TIDMSURE

RNS Number : 6142L

Sure Ventures PLC

28 December 2018

Chairman's Statement

Dear Shareholders.

On behalf of my fellow directors, I am delighted to present the

interim results of Sure Ventures plc (the 'Company') covering the

six months ended 30 September 2018.

FINANCIAL Performance

In the six month period to 30 September 2018 the Company's

performance has been in line with expectations with a net asset

value total return of 10.29% (31 March 2018: -7.88%) and a life to

date performance of +1.60%. The profitability of the Company in the

first reporting period to 31(st) March 2018 was impacted by the

realisation of all fund related formation costs in this first

period of trading in accordance with International Financial

Reporting Standards.

The improvement in performance in the interim period to 30

September 2018 has been driven in large part by the performance of

the Company's first direct investment, Immotion Group PLC

('Immotion'). Immotion, is a UK based company that creates its own

high-quality VR content and enhances the immersive experience by

coupling this content with motion simulation. The GBP500,000

investment made on 24 April 2018 is the only direct investment made

by the Company to date. Immotion listed on the Alternative

Investment Market on 12 July 2018, at a price that represented a

notable uplift in the value of the Company's original investment

and has continued to perform positively. Whilst the fair value of

the Company's investment in Suir Valley Ventures has fallen during

the period since 31 March 2018, the life to date performance of

Suir Valley Ventures is 15.8%.

Further detail is provided in the report of the Investment

Manager which follows this statement.

Dividend

During the interim period to 30 September 2018, the Company has

not declared a dividend (31 March 2018: GBPnil). Pursuant to the

Company's dividend policy the directors intend to manage the

Company's affairs to achieve shareholder returns through capital

growth rather than income. The Company does not expect to receive a

material amount of dividends or other income from its direct or

indirect investments. It should not be expected that the Company

will pay a significant annual dividend, if any.

Gearing

The Company may deploy gearing of up to 20% of net asset value

(calculated at the time of borrowing) to seek to enhance returns

and for the purposes of capital flexibility and efficient portfolio

management. The Company's gearing is expected to primarily comprise

bank borrowings, but may include the use of derivative instruments

and such other methods as the board may determine. During the

period to 30 September 2018 the Company did not employ any

borrowing (31 March 2018: GBPnil).

The board will continue to review the Company's borrowing, in

conjunction with the Company's investment Manager on a regular

basis pursuant with the Company's overall cash management and

investment strategy.

Outlook

On 2 July 2018 the Company announced the raising of gross

proceeds of GBP200,000 pursuant to the issue of new ordinary

shares.

On 27 September 2018 the Company raised gross proceeds of

GBP1,078,480 by conditionally allotting ordinary shares at

GBP1.0225 each. The issue of these shares became effective on 3

October 2018 when the shares were admitted to the Specialist Funds

Segment of the Main Market of the London Stock Exchange. The

Company now has 4,564,748 ordinary shares in issue.The Investment

Manager's Report following this Statement gives further detail on

the affairs of the Company. The board is confident of the long-term

prospects for the Company in pursuit of its investment

objectives.

Perry Wilson

Chairman

21 December 2018

Investment Manager's Report

The company

Sure Ventures plc (the 'Company') has been established to enable

investors to gain access to early stage technology companies within

the market verticals of augmented reality and virtual reality

(AR/VR), the Internet of Things (IoT) and financial technology

(FinTech).

The Company aims to gain access to deal flow ordinarily reserved

for venture capital funds and ultra-high net worth angel investors,

establishing a diversified software-centric portfolio with a clear

strategy. Listing the fund on the London Stock Exchange should

offer investors:

Relative liquidity

A quoted share price

A high level of corporate governance

It is often too expensive, too risky and too labour intensive

for investors to build their own portfolio of the type. We are

leveraging the diverse skillsets of an experienced management team

who have the industry network to gain access to quality deal flow,

the expertise to complete extensive due diligence in target markets

and the entrepreneurial skills to help these companies to mature

successfully. Those investing in our fund will get exposure to Suir

Valley Ventures which in turn makes direct investments in the above

sectors in the Republic of Ireland.

