| Montrouge, 7 November 2018 |

Results for the third quarter and

first nine months of 2018

Q3-18: solid

and growing results[1]

| Crédit Agricole S.A. |

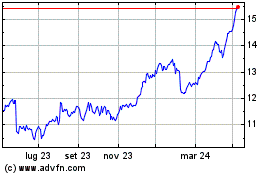

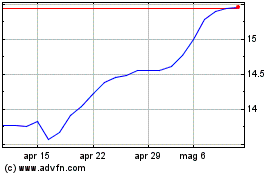

Stated net income[2]

Q3: €1,101m

+3.2% Q3/Q3

9M: €3,393m

+4.0% 9M/9M |

Stated net revenues

Q3: €4,802m

+5.0% Q3/Q3

9M: €14,882m

+6.4% 9M/9M |

Fully-loaded CET1 ratio

11.5%

+11bp in Q3,

well above the MTP target (11%) |

-

Underlying1 net profit2

Q3 €1,133m, +17.3% Q3/Q3 (9M: €3,338m, +9.5%

9M/9M)

-

Earnings per share1: Q3 €0.36, +18.6% Q3/Q3, 9M

€1.06, +10.9% 9M/9M; ROTE1 13.1% 9M annualised

-

Contribution by all the

business divisions to growth in revenue and results, with a

particularly high level of profitability in CIB, and strong growth

in CIB/Financing

-

Good cost control: jaws

effect1 excluding SRF[3] > 2pp

Q3/Q3, 1.7pp 9M/9M, improvement in C/I ratio1 Q3/Q3 and 9M/9M

-

Still a very low cost of credit

risk, with further decline: 26bp[4] (-5bp

Q3/Q3)

-

Fully-loaded CET1 ratio:

+11bp in Q3, good management of risk-weighted assets, 9M

provision for dividend: €0.53

|

| Crédit Agricole Group* |

Stated net income2

Q3: €1,769m

-7.3% Q3/Q3

9M: €5,273m

-6.1% 9M/9M |

Stated net revenues

Q3: €8,043m

+2.0% Q3/Q3

9M: €24,729m

+2.8% 9M/9M |

Fully-loaded CET1 ratio

14.9%

+12bp in Q3

540bp above the P2R[5] |

-

Very strong, good quality activity in all

business lines: Retail Banking, Specialised Businesses and the

Large Customers division

-

Q3 underlying1 net profit2: €1,815m, +3.2% Q3/Q3; 9M:

€5,224m, -3.8% 9M/9M after a sharp increase in the SRF3 and a

negative scope effect

-

Resumption of revenue

growth1 for the Regional banks

-

A positive jaws

effect1 excluding the

SRF3 Q3/Q3 thanks to

an increase in revenues across all business divisions,

including Retail Banking France, and good cost control

excluding the SRF (+2.8%)

-

Decrease in cost of credit

risk to 18bp4

(Regional banks: -€104m in Q3-18, vs. just -51 in Q3-17)

-

S&P raised its long-term

rating to A+/stable outlook on 19 October; each rating agency

has raised its long-term rating over the last three years

* Crédit Agricole S.A. and

Regional banks at 100% |

This press release comments on

the results of Crédit Agricole S.A. and those of

Crédit Agricole Group, which comprises the

Crédit Agricole S.A. entities and the

Crédit Agricole Regional banks, which own 56.3% of

Crédit Agricole S.A. Please see from

p. 15 onwards for

details of specific items which, after restatement for the

various related intermediary balances, are used to calculate

underlying results. A reconciliation between the stated income

statement and the underlying income statement can be found from

p. 21 onwards for

Crédit Agricole Group and from p. 17 onwards for

Crédit Agricole S.A.

Crédit Agricole Group

Crédit Agricole Group made a

net profit Group share of €1,815 million in the

third quarter, posting high profitability and further growth

in relation to the same quarter last year. Commercial momentum

remained strong across all business lines thanks to the capture of

new customers by the Group's retail banks and cross-selling.

All the business divisions generated revenue growth over the

quarter, including Retail Banking France, the

Regional banks and LCL, which seem to have reached the point

where the decrease in interest margin is offset by growth in

volumes and commission income. Tight cost control enabled a

positive jaws effect of nearly one percentage point

on an underlying[6] basis and

an improvement in the cost/income ratio to 62.8%. Consequently, all

the Group's business divisions posted growth in gross

operating income, including Retail Banking France. There are

some mixed developments behind the apparent stability of the cost

of risk: credit quality continued to improve in Retail Banking

in Italy and remained excellent for Corporate and Investment

Banking, LCL and the Regional banks, even if the latter saw a

doubling of their cost of risk as a result of reversals of

collective provisions in the third quarter of 2017.

As in the previous quarter, the strong level of results and related

growth can be fully attributed to higher revenues and cost control.

The fully-loaded Common Equity Tier 1 ratio at

end-September 2018 increased by +12 basis points

compared to end-June at 14.9%, 540 basis points above the

required regulatory level[7].

In line with the "Strategic

Ambition 2020" medium-term plan (MTP), the Group's stable,

diversified and profitable business model drove organic growth

in all its business lines, largely through synergies between the

specialised business lines and the retail networks, and ensured a

high level of operating efficiency while generating leeway to

invest in development.

The following highlights since the

last quarterly publication must be taken into account:

-

the merger of each of the legal

entities of the three Italian banks acquired at the end of 2017

- CR Rimini, CR Cesena, CR San Miniato - was

completed on 22 September on finalisation of the merger of

CR Rimini with CA Italia; these four entities are now

grouped together to optimise cost savings; the migration of their

IT systems for this purpose was also finalised during the

quarter;

-

CA Assurances (CAA),

in line with its new strategy to expand

distribution to international partners outside of the

Crédit Agricole Group, strengthened its property &

casualty insurance partnership with Portuguese bank Novo Banco

by signing a framework agreement on 15 October to increase its

stake in the jointly-owned subsidiary GNB Seguros from 50% to

75% by acquiring the 25% stake held by the Portuguese insurance

company Seguradoras Unidas;

-

S&P Global Ratings upgraded its senior long-term credit rating for the Group and its

main subsidiaries by one notch on 19 October from A to A+ with a stable outlook, having

factored in the improvement in the Group's risk profile and its

resilience capacity, despite the less favourable environment for

its activities;

-

the results of the EBA

(European Banking Authority) stress tests published on 2

November show a solid Group financial position and solid business

lines, with Crédit Agricole Group's CET1

ratio at 10.2%, remaining well above the required SREP level of

9.5% even in an adverse scenario, without ever hitting the

distribution restriction level;

-

Concerning the litigation

matter with OFAC, the US authorities (United States Attorney's

Office for the District of Columbia and District Attorney of the

County of New York) decided on 19 October 2018 to

cease the pursuit of criminal sanctions which

had been deferred for three years in line with the deferred

prosecution agreement signed between CACIB and said authorities in

October 2015; the authorities acknowledged that CACIB has fulfilled all the obligations required of it

under such agreements, which have now expired; the US

authorities thus acknowledged the improvements in compliance

implemented by CACIB, which remains fully committed to

strengthening its procedures and internal controls to ensure

compliance with international economic sanctions;

In

third quarter 2018, Crédit Agricole Group's

stated net income came to €1,769 million compared to €1,907 million in

third quarter 2017.

In line with previous quarters,

there were few specific items, in line

with previous quarters (no new elements) and the net effect on

net income this quarter is limited: -€46 million. They include a cost of

-€6 million (-12 before tax and non-controlling

interests) related to the integration of Pioneer Investments

in Amundi, integration costs related to the three Italian banks of

-€3 million (-7 before tax and non-controlling

interests), and the net balance of recurring volatile accounting

items of -€37 million, namely DVA[8] in the

amount of -€6 million,

hedging of the loan portfolio of the

Large Customers division in the amount of -€10 million

and provisions for home purchase savings of -€22 million

(-33 before tax, of which -22 related to the

Regional banks and -2 related to LCL). In

third quarter 2017, specific items had an impact

on net income of +€149 million,

notably a positive impact from the disposal of the stake in BSF

(+€117 million in equity-accounted entities), the

integration costs of Pioneer Investments in the amount of

-€11 million (-27 million before tax and non-controlling

interests), the initial integration costs of the three Italian

banks in the amount of -€3 million (-5 before tax) and a

net balance of +€46 million in net income from

recurring volatile accounting items, namely issuer

spread for -€23 million (-28 before tax),

hedging of the loan portfolios of the

Large Customers division for -€9 million and

provisions for home purchase savings plans for

+€78 million (+119 before tax), of which +80 related to the

Regional banks and +8 related to LCL.

