Pound Slides Amid Soft U.K. Inflation, Risk Aversion

14 Novembre 2018 - 7:58AM

RTTF2

The pound dropped against its major counterparts in the European

session on Wednesday, as U.K. consumer prices rose less than

forecast in October and investors awaited the outcome of a

make-or-break cabinet meeting today where Prime Minister Theresa

May will try to sell her Brexit deal to her top team.

Data from the Office for National Statistics showed that the

consumer price index grew 2.4 percent year-on-year in October,

slighter slower than the 2.5 percent growth economists' had

forecast.

The pace of growth was unchanged from the previous month.

On a month-on-month basis, the CPI edged up 0.1 percent in

October, which was slower than the 0.2 percent gain economists had

forecast.

Core inflation, which excludes the prices of energy, food,

alcoholic beverages and tobacco, was also steady in October, at 1.9

percent. The figure was expected to climb to 2 percent.

Output price inflation accelerated to 3.3 percent from 3.1

percent. Economists had expected the rate to remain unchanged.

In contrast, input price inflation eased to 10 percent from 10.1

percent. Economists had forecast a lower figure of 9.9 percent.

European stocks fell sharply as weak GDP data from Japan and

Germany spurred concerns about sluggish global economic growth.

Mixed data out of China, the steepest drop in oil prices in more

than three years and lingering concerns surrounding Italy also

dented sentiment.

The currency climbed against its major counterparts in the Asian

session.

The pound slipped to 1.2905 versus the dollar, after rising to

1.3035 at 6:00 pm ET. On the downside, 1.28 is possibly seen as the

next support level for the pound.

The pound reversed from an early high of 0.8666 against the

euro, dropping to 0.8731. The pound is likely to challenge support

around the 0.89 level.

Preliminary figures from the Federal Statistical Office showed

that Germany's economy contracted at a faster-than-expected pace in

the third quarter, marking the first decline since the first three

months of 2015 and the worst fall since early 2013.

Gross domestic product declined a seasonally and

calendar-adjusted 0.2 percent in the three months to September,

after expanding 0.5 percent in the second quarter. Economists had

forecast a 0.1 percent drop.

Having climbed to 148.42 against the yen at 7:00 pm ET, the

pound reversed direction and fell to 147.01. The pound is seen

finding support around the 146.00 mark.

Data from the Cabinet Office showed that Japan's gross domestic

product fell a seasonally adjusted 0.3 percent on quarter in the

third quarter of 2018.

That was in line with expectations following the 0.7 percent

gain in the previous three months.

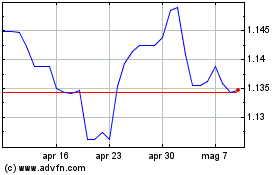

The U.K. currency reached as low as 1.3014 against the Swiss

franc, down from a high of 1.3127 touched at 6:00 pm ET. The next

possible support for the pound is seen around the 1.29 mark.

Looking ahead, U.S. CPI for October is scheduled for release in

the New York session.

At 10:00 am ET, Federal Reserve Governor Randal Quarles will

testify on banking supervision and regulation before the House

Financial Services Committee in Washington DC.

Grafico Cross Sterling vs CHF (FX:GBPCHF)

Da Mar 2024 a Apr 2024

Grafico Cross Sterling vs CHF (FX:GBPCHF)

Da Apr 2023 a Apr 2024