Augmented Reality & Virtual Reality

The AR/VR market is evolving at a rapid pace. The market is

expected to grow into a US$108 billion industry within the next

five years [1] Significant investment in VR hardware capability and

headset development has been made by major industry players such as

Facebook (through its Oculus division), Microsoft, Sony (through

its PlayStation division), HTC, Samsung and others. In 2017 Apple

and Google launched development tools supporting the growth of AR

smartphone apps. These investments have ignited a new and exciting

industry within the technology sector. Hardware manufacturers and

AR/VR users are now searching for software capabilities/support and

content, and we believe that exposure to this industry via the

Company and direct investment into software companies in the space

will offer significant upside potential for investors. Through our

network of technology accelerators, angel investor partners and

industry contacts in the AR/VR space, we expect to have a strong

chance of discovering the industry leaders of tomorrow.

Internet of Things

The Internet of Things (IoT) as a segment of the market is a

broad investment area, but is defined as the interconnection via

the internet of computing devices embedded in everyday objects

enabling them to send and receive data. The market was estimated to

be worth US$120 billion dollars in 2016 and is predicted to reach a

size of US$253 billion by 2021[2]. The global growth and

advancement of internet coverage, the increased speed and

capability of connectivity and the mass market penetration of

smartphones/tablet sales has opened up significant opportunities

for software companies. Businesses from many industries are

embracing the efficiencies, cost savings and the "direct to

consumer" penetration this technological advancement has offered.

We see continued growth opportunities in this area and believe that

investor returns will benefit from exposure to the space.

FinTech

FinTech is an industry segment that has grown significantly and

continues to do so at a rapid pace. It has a transaction value

that's estimated to be US$2.6 trillion US dollars. The market is

predicted to expand to a size of US$6.9 trillion in the next 5

years, which represents a transaction value at a compound annual

growth rate of 20.5%[3]. The banking, finance and insurance

industries are increasingly accepting and embracing the

efficiencies and benefits of technology. Ever changing financial

regulation, cyber security requirements and payment trends are

driven by technological advancement. We continue to see new and

exciting deal flow in this area and believe that this market

segment will continue to develop at pace. We believe that investors

looking for exposure to the emerging software technology market

should include a FinTech element in their investment strategy.

[1] eDigi-Capital, 2017 (https://www.digi-capital.com/)

[2] Zinnov Zones 2016 - Internet Of Things Technology Services

(http://zinnovzones.com)

[3] Statistica, June 2017

(https://www.statista.com/chart/4204/fintech-market-outlook/

PORTFOLIO BREAKDOWN

On 17 January 2018 the placing of 3.31m ordinary shares of Sure

Ventures plc was concluded, following an extensive fundraising

programme as described in the prospectus published on 17 November

2017 ('the prospectus'). The ordinary shares were admitted to

trading on the Specialist Fund Segment of the London Stock Exchange

on 19 January 2018 under the ISIN: GB00BYWYZ460. On 2 July 2018 the

Company announced the raising of gross proceeds of GBP200,000 by

the placing of new ordinary shares.

On 6 February 2018, Sure Ventures entered into a EUR4.5m

commitment to Suir Valley Ventures, the sole sub-fund of Suir

Valley Funds ICAV and its investment was equalised into the

sub-fund at that date. The first drawdown of this commitment was

made on 5 March 2018 with the second drawdown on 22 August

2018.

In addition to investing in Suir Valley Ventures, Sure Ventures

plc may, in pursuit of its investment objectives, invest directly

in investee companies. On 24 April 2018 the Company announced a

GBP500,000 direct investment in Immotion Group Plc a UK-based

company focused on creating superior out-of-home immersive VR

experiences in Europe and the USA. On 12 July 2018 it was announced

that the company had listed on AIM (ticker IMMO.L) having raised

GBP5.75mm through an oversubscribed placing.

