TIDMTPX

RNS Number : 0499L

Panoply Holdings PLC (The)

20 December 2018

20 December 2018

The Panoply Holdings PLC

("The Panoply", or the "Group")

Interim results

The Panoply, a digitally native technology services company, is

pleased to announce its results for the six month period ending 30

September 2018.

Financial highlights*

-- Revenue up 48% to GBP10.1m (2017: GBP6.9m)

-- Adjusted EBITDA** up 57% to GBP1.9m (2017: GBP1.2m)

-- Adjusted EBITDA** excluding central costs up 66% to GBP2.2m

(2017: GBP1.3m)

-- Adjusted profit after tax*** up 54% to GBP1.8m (2017: GBP1.2m)

-- Earnings per share of 3.4p up from 2.5p (based on total

shares in issue at Admission)

-- Cash at bank increased 14% to GBP4.0m (2017: GBP3.2m)

Operational highlights

-- Significant growth in number of customers with 90 customers

billed in the six month period to 30 September 2018 compared

with 114 customers billed in the 15 months to 31 March

2018

-- 41% of customers billed in the six months to 30 September

2018 were also billed in 2016 and 2017 demonstrating

the long standing relationships that the Group is building

-- Government sector work grew by 250% and has increased

from 13% of total revenue in the 15 month period to 31

March 2018 to 28% in the 6 month period to 30 September

2018 highlighting the strength of growth in that sector

Post-period highlights

-- Completion of the IPO and an oversubscribed fundraise

raising GBP5m in new equity for the Group

-- Completion of the acquisitions of Manifesto Digital Limited,

Not Binary Limited, Questers Global Group Limited and

Bene Agere Norden AS ("Acquisitions") at IPO

-- Subsequent completion of the acquisition of Deeson Group

Holdings Limited on 17 December 2018 for an initial consideration

of GBP1.35m in shares

*All figures are reported proforma and on the same basis as in

Panoply's recent Admission Document (see note 1)

** Adjusted EBITDA is a non-IFRS measure that the Company uses

to measure its performance and is defined as earnings before

interest, taxation, depreciation and amortisation and after add

back of exceptional items related to the IPO and acquisitions made

by the Group

*** Adjusted profit before tax includes an add back in respect

of exceptional items related to the IPO and acquisitions made by

the Group

Neal Gandhi, Chief Executive Officer, commented:

"4 December 2018 was a seminal moment for The Panoply as we

achieved our goal of listing on AIM. I would like to thank the

founders and staff of the four pre-IPO companies who chose to come

on our journey with us and for allowing us to create the platform

that we now have. Although the four companies recently acquired

only became legally part of the Group on the day of the IPO, the

companies have been working together for around 18 months, so the

strong results reported here are, at least in part as a result of

that collaboration, as well as their own organic growth.

We are pleased to have seen the number of customers we work with

continue to grow, a strong leading indicator. Alongside this, a

large proportion of our customers billed in the six months to 30

September 2018 we have also worked with for the previous two years,

demonstrating client longevity. All three of the sectors we work

with, commercial, Government and NGOs, have grown, driven by our

outcomes-based agile approach.

On 17 December 2018, we completed the acquisition of Deeson

Group Holdings Limited ("Deeson"), a digital agency specialising in

high profile content-managed web sites and digital products. The

acquisition is expected to be immediately earnings enhancing and is

early evidence of our ability to execute on our strategy of

acquiring complementary companies in order to grow our

capabilities. We are excited about the future and our ability to

continue to grow. We look forward to continuing to deliver

excellent outcomes for clients at a pace and price they expect to

pay."

