Vinci Airports Buys Majority Stake in Gatwick Airport for GBP2.9 Billion -- Update

27 Dicembre 2018 - 11:54AM

Dow Jones News

(Rewrites throughout and adds comments from Gatwick Chairman,

CEO and Global Infrastructure Partners.)

By Anthony Shevlin and Ian Walker

Vinci SA (DG.FR) said Thursday that it will buy a majority

shareholding in London's Gatwick airport in a deal that values the

U.K.'s second-largest airport at over $7 billion.

Vinci Airports, a Vinci Concessions subsidiary, will acquire a

50.01% shareholding in the airport for GBP2.9 billion ($3.68

billion) and the deal is expected to be completed in the first half

of 2019, Vinci said.

The remaining 49.99% stake will be managed by Global

Infrastructure Partners (GIP.XX).

Gatwick Chairman David Higgins described the deal as a "vote of

confidence in Gatwick and its future potential," while Chief

Executive Stewart Wingate said there won't be any changes to the

immediate running of Gatwick.

Gatwick Airport serves more than 228 destinations in 74

countries and is used by 46 million passengers a year. It is owned

by a group of international investment funds and pension funds, of

which Global Infrastructure Partners is the largest

shareholder.

"This partnership is focused on continuing the transformation at

the airport over the last decade," GIP partner Michael McGhee

said.

Vinci Airports manages the development and operations of 46

airports in France, Portugal, the U.K., Sweden, Serbia, Cambodia,

Japan, the U.S., Dominican Republic, Costa Rica, Chile and Brazil.

It is used by more than 250 airlines, and the network handled over

228 million passengers in 2018.

Write to Anthony Shevlin at anthony.shevlin@dowjones.com;

@anthony_shevlin and Ian Walker at ian.walker@wsj.com.

(END) Dow Jones Newswires

December 27, 2018 05:39 ET (10:39 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

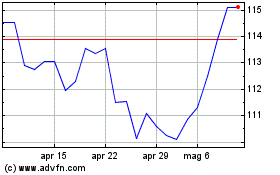

Grafico Azioni Vinci (EU:DG)

Storico

Da Mar 2024 a Apr 2024

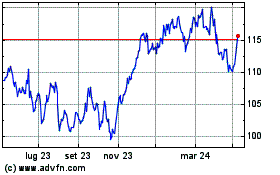

Grafico Azioni Vinci (EU:DG)

Storico

Da Apr 2023 a Apr 2024