In addition to the two investments made above, the Company has

pursued the cash management strategy as outlined in the prospectus

and made an investment in UK Treasury Bills.

suir valley Funds ICAV

Suir Valley Funds ICAV (the "ICAV") is a close-ended Irish

collective asset-management vehicle with segregated liability

between sub-funds incorporated in the Republic of Ireland pursuant

to the Irish Collective Asset-management Vehicles Act 2015 and

constituted as an umbrella fund insofar as the share capital of the

ICAV is divided into different series with each series representing

a portfolio of assets comprising a separate sub-fund.

The ICAV was registered on 18 October 2016 and authorised by the

Central Bank of Ireland as a qualifying investor alternative

investment fund ("QIAIF") on 10 January 2017. The initial sub-fund

of the ICAV is Suir Valley Ventures (the "Fund"), which had an

initial closing date of 1 March 2017. The Fund intends to invest in

a broad range of software companies but with a focus on companies

in the AR/VR, FinTech and IoT sectors.

As at 30 September 2018 the Fund had commitments totalling

EUR20.3m and had made five direct investments into companies

spanning the AR/VR and IoT sectors. On 12 March 2018, Immersive VR

Education Limited, the Fund's first investment, completed a

flotation on the London Stock Exchange (AIM) and the Dublin Stock

Exchange (ESM). The public company is now called VR Education

Holdings PLC - ticker VRE. VRE was the first software company to

list on the ESM since that market's inception. The Company's

EUR4,500,000 commitment to the Fund was made at a price of EUR1.00

per share; the last recorded dealing NAV of the Fund as at 30

September 2018 was at EUR1.1583 representing a return since

inception for investors of 15.83%.

DIRECT INVESTMENTS

Immotion Group PLC ('Immotion'), a UK based company that creates

its own high-quality VR content and enhances the immersive

experience by coupling this content with motion simulation, is the

only direct investment made by the Company to date, with a

GBP500,000 investment made in February 2018. Immotion listed on AIM

in July 2018, at a price that represented a notable uplift in the

value of Sure Venture's original investment. Immotion has made

continued progress, rolling out VR centres in Yorkshire,

Manchester, Cardiff, Newcastle, Derby and Uxbridge. It has also

created new proprietary content (such as Delta Zero VR) and a

branded roller coaster experience for the Lego discovery centre in

Manchester.

performance

During the period to 30 September 2018 the Company has made a

total return on net asset value per share of +10.29% (31 March

2018: -7.88%), which represents a life to date performance of

+1.60%.

This return since commencement of operations is in line with

expectation and can be attributed to the recognition of one-off

formation costs, placing fees and fund operating costs tempered by

the positive performance of the investments in the Fund and the

direct investment in Immotion.

FutuRe Investment OUTLOOK

We are pleased with the progress the Fund has made thus far. The

Fund has built a well balanced portfolio with exposure to several

exciting and rapidly growing companies. Overall our investments

have grown at a healthy rate which we believe provides an

encouraging outlook for further investments in our chosen sectors.

We are especially pleased with the successful flotation of our

first direct investment, Immotion, that came to fruition shortly

after investment. We look forward to providing further updates as

further investments are made by the Company directly and by the

Fund and the current investee companies continue to develop.

Shard Capital AIFM LLP

Investment Manager

21 December 2018

Condensed Statement of Comprehensive Income

For the six months ended 30 September 2018 (unaudited)

Revenue Capital Total

GBP GBP GBP

========== ========

Income

=========================================== ========== ======== ==========

Other net changes in fair value on

financial assets at fair value through

profit or loss - 467,649 467,649

============================================ ========== ======== ==========

Other income 3,174 - 3,174

============================================ ========== ======== ==========

Management fee rebate 1,155 3,611 4,766

============================================ ========== ======== ==========

Total net income 4,329 471,260 475,589

============================================ ========== ======== ==========

Expenses

=========================================== ========== ======== ==========

Management fee - - -

=========================================== ========== ======== ==========

Custodian, secretarial and administration

fees (36,933) - (36,933)

============================================ ========== ======== ==========

Other expenses (92,521) - (92,521)