Enquiries:

The Panoply Holdings

Neal Gandhi (CEO) Via Alma PR

Oliver Rigby (CFO)

Stifel Nicolaus Europe Limited +44 (0)207 710 7600

(Nomad and Broker)

Fred Walsh

Alex Price

Neil Shah

Luisa Orsini Baroni

Alma PR panoply@almapr.co.uk

(Financial PR) +44(0)203 405 0206

Josh Royston 07780 901979

Rebecca Sanders-Hewett

Susie Hudson

About The Panoply

The Panoply is a digitally native technology services company,

built to service clients' digital transformation needs. Founded in

2016, with the aim of identifying and acquiring best-of-breed

specialist information technology and innovation consulting

businesses across Europe, the Group collaborates with its clients

to deliver the technology outcomes they're looking for at the pace

that they expect and demand.

www.thepanoply.com

Chief Executive's Review

I am pleased to be able to report our interim results for the

Panoply Group which relate to the period before we became a public

company.

Performance against growth strategy: acquisitions

Following our Admission to trading on AIM on 4 December 2018 and

the resulting completion of our target acquisitions, alongside the

acquisition of Deeson announced this week, the Group now

comprises:

-- TPX Bene Agere: an Oslo-based strategy and management

consultancy;

-- TPX Manifesto Digital: an award-winning London-based

digital experience agency;

-- Deeson: a leading digital agency, intended to rebrand

as TPX Manifesto in the coming months;

-- TPX Not Binary: an award-winning London-based IT consultancy

focused on digital transformation; and

-- TPX Questers: an award-winning provider of onshore and

nearshore agile software development services

Combined revenues (excluding Deeson) for the six months to 30

September 2018 of GBP10.1m represented an increase of 48% over the

corresponding period last year on a pro-forma basis. Adjusted

EBITDA was particularly strong at GBP1.9m, an increase of GBP0.7m

driven by organic growth.

Performance against growth strategy: The Panoply multiplier

effect

Whilst the four initial acquisitions were only completed on 4

December 2018, the businesses had already been working in tandem

and with the ethos of The Panoply for a number of months. These

half-year results reflect, in part, those combined efforts and

demonstrate the success of the unified Group as well as the

validity of our business model.

The Group significantly increased customer count with 90

customers billed in the six months to 30 September 2018 compared

with 114 customers billed in the 15 months to 31 March 2018. 41% of

customers billed in the six months to 30 September 2018 were billed

in 2016 and 2017 demonstrating our longevity within strategic

clients.

The results have been driven across the Group but with a

particular increase in work in the public sector, and important new

client wins including work streams that the individual companies do

not believe they would have secured without being part of the wider

offering. This includes a new brief with the DVLA which now

represents the Group's largest single client, with work commencing

in the second half of the financial year. We have also secured

further new client wins, including Seatgeek, News International and

Christian AID which we expect to deliver additional revenue in the

second half of the year and also support our longer-term

growth.

The quality of our work continues to be recognised with TPX

Manifesto recently winning agency of the year at the 2018 Drum

awards and TPX Not Binary being recognised earlier in the year by

winning a WCIT award.

Admission to AIM

The Group's IPO was clearly a seminal moment, as it led to the

formation of The Panoply and gives us the financial strength and

stability to grow our business. It provides us with the necessary

working capital to invest in each of the business units as well as

providing an equity base to achieve our acquisition ambitions. The

IPO took place during particularly volatile market conditions and I

would like to thank our new shareholders for their support and for

sharing our confidence in the Group's prospects.

Outlook

As we enter the second half of the year the business has

considerable momentum. The acquisition of Deeson provides a first

earnings enhancing acquisition for the Group post-IPO. The Board

continues to evaluate further acquisitions.

The Directors are encouraged by the strong year on year growth

and are confident of meeting full year expectations. Following

completion of the IPO and the acquisitions, The Panoply has put in

place a Board and central team to provide strong governance and

that can continue to build the Group through both organic and

acquisitive growth. The investment in the central team is expected

to reduce the Group's net operating margin but the group is well

operationally geared to execute of future growth plans and the

overall impact of central overhead will reduce as we scale. The

Group will remain profitable and cash generative during this

period.

The Panoply's goal is to create a leading digitally native

technology services company across Europe. The IPO provides the

platform for this and we are operating in a fast growing market

where clients are looking to digitally transform their businesses

for the automation age.

Financial review

The financial information set out in this announcement has been

prepared on the basis that the Acquisitions completed on IPO were

recognised as part of the Group for the entire period and the

entire comparative periods, albeit the entities were not under the

control of the Company during this time.