Excluding these

specific items, underlying

net income was [9] €1,815 million, representing an increase of +3.2%

versus the third quarter of 2017. This is the second

time since the third quarter of 2016[10] that the

Group has surpassed €1.8 billion in the third quarter, as

it traditionally records a decline in Q3 versus the

first two quarters of the year due to seasonal effects.

Underlying net income fell by -11.7% in relation to the

second quarter of 2018 net income of

€2,056 million, which was the highest

quarterly underlying net income posted by the Group

since it began publishing its quarterly results.

Table 1.

Consolidated results of

Crédit Agricole Group in Q3-2018 and in Q3-2017

|

€m |

Q3-18

stated |

Q3-17

stated |

Ch. Q3/Q3

stated |

Q3-18

underlying |

Q3-17

underlying |

Ch. Q3/Q3

underlying |

| |

|

|

|

|

|

|

| Revenues |

8,043 |

7,885 |

+2.0% |

8,097 |

7,807 |

+3.7% |

| Operating expenses

excl.SRF |

(5,102) |

(4,974) |

+2.6% |

(5,083) |

(4,947) |

+2.8% |

| SRF |

- |

- |

n.m. |

- |

- |

n.m. |

| Gross operating income |

2,940 |

2,911 |

+1.0% |

3,014 |

2,860 |

+5.4% |

| Cost of risk |

(323) |

(317) |

+1.9% |

(323) |

(317) |

+1.9% |

| Cost of legal

risk |

- |

(75) |

(100.0%) |

- |

(75) |

(100.0%) |

| Equity-accounted

entities |

77 |

240 |

(67.9%) |

77 |

123 |

(37.4%) |

| Net income on other

assets |

2 |

1 |

+60.3% |

2 |

6 |

(72.1%) |

| Change in value of

goodwill |

- |

- |

n.m. |

- |

- |

n.m. |

| Income before tax |

2,696 |

2,760 |

(2.3%) |

2,770 |

2,597 |

+6.6% |

| Tax |

(816) |

(743) |

+9.8% |

(839) |

(719) |

+16.7% |

| Net income from

discont'd or held-for-sale ope. |

(1) |

(2) |

(52.9%) |

(1) |

(2) |

(52.9%) |

| Net income |

1,879 |

2,015 |

(6.7%) |

1,930 |

1,876 |

+2.9% |

| Non controlling

interests |

(110) |

(108) |

+2.5% |

(115) |

(117) |

(2.2%) |

| Net income Group Share |

1,769 |

1,907 |

(7.3%) |

1,815 |

1,759 |

+3.2% |

| Cost/Income ratio excl.SRF (%) |

63.4% |

63.1% |

+0.4 pp |

62.8% |

63.4% |

-0.6 pp |

Third-quarter underlying revenues increased by +3.7% in relation to third quarter 2017, at

€8,097 million, surpassing the €8 billion mark despite

the seasonal effect. All the business lines contributed to growth,

including the two French Retail Banking networks,

the Regional banks and LCL, that seem to have reached the

inflection point for revenue growth after suffering pressure

on their interest income as a result of lower

interest rates. Growth in volumes, which remained very strong,

particularly in all lending segments, and in commission income

offset the year-on-year decrease in margins on home loans.

Underlying revenues (excluding

provisions for home purchase savings) of the

Regional banks and LCL increased by +1.0% and +2.3%

respectively in relation to the

third quarter of 2017. These two networks are the

two biggest contributors[11] to Group

revenues, accounting for 50% of said revenues (40% for the

Regional banks and 10% for LCL). All the other business lines

contributed positively to growth, barring Amundi (-1.5%), which

from the third quarter ceased to benefit from the scope effect

related to Pioneer (integrated since 3 July 2017) and

which posted a very low level of performance fees for the quarter;

nevertheless, management fees, which are a more accurate reflection

of the activity and growth in assets under management,

grew by +3.6%.

Among the business lines that

recorded growth, it is worth noting the Insurance activity and

CIB/Financing, each of which accounted for 8% of total Group

revenues this quarter, and which saw increases of +27.6% and +25.5%

respectively in relation to the

same quarter last year, without any

scope effect. These business lines are the fourth and third

largest contributors respectively to Group revenues. During the

quarter, Crédit Agricole Assurances benefited from the

normalisation of the recognition of its financial margin, in

relation to a very low level in the third quarter of 2017, and

continued strong premium income growth in non-life

insurance, along with strict control of the combined ratio in

property & casualty insurance despite climatic

events. The CIB/Financing activities recorded strong commercial

banking performances across all product lines, notably in

trade finance, and a solid level of origination in

structured financing.

The

Regional banks therefore recorded underlying revenue

growth for the second quarter in a row, at +1.0% to

€3,242 million (compared to +0.5% in Q2 versus the same

quarter last year). The environment of ongoing low interest rates

continued to weigh on interest margin, but

interest income stabilised thanks to strong growth in volumes,

while the increase in fee and commission income

(+1.5% in relation to third quarter 2017) enabled growth

in revenues; they account for more than half of commercial banking

revenues.

Underlying

operating expenses increased at a slower pace than revenues, at

+2.8% in relation to

third quarter 2017. This gave a positive jaws effect of

nearly one percentage point, while the underlying cost/income ratio improved by

0.6 percentage point in relation to

third quarter 2017 at 62.8%.

Underlying gross operating income increased by

+5.4% compared to

third quarter 2017.

The cost of

credit risk remained almost stable at -€323 million versus

-€317 million in third quarter 2017, but it

decreased in relation to the previous quarter (-€397 million).

Behind this year-on-year stability there is in fact a decline when

we exclude changes in provisions for the Regional banks,

notably the continued high reversals in the

third quarter of 2017: Excluding the

Regional banks, the cost of risk decreased by

-16.5%, attributable in particular to the Large Customers

division, which recorded net reversals of +€57 million

compared to net reversals of +€21 million in

third quarter 2017, and Retail Banking in Italy,

whose cost of risk decreased by -12.4% to

-€70 million despite the integration of the

three Italian banks since the end of 2017, thanks to the

improvement in the quality of the loan portfolios. The

cost of credit risk relative to outstandings

remained low, at 18 basis points[12], stable in

relation to third quarter 2017 and

second quarter 2018. It remained at a very low level for

the Regional banks - 10 basis points - and decreased

further for Retail Banking in Italy, at

73 basis points, versus 89 in the same period last year

and 101 two years ago.

Adding the contribution from

equity-accounted entities, which decreased by -37.4%/-€46 million

to €77 million due to the deconsolidation of BSF (contribution of

€46 million in third quarter 2017), underlying pre-tax income rose by +6.6% compared to

third quarter 2017, reaching €2,770 million.

Several business lines -

Regional banks, LCL, Insurance, Wealth Management,

Consumer finance - recorded an increase in

their tax expense in relation to a low comparison base in

third quarter 2017 for different reasons depending on the

business line, which explains the higher increase in this item

(+16.7%) than in pre-tax income, even after

restatement for the contribution from equity-accounted entities

(+8.9%), and therefore in the effective tax rate to 31.1%

(+2.1 percentage points in relation to

third quarter 2017.

Despite the decrease in

non-controlling interests linked to the acquisition of the minority

interests of CACEIS (-2.2%), this explains the smaller increase of +3.2% in underlying net income to

€1,815 million.

Table 2.

