Pound Spikes Up As U.K. Wage Growth Improves To 10-year High

11 Dicembre 2018 - 8:10AM

RTTF2

The pound strengthened against its major counterparts in the

European session on Tuesday, as U.K. jobs data showed that earnings

topped expectations in the three months to October, which was the

fastest pace of growth since December 2008.

Data from the Office for National Statistics showed that average

earnings including bonuses rose 3.3 percent year-on-year in the

three months to October after a 3 percent increase in the three

months to July. Economists had expected the rate to remain

unchanged.

Excluding bonuses, average earnings grew 3.3 percent

year-on-year following a 3.2 percent rise in the previous period.

The rate was forecast to remain unchanged.

The ILO jobless rate was steady at 4.1 percent in the three

months to October, in line with economists' expectations.

Investors cheered progress in trade talks after reports

suggested that Chinese Vice Premier Liu, U.S. Treasury Secretary

Steven Mnuchin and U.S. Trade Representative Robert Lighthizer have

discussed trade issues despite a diplomatic row over the arrest of

a senior Chinese businesswoman.

The currency held steady against its major counterparts in the

Asian session, barring the greenback.

The pound edged up to 1.2472 against the franc, after falling to

1.2422 at 5:00 pm ET. The pound is seen finding resistance around

the 1.26 level.

The pound appreciated to 1.2638 against the greenback, following

a decline to 1.2550 at 5:00 pm ET. The next possible resistance for

the pound is seen around the 1.28 region.

Reversing from an early low of 142.03 against the yen, the pound

rose to 142.93 following the data. If the pound rises further,

145.00 is possibly seen as its next resistance level.

Data from the Bank of Japan showed that Japan M2 money stock

rose 2.3 percent on year in November, standing at 1,010.5 trillion

yen.

That was shy of expectations for an increase of 2.6 percent and

down from 2.7 percent in October.

Having fallen to 0.9049 against the euro at 2:30 am ET, the

pound reversed direction and bounced off to 0.9006. The pound is

likely to find resistance around the 0.88 level.

Data from the Centre for European Economic Research showed that

German investor confidence rose strongly in December, defying

expectations for a modest weakening, but caution prevailed as

financial analysts' assessment of the current economic situation

again deteriorated sharply due to sluggish economic growth and

uncertainties linked to global trade and Brexit.

The ZEW Indicator of Economic Sentiment for Germany rose 6.6

points to reach minus 17.5 points in December.

Looking ahead, U.S. producer price index for November is set for

release in the New York session.

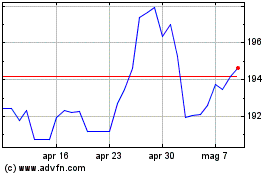

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Mar 2024 a Apr 2024

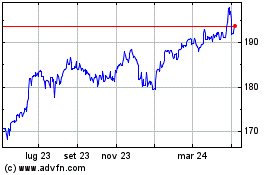

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Apr 2023 a Apr 2024