Pound Climbs Amid Risk Appetite On Upcoming US-China Trade Talks

04 Gennaio 2019 - 7:11AM

RTTF2

The pound gained ground against its major counterparts in the

European session on Friday amid risk appetite, as the U.S. and

China planned fresh trade talks next week and a private survey

showed growth in the Chinese service sector accelerated to a

six-month high in December, helping ease global growth worries.

Chinese slowing growth is having an impact on Apple and other

American companies, but sales should recover once Washington

strikes a trade deal with Beijing, a senior White House adviser

said.

Survey data from IHS Markit showed that U.K. service sector

activity expanded more than forecast in December.

The CIPS Purchasing Managers' Index, or PMI, rose to 51.2 from

50.4 in November. Economists had forecast a score of 50.7.

Meanwhile, data from the Nationwide Building Society showed that

UK house price inflation slowed sharply in December to its weakest

level since early 2013, as buyer confidence eroded amid the

persistent uncertainties linked to Brexit.

The house price index rose 0.5 percent year-on-year following a

1.9 percent increase in November. Economists had forecast a 1.5

percent increase.

The currency has been trading higher against its major opponents

in the Asian session.

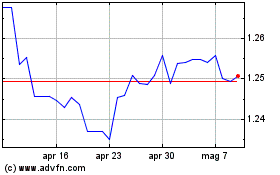

The pound appreciated to a 2-day high of 1.2682 against the

greenback, following a decline to 1.2616 at 7:00 pm ET. The pound

is likely to find resistance around the 1.28 level.

The pound bounced off to 136.98 against the yen, from a low of

135.81 hit at 7:00 pm ET. The pound is seen finding resistance

around the 138.00 region.

The pound firmed to a 2-day high of 1.2533 against the franc,

reversing from a low of 1.2451 seen at 5:00 pm ET. If the pound

rises further, 1.27 is possibly seen as its next resistance

level.

Having dropped to 0.9030 against the euro at 7:00 pm ET, the

pound changed direction and advanced to a 4-day high of 0.8981. The

next possible resistance for the pound is seen around the 0.88

level.

Data from Eurostat showed that Eurozone's consumer price

inflation slowed more-than-expected in December to its lowest level

in eight months.

The consumer price index rose 1.6 percent year-on-year following

a 1.9 percent increase in November. Economists had forecast 1.8

percent inflation.

Looking ahead, U.S. and Canadian jobs data for December are

scheduled for release in the New York session.

At 10:15 am ET, Federal Reserve Chair Jerome Powell participates

in a panel discussion titled "Federal Reserve chairs: Joint

Interview" at the American Economic Association's Annual Meeting in

Atlanta.

At the same time, Federal Reserve Bank of Atlanta President

Raphael Bostic will participate in a panel discussion titled "The

Future of Traditional Banking" at the American Economic

Association's Annual Meeting in Atlanta.

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Mar 2024 a Apr 2024

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Apr 2023 a Apr 2024