Consolidated results of

Crédit Agricole Group in 9M 2018 and in 9M 2017

|

€m |

9M-18

stated |

9M-17

stated |

Ch. 9M/9M

stated |

9M-18

underlying |

9M-17

underlying |

Ch. 9M/9M

underlying |

| |

|

|

|

|

|

|

| Revenues |

24,729 |

24,062 |

+2.8% |

24,748 |

24,080 |

+2.8% |

| Operating expenses

excl.SRF |

(15,587) |

(15,167) |

+2.8% |

(15,566) |

(15,108) |

+3.0% |

| SRF |

(389) |

(285) |

+36.2% |

(389) |

(285) |

+36.2% |

| Gross operating income |

8,754 |

8,610 |

+1.7% |

8,794 |

8,686 |

+1.2% |

| Cost of risk |

(1,141) |

(1,113) |

+2.5% |

(1,141) |

(1,113) |

+2.5% |

| Cost of legal

risk |

(5) |

(115) |

(96.0%) |

- |

(115) |

(100.0%) |

| Equity-accounted

entities |

256 |

683 |

(62.6%) |

256 |

459 |

(44.3%) |

| Net income on other

assets |

39 |

(0) |

n.m. |

39 |

5 |

x

8.4 |

| Change in value of

goodwill |

86 |

- |

n.m. |

- |

- |

n.m. |

| Income before tax |

7,989 |

8,065 |

(0.9%) |

7,948 |

7,922 |

+0.3% |

| Tax |

(2,317) |

(2,185) |

+6.0% |

(2,331) |

(2,208) |

+5.6% |

| Net income from

discont'd or held-for-sale ope. |

(3) |

43 |

n.m. |

(3) |

43 |

n.m. |

| Net income |

5,669 |

5,923 |

(4.3%) |

5,614 |

5,757 |

(2.5%) |

| Non controlling

interests |

(395) |

(310) |

+27.6% |

(390) |

(327) |

+19.2% |

| Net income Group Share |

5,273 |

5,614 |

(6.1%) |

5,224 |

5,430 |

(3.8%) |

| Cost/Income ratio excl.SRF (%) |

63.0% |

63.0% |

-0.0 pp |

62.9% |

62.7% |

+0.2 pp |

Underlying net

income in the first nine months of 2018 decreased by -3.8% in relation to the first nine months of 2017, and

by -0.2% excluding the SRF. It should be noted

that while a calculation on a like-for-like basis is no longer

possible after the merger of the legal entities of the three

Italian banks, the scope effect on growth over nine months is

without doubt negative: the sale and deconsolidation of BSF and

Eurazéo led to a loss in contribution to net income of

+€203 million, while the contribution of Pioneer to be

reintegrated over one six-month period had a positive impact on

nine-month growth of just €75 million, and the three Italian

banks and Banca Leonardo did not offset the difference.

Underlying

revenues increased by +2.8%, with

underlying operating expenses excluding SRF up

by +3.0% and the cost of

credit risk (excluding an unallocated legal provision of

-€115 million in the first - -40 - and third - -75 - quarters

of 2017) up by +2.5%. Pre-tax

income therefore remained almost stable

(+0.3%) at €7,948 million, but the increase in tax (+5.6%)

already signalled in the third quarter and in minority interests

linked mainly to the scope effect of Pioneer and the reduction in

the stake in Amundi led to a reduction in underlying net

income.

During the third quarter, the

Regional banks saw continued good

business growth, both in loans, with outstandings of €479.1 billion

at end-September 2018, up +6.6% in relation to

end-September 2017, and in customer savings, which increased

by +3.8% to outstandings of €688.3 billion. As in the previous

quarters, growth was particularly strong in home loans

(+8.0%), consumer loans (+9.8%), and

loans to businesses and professional clients

(+8.8%). Life insurance assets under management increased by +3.5%,

with the share of unit-linked up by +12.3% in relation to

end-September 2017.

These improvements are associated

with winning new customers, i.e. 136,000 additional individual

customers (net new customers) since the beginning of the year,

including 22,000 for BforBank. The launch of EKO in

December 2017, an access banking solution for the

Regional banks, made it possible to attract

new prospects. Nearly 64,000 customers have opened an

account since launch, i.e. 8% new accounts opened over the period,

in line with the customer segment specifically targeted by the

offer: 31% of the new relationships were formed online.

This commercial performance made a

significant contribution to growth in

Crédit Agricole S.A.'s business lines, which distribute a

large number of products as the Group's main distribution network

and the leading Retail Banking network in France.

In the

third quarter of 2018, the contribution of the Regional banks to

Crédit Agricole Group's underlying

net income came to €671 million, representing a decrease of -13.3% compared to third quarter 2017,

attributable to the aforementioned provision movements (cost of

risk doubled from a very low level).

Over nine

months, this contribution comes to €1,866 million, down -19.3%

also, for the same reason (cost of risk nearly tripled from a very

low level).

The performance of the other

Crédit Agricole Group business lines is described in

detail in the section of this press release on

Crédit Agricole S.A.

Over the quarter,

Crédit Agricole Group's financial solidity remained

robust, with a fully-loaded common equity Tier 1

(CET1) ratio[13] of

14.9%, up by+12 basis points

compared to end-June 2018. This ratio provides a substantial buffer

above the distribution restriction trigger applicable to

Crédit Agricole Group as of 1 January 2019, set

at 9.5% by the ECB.

The TLAC

ratio was 21.2% at 30 September 2018,

excluding eligible senior preferred debt,

stable from end-June 2018 (21.2%) and up compared to

end-September 2017 (20.6%). This ratio is

170 basis points above the minimum requirement excluding

countercyclical buffer for 2019 of 19.5%, without taking into

account senior preferred debt that is eligible at 2.5% of

risk-weighted assets based on the regulatory calculation. The

TLAC ratio target of 22% by 2019, excluding eligible

senior preferred debt, has been confirmed, with a CET1 ratio target

of 15.5% to 16% and 6% to 6.5% for

senior non-preferred debt, Tier 2 and

additional Tier 1 instruments. The Group issued the equivalent of €6.0 billion in Tier 2 and

senior non-preferred debt over the first nine months of the

year.

The MREL

ratio was circa 13% at

30 September 2018, of which 8.3%

excluding eligible senior preferred debt.

Crédit Agricole Group was notified on

8 June 2018 of the immediately applicable minimum

required level including eligible senior preferred debt.

Crédit Agricole Group complied with this minimum level at

30 September 2018.

The phased-in

leverage ratio[14] came

to 5.4%, stable compared

to end-June 2018.

Crédit Agricole Group's

liquidity position is solid. Its banking cash

balance sheet, at €1,210 billion at

30 September 2018, shows a surplus of

stable funding resources over stable application of funds of

€111 billion, up €5 billion compared to

end-June 2018. This surplus exceeds the MTP target of

over €100 billion. The surplus of stable funds finances the

HQLA (High Quality Liquid Assets) securities

portfolio generated by the LCR (Liquidity Coverage Ratio)

requirement for customers and customer-related activities. The

liquidity reserves, which include capital

gains and discounts on securities portfolios, stood at €262 billion on 30 September 2018, covering the

level of short-term debt (€110 billion) more than twice

over.

Crédit Agricole Group

issuers raised €26.1 billion equivalent

of medium- and long-term debt in the

first nine months of 2018, versus just over

€36.1 billion for the whole of 2017. Moreover,

Crédit Agricole Group placed €2.4 billion in bonds

with its retail banking networks (the

Regional banks, LCL and CA Italia). Crédit Agricole S.A. raised a total of

€12.2 billion over the first nine months of 2018,

representing 47% of the total issuance of all the Group's issuers,

thus achieving 102% of its issuance programme for

2018.

* *

*

Dominique Lefebvre, Chairman of

SAS Rue La Boétie and Chairman of Crédit Agricole S.A.'s

Board of Directors, commented on the Group's nine-month 2018

results and activity as follows:" Over the first

nine months of the year, Crédit Agricole Group has

demonstrated the soundness of the customer projects, organisation

and business model adopted by it. Our retail banks on domestic

markets in France and Italy all gained new customers.

Thanks to our

customer-focused universal banking model, which underpins our

overall relationship with our customers and the quality and

diversity of the products and services proposed by our specialised

business lines, we have been able to increase the equipment rate of

our insurance and banking customers, notably in property &

casualty insurance.The relevance of this banking model combined

with steadfast financial soundness are strong attributes that can

turn a persistently uncertain environment to good account."