The Group has seen significant growth in year on year revenue,

which has resulted in strong growth in Adjusted EBITDA and profit

after tax.

There has been revenue growth in all five of our service lines.

Currently our three largest service lines are Experience, XaaS and

Transformation, which accounted for 97% of revenue in the 6 month

period to 30 September 2018.

Our emerging service lines in Automation and Intelligence are

areas where we intend to invest over the coming 12 months and we

hope to see growth in these as we move forward.

Cash remained strong at the end of the period. Following the IPO

a significant portion of the cash on the subsidiary company's

balance sheets was paid to the vendors under the terms of the

Acquisitions but this was replenished with the proceeds of the

oversubscribed placing (raising GBP5m of gross proceeds). The Group

remains cash generative and has no debt.

Trading post-period end has continued to be strong and we are

trading in line with our expectations. As a result of the expected

growth in EBITDA of the businesses acquired at the IPO, and as set

out in the Group's Admission Document, we anticipate that there

will be significant further earn out consideration to be issued in

respect of the Acquisitions. Any consideration will be satisfied in

shares over a 24 month period at the higher of the market price or

74p (being the placing price at the time of the IPO).

It should be noted that revenue in Norway in the six months to

30 September 2018 reduced compared with the earlier period which

benefited from a major one off contract with Digital Norway in

2017. However that engagement has positioned the Group at the

forefront of digital transformation in the region and we anticipate

will help the Group to scale in the region as a consequence.

Summary of The Panoply's services

Experience - using customer-centered insight in the design and

creation of digital products and services centered on the needs of

the people that use them. Helping organisations plan and improve

the experience of their customers and initiating the projects and

programmes that will transform this at scale.

Intelligence - enabling intelligent business through helping

organisations to gather, analyse, interpret and make decisions

based on their data. From straightforward business intelligence and

management information through to machine learning, artificial

intelligence and predictive and prescriptive analysis.

XaaS - providing access to the talent, platforms and

methodologies that allow organisations to scale innovation and

realise efficiency, repeatability and reliability in their core

operations. Underpinned by several key technology partnerships such

as Amazon Web Services, Microsoft Azure, Google Cloud Platform and

Digital Experience Management with Acquia.

Transformation - partnering with organisations to help them

increase their digital maturity and become truly digital

businesses. This can involve the replacement of large platforms,

the introduction of new working methodologies and the complete

reinvention of products services and business models. The Panoply

may help organisations with aspects of their transformation or

partner with them for aspects of it.

Automation - The Panoply's automation services seek to enable

business growth through the use of data in marketing to enable

automated decision-making for communications and to drive

efficiency through the mapping and automating of existing

processes. In marketing, automation technology is used to interpret

large volumes of data and deliver highly targeted communications

across multiple channels, mapping data to customer segments based

on previous interactions. Complex multi-faceted journeys can be

managed through mapping the customer experience and linking this to

these automated journeys. Using Robotic Process Automation (RPA)

existing business processes can be automated using a digital

workforce freeing up staff from highly repetitive tasks.

Neal Gandhi

Chief Executive Officer

Combined Statement of comprehensive income

Six months ended 30 September

2018

6 months

6 months to 30 15 months

to 30 September September to 31 March

2018 2017 2018

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

Revenue 2 10,130 6,858 18,488

Cost of sales (6,341) (4,282) (11,771)

----------------- ----------- -------------

Gross profit 3,789 2,576 6,717

Administrative costs (1,918) (1,403) (3,489)

Other income 58 53 103

----------------- ----------- -------------

Adjusted EBITDA 2 1,929 1,226 3,331

Depreciation (51) (44) (123)

Costs directly attributable

to the business combination (551) (37) (527)

Other exceptional items - - (307)

----------------- ----------- -------------

Operating profit 1,327 1,145 2,374

----------------- ----------- -------------

Finance income 7 6 12

Finance costs (5) (6) (2)

