By Saabira Chaudhuri

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 13, 2018).

Activist hedge fund Elliott Management Corp. has built a EUR1

billion ($1.13 billion) stake in Pernod Ricard, calling on the

owner of Chivas Regal whisky and Absolut vodka to shake up

management and boost profit margins.

The stake, of over 2.5%, is Elliott's latest big bet on Europe,

where its investments in recent years include Telecom Italia SpA

and Sky PLC. Earlier this year, it acquired Britain's biggest

bookstore chain, Waterstones.

The hedge fund said Pernod has lost market share across various

segments, including vodka, gin and some types of whisky, and has

"significant room for improvement." While its sales have grown

steadily for years, margin growth has stagnated, leaving Pernod's

operating margins 5 percentage points below those of rival Diageo

PLC, the fund said.

Elliott will press Pernod to set more ambitious targets for

cutting costs by centralizing more functions and raising revenue to

improve margins, while adding new talent from the outside,

according to a person familiar with the matter.

"Our strategy is working and is the right one combining

short-term profitability and sustainable, profitable and

responsible growth under a consistent and long-term road map,"

Pernod Ricard Chief Executive Alex Ricard said. Sales and profit

growth from ongoing operations have accelerated this year while the

company's cost-savings plan is ahead of schedule, he said.

Shares of the Paris-listed company gained 5.9% Wednesday.

Elliott is among the world's biggest hedge funds and one of the

most prominent activist investors globally, having launched

campaigns against a raft of companies including Australian mining

giant BHP Group Ltd., South Korea's Samsung Electronics Co. and

U.S. aerospace-parts maker Arconic Inc.

The New York-based fund's European foray, though, has seen mixed

success.

Elliott is waging a bitter battle against French media

conglomerate Vivendi SA over control of Telecom Italia since

winning a proxy battle to install new directors in May. The hedge

fund, like many of its rivals, also took a hit on NXP

Semiconductors NV of the Netherlands, betting incorrectly that its

deal to be acquired by Qualcomm Inc. would be approved by

regulators.

Elliott's European bets have been largely led by Gordon Singer,

the son of Elliott founder Paul Singer, and a group of managers

based in London. The fund has been active overseas for years, but

recently ramped up its public campaigning in Europe. Its approach

-- often backing demands for change with threats to oust management

and directors -- contrasts with the quieter campaigns more typical

of activist investors on the Continent.

The Wall Street Journal recently reported that Elliott has been

changing tack to focus on a target company's governance and board

structure rather than just on margins and sales. In the case of

Pernod, the fund views its management and board as being too French

and insular, while lacking diverse career experience.

The drinks company traces its roots back to 1805 when

Henri-Louis Pernod founded an absinthe distillery in a French-Swiss

border village. In 1932 Paul Ricard founded his own anise-based

spirits operation in Marseille. The two French companies merged in

1975.

Pernod had been considered safe from outside pressure as the

family behind it holds about 15% of shares and 25% of voting

rights.

Elliott isn't looking to oust Alex Ricard -- the grandson of

Paul -- as CEO nor to pressure Pernod to sell itself, said a person

familiar with its thinking. Given the family's influence and the

importance of its name to the Pernod brand, the hedge fund needs

its cooperation. Antitrust issues and likely pushback from the

French government over a sale of Pernod -- one of the country's

best-known companies -- would make a sale difficult.

Mr. Ricard, when meeting with Elliott in November, was receptive

to its concerns and agreed Pernod needs to be bolder, said this

person.

However on Wednesday, Mr. Ricard indicated he doesn't agree with

Elliott's assessment. He noted that Pernod's share price has risen

nearly 38% over the past three years, outperforming French and

European indexes, and that the company in that period has added

three directors to its board, giving it a range of experience.

The hedge fund said Pernod's EUR6 billion ($6.8 billion)

acquisition of Absolut in 2008 has fallen short of expectations.

Absolut, like most big vodka brands in the U.S., has struggled with

fierce price competition and customer defection to Tito's vodka or

other tipples like gin. Pernod in 2015 took a big write-down on

Absolut, blaming a challenging U.S. market.

The Paris-based company has over 140 brands, some of which

aren't growing. Elliott hasn't singled out brands Pernod should

sell but wants the company to do an analysis of its portfolio.

Ben Dummett contributed to this article.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

December 13, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

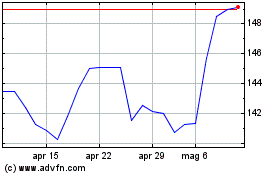

Grafico Azioni Pernod Ricard (EU:RI)

Storico

Da Mar 2024 a Apr 2024

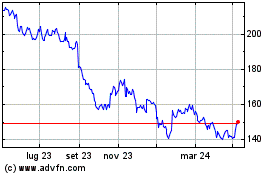

Grafico Azioni Pernod Ricard (EU:RI)

Storico

Da Apr 2023 a Apr 2024