============================================ ========== ======== ==========

Total operating expenses (129,454) - (129,454)

============================================ ========== ======== ==========

(Loss) / Profit before Taxation and

after finance costs (125,125) 471,260 346,135

============================================ ========== ======== ==========

Taxation - - -

=========================================== ========== ======== ==========

(Loss) / Profit after taxation (125,125) 471,260 346,135

============================================ ========== ======== ==========

Earnings per share (3.67) 13.84 10.17

============================================ ========== ======== ==========

For the period from 21 June 2017 (date of incorporation) to 31

March 2018 (audited)

Revenue Capital Total

GBP GBP GBP

========== ========

Income

=========================================== ========== ======== ==========

Other net changes in fair value on

financial assets at fair value through

profit or loss - 44,980 44,980

============================================ ========== ======== ==========

Total net income - 44,980 44,980

============================================ ========== ======== ==========

Expenses

=========================================== ========== ======== ==========

Management fee (1,155) (3,611) (4,766)

============================================ ========== ======== ==========

Custodian, secretarial and administration

fees (19,850) - (19,850)

============================================ ========== ======== ==========

Other expenses (230,282) - (230,282)

============================================ ========== ======== ==========

Total operating expenses (251,287) (3,611) (254,898)

============================================ ========== ======== ==========

(Loss) / Profit before Taxation and

after finance costs (251,287) 41,369 (209,918)

============================================ ========== ======== ==========

Taxation - - -

=========================================== ========== ======== ==========

(Loss) / Profit after taxation (251,287) 41,369 (209,918)

============================================ ========== ======== ==========

Earnings per share (7.59)p 1.25p (6.34)p

============================================ ========== ======== ==========

The total comprehensive income and expense for the period is

attributable to shareholders of the Company

The accompanying notes on pages 11 to 17 form part of these

condensed interim financial statements.

Condensed Statement of Financial Position

As at 30 September 2018

Notes 30 September 31 March 2018

2018

(unaudited) (audited)

GBP GBP

====== =============

Non-current assets

======================================= ====== ============= ==============

Investments held at fair value

through profit or loss 7 2,821,001 739,258

======================================= ====== ============= ==============

2,821,001 739,258

======================================= ====== ============= ==============

Current assets

======================================= ====== ============= ==============

Receivables 3,700 689,713

======================================= ====== ============= ==============

Cash and cash equivalents 789,931 1,663,505

======================================= ====== ============= ==============

793,631 2,353,218

======================================= ====== ============= ==============

Total assets 3,614,632 3,092,476

======================================= ====== ============= ==============

Current liabilities

======================================= ====== ============= ==============

Management fee payable - (4,766)

======================================= ====== ============= ==============

Other payables (48,614) (38,550)

======================================= ====== ============= ==============

(48,614) (43,316)

======================================= ====== ============= ==============

Total assets less current liabilities 3,566,018 3,049,160

======================================= ====== ============= ==============

Total net assets 3,566,018 3,049,160

======================================= ====== ============= ==============

Shareholders' funds

======================================= ====== ============= ==============

Ordinary share capital 8 35,100 33,100

======================================= ====== ============= ==============

Share premium 3,394,701 3,225,978

======================================= ====== ============= ==============

Revenue reserves (376,412) (251,287)

======================================= ====== ============= ==============

Capital reserves 512,629 41,369

======================================= ====== ============= ==============

Total shareholders' funds 3,566,018 3,049,160

======================================= ====== ============= ==============

Net asset value per share 101.59p 92.12p

======================================= ====== ============= ==============

The accompanying notes on pages 11 to 17 form part of these

condensed interim financial statements.

The financial statements on pages 11 to 17 were approved by the

board of directors and authorised for issue on 21 December 2018.