----------------- ----------- -------------

Net finance costs 2 - 10

----------------- ----------- -------------

Profit before tax 1,329 1,145 2,384

Taxation 54 (142) (383)

Profit for the period 1,383 1,003 2,001

----------------- ----------- -------------

Items that may subsequently

be transferred to profit and

loss

Exchange differences on translation

of foreign operations 67 (1) (132)

----------------- ----------- -------------

1,459 1,002 1,869

----------------- ----------- -------------

Earnings per share (adjusted)

Basic (pence) 3 3.4 2.5 4.9

Combined Statement of financial

position

As at 30 September 2018

30 September 30 September 31 March

2018 2017 2018

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Property, plant and equipment 264 303 295

Intangible assets 20 18 20

------------- ------------- ---------

284 321 315

------------- ------------- ---------

Current assets

Trade and other receivables 4,083 2,282 2,962

Inventory 3 1 5

Cash and cash equivalents 3,960 3,203 3,462

------------- ------------- ---------

8,046 5,486 6,429

------------- ------------- ---------

Total assets 8,330 5,807 6,744

------------- ------------- ---------

EQUITY AND LIABILITIES

EQUITY

Issued share capital - - -

Share premium 1,130 490 490

Foreign Exchange Reserve 23 (3) (44)

Other reserves 192 125 192

Retained earnings 4,136 2,896 2,918

------------- ------------- ---------

Total equity 5,481 3,508 3,556

------------- ------------- ---------

LIABILITIES

Non-current liabilities

Deferred tax liabilities 9 42 9

------------- ------------- ---------

Total non-current liabilities 9 42 9

------------- ------------- ---------

Current liabilities

Trade and other payables 1,698 1,057 1,870

Current tax liabilities 1,142 1,200 1,309

Total current liabilities 2,840 2,257 3,179

------------- ------------- ---------

Total liabilities 2,849 2,299 3,188

------------- ------------- ---------

Total equity and liabilities 8,330 5,807 6,744

============= ============= =========

Combined Statement of cash flow

As at 30 September 2018

6 months

6 months to 30 15 months

to 30 September September to 31 March

2018 2017 2018

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Cash flows from operating activities:

Profit before tax 1,329 1,145 2,384

Depreciation of property, plant

and equipment 51 44 123

Profit on disposal of property,

plant and equipment - - 6

Share based payments - - 9

Foreign exchange losses/(gains) 161 (12) (126)

Finance income (7) (6) (12)

Finance expense 5 6 (2)

------------------ --------------- -------------

1,539 1,177 2,382

Working capital adjustments

Increase in trade and other receivables (1,122) (259) (710)

Decrease/(increase) in trade

and other payables (340) 448 1,054

Decrease/(increase) in inventory 2 1 (3)

------------------ --------------- -------------

(1,460) 190 341

Tax paid (39) (49) (36)

------------------ --------------- -------------

Net cash generated from operating

activities 40 1,318 2,687

------------------ --------------- -------------

Cash flows from investing activities:

Interest received 7 6 12

Additions to property, plant

and equipment (19) (18) (80)

Net cash used in investing activities (12) (12) (68)

------------------ --------------- -------------

Net cash used from financing

activities

Issue of ordinary share capital

net of issue costs 640 490 490

Movement in other reserves - - 132

Dividends paid to former owners

of acquired subsidiaries (165) (618) (1,375)

Net interest paid (5) (6) 2

------------------ --------------- -------------

Net cash generated from/ (used)

in financing activities 470 (134) (751)

------------------ --------------- -------------

Net increase in cash and cash

equivalents 498 1,172 1,868

------------------ --------------- -------------

Cash and cash equivalents at

beginning of the period 3,462 2,031 1,594

------------------ --------------- -------------

Cash and cash equivalents at

end of the period 3,960 3,203 3,462

================== =============== =============

1. Basis of preparation

The Acquisition Subsidiaries comprise:

-- Bene Agere Norden AS - incorporated in Norway on 27 June 2012.

-- Manifesto Digital Limited - incorporated in England and Wales on 19 December 2011.

