Schneider Electric Shares Rise on Guidance Hike, Revenue Beat -- Update

25 Ottobre 2018 - 10:51AM

Dow Jones News

By Nathan Allen

Shares in Schneider Electric SE (SU.FR) rose more than 5%

Thursday morning after the French group raised its 2018 guidance

and reported better-than-expected third-quarter revenue.

Revenue rose to 6.38 billion euros ($7.29 billion) from EUR5.90

billion a year earlier, the company said, comfortably beating a

FactSet-compiled consensus of EUR6.31 billion.

Based on the results, Schneider raised its target for 2018

organic sales growth to 6% from a previous estimate of between 5%

and 6%. It also said it now expects organic growth in adjust

earnings before interest, taxes, depreciation and amortization of

between 8% and 9%, compared with an earlier forecast of between 7%

and 8%.

The company may accelerate a previously announced EUR1 billion

buyback program to end in 2018, rather than previous guidance for

2019.

At 0810 GMT the company was trading 5.4% higher at EUR60.86.

All of Schneider's business units and regions contributed to the

higher growth. The company reported organic growth of 11% in Asia

Pacific and 9% in North America.

Jefferies analyst Peter Reilly said the biggest surprise was the

solid growth at Schneider's medium-voltage and secure-power

businesses, which are generally the lowest-performing units.

The results are likely to prompt upgrades to consensus estimates

and improve sentiment on the stock, which has come under pressure

recently, according to UBS's Markus Mittermaier.

However, the slowing outlook for Asia Pacific growth raises some

concerns for the future, Mr. Mittermaier said.

Write to Nathan Allen at nathan.allen@dowjones.com

(END) Dow Jones Newswires

October 25, 2018 04:36 ET (08:36 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

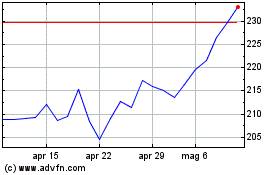

Grafico Azioni Schneider Electric (EU:SU)

Storico

Da Mar 2024 a Apr 2024

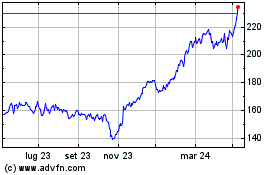

Grafico Azioni Schneider Electric (EU:SU)

Storico

Da Apr 2023 a Apr 2024