Heineken N.V. reports on 2018 third quarter trading

24 Ottobre 2018 - 8:01AM

Amsterdam, 24 October 2018 - Heineken N.V. (EURONEXT: HEIA;

OTCQX: HEINY) today publishes its trading update for the third

quarter of 2018.

KEY HIGHLIGHTS

- Consolidated beer volume +4.6% organically, with growth in all

regions.

- Heineken® volume +9.2% with double digit growth in Africa,

Middle East & Eastern Europe and the Americas.

CEO STATEMENTJean-François van Boxmeer, Chairman of the

Executive Board & CEO, commented:"Volume growth continued in

the third quarter, benefiting from good weather in Europe and

strong growth in Brazil, Mexico, Vietnam and South Africa. The

Heineken® brand continued to outperform, driven by Brazil, South

Africa, France and Russia. In August, we announced the signing of

non-binding agreements with China Resources to join forces to win

in China. Our expectations for the full year 2018 remain

unchanged."

THIRD QUARTER AND NINE MONTHS VOLUME BREAKDOWN

|

Consolidated beer volume1 (in mhl or %) |

3Q18 |

Totalgrowth % |

Organic growth % |

YTD 3Q18 |

Totalgrowth % |

Organic growth % |

| Heineken N.V. |

62.6 |

|

4.4 |

|

4.6 |

|

175.3 |

|

8.7 |

|

4.5 |

|

| Africa,

Middle East & Eastern Europe |

10.4 |

|

2.3 |

|

3.1 |

|

30.5 |

|

3.3 |

|

4.7 |

|

|

Americas |

21.6 |

|

8.1 |

|

8.1 |

|

61.2 |

|

21.5 |

|

6.9 |

|

| Asia

Pacific |

7.1 |

|

3.7 |

|

4.8 |

|

21.2 |

|

9.0 |

|

10.1 |

|

|

Europe |

23.5 |

|

2.2 |

|

2.2 |

|

62.4 |

|

0.7 |

|

0.7 |

|

|

Heineken® (in mhl or %) |

3Q18 |

Organic growth % |

YTD 3Q18 |

Organic growth % |

|

Heineken® |

10.3 |

|

9.2 |

|

28.8 |

|

8.1 |

|

| Africa,

Middle East & Eastern Europe |

1.6 |

|

17.1 |

|

4.5 |

|

26.0 |

|

|

Americas |

3.0 |

|

14.7 |

|

8.5 |

|

10.7 |

|

| Asia

Pacific |

1.5 |

|

-6.4 |

|

4.6 |

|

-1.5 |

|

|

Europe |

4.1 |

|

9.0 |

|

11.2 |

|

4.3 |

|

Heineken® volume grew by 9.2%. Key markets contributing

with double digit growth included Brazil, South Africa, France,

Russia, the UK, Poland, Canada and Mexico. Volume in Asia Pacific

declined mainly due to Vietnam, Thailand and Taiwan.

1 Refer to the Definitions section for an explanation of organic

growth.

REGIONAL REVIEW

Africa, Middle East & Eastern Europe

- Consolidated beer volume grew organically by 3.1%.

- In Nigeria beer volume declined high-single digit,

driven by increased competitive pressure.

- In Russia beer volume was up mid-single digit, driven by

the continued strong growth of our economy brands portfolio and

Heineken®.

- In South Africa total volume showed strong double digit

growth, driven by Heineken® and Strongbow brand momentum and an

increase in promotional activity.

- Ethiopia delivered high-single digit beer volume growth

despite increased competitive pressure and some social unrest in

parts of the country.

- In Egypt beer volume was up double digit, driven by

increased tourism and a more stable economic environment.

- In the DRC the decline in beer volume moderated to

mid-single digit as the business laps prior year price

increases.

Americas

- Consolidated beer volume grew organically by 8.1%.

- In Mexico beer volume was up high-single digit, driven

by increased promotional activity. Heineken® and Dos Equis

continued to grow double digit.

- Brazil sustained its double digit beer volume growth,

driven by the premium portfolio led by Heineken®, and the

mainstream portfolio with both Amstel and Devassa.

- Beer volume in the USA was broadly flat, with Heineken®

and Lagunitas growing low-single digit. Heineken® benefited from

shipments phasing between June and July.

Asia Pacific

- Consolidated beer volume was up organically by 4.8%.