Crédit Agricole S.A. Solid growth in Q3/Q3 and 9M/9M results, despite difficult

markets in Q3

-

Underlying net income above

€1bn: Q3-18 €1,133m, the highest third-quarter level since the

financial crisis; +17.3% Q3/Q3, 9M-18 €3,338m,

+9.5% 9M/9M despite an increase in the SRF;

-

Contribution by all of the

business divisions to growth (SFS stable), with a particularly

high level of growth and profitability in CIB/Financing;

-

Underlying annualised

ROTE[15] 13.1%;

RONE Corporate and Investment Banking 13.1% after tax and

AT1 costs;

Strong activity, growth in revenue Q3/Q3 in all

business lines

-

Strong growth in lending

for the Retail Banks, good resilience in savings

inflows in a difficult market environment;

-

Underlying revenues up +5.9%

Q3/Q3, contribution by all the business divisions, strong

increase in Insurance (+27.1%) and Large Customers (+5.5%),

notably for the CIB/Financing activities (+25.5%);

Confirmed cost control and further fall in the

cost of risk

-

Further improvement in

operating efficiency: underlying expenses +3.6% Q3/Q3,

strong jaws effect (>+2pp

Q3/Q3) in all business lines (+1.7pp 9M/9M),

further improvement in the underlying C/I ratio 1.4pp Q3/Q3 and

1.0pp 9M/9M;

-

Further decrease in the cost of

credit risk: -16.5% Q3/Q3; cost of risk relative to

outstandings: 26bp;

Financial solidity: increase in CET1 ratio Q3/Q2

and upgrade by S&P

-

Fully-loaded CET1 ratio

11.5%, above the MTP target of 11%, +11bp in Q3;

-

Capital generation through retained earnings

(+16bp, including a 9M dividend provision at €0.53);

-

RWA stable: +€0.5bn/end-June; impact from

reserves booked under OCI: -7bp, of which -2bp related to the

widening of spreads on Italian sovereign yields;

-

Long-term rating by S&P raised to A+ (stable

outlook), rating raised by each rating agency in the past three

years (Moody's to A1/positive outlook and Fitch to A+/stable

outlook);

-

Settlement of OFAC litigation: definitive

discharge from criminal prosecution at the end of the three-year

probationary period.

Crédit Agricole S.A.'s

Board of Directors, chaired by Dominique Lefebvre, met on 6

November 2018 to examine the financial statements for the

third quarter and first nine months of 2018.

In

third quarter 2018, stated net income was

€1,101 million versus €1,066 million in the

third quarter of 2017.

There were a small number of

specific items this quarter, which had a

limited net negative effect of

-€32 million on net income, notably the cost of

integrating Pioneer Investments in Amundi which amounted to

-€6 million (-12 before tax and non-controlling interests),

the cost of integrating the three Italian banks in the amount of

-€4 million (-7 before tax and non-controlling interests), and

the net balance of -€23 million in net income from

recurring volatile accounting items, namely the

DVA[16] for

-€6 million,

hedging of the loan portfolios of the

Large Customers division for -€10 million and provisions

for home purchase savings for -€7 million. In third quarter 2017, specific items

had an impact on net income of +€100 million, notably a

positive impact from the disposal of the stake in

BSF[17]

(+€117 million under equity-accounted entities),

integration costs related to Pioneer Investments in the amount

of -€14 million (-€27 million before tax and

non-controlling interests), and a net balance of

+€3 million in net income from recurring volatile

accounting items, namely issuer spread for -€14 million,

hedging of the loan portfolios of the

Large Customers division for -€9 million and

provisions for home purchase savings plans for

+€26 million.

Excluding these

specific items, underlying net income for

third quarter 2018 came to €1,133 million, an increase

of +17.3% compared to third quarter 2017. This is the

highest level of third-quarter underlying net income

published by Crédit Agricole S.A. since the financial

crisis[18].

Underlying

earnings per share came to €0.36, an increase of +18.6% compared to third quarter 2017.

Tangible net asset per share

(not revaluated, excluding OCI reserves, before deduction

of the dividend) came to €11.5, up +3.2% versus end-September 2017 (including the

IFRS9 impact of -€0.04 per share) and +3.0%

versus end-June 2018.

Table 3.

Consolidated results of

Crédit Agricole S.A. in Q3-2018 and in Q3-2017

|

€m |

Q3-18

stated |

Q3-17

stated |

Ch. Q3/Q3

stated |

Q3-18

underlying |

Q3-17

underlying |

Ch. Q3/Q3

underlying |

| |

|

|

|

|

|

|

| Revenues |

4,802 |

4,575 |

+5.0% |

4,834 |

4,564 |

+5.9% |

| Operating expenses

excl.SRF |

(2,998) |

(2,902) |

+3.3% |

(2,979) |

(2,875) |

+3.6% |

| SRF |

- |

- |

n.m. |

- |

- |

n.m. |

| Gross operating income |

1,804 |

1,672 |

+7.8% |

1,856 |

1,689 |

+9.9% |

| Cost of risk |

(218) |

(262) |

(16.5%) |

(218) |

(262) |

(16.5%) |

| Cost of legal

risk |

- |

(75) |

(100.0%) |

- |

(75) |

(100.0%) |

| Equity-accounted

entities |

78 |

239 |

(67.3%) |

78 |

122 |

(35.9%) |

| Net income on other

assets |

(0) |

(7) |

(98.7%) |

(0) |

(2) |

(96.0%) |

| Change in value of

goodwill |

- |

- |

n.m. |

- |

- |

n.m. |

| Income before tax |

1,663 |

1,567 |

+6.1% |

1,715 |

1,472 |

+16.5% |

| Tax |

(434) |

(367) |

+18.3% |

(449) |

(364) |

+23.3% |

| Net income from

discont'd or held-for-sale ope. |

(1) |

(2) |

n.m. |

(1) |

(2) |

n.m. |

| Net income |

1,228 |

1,198 |

+2.5% |

1,265 |

1,105 |

+14.4% |

| Non controlling

interests |

(128) |

(132) |

(3.2%) |

(132) |

(139) |

(5.3%) |

| Net income Group Share |

1,101 |

1,066 |

+3.2% |

1,133 |

966 |

+17.3% |

| Earnings per share (€) |

0.35 |

0.34 |

+3.1% |

0.36 |

0.31 |

+18.6% |

| Cost/Income ratio excl.SRF (%) |

62.4% |

63.4% |

-1.0 pp |

61.6% |

63.0% |

-1.4 pp |

All the business

lines contributed to growth in underlying net income

barring Specialised Financial Services, which saw a

stable year-on-year performance. This growth was achieved despite a

more difficult market environment, thanks to a high level of

activity, albeit slower in some business lines due to annual

seasonal effects (namely Asset and Wealth management). This

activity was of good quality in terms of risk profile and

profitability, notably because it was amplified by cross-selling

between the Crédit Agricole S.A. businesses and the

Crédit Agricole Group Retail Banks, including the

Regional banks, in line with the medium-term plan (MTP)

strategy to strengthen cross-selling. The revenue growth recorded

in all of the business lines attest to this. The quarter was also

marked by a continued improvement in operating efficiency, as

reflected in positive jaws effects and an improvement in the

underlying cost/income ratio. Finally, the reduction in

the cost of risk, particularly in Italy, and the net reversals of

credit provisions in Corporate and Investment Banking enabled an

acceleration of growth in net income.

It should be noted that due to the

legal merger of each of the three Italian banks with CA Italia

it is no longer possible to calculate a scope effect from the

third quarter of 2018. As for the

Crédit Agricole Group, the scope effect was

undoubtedly negative in terms of growth in underlying net income,

as the contribution of BSF in the

third quarter of 2017 (€46 million) was not yet

offset by the contributions of the three Italian banks

and Banca Leonardo. Conversely, the forex effect being

much smaller than during the two previous quarters (the

euro lost -1.3% vs. the US dollar on average in

third quarter 2018 in relation to the same period in

2017), no forex effect was calculated for this quarter.

Third quarter 2018 underlying revenues reached €4,834 million, up

+5.9% thanks to a contribution by all the

business lines, including Retail Banking, which saw an

increase of +4.3% versus third quarter 2017, attributable

to a strong performance by LCL, +2.3% (+3.5% excluding

renegotiation fees and early redemptions) and the scope effect of

the three Italian banks. Of particular note is the very strong

performance by the Insurance activity (+27.1%) and

Corporate and Investment Banking, whose revenues

grew by +4.4% despite a high comparison base in the

third quarter of 2017 and difficult markets in the

third quarter of 2018. This increase was notably

underpinned by Corporate Banking (+25.5%), which benefited during

the quarter from strong performances in all Commercial Banking

product lines and a high level of Structured financing

activity.

