U.S. Dollar Slides On Political Worries

03 Gennaio 2019 - 7:17AM

RTTF2

The U.S. dollar declined against its major counterparts in the

European session on Thursday, as uncertainty about U.S. trade

policy and political wrangling in Washington over federal

government funding of a border wall fueled concerns about a global

economic slowdown.

Brexit-related worries and Apple's profit warning, citing a

weakening economy in China and lower-than-expected iPhone revenue,

also spooked markets.

Political stalemate continued in the U.S. as a partial

government shutdown entered its 13th day.

Democrats are set to take control of the House today and intend

to move forward with plans to reopen the government without

providing funding for the wall, although the White House has called

the plan a "non-starter."

In remarks to reporters ahead of the meeting, Trump indicated

the partial government shutdown will continue for "as long as it

takes," standing by his demand for $5 billion for the border

wall.

Investors await ADP private payrolls data and ISM manufacturing

index for December later in the day for more direction.

The currency was trading mixed against its major counterparts in

the Asian session. While it fell against the franc and the yen, it

rose against the euro and the pound.

The greenback dropped to 1.2586 against the pound, from a

21-month high of 1.2401 hit at 5:45 pm ET. On the downside, 1.27 is

likely seen as the next support level for the greenback.

Survey data from IHS Markit showed that British construction

sector growth was the weakest in three months in December, amid a

slower rise in commercial work.

The CIPS Purchasing Managers' Index, or PMI, fell to 52.8 from

53.4 in November. The latest reading was in line with economists'

expectations.

The greenback declined to 1.1384 against the euro, reversing

from more than a 2-week high of 1.1306 seen at 5:45 pm ET. If the

greenback falls further, 1.15 is possibly seen as its next support

level.

The greenback retreated to 1.3608 against the loonie, 0.6974

against the aussie and 0.6655 against the kiwi, from its early high

of 1.3654, near 10-year high of 0.6745 and a 2-month high of

0.6587, respectively. The greenback is poised to challenge support

around 1.35 against the loonie, 0.72 against the aussie and 0.68

against the kiwi.

The greenback held steady against the yen, after having dropped

to a 9-1/2-month low of 104.74 at 5:30 pm ET. The pair ended

yesterday's trading at 108.87.

On the flip side, the greenback recovered to 0.9883 against the

Swiss franc, from a low of 0.9846 hit at 2:00 am ET. The greenback

is likely to challenge resistance around the 1.00 level.

Looking ahead, at 8:15 am ET, U.S. ADP private payrolls data for

December is set for release.

In the New York session, U.S. weekly jobless claims for the week

ended December 29, ISM manufacturing index for December and

construction spending data for November are scheduled for

release.

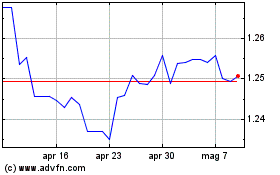

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Mar 2024 a Apr 2024

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Apr 2023 a Apr 2024