- In Vietnam beer volume continued to grow double digit,

driven by Tiger and Larue.

- In Indonesia beer volume was up high-single digit driven

by sustained economic growth.

- In Cambodia beer volume declined mid-single digit due to

intensified market competition through price promotion.

Europe

- Consolidated beer volume grew organically by 2.2%.

- In the UK total volumes were up mid-single digit driven

by Heineken® and our international brands portfolio.

- In France and the Netherlands beer volumes were

up double digit, benefiting from warmer temperatures.

- Performance in Italy continued to be strong with beer

volume up high-single digit, led by Heineken® and Ichnusa.

- In Poland and Spain beer volumes declined

low-single digit.

REPORTED NET PROFIT

Reported net profit for the nine months was €1,606 million

(2017: €1,486 million).

TRANSLATIONAL CURRENCY UPDATE

Using spot rates as at 16 October 2018 for the remainder of this

year, the calculated negative currency translational impact would

be approximately €175 million (vs €179m on 24 July) at

consolidated operating profit level (beia), and negative €110

million (vs €112m on 24 July) at net profit level (beia).

PROPOSED STRATEGIC PARTNERSHIP WITH CHINA RESOURCES

On 3 August 2018, HEINEKEN announced that it had signed

non-binding agreements with China Resources Enterprise, Limited

('CRE') and China Resources Beer (Holdings) Co. Ltd. ('CR Beer') to

create a long-term strategic partnership for Mainland China, Hong

Kong and Macau. All parties continue to work towards signing

definitive agreements and will share further updates as they

develop.

FINANCING UPDATE

On 3 September 2018, HEINEKEN placed €600 million of 8.5-year

Notes with a coupon of 1.25% and €650 million of 12.5-year Notes

with a coupon of 1.75%. The Notes have been issued under the

Company's Euro Medium Term Note Programme and are listed on the

Luxembourg Stock Exchange.

The proceeds from the Notes issuance are to be used for general

corporate purposes, which may include repayment of debt and/or

acquisitions.

DEFINITIONS

Organic growth in volume excludes the effect of consolidation

changes. For a full list of definitions see the Heineken N.V.

HY2018 results published on 30 July 2018.

ENQUIRIES

| Media |

Investors |

| John-Paul

Schuirink |

Federico Castillo

Martinez |

| Director of Global

Communication |

Director of Investor

Relations |

| Michael

Fuchs |

Chris MacDonald /

Aris Hernandez |

| Corporate &

Financial Communication Manager |

Investor Relations

Manager / Senior Analyst |

| E-mail:

pressoffice@heineken.com |

E-mail:

investors@heineken.com |

| Tel:

+31-20-5239355 |

Tel:

+31-20-5239590 |

Editorial information:HEINEKEN is the world's most international

brewer. It is the leading developer and marketer of premium beer

and cider brands. Led by the Heineken® brand, the Group has a

portfolio of more than 300 international, regional, local and

speciality beers and ciders. We are committed to innovation,

long-term brand investment, disciplined sales execution and focused

cost management. Through "Brewing a Better World", sustainability

is embedded in the business and delivers value for all

stakeholders. HEINEKEN has a well-balanced geographic footprint

with leadership positions in both developed and developing markets.

We employ over 80,000 employees and operate breweries, malteries,

cider plants and other production facilities in more than 70

countries. Heineken N.V. and Heineken Holding N.V. shares trade on

the Euronext in Amsterdam. Prices for the ordinary shares may be

accessed on Bloomberg under the symbols HEIA NA and HEIO NA and on

Reuters under HEIN.AS and HEIO.AS. HEINEKEN has two sponsored level

1 American Depositary Receipt (ADR) programmes: Heineken N.V.

(OTCQX: HEINY) and Heineken Holding N.V. (OTCQX: HKHHY). Most

recent information is available on HEINEKEN's website:

www.theHEINEKENcompany.com and follow us on Twitter via

@HEINEKENCorp.

Market Abuse RegulationThis press release may contain inside

information within the meaning of Article 7(1) of the EU Market

Abuse Regulation.