Other notable activity

developments among the business lines in the third quarter

include:

-

a high level of lending

activity in Retail Banking on the Group's domestic

markets, with growth in loans to businesses topping +10% for

the Regional banks and LCL versus 30 September 2017,

and strong home loan activity, which grew by +4.5% at LCL and +8.0%

among the Regional banks; since December 2017,

CA Italia has benefited from a scope effect related to the

three Italian banks, which recorded a sharp sequential increase in

their loan origination, e.g. new home loans up +26% in

the third quarter versus the second quarter, after +61% in the

second quarter versus the first quarter;

-

strong net inflows in the

Asset gathering & Insurance division, attributable in

particular to life insurance (+€2.0 billion, of which

€1.2 billion in unit-linked activity) and good resilience in

asset management (+€6.1 billion), despite a difficult

market environment and the announced loss in the

second quarter of the Fineco mandate; the Insurance business

continued to generate strong growth in property & casualty

premiums, which reached +8.6%, thanks notably to growth in the

customer equipment rate at the retail banks

(+1.3 percentage points over nine months for the

Regional banks to 35.9% and +1.1 for LCL at 23.5%);

-

good growth in Specialised

Financial Services outstandings, both in

Consumer finance's managed loans (+6.9% versus

end-September 2017 to €85.9 billion, showing an

acceleration versus end-June), which were driven by partnerships

with automotive companies and the Group networks, and in

consolidated finance leases (+3.4% versus end-September 2017

to €14.3 billion, particularly international leases +10.2%),

and factoring revenue (+3.6% in third quarter 2018 versus

the same quarter in 2017);

-

the high level of activity in CIB/Financing

activities, which this quarter did not lead to an increase in

risk-weighted assets thanks to good syndication activity and risk

transfer: the average primary distribution rate

over twelve rolling months was 38%.

Since the last quarterly

publication there has been a notable reinforcement of

Crédit Agricole Assurances' bancassurance partnership with Portuguese bank Novo

Banco, achieved by bringing CAA's interest in the brokerage firm

GNB Seguros to 75% through the purchase of the 25% stake held by

Portuguese insurance company Seguradoras Unidas. Details of

the other highlights are provided in the section on

Crédit Agricole Group.

Revenue

growth was reinforced by good cost

control, with underlying expenses growing by just +3.6% versus third quarter 2017. It should be

noted that the bulk of this increase of +€104 million came

from three business lines: Retail Banking in Italy

(+16.5%/+€40 million) due to the scope effect,

CIB/Financing activities thanks to its strong level of activity

(+6.6%/+€15 million, but revenues rose by +25.5%) and the

Corporate Centre (+€27 million/+14.8%) due to investment

in information systems and payments. By contrast, the other

business lines showed no change (Consumer finance,

Insurance) or a decrease (Asset Management, LCL). This

tight cost management made it possible to generate a

significant jaws effect between growth in

underlying revenues and in underlying expenses of more

than +2 percentage points, leading to an improvement in the cost/income ratio of

1.4 percentage points versus

third quarter 2017, to 61.6%. All

business divisions contributed to this good performance, each

generating a positive underlying jaws effect.

Underlying

gross operating income therefore increased by

+9.9% compared to

third quarter 2017.

The cost of

risk decreased further to a very low level, reaching

€218 million versus €262 million in

third quarter 2017, down

-16.5%/-€44 million in relation to

third quarter 2017, notably attributable to the

Large Customers division, which recorded net reversals of

+€57 million compared to net reversals of +€21 million in

third quarter 2017, and Retail Banking in Italy,

whose cost of risk decreased by -12.4%/-€10 million despite

the integration since the end of 2017 of the three Italian banks,

thanks to an improvement in the quality of the

loan portfolios. By contrast, the cost of risk increased for

Specialised Financial Services (+10.3%/+€13 millions) and for

Consumer finance in particular: the cost of risk relative to

outstandings normalised at 118 basis points while

consolidated outstandings increased. A slight increase also for LCL

(+11.1%/+€5 million), but from a very low level. The cost of credit risk relative to outstandings of

Crédit Agricole S.A. remained low at

26 basis points[19], down

-5 basis points versus third quarter 2017 but

stable in relation to second quarter 2018 and still lower

than the 50 basis point assumption in the medium-term

plan.

The underlying

contribution of equity-accounted entities

decreased by -35.9% to €78 million. Excluding the loss of the

contribution from BSF, it would have increased by +3% notably due

to the sharp increase in profitability of the Asset management

joint ventures in Asia.

Underlying

pre-tax income[20] before

discontinued operations and non-controlling interests increased by

+16.5% to €1,715 million. The third and second

quarters of 2017 benefited from low tax on capital gains

on the disposal by the Insurance business line, which saw the

underlying effective tax rate come out at 27.0% versus 27.4% in

third quarter 2018. The underlying tax expense therefore

increased at a higher pace than pre-tax income, by +23.3% to

€449 million. This brought growth in net income before non-controlling interests to

+14.4%. The decrease in non-controlling interests, partly

linked to the buyback of non-controlling interests in CACEIS last

December, brought the increase in underlying net

income to +17.3% versus

third quarter 2017, at €1,133 million.

Stated net income in the first nine months of 2018

amounted to €3,393 million, compared to

€3,262 million in the first nine

months of 2017, an increase of +4.0%.

Specific items during the first nine months of

2018 had an impact of +€54 million on

stated net income. In addition to the

third quarter items already mentioned above, the

first half 2018 items had a positive impact of

+€87 million, including the adjustment of negative goodwill

recognised at the time of acquisition of the

three Italian banks totalling +€66 million, the cost

of integrating Pioneer Investments of -€8 million

(-€14 million over nine months), reversals of integration

costs for the three Italian banks leading to net

reversals over nine months of +€5 million and recurring

specific items over nine months, namely the DVA for

+€5 million,

hedging of the loan portfolios of the

Large Customers division for +€4 million, and provisions

for home loan savings of -€7 million. Specific items for the first nine months of 2017

had an impact of +€214 million on net income. They

notably included an impact on net income from the

integration costs of Pioneer in the amount of

-€28 million, the capital gain on the disposal of BSF in the

amount of +€107 million, the capital gain on the sale of

Eurazeo in the amount of +€114 million, issuer spread of

-€69 million, the DVA of -€39 million,

hedging of the loan portfolio of the

Large Customers division in the amount of -€34 million

and provisions for home loan savings of

+€165 million.

Excluding these

specific items, underlying net income

reached €3,338 million, increasing by +9.5% compared with the first nine months of 2017.

It was impacted by the sharp increase in the

SRF (+24.5%); if we strip out this increase in

the SRF, underlying net income would have grown by +10.5%.

Underlying

earnings per share came to €1.06, an increase of +10.9% compared to the

first nine months of 2017.

Annualised ROTE[21] (return on

tangible equity excluding intangibles) net of coupons on Additional

Tier 1 securities reached 13.1% in the first nine months of 2018, a significant

increase compared to the first nine months of 2017

(12.4%).

Table 4.