They were signed on its behalf by:

Perry Wilson, Chairman

Condensed Statement of Changes in Equity

For the six months ended 30 September 2018 (unaudited)

Ordinary Share Revenue Capital Total Total

Share Premium Reserves Reserves Reserves Equity

Capital GBP GBP GBP GBP GBP

GBP

========= ========== ========== ========== ==========

Balance at 31

March 2018 33,100 3,225,978 (251,287) 41,369 (209,918) 3,049,160

================= ========= ========== ========== ========== ========== ==========

Ordinary shares

issued 2,000 198,000 - - - 200,000

================= ========= ========== ========== ========== ========== ==========

Ordinary shares

issue costs - (29,277) - - - (29,277)

================= ========= ========== ========== ========== ========== ==========

(Loss) / Profit

after taxation - - (125,125) 471,260 346,135 346,135

================= ========= ========== ========== ========== ========== ==========

Dividends paid - - - - - -

in the period

================= ========= ========== ========== ========== ========== ==========

Balance at 30

September 2018 35,100 3,394,701 (376,412) 512,629 136,217 3,566,018

================= ========= ========== ========== ========== ========== ==========

For the period from 21 June 2017 (date of incorporation) to 31

March 2018 (audited)

Ordinary Share Revenue Capital Total Total

Share Premium Reserves Reserves Reserves Equity

Capital GBP GBP GBP GBP GBP

GBP

========= ========== ========== ========== ==========

Balance at 21 - - - - - -

June 2017

================= ========= ========== ========== ========== ========== ==========

Ordinary shares

issued 33,100 3,276,900 - - - 3,310,000

================= ========= ========== ========== ========== ========== ==========

Ordinary shares

issue costs - (50,922) - - - (50,922)

================= ========= ========== ========== ========== ========== ==========

(Loss) / Profit

after taxation - - (251,287) 41,369 (209,918) (209,918)

================= ========= ========== ========== ========== ========== ==========

Dividends paid - - - - - -

in the period

================= ========= ========== ========== ========== ========== ==========

Balance at 31

March 2018 33,100 3,225,978 (251,287) 41,369 (209,918) 3,049,160

================= ========= ========== ========== ========== ========== ==========

The accompanying notes on pages 11 to 17 form part of these

condensed interim financial statements.

Condensed Statement of Cash Flows

For the six months ended 30 September 2018

30 September 31 March 2018

2018

(unaudited) (audited)

GBP GBP

==== =============

Cash flows from operating activities:

============================================ ==== ============= ==============

Profit / (Loss) after taxation 346,135 (209,918)

================================================== ============= ==============

Adjustments for:

============================================ ==== ============= ==============

Decrease in receivables 686,013 -

============================================ ==== ============= ==============

Increase in payables 10,064 43,316

================================================== ============= ==============

Unrealised (loss)/gain on foreign

exchange (3,221) 6,875

================================================== ============= ==============

Decrease in Management fee payable (4,766) -

============================================ ==== ============= ==============

Net changes in fair value on financial

assets at fair value through profit

or loss (467,649) (51,855)

================================================== ============= ==============

Net cash inflow/outflow from operating

activities 566,576 (211,582)

================================================== ============= ==============

Cash flows from investing activities:

============================================ ==== ============= ==============

Purchase of investments (1,610,873) (694,278)

================================================== ============= ==============

Net cash (outflow) from investing

activities (1,610,873) (694,278)

================================================== ============= ==============

Cash flows from financing activities:

============================================ ==== ============= ==============

Proceeds from issue of ordinary shares 200,000 2,620,287

================================================== ============= ==============

Share issue costs (29,277) (50,922)

================================================== ============= ==============

Net cash inflow from financing activities 170,723 2,569,365

================================================== ============= ==============

Net change in cash and cash equivalents (873,574) 1,663,505

================================================== ============= ==============

Cash and cash equivalents at the beginning

of the period 1,663,505 -

============================================ ==== ============= ==============

Net cash and cash equivalents 789,931 1,663,505

================================================== ============= ==============

The accompanying notes on pages 11 to 17 form part of these

condensed interim financial statements.

Notes to the Condensed Interim Financial Statements

1) General information

Sure Ventures plc (the "Company") is a company incorporated in

England and Wales (registration number: 10829500) on 21 June 2017,

commencing trading on 19 January 2018 upon listing. The registered

office of the Company is 23rd Floor, 20 Fenchurch Street, London,

United Kingdom, EC3M 3BY.