-- Not Binary Limited - incorporated in England and Wales on 23 March 2017.

-- Questers Global Group Limited - incorporated in England and Wales on 22 June 2012.

The Panoply Holdings PLC ("the Company") entered into share

purchase agreements to acquire the entire share capital of the

Acquisition Subsidiaries. The agreements were conditional upon

Admission of the Company's shares to trading on AIM and as a result

completed on the day of the Company's IPO on 4 December 2018. The

consideration was paid by way of shares in the Company and

cash.

The Combined historical financial information has been prepared

on the basis that the Acquisition Subsidiaries were recognised as

part of the Group for the entire period since their respective

dates of incorporation, albeit that the entities were not under the

control of the Company during this time. Accordingly, no share

capital and individual reserves have been shown for the Acquisition

Subsidiaries and the aggregate share capital and share premium

attributable to the Acquisition Subsidiaries has been disclosed as

other reserves. No adjustment has been made for the consideration

paid since 30 September 2018 for the acquisitions, the fair value

of the assets and liabilities to be acquired, goodwill or other

intangible assets arising.

The Combined historical financial information does not include

any information in respect of the Deeson Group Holdings Limited

business acquired on 17 December 2018.

The Combined historical financial information in this report has

been prepared using accounting policies consistent with

International Financial Reporting Standards (IFRS) as adopted by

the European Union and IFRS Interpretations Committee (IFRIC)

interpretations except for IFRS 3 "Business Combinations" and IFRS

10 "Consolidated Financial Statements" in relation to the

accounting for the acquisition and consolidation of the

subsidiaries which will be required in the annual accounts for the

period to 31 March 2019. IFRS is subject to amendment and

interpretation by the International Accounting Standards Board

(IASB) and IFRIC and there is an ongoing process of review and

endorsement by the European Commission. The financial information

has been prepared on the basis of IFRS that the Directors expect to

be adopted by the European Union and applicable as at 31 March

2019.

The Group has chosen not to adopt IAS 34 - Interim Financial

Statements, in preparing the Combined historical financial

information.

The Group has adopted IFRS 9 "Financial Instruments" and IFRS 15

"Revenue from Contracts from Customers" which are new standards

applicable mandatory for the period ending 31 March 2019. The Group

has not as yet adopted IFRS 16 "Leases" which is a new standard

applicable mandatory for periods beginning 1 January 2019 and are

currently assessing the financial impact to the Group.

The Group has calculated the adjusted basic earnings per share

based on the number of shares in issue at the date of Admission on

the AIM market.

Non-Statutory accounts

The financial information set out in this interim report does

not constitute the Group's statutory accounts, within the meaning

of Section 434 of the Companies Act 2006. The statutory accounts of

the Company for the period ended 31 March 2018 have been delivered

to the Registrar of Companies. The auditors reported on those

accounts; their report was unqualified, did not contain a statement

under either Section 498 (2) or Section 498 (3) of the Companies

Act 2006 and did not include references to any matters to which the

auditor drew attention by way of emphasis.

The financial information for the six months ended 30 September

2018 and 30 September 2017 is unaudited.

2. Service Line Reporting

The Board of Directors considers the business from a services

perspective. Management separately considers services split between

Experience, XaaS, Intelligence, Transformation and Automation.

Strategic decisions regarding future investment is based on the

split of services and potential growth opportunities.

(i) An analysis of turnover from external customers by geographical market is given below:

15 months

30 September 30 September to 31 March

2018 2017 2018

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

United Kingdom 8,210 5,153 14,574

EU 116 219 71

Norway 1,090 1,138 2,893

Other 714 348 950

Total Revenue 10,130 6,858 18,488

(ii) An analysis of turnover from external customers by sectors is given below:

15 months

30 September 30 September to 31 March

2018 2017 2018

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Commercial 5,519 4,955 12,720

Government 2,843 805 2,443

NGO 1,768 1,098 3,325

Total Revenue 10,130 6,858 18,488

---------------- ---------------- ---------------

(iii) An analysis of turnover by segments is shown below:

