Bank Of England Set To Hold Rates Steady Amid Brexit Chaos

19 Dicembre 2018 - 7:26AM

RTTF2

The Bank of England is set to hold interest rates unchanged on

Thursday as the economic outlook remains highly uncertain with the

Theresa May government being accused of dilly-dallying on reaching

a deal over Britain's exit from the European Union. The nine-member

Monetary Policy Committee, led by Governor Mark Carney, is widely

expected to leave the bank rate unchanged at 0.75 percent and

maintain the asset purchase target at GBP 435 billion. The

corporate bond purchase target is also expected to be maintained at

GBP 10 billion. The policy decision announcement is due at 7 am ET.

The previous change in the bank rate was a quarter-point hike in

August and the rate is now at its highest level since 2009. A

no-deal Brexit and the consequent chaos would tie the central

bank's hands and markets are now less convinced that the Bank of

England will hike interest rates next year. The UK economy is

showing signs of slowing as the uncertainty regarding the country's

post-Brexit trade relations remain unclear. Britain is preparing to

leave the European Union on March 29, 2019. Despite surviving a

recent no-confidence motion triggered within the Conservative Party

and delaying a crucial vote on a Brexit deal, Prime Minister May is

yet to achieve a consensus among lawmakers regarding Britain's

future relationship with the EU. The prospect of a much-feared

"no-deal" Brexit is increasing and recent surveys suggest that

businesses are readying themselves to face what could be a most

chaotic event.

Britain's five leading business groups including the BCC and the

CBI, on Wednesday, urged lawmakers to prevent a disorderly

"no-deal" Brexit.

"Businesses of all sizes are reaching the point of no return,

with many now putting in place contingency plans that are a

significant drain of time and money," heads of the five groups said

in a letter.

"While many companies are actively preparing for a 'no deal'

scenario, there are also hundreds of thousands who have yet to

start - and cannot be expected to be ready in such a short space of

time," they added. The Bank of England has warned that a no-deal

Brexit would cause a severe recession in the UK, the kind not even

seen during the global financial crisis a decade ago.

The central bank's analysis projected that inflation could hit

6.5 percent as the pound dives in a no-deal or disorderly

Brexit.

Governor Carney also predicted that food prices could jump as

much as 10 percent if there is a 25 percent slump in the pound due

to a no-deal Brexit.

Headline inflation slowed to a 20-month low of 2.3 percent in

November, ONS data showed on Wednesday, yet remains above the

central bank's target of 2 percent.

A recent BoE survey showed that households' inflation

expectations for the coming year has risen to a five-year high of

3.2 percent.

UK wage growth hit a decade high in October, suggesting that

labor shortages are making employers raise pay to retain existing

employees and attract new ones.

And if a no-deal Brexit is avoided, increased earnings could

boost spending and contribute to economic growth. Latest data from

the ONS revealed that economic growth slowed in the three months to

October, mainly due to a fall in car sales and stagnation in

manufacturing.

Recent purchasing managers' survey showed that both

manufacturing and services growth were subdued in December, while

construction expanded at the fastest pace in four months.

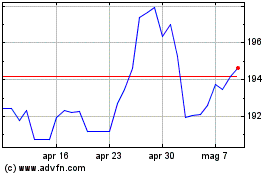

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Mar 2024 a Apr 2024

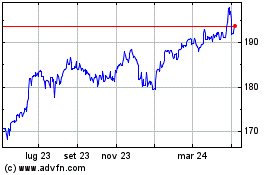

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Apr 2023 a Apr 2024