The Company is an investment company within the meaning of

section 833 of the Companies Act 2006.

The Company operates as an investment trust in accordance with

Chapter 4 of Part 24 of the Corporation Tax Act 2010 and the

Investment Trust (Approved Company) (Tax) Regulations 2011. In the

opinion of the directors, the Company has conducted its affairs so

that it is able to maintain its status as an investment trust.

Approval of The Company's application for approval as an investment

trust was received from HMRC on 22 November 2018, applicable from

the accounting period commencing 1 April 2018.

The Company is an externally managed closed-ended investment

company with an unlimited life and has no employees.

The information set out in these unaudited condensed interim

financial statements for the period ended 30 September 2018 does

not constitute statutory accounts as defined in section 435 of

Companies Act 2006. Comparative figures from inception to 31 March

2018 are derived from the financial statements for that period. The

financial statements for the period ended 31 March 2018 have been

delivered to the Registrar of Companies and contain an unqualified

audit report and did not contain a statement under emphasis of

matter or statements under section 498(2) or (3) of the Companies

Act 2006. The financial statements of the Company for the period

ended 31 March 2018 are available upon request from the Company's

registered office at 23(rd) Floor, 20 Fenchurch Street, London,

United Kingdom, EC3M 3BY.

2) Basis of accounting

The financial statements of the Company have been prepared in

accordance with International Financial Reporting Standards (IFRS)

and IFRIC interpretations (IFRS IC) as adopted by the European

Union. They do not include all the information required for the

full annual financial statements, and should be read in conjunction

with the annual financial statements of the Company for the period

ended 31 March 2018. The principal accounting policies adopted in

the preparation of the financial information in these unaudited

condensed interim financial statements are unchanged from those

used in the Company's financial statements for the period ended 31

March 2018. This report does not itself contain sufficient

information to comply with IFRS.

3) Estimates

The preparation of the unaudited condensed interim financial

statements requires management to make judgement, estimates and

assumptions that affect the application of accounting policies and

the reported amounts of assets and liabilities, income and

expenses. Actual results may differ from these estimates.

In preparing these unaudited condensed interim financial

statements, the significant judgement made by management in

applying the Company's accounting policies and the key sources of

estimation were the same as those that applied to the Company

financial statements as at and for the period ended 31 March

2018.

4) Financial risk management

The Company's financial risk management objectives and policies

are consistent with those disclosed in the Company financial

statements as at and for the period ended 31 March 2018.

5) Taxation

As an investment trust the Company is exempt from corporation

tax on capital gains. The Company's revenue income is subject to

tax, but offset by any interest distribution paid, which has the

effect of reducing that corporation tax to nil. This means the

interest distribution may be taxable in the hands of the Company's

shareholders.

6) Earnings per Share

For the six months period ended Revenue Capital Total

30 September 2018 pence pence pence

======== ========

Earnings per ordinary share (3.67)p 13.84p 10.17p

================================= ======== ======== ========

For the financial period ended 31 from March 2018

Earnings per ordinary share (7.59)p 1.25p (6.34)p

================================= ======== ======== ========

The calculation of the above is based on revenue return loss of

GBP125,125 (31 March 2018: loss GBP251,287), capital return profit

of GBP471,260 (31 March 2018: profit GBP41,369) and total return

profit of GBP346,135 (31 March 2018: loss GBP209,919) and weighted

average number of ordinary shares of 3,405,082 (31 March 2018:

3,310,000) as at 30 September 2018

7) INVESTMENTS AT FAIR VALUE THROUGH PROFIT OR LOSS

As at 30 September As at 31 March

2018 2018

GBP GBP

===================

Opening cost -

======================================= =================== ===============

Opening fair value 739,258 -

======================================= =================== ===============

Purchases at cost 1,610,873 694,278

======================================= =================== ===============

Cost at fair value measurement 467,649 51,855

======================================= =================== ===============

Unrealised (loss) on foreign exchange 3,221 (6,875)

======================================= =================== ===============

Closing fair value 2,821,001 739,258

======================================= =================== ===============

8) Ordinary Share Capital

The table below details the issued share capital of the Company

as at the date of the Financial Statements.