15 months

30 September 30 September to 31 March

2018 2017 2018

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Experience 2,342 2,046 4,681

XaaS 3,408 2,781 7,096

Transformation 4,095 2,031 6,204

All other segments 285 - 507

Total Revenue 10,130 6,858 18,488

Total Adjusted EBITDA

15 months

30 September 30 September to 31 March

2018 2017 2018

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Experience 689 406 1,163

XaaS 459 297 814

Transformation 977 603 1,515

All other segments (197) (80) (161)

Total Adjusted EBITDA 1,929 1,226 3,331

3. Adjusted earnings per share

15 months

30 September 30 September to 31 March

2018 2017 2018

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Profit 1,383 1,003 2,001

Profit for the purposes of basic

and diluted profit

per share being net profit attributable

to equity

shareholders

Number of shares

For the purpose of basic profit

per share

Based on number of shares at

Admission 40,601,642 40,601,642 40,601,642

Basic earnings per share (p) 3.4 2.5 4.9

4. Events after the reporting period

a) Business combinations

The Company entered into share purchase agreements with the

sellers of the following companies on the dates noted below:

-- Bene Agere Norden AS - SPA entered on 26 April 2018

-- Manifesto Digital Limited - SPA entered on 10 May 2018

-- Not Binary Limited - SPA entered on 20 April 2018

-- Questers Global Group Limited - SPA entered on 11 May 2018

The transactions completed upon Admission of the shares of the

Company to trading on AIM on 4 December 2018 and resulted in

18,799,065 Ordinary Shares being issued to the vendors.

On 17 December 2018 the Company entered into a share purchase

agreement to acquire Deeson Group Holdings Limited resulting in the

issue of a further 1,636,363 Ordinary Shares.

b) Bonus issue of shares

On 16 October 2018 the Company declared a bonus issue of 480

ordinary shares for every 1 ordinary share held at 16 October 2018

increasing the Company's issued ordinary share capital to 5,483,400

Ordinary 1 pence shares. In order to pay-up the nominal value of

the ordinary shares issued under the bonus issue, share premium of

the Company in an amount equal to GBP54,720 was used, reducing the

share premium account of the Company by the same amount.

c) Gifting and cancellation of shares

On 18 October 2018, Oliver Rigby and Neal Gandhi transferred

192,400 Ordinary Shares and 288,600 Ordinary Shares respectively to

the Company for nil consideration. In aggregate 481,000 Ordinary

Shares were transferred to the Company. On 18 October 2018

(following the Company's re-registration as a public limited

company), the share capital of the Company was decreased from

5,483,400 Ordinary Shares to 5,002,400 Ordinary Shares by the

cancellation of 481,000 Ordinary Shares pursuant to section 662 of

the Act.

d) Bonus issue of shares

On 23 November 2018 the Company declared a bonus issue of 2

ordinary shares for every 1 ordinary share held at 23 November 2018

increasing the Company's issued ordinary share capital to

15,045,822 Ordinary 1 pence shares. In order to pay-up the nominal

value of the ordinary shares issued under the bonus issue, share

premium of the Company in an amount equal to GBP100,305.48 was

used, reducing the share premium account of the Company by the same

amount.

e) IPO and Placing

On 4 December the Company completed an IPO on AIM and completed

a placing to raise gross proceeds of GBP5m. This resulted in a

further issue of 6,756,755 Ordinary Shares. Following completion of

the IPO the total number of shares in issue was 40,601,642.

f) Issue of Options

At the time of the IPO, the Company also granted options over

3,927,788 Ordinary Shares. The fully diluted number of Ordinary

Shares following Admission was 44,529,430.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BBLBLVLFFFBE

(END) Dow Jones Newswires

December 20, 2018 02:00 ET (07:00 GMT)

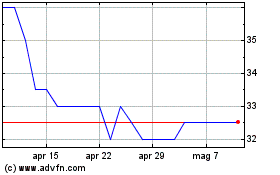

Grafico Azioni Tpximpact (LSE:TPX)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Tpximpact (LSE:TPX)

Storico

Da Apr 2023 a Apr 2024