,007 |

+3.0% |

5,865 |

+3.6% |

7,867 |

+4.5% |

| United Kingdom |

1,951 |

+12.2% |

4,822 |

+5.8% |

6,111 |

+4.7% |

| Dominican

Republic |

1,243 |

-0.4% |

3,819 |

-2.7% |

5,016 |

-1.9% |

| Sweden |

664 |

-1.6% |

1,703 |

+4.4% |

2,185 |

+5.6% |

|

Total fully consolidated

subsidiaries |

33,422 |

+6.0% |

88,421 |

+7.8% |

113,859 |

+8.6% |

| Kansai, Japan

(40%) |

11,570 |

-7.0% |

35,726 |

+3.1% |

47,686 |

+4.9% |

| Santiago, Chile

(40%) |

5,773 |

+6.2% |

17,093 |

+9.2% |

22,862 |

+10.3% |

| Liberia, Costa Rica

(45%) |

205 |

+4.5% |

888 |

+2.1% |

1,107 |

+0.1% |

|

Rennes-Dinard, France (49%) |

311 |

+13.7% |

745 |

+12.5% |

929 |

+12.2% |

|

Total equity-accounted

subsidiaries |

17,860 |

-2.6% |

54,451 |

+5.0% |

72,583 |

+6.5% |

| Total VINCI Airports |

51,281 |

+2.8% |

142,872 |

+6.7% |

186,443 |

+7.8% |

1

Data at 100%, irrespective of percentage held.

2

2018 and 2017 data include full-year airport passenger

numbers.

APPENDIX D:

GLOSSARY

Concession subsidiaries' revenue

from works done by non-Group companies: this indicator relates to

construction work done by concession companies as programme manager

on behalf of concession grantors. Consideration for that work is

recognised as an intangible asset or financial asset depending on

the accounting model applied to the concession contract, in

accordance with IFRIC 12 "Service Concession Arrangements". It

excludes work done by Contracting business lines.

Like-for-like revenue

growth: this indicator measures the change in revenue at constant

scope and exchange rates.

Net financial surplus/debt: the

reconciliation between this indicator and balance sheet items is

detailed in the notes to the Group's consolidated financial

statements.

It corresponds to the difference

between financial assets and financial debt. If the assets outweigh

the liabilities, the balance represents a net financial surplus,

and if the liabilities outweigh the assets, the balance represents

net financial debt. Financial debt includes bonds and other

borrowings and financial debt (including finance lease transactions

and liabilities relating to financial instruments). Financial

assets include cash and cash equivalents and assets relating to

derivative instruments.

Order book: the order book in the

Contracting business (VINCI Energies, Eurovia, VINCI Construction)

represents the volume of business yet to be carried out on projects

where the contract is in force (in particular after service orders

have been obtained or after conditions precedent have been met) and

financed.

Order intake: in the Contracting

business lines (VINCI Energies, Eurovia, VINCI Construction), a new

order is recorded when the contract has been not only signed but is

also in force (for example, after the service order has been

obtained or after conditions precedent have been met) and when the

project's financing is in place. The amount recorded in order

intake corresponds to the contractual revenue.

VINCI Airports passenger traffic:

this is the number of passengers who have travelled on commercial

flights from a VINCI Airports airport during a given period.

VINCI Autoroutes motorway traffic:

this is the number of kilometres travelled by light and heavy

vehicles on the motorway network managed by VINCI Autoroutes during

a given period.

Concession and PPP (public-private partnership)

contracts: public-private partnerships are forms of long-term

public-sector contracts through which a public authority calls upon

a private-sector partner to design, build, finance, operate and

maintain a facility or item of public infrastructure and/or manage

a service.

In France, a distinction is drawn between concessions (for works or

services) and partnership contracts.

Outside France, there are categories of public contracts - known by

a variety of names - with characteristics similar to those of the

French concession and partnership contracts.

In a concession, the concession-holder receives a toll (or other

form of remuneration) directly from users of the infrastructure or

service, on terms defined in the contract with the public-sector

authority that granted the concession. The concession-holder

therefore bears "traffic level risk" related to the use of the

infrastructure.

In a partnership contract, the private partner is paid by the

public authority, the amount being tied to performance targets,

regardless of the infrastructure's level of usage. The private

partner therefore bears no traffic level risk.

[2]

Excluding concession subsidiaries' revenue from works done by

non-Group companies (see glossary).

PDF

This

announcement is distributed by West Corporation on behalf of West

Corporation clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: VINCI via Globenewswire

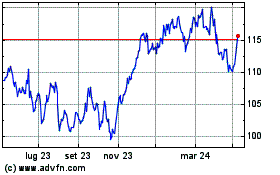

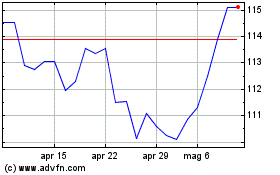

Grafico Azioni Vinci (EU:DG)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Vinci (EU:DG)

Storico

Da Apr 2023 a Apr 2024