Disclaimer: This press release contains forward-looking

statements with regard to the financial position and results of

HEINEKEN's activities. These forward-looking statements are subject

to risks and uncertainties that could cause actual results to

differ materially from those expressed in the forward-looking

statements. Many of these risks and uncertainties relate to factors

that are beyond HEINEKEN's ability to control or estimate

precisely, such as future market and economic conditions, the

behaviour of other market participants, changes in consumer

preferences, the ability to successfully integrate acquired

businesses and achieve anticipated synergies, costs of raw

materials, interest-rate and exchange-rate fluctuations, changes in

tax rates, changes in law, change in pension costs, the actions of

government regulators and weather conditions. These and other risk

factors are detailed in HEINEKEN's publicly filed annual reports.

You are cautioned not to place undue reliance on these

forward-looking statements, which speak only of the date of this

press release. HEINEKEN does not undertake any obligation to update

these forward-looking statements contained in this press release.

Market share estimates contained in this press release are based on

outside sources, such as specialised research institutes, in

combination with management estimates.

Consolidated Metrics: Third Quarter 2018

|

|

3Q18 |

|

In mhl or €million unless otherwise stated & consolidated

figures unless otherwise stated |

3Q17 |

Consolidation Impact |

Organic Growth |

3Q18 |

Organic Growth % |

|

Africa, Middle East & Eastern Europe |

|

|

|

|

|

|

Total volume |

12.2 |

|

-0.1 |

|

0.4 |

|

12.5 |

|

3.5 |

|

|

Beer volume |

10.2 |

|

-0.1 |

|

0.3 |

|

10.4 |

|

3.1 |

|

|

Licensed & non-beer volume |

2.0 |

|

- |

|

0.1 |

|

2.1 |

|

5.4 |

|

|

Third party products volume |

- |

|

- |

|

- |

|

- |

|

8.2 |

|

|

|

|

|

|

|

|

|

Group beer volume |

10.6 |

|

|

|

10.7 |

|

|

|

Americas |

|

|

|

|

|

|

Total volume |

22.5 |

|

- |

|

1.7 |

|

24.2 |

|

7.5 |

|

|

Beer volume |

20.0 |

|

- |

|

1.6 |

|

21.6 |

|

8.1 |

|

|

Licensed & non-beer volume |

2.3 |

|

- |

|

0.2 |

|

2.5 |

|

6.7 |

|

|

Third party products volume |

0.2 |

|

- |

|

-0.1 |

|

0.1 |

|

-51.7 |

|

|

|

|

|

|

|

|

|

Group beer volume |

21.0 |

|

|

|

22.7 |

|

|

|

Asia Pacific |

|

|

|

|

|

|

Total volume |

7.0 |

|

-0.1 |

|

0.4 |

|

7.3 |

|

5.2 |

|

|

Beer volume |

6.8 |

|

-0.1 |

|

0.3 |

|

7.1 |

|

4.8 |

|

|

Licensed & non-beer volume |

0.2 |

|

- |

|

0.1 |

|

0.2 |

|

39.0 |

|

|

Third party products volume |

- |

|

- |

|

- |

|

- |

|

-46.0 |

|

|

|

|

|

|

|

|

|

Group beer volume |

8.4 |

|

|

|

8.9 |

|

|

|

Europe |

|

|

|

|

|

|

Total volume |

28.4 |

|

0.1 |

|

0.8 |

|

29.3 |

|

2.9 |

|

|

Beer volume |

23.0 |

|

- |

|

0.5 |

|

23.5 |

|

2.2 |

|

|

Licensed & non-beer volume |

3.1 |

|

- |

|

0.3 |

|

3.4 |

|

9.0 |

|

|

Third party products volume |

2.3 |

|

0.1 |

|

- |

|

2.4 |

|

2.0 |

|

|

|

|

|