Consolidated results of

Crédit Agricole S.A. in 9M 2018 and in 9M 2017

|

€m |

9M-18

stated |

9M-17

stated |

Ch. 9M/9M

stated |

9M-18

underlying |

9M-17

underlying |

Ch. 9M/9M

underlying |

| |

|

|

|

|

|

|

| Revenues |

14,882 |

13,983 |

+6.4% |

14,880 |

13,962 |

+6.6% |

| Operating expenses

excl.SRF |

(9,074) |

(8,693) |

+4.4% |

(9,053) |

(8,635) |

+4.9% |

| SRF |

(301) |

(242) |

+24.5% |

(301) |

(242) |

+24.5% |

| Gross operating income |

5,507 |

5,047 |

+9.1% |

5,525 |

5,086 |

+8.6% |

| Cost of risk |

(755) |

(972) |

(22.3%) |

(755) |

(972) |

(22.3%) |

| Cost of legal

risk |

(5) |

(115) |

(96.0%) |

- |

(115) |

(100.0%) |

| Equity-accounted

entities |

248 |

678 |

(63.4%) |

248 |

454 |

(45.3%) |

| Net income on other

assets |

32 |

(8) |

n.m. |

32 |

(3) |

n.m. |

| Change in value of

goodwill |

86 |

- |

n.m. |

- |

- |

n.m. |

| Income before tax |

5,113 |

4,630 |

+10.4% |

5,050 |

4,449 |

+13.5% |

| Tax |

(1,244) |

(1,030) |

+20.8% |

(1,250) |

(1,046) |

+19.6% |

| Net income from

discont'd or held-for-sale ope. |

(3) |

43 |

n.m. |

(3) |

43 |

n.m. |

| Net income |

3,866 |

3,643 |

+6.1% |

3,797 |

3,447 |

+10.2% |

| Non controlling

interests |

(473) |

(381) |

+24.1% |

(459) |

(399) |

+15.0% |

| Net income Group Share |

3,393 |

3,262 |

+4.0% |

3,338 |

3,048 |

+9.5% |

| Earnings per share (€) |

1.08 |

1.03 |

+4.7% |

1.06 |

0.96 |

+10.9% |

| Cost/Income ratio excl.SRF (%) |

61.0% |

62.2% |

-1.2 pp |

60.8% |

61.8% |

-1.0 pp |

As during the quarter, this

performance was achieved through strong growth in revenues,

excellent cost control and a decrease in the cost of risk.

Underlying

revenues increased by +6.6% in relation to

the first nine months of 2017, with a positive contribution

recorded by all the divisions, and the performance in the third

quarter enabling the Large Customers division to make up the

lag it recorded in the first half of the year.

Underlying

operating expenses increased by +4.9%, excluding the contribution to the SRF, which

increased by a significant +24.5% to €301 million during the

first nine months of 2018 versus €242 million

during the first nine months of 2017. Thanks to this

positive jaws effect of +1.7 percentage points, the

underlying cost/income ratio excluding the

SRF improved by 1.0 percentage point to 60.8%.

The cost of

credit risk excluding unallocated legal provisions (-€115

million in the first nine months of 2017) decreased by

-22.3%/+€217 million compared to the

first nine months of 2017, at -€755 million. As

during the first half, this decrease can mainly be explained by the

Large Customers division (+€204 million), with net

reversals for this division over nine months (+€38 million)

compared with net allocations (-€166 million) in the

first nine months of 2017, notably Corporate Financing

(+€237 million year-on-year). The contribution changes of the

other activities more or less cancelled each other out: slight

increase for Specialised Financial Services

(+8.8%/-€30 million) and LCL (+5.3%/-€8 million), but a

decrease for International Retail Banking

(-15.7%/+€51 million).

As for the quarter, the -45.3%/-€206 million decrease in underlying results

of the equity-accounted companies can be

explained by the deconsolidation of BSF and to a

lesser extent of Eurazeo, in the amount of -€204 million.

After restatement for this item, growth was recorded in the

Asset management and Consumer finance joint ventures. It

should be noted that the equity-accounted companies contributed

just 7% to underlying net income compared with 15% in the

first nine months of 2017, even though there was an

increase in the related results. The increase in the share of fully

consolidated profit was a significant step in simplifying

Crédit Agricole S.A. and in improving its cash control,

enabling better coverage of dividends.

Underlying

pre-tax income increased by +13.5%,

surpassing the €5 billion mark, at €5,050 million. The decrease in the contribution

of equity-accounted companies and the converse increase in the

share of fully-consolidated income explains the higher increase in

taxation than in pre-tax income, at +19.6%. Net income increased by just +10.2%, while

the stronger increase in non-controlling

interests (+15.0%), notably attributable

to the sharp increase in Amundi's contribution after the

integration of Pioneer, brought growth in underlying net income to +9.5%, at €3,338 million.

In third quarter 2018,

Crédit Agricole S.A.'s financial solidity strengthened,

with a fully-loaded Common Equity Tier 1

(CET1) ratio[22] of

11.5%, up by+11 basis points

compared to end-June 2018. This increase can mainly be

attributed to capital generation during the quarter

(+16 basis points), after the deduction of coupons on

additional Tier 1 securities accrued during the

quarter and a prudential provision for the quarterly dividend

accrual of €0.18 per share (€0.53 per share for the

first nine months of 2018) and the

capital increase reserved for employees settled on

1 August (+4 basis points), from which the negative

effects of changes in OCI reserves (-7 basis points,

of which -2 related to the broadening of spreads on Italian

sovereign yields) and moderate growth in risk-weighted assets over

the quarter (-1 basis point) were deducted. Risk-weighted assets amounted to €307 billion at end-September 2018, stable compared with end-June.

The phased-in leverage ratio[23] was

4.1% at end-September 2018 as defined in the

Delegated Act adopted by the European Commission.

Crédit Agricole S.A.'s

average LCR ratio over twelve months stood at

134.5% at end-September 2018 (134.2% related

to Crédit Agricole Group), higher than the Medium-Term

Plan target of over 110%.

At end-September

2018, Crédit Agricole S.A. had completed 102% of its €12 billion medium- to long term market

funding programme for the year (€12.2 billion). It raised the

equivalent of €6.2 billion in senior preferred debt

(uncollateralised) and collateralised senior debt and the

equivalent of €6.0 billion in Tier 2 and senior non-preferred debt,

the latter amounting to €4.6 billion.

* *

*

Philippe Brassac, Chief Executive

Officer, commented on the third-quarter 2018 results and activity

of Crédit Agricole S.A. as follows: "During the third quarter, Crédit Agricole S.A.

continued to develop in line with the MTP by successfully

integrating recent acquisitions and achieving organic growth in all

of its business lines. This development was efficiently achieved:

expenses continued to be tightly managed, the cost/income ratio

improved, and risk-weighted assets remained almost stable in

relation to the previous quarter. Consequently, we achieved a

strong increase in net income and high profitability, and further

strengthened our financial soundness and the quality of our credit

portfolios. This is reflected in the upgrade by one notch by

S&P of the Group's long-term credit rating. The Group therefore

is well equipped to thrive on all its markets."

Corporate social

and environmental

responsibility

Numerous awards

for Crédit Agricole Group's CSR policy

In recent months, Crédit Agricole

S.A. and its subsidiaries have been awarded many prizes that reward

its Corporate social and environmental responsibility policy, signs

of the Group's success in integrating ESG criteria (environnement,

society and governance) in its investment and lending criteria.

Thus, Amundi was awarded the Corbeille Epargne

Salariale by the French financial weekly «

Mieux vivre votre argent », LCL received the « Best

employee savings plans 5-year management - Equity » award

« Best 1-year PEA (Equity) fund range »,

Crédit Agricole was top-ranked for the « Corbeille Long Terme » (Long term - 5-year

- fund management), the most prestigious prize.

Crédit Agricole CIB received several awards at the

GlobalCapital Green/Sustainable and Responsible

Capital Markets Awards, benchmark prizes for green, social and

sustainable bonds and loans. CA-CIB was voted «

Overall Most Impressive Investment Bank for Green/SRI Capital

Markets ». Finally, Crédit Agricole Assurances

received the award Global Invest Sustainable

Insurance company of the year, organised by the French

financial daily l'Agefi, that rewards the engagement of

CA Assurances in sustainable investments.

Amundi's

commitment to respectful management of ESG analysis

A pioneer in responsible

investment and European leader in asset management, Amundi recently

launched an ambitious action plan to give its commitments new

impetus. The use of ESG (Environmental, Social, Governance)

criteria in its analysis will be rolled out across all of the

Group's fund management within the next three years and the voting

policy at general meetings will systematically incorporate the

results of the companies' ESG rating. Amundi is further

strengthening its responsible investment approach by doubling its

investment in projects with an environmental impact and those

dedicated to the social and solidarity economy.

Integrated

report

Crédit Agricole S.A.

published its third Integrated Report - jointly prepared and

approved by the Board of Directors - at its Annual Shareholders'

Meeting of 16 May. Prepared based on the recommendations of the

IIRC (International Integrated Report Committee), of which

Crédit Agricole S.A. has been a member since 2016, it

offers a summary account of all the Group's other financial and

extra-financial information and of its business model, strategy and

key performance indicators. This document reflects the growing pace

of integration of CSR in the Group's strategy and different

business lines.