Issued and allotted No. of shares No. of shares 30 September 31 March

30 September 31 March 2018 2018

2018 2018 GBP GBP

============== ============== ==============

Ordinary shares of 1 penny -

each

============================ ============== ============== ============== ==========

3,510,000 3,310,000 35,100 33,100

============================ ============== ============== ============== ==========

On incorporation, the issued share capital of the Company was

GBP0.01 represented by one ordinary share of GBP0.01. Redeemable

preference shares of 50,000 were also issued with a nominal value

of GBP1 each, of which 25% were paid. The redeemable shares were

issued to enable the Company to obtain a certificate of entitlement

to conduct business and to borrow under section 761 of the

Companies Act 2006. The redeemable shares were redeemed on listing

from the proceeds of the issue of the new ordinary shares upon

admission on 19 January 2018.

3,310,100 ordinary shares of GBP0.01 each were issued to

shareholders as part of the placing and offer for subscription in

accordance with the Company's prospectus dated 17 November 2017 and

the supplementary prospectus dated 2 January 2018. The shares were

admitted to trading on the Specialist Fund Segment ('SFS') of the

London Stock Exchange on 19 January 2018.

An additional 200,000 ordinary shares of GBP0.01 each were

issued to shareholders as part of the placing and offer for

subscription and admitted to trading on the SFS on 5 July 2018.

9) Related Party Transactions and Transactions with the

Manager

Directors - There were no contracts subsisting during or at the

end of the period in which a director of the Company is or was

interested and which are or were significant in relation to the

Company's business. There were no other transactions during the

period with the directors of the Company. The directors do not hold

any ordinary shares of the Company.

At 30 September 2018, there was GBP1,672 (31 March 2018: GBP203)

payable in respect of directors fees and expenses.

Manager - Shard Capital AIFM LLP (the 'Manager'), a UK-based

company authorised and regulated by the Financial Conduct

Authority, has been appointed the Company's manager and authorised

investment fund manager for the purposes of the Alternative

Investment Fund Managers Directive. Details of the services

provided by the manager and the fees paid are given in the

prospectus dated 17 November 2017.

During the period the Company was rebated GBP4,767 (31 March

2018: paid GBP4,767) of fees and at 30 September 2018, there was

GBPnil (31 March 2018: GBP4,767) payable to the manager.

During the period the Company paid GBP9,697 (31 March 2018:

GBP50,922) of placement fees to Shard Capital Partners LLP.

During the period the Company paid GBP6,000 (31 March 2018:

GBP3,000) of advisory fees to Shard Capital Partners LLP.

10) SubsequENT EVENTS

On 27 September 2018 the Company raised gross proceeds of

GBP1,078,480 by conditionally allotting ordinary shares at

GBP1.0225 each. The issue of these shares became effective on 3

October 2018 when the shares were admitted to the Specialist Funds

Segment of the Main Market of the London Stock Exchange. The

Company now has 4,564,748 ordinary shares in issue.

On 12 October 2018 the Company made a further EUR306,480

investment in Suir Valley Ventures (the "Fund"), representing the

third drawdown against the Company's EUR4,500,000 commitment to the

Fund.

On 20 December 2018 Sean Nicolson resigned as Non-Executive

Director of the Company and Chairman of the Board.

On 20 December 2018 Perry Wilson was appointed as a

Non-Executive Director of the Company and Chairman of the

Board.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR DMMZZGNVGRZZ

(END) Dow Jones Newswires

December 28, 2018 02:00 ET (07:00 GMT)

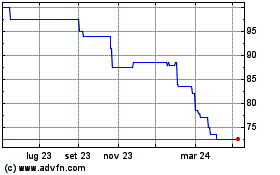

Grafico Azioni Sure Ventures (LSE:SURE)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Sure Ventures (LSE:SURE)

Storico

Da Apr 2023 a Apr 2024