|

|

|

|

Group beer volume |

23.6 |

|

|

|

24.7 |

|

|

|

Heineken N.V. |

|

|

|

|

|

|

Total volume |

70.1 |

|

-0.1 |

|

3.3 |

|

73.3 |

|

4.7 |

|

|

Beer volume |

60.0 |

|

-0.2 |

|

2.8 |

|

62.6 |

|

4.6 |

|

|

Licensed & non-beer volume |

7.6 |

|

- |

|

0.6 |

|

8.2 |

|

7.8 |

|

|

Third party products volume |

2.5 |

|

0.1 |

|

-0.1 |

|

2.5 |

|

-2.4 |

|

|

|

|

|

|

|

|

|

Group beer volume |

63.5 |

|

|

|

67.0 |

|

|

Note: due to rounding, this table will not always cast

Consolidated Metrics: First nine months 2018

|

|

3Q18 |

|

In mhl or €million unless otherwise stated & consolidated

figures unless otherwise stated |

3Q17 |

Consolidation Impact |

Organic Growth |

3Q18 |

Organic Growth % |

|

Africa, Middle East & Eastern Europe |

|

|

|

|

|

|

Total volume |

34.7 |

|

-0.5 |

|

1.9 |

|

36.1 |

|

5.6 |

|

|

Beer volume |

29.5 |

|

-0.4 |

|

1.4 |

|

30.5 |

|

4.7 |

|

|

Licensed & non-beer volume |

5.1 |

|

-0.1 |

|

0.5 |

|

5.5 |

|

10.7 |

|

|

Third party products volume |

0.1 |

|

- |

|

- |

|

0.1 |

|

8.2 |

|

|

|

|

|

|

|

|

|

Group beer volume |

30.5 |

|

|

|

31.4 |

|

|

|

Americas |

|

|

|

|

|

|

Total volume |

54.3 |

|

10.7 |

|

3.8 |

|

68.9 |

|

7.0 |

|

|

Beer volume |

50.4 |

|

7.3 |

|

3.5 |

|

61.2 |

|

6.9 |

|

|

Licensed & non-beer volume |

3.7 |

|

3.4 |

|

0.1 |

|

7.3 |

|

5.0 |

|

|

Third party products volume |

0.2 |

|

- |

|

0.2 |

|

0.4 |

|

69.1 |

|

|

|

|

|

|

|

|

|

Group beer volume |

53.7 |

|

|

|

64.7 |

|

|

|

Asia Pacific |

|

|

|

|

|

|

Total volume |

19.9 |

|

-0.1 |

|

2.0 |

|

21.8 |

|

10.3 |

|

|

Beer volume |

19.4 |

|

-0.2 |

|

2.0 |

|

21.2 |

|

10.1 |

|

|

Licensed & non-beer volume |

0.4 |

|

0.1 |

|

- |

|

0.6 |

|

28.6 |

|

|

Third party products volume |

0.1 |

|

- |

|

- |

|

- |

|

-29.9 |

|

|

|

|

|

|

|

|

|

Group beer volume |

24.4 |

|

|

|

26.7 |

|

|

|

Europe |

|

|

|

|

|

|

Total volume |

76.7 |

|

0.2 |

|

0.6 |

|

77.5 |

|

0.8 |

|

|

Beer volume |

62.0 |

|

- |

|

0.4 |

|

62.4 |

|

0.7 |

|

|

Licensed & non-beer volume |

8.5 |

|

- |

|

0.4 |

|

8.9 |

|

4.2 |

|

|

Third party products volume |

6.2 |

|

0.2 |

|

-0.2 |

|

6.2 |

|

-3.2 |

|

|

|

|

|

|

|

|

|

Group beer volume |

64.0 |

|

|

|

64.0 |

|

|

|

Heineken N.V. |

|

|

|

|

|

|

Total volume |

185.5 |

|

10.3 |

|

8.4 |

|

204.3 |

|

4.5 |

|

|

Beer volume |

161.3 |

|

6.7 |

|

7.3 |

|

175.3 |

|

4.5 |

|

|

Licensed & non-beer volume |

17.6 |

|

3.4 |

|

1.2 |

|

22.3 |

|

6.8 |

|

|

Third party products volume |

6.6 |

|

0.2 |

|

-0.1 |

|

6.7 |

|

-0.9 |

|

|

|

|

|

|

|

|

|

Group beer volume |

172.6 |

|

|

|

186.9 |

|

|

Note: due to rounding, this table will not always cast

- Please click here for full media release.pdf

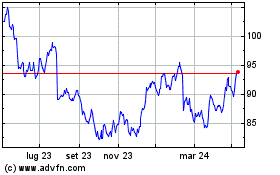

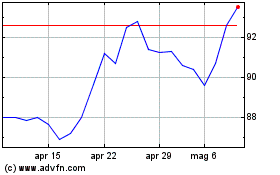

Grafico Azioni Heineken (EU:HEIA)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Heineken (EU:HEIA)

Storico

Da Apr 2023 a Apr 2024