Liquidity Green

Supporting Factor

In order to assist its business

lines, Crédit Agricole CIB implemented an initiative

under which projects to help combat climate change can benefit from

a more advantageous internal funding rate. With the "Liquidity

Green Supporting Factor" favourable terms can be offered to

investors enabling an increase in responsible financing

amounts.

Appendix 1 - Specific items,

Crédit Agricole S.A. and

Crédit Agricole Group

Table 5.

Crédit Agricole S.A. -

Specific items, Q3-18 and Q3-17, 9M-18 and 9M-17

|

|

|

Q3-18 |

Q3-17 |

|

9M-18 |

9M-17 |

|

€m |

|

Gross

impact* |

Impact on

NIGS |

Gross

impact* |

Impact on

NIGS |

|

Gross

impact* |

Impact on

NIGS |

Gross

impact* |

Impact on

NIGS |

| Issuer

spreads (CC) |

|

- |

- |

(16) |

(14) |

|

- |

- |

(121) |

(69) |

| DVA

(LC) |

|

(8) |

(6) |

(0) |

(0) |

|

8 |

5 |

(61) |

(39) |

| Loan

portfolio hedges (LC) |

|

(14) |

(10) |

(13) |

(9) |

|

6 |

4 |

(53) |

(34) |

| Home

Purchase Savings Plans (FRB) |

|

(2) |

(1) |

8 |

5 |

|

(2) |

(1) |

63 |

39 |

| Home

Purchase Savings Plans (CC) |

|

(9) |

(6) |

32 |

21 |

|

(9) |

(6) |

154 |

101 |

| Liability

management upfront payment (CC) |

|

- |

- |

- |

- |

|

- |

- |

39 |

26 |

| Total impact on revenues |

|

(33) |

(23) |

10 |

3 |

|

2 |

3 |

20 |

23 |

| Pioneer

integration costs (AG) |

|

(12) |

(6) |

(27) |

(14) |

|

(30) |

(14) |

(59) |

(28) |

| 3 Italian

banks integration costs (IRB) |

|

(7) |

(4) |

- |

- |

|

9 |

5 |

- |

- |

| Total impact on operating expenses |

|

(19) |

(10) |

(27) |

(14) |

|

(21) |

(10) |

(59) |

(28) |

| ECB fine

(CC) |

|

|

|

- |

- |

|

(5) |

(5) |

- |

- |

| Total impact Non-allocated legal risk provisions |

|

|

|

- |

- |

|

(5) |

(5) |

- |

- |

| Eurazeo

sale (CC) |

|

- |

- |

|

|

|

- |

- |

107 |

107 |

| Disposal of

BSF (LC) |

|

- |

- |

117 |

114 |

|

- |

- |

117 |

114 |

| Total impact on equity affiliates |

|

- |

- |

107 |

107 |

|

|

|

224 |

221 |

| Change of

value of goodwill (CC) |

|

- |

- |

- |

- |

|

86 |

66 |

- |

- |

| Total impact on change of value of goodwill |

|

- |

- |

- |

- |

|

86 |

66 |

- |

- |

| CA Italy

acquisition costs (IRB) |

|

- |

- |

(5) |

(3) |

|

- |

- |

(5) |

(3) |

| Total impact on Net income on other assets |

|

- |

- |

(5) |

(3) |

|

- |

- |

(5) |

(3) |

|

Total impact of specific items |

|

(52) |

(32) |

95 |

100 |

- |

62 |

54 |

181 |

214 |

| Asset

gathering |

|

(12) |

(6) |

(27) |

(14) |

|

(30) |

(14) |

(59) |

(28) |

| French Retail

banking |

|

(2) |

(1) |

8 |

5 |

|

(2) |

(1) |

63 |

39 |

| International Retail

banking |

|

(7) |

(4) |

(5) |

(3) |

|

9 |

5 |

(5) |

(3) |

| Specialised

financial services |

|

- |

- |

- |

- |

|

- |

- |

- |

- |

| Large

customers |

|

(21) |

(16) |

103 |

106 |

|

13 |

10 |

3 |

41 |

| Corporate

centre |

|

(9) |

(6) |

16 |

6 |

|

72 |

55 |

179 |

165 |

| * Impacts before tax and minority interests |

Table 6.

Crédit Agricole Group -

Specific items, Q3-18 and Q3-17, 9M-18 and 9M-17

|

|

|

Q3-18 |

Q3-17 |

|

9M-18 |

9M-17 |

|

€m |

|

Gross

impact* |

Impact on

NIGS |

Gross

impact* |

Impact on

NIGS |

|

Gross

impact* |

Impact on

NIGS |

Gross

impact* |

Impact on

NIGS |

| Issuer

spreads (CC) |

|

- |

- |

(28) |

(23) |

|

- |

- |

(145) |

(91) |

| DVA

(LC) |

|

(8) |

(6) |

(0) |

(0) |

|

8 |

6 |

(61) |

(40) |

| Loan

portfolio hedges (LC) |

|

(14) |

(10) |

(13) |

(9) |

|

6 |

5 |

(53) |

(35) |

| Home

Purchase Savings Plans (FRB) |

|

(2) |

(1) |

8 |

5 |

|

(2) |

(1) |

63 |

41 |

| Home

Purchase Savings Plans (CC) |

|

(9) |

(6) |

32 |

21 |

|

(9) |

(6) |

154 |

101 |

| Home

Purchase Savings Plans (RB) |

|

(22) |

(14) |

80 |

52 |

|

(22) |

(14) |

205 |

134 |

| Adjustment

on liability costs (RB) |

|

- |

- |

- |

- |

|

- |

- |

(218) |

(148) |

| Liability

management upfront payment (CC) |

|

- |

- |

- |

- |

|

- |

- |

39 |

26 |

| Total impact on revenues |

|

(54) |

(37) |

78 |

46 |

|

(19) |

(11) |

(17) |

(12) |

| Pioneer

integration costs (AG) |

|

(12) |

(6) |

(27) |

(11) |

|

(30) |

(14) |

(59) |

(26) |

| 3 Italian

banks integration costs (IRB) |

|

(7) |

(3) |

- |

- |

|

9 |

6 |

- |

- |

| Total impact on operating expenses |

|

(19) |

(9) |

(27) |

(11) |

|

(21) |

(8) |

(59) |

(26) |

| ECB fine

(CC) |

|

|

|

- |

- |

|

(5) |

(5) |

- |

- |

| Total impact Non-allocated legal risk provisions |

|

|

|

- |

- |

|

(5) |

(5) |

- |

- |

| Eurazeo

sale (CC) |

|

- |

- |

|

|

|

- |

- |

107 |

107 |

| Disposal of

BSF (LC) |

|

- |

- |

117 |

117 |

|

- |

- |

117 |

117 |

| Total impact on equity affiliates |

|

- |

- |

117 |

117 |

|

|

|

224 |

224 |

| Change of

value of goodwill (CC) |

|

- |

- |

- |

- |

|

86 |

74 |

- |

- |

| Total impact on change of value of goodwill |

|

- |

- |

- |

- |

|

86 |

74 |

- |

- |

| CA Italy

acquisition costs (IRB) |

|

- |

- |

(5) |

(3) |

|

- |

- |

(5) |

(3) |

| Total impact on Net income on other assets |

|

- |

- |

(5) |

(3) |

|

- |

- |

(5) |

(3) |

|

Total impact of specific items |

|

29 |

20 |

163 |

149 |

- |

41 |

50 |

143 |

184 |

| Asset

gathering |

|

(8) |

(4) |

(27) |

(11) |

|

(30) |

(14) |

(59) |

(26) |

| French Retail

banking |

|

- |

- |

87 |

57 |

|

(24) |

(15) |

49 |

27 |

| International Retail

banking |

|

16 |

9 |

(5) |

(3) |

|

9 |

6 |

(5) |

(3) |

| Specialised

financial services |

|

- |

- |

- |

- |

|

- |

- |

- |

- |

| Large

customers |

|

25 |

19 |

103 |

108 |

|

13 |

10 |

3 |

42 |

| Corporate

centre |

|

(5) |

(5) |

4 |

(3) |

|

72 |

63 |

155 |

143 |

| *

Impacts before tax and minority interests |

|

|

|

|

|

|

|

|

|

|

Appendix 2 - Crédit Agricole S.A.:

Stated and underlying detailed income statement

Table 7.

Crédit Agricole S.A. - From stated to

underlying results, Q3-18 and

Q3-17

|

€m |

Q3-18

stated |

Specific

items |

Q3-18

underlying |

Q3-17

stated |

Specific

items |

Q3-17

underlying |

Ch. Q3/Q3

stated |

Ch. Q3/Q3

underlying |

| |

|

|

|

|

|

|

|

|

| Revenues |

4,802 |

(33) |

4,834 |

4,575 |

10 |

4,564 |

+5.0% |

+5.9% |

| Operating expenses

excl.SRF |

(2,998) |

(19) |

(2,979) |

(2,902) |

(27) |

(2,875) |

+3.3% |

+3.6% |

| SRF |

- |

- |

- |

- |

- |

- |

n.m. |

n.m. |

| Gross operating income |

1,804 |

(52) |

1,856 |

1,672 |

(17) |

1,689 |

+7.8% |

+9.9% |

| Cost of risk |

(218) |

- |

(218) |

(262) |

- |

(262) |

(16.5%) |

(16.5%) |

| Cost of legal

risk |

- |

- |

- |

(75) |

- |

(75) |

(100.0%) |

(100.0%) |

| Equity-accounted

entities |

78 |

- |

78 |

239 |

117 |

122 |

(67.3%) |

(35.9%) |

| Net income on other

assets |

(0) |

- |

(0) |

(7) |

(5) |

(2) |

(98.7%) |

(96.0%) |

| Change in value of

goodwill |

- |

- |

- |

- |

- |

- |

n.m. |

n.m. |

| Income before tax |

1,663 |

(52) |

1,715 |

1,567 |

95 |

1,472 |

+6.1% |

+16.5% |

| Tax |

(434) |

15 |

(449) |

(367) |

(2) |

(364) |

+18.3% |

+23.3% |

| Net income from

discont'd or held-for-sale ope. |

(1) |

- |

(1) |

(2) |

- |

(2) |

n.m. |

n.m. |

| Net income |

1,228 |

(37) |

1,265 |

1,198 |

93 |

1,105 |

+2.5% |

+14.4% |

| Non controlling

interests |

(128) |

4 |

(132) |

(132) |

7 |

(139) |

(3.2%) |

(5.3%) |

| Net income Group Share |

1,101 |

(32) |

1,133 |

1,066 |

100 |

966 |

+3.2% |

+17.3% |

| Earnings per share (€) |

0.35 |

(0.01) |

0.37 |

0.34 |

0.04 |

0.31 |

+3.4% |

+18.9% |

| Cost/Income ratio excl.SRF (%) |

62.4% |

|

61.6% |

63.4% |

|

63.0% |

-1.0 pp |

-1.4 pp |

Table 8.

Crédit Agricole S.A. - From stated to

underlying results, 9M-18 and 9M-17

|

€m |

9M-18

stated |

Specific items |

9M-18

underlying |

9M-17

stated |

Specific items |

9M-17

underlying |

Ch. 9M/9M

stated |

Ch. 9M/9M

underlying |

| |

|

|

|

|

|

|

|

|

| Revenues |

14,882 |

2 |

14,880 |

13,983 |

20 |

13,962 |

+6.4% |

+6.6% |

| Operating expenses

excl.SRF |

(9,074) |

(21) |

(9,053) |

(8,693) |

(59) |

(8,635) |

+4.4% |

+4.9% |

| SRF |

(301) |

- |

(301) |

(242) |

- |

(242) |

+24.5% |

+24.5% |

| Gross operating income |

5,507 |

(18) |

5,525 |

5,047 |

(38) |

5,086 |

+9.1% |

+8.6% |

| Cost of risk |

(755) |

- |

(755) |

(972) |

- |

(972) |

(22.3%) |

(22.3%) |

| Cost of legal

risk |

(5) |

(5) |

- |

(115) |

- |

(115) |

(96.0%) |

(100.0%) |

| Equity-accounted

entities |

248 |

- |

248 |

678 |

224 |

454 |

(63.4%) |

(45.3%) |

| Net income on other

assets |

32 |

- |

32 |

(8) |

(5) |

(3) |

n.m. |

n.m. |

| Change in value of

goodwill |

86 |

86 |

- |

- |

- |

- |

n.m. |

n.m. |

| Income before tax |

5,113 |

62 |

5,050 |

4,630 |

181 |

4,449 |

+10.4% |

+13.5% |

| Tax |

(1,244) |

6 |

(1,250) |

(1,030) |

16 |

(1,046) |

+20.8% |

+19.6% |

| Net income from

discont'd or held-for-sale ope. |

(3) |

- |

(3) |

43 |

- |

43 |

n.m. |

n.m. |

| Net income |

3,866 |

69 |

3,797 |

3,643 |

196 |

3,447 |

+6.1% |

+10.2% |

| Non controlling

interests |

(473) |

(15) |

(459) |

(381) |

18 |

(399) |

+24.1% |

+15.0% |

| Net income Group Share |

3,393 |

54 |

3,338 |

3,262 |

214 |

3,048 |

+4.0% |

+9.5% |

| Earnings per share (€) |

1.08 |

0.02 |

1.06 |

1.03 |

0.08 |

0.96 |

+4.7% |

+10.9% |

| Cost/Income ratio excl.SRF (%) |

61.0% |

|

60.8% |

62.2% |

|

61.8% |

-1.2 pp |

-1.0 pp |

Appendix 3 - Crédit Agricole S.A.: Results by division

Table 9.

Crédit Agricole S.A.: Results by division, Q3-18

and Q3-17

| Q3-18

(stated) |

|

€m |

AG |

FRB (LCL) |

IRB |

SFS |

LC |

CC |

Total |

|

|

|

|

|

|

|

|

|

| Revenues |

1,452 |

858 |

662 |

695 |

1,297 |

(162) |

4,802 |

| Operating expenses

excl. SRF |

(680) |

(578) |

(417) |

(339) |

(773) |

(212) |

(2,998) |

| SRF |

- |

- |

- |

- |

- |

- |

- |

| Gross operating income |

772 |

280 |

245 |

356 |

524 |

(374) |

1,804 |

| Cost of risk |

14 |

(50) |

(95) |

(141) |

57 |

(2) |

(218) |

| Cost of legal

risk |

- |

- |

- |

- |

- |

- |

- |

| Equity-accounted

entities |

12 |

- |

- |

63 |

1 |

2 |

78 |

| Net income on other

assets |

(2) |

0 |

0 |

1 |

1 |

(0) |

(0) |

| Change in value of

goodwill |

- |

- |

- |

- |

- |

- |

- |

| Income before tax |

796 |

231 |

150 |

279 |

582 |

(375) |

1,663 |

| Tax |

(242) |

(68) |

(45) |

(63) |

(166) |

151 |

(434) |

| Net income from

discontinued or held-for-sale operations |

(1) |

- |

- |

(0) |

- |

- |

(1) |

| Net income |

554 |

162 |

106 |

215 |

416 |

(224) |

1,228 |

| Non controlling

interests |

(70) |

(7) |

(29) |

(24) |

(8) |

11 |

(128) |

| Net income Group Share |

484 |

155 |

77 |

190 |

408 |

(213) |

1,101 |

| Q3-17

(stated) |

|

€m |

AG |

FRB (LCL) |

IRB |

SFS |

LC |

CC |

Total |

|

|

|

|

|

|

|

|

|

| Revenues |

1,302 |

848 |

619 |

675 |

1,236 |

(106) |

4,575 |

| Operating expenses

excl. SRF |

(680) |

(595) |

(364) |

(337) |

(741) |

(184) |

(2,902) |

| SRF |

- |

- |

- |

- |

- |

- |

- |

| Gross operating income |

622 |

253 |

255 |

338 |

495 |

(291) |

1,672 |

| Cost of risk |

0 |

(45) |

(113) |

(128) |

21 |

3 |

(262) |

| Cost of legal

risk |

- |

- |

- |

- |

(75) |

- |

(75) |

| Equity-accounted

entities |

9 |

- |

- |