Revamp includes job cuts, plant closures; several low-profit

models will be scrapped

By William Boston

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 11, 2019).

BERLIN -- Ford Motor Co. is launching an overhaul of its

money-losing European business that is expected to include

thousands of job cuts, plant closures and the cancellation of

low-profit models amid a series of bad news for global car

makers.

The move is part of a broad cost-cutting effort that Ford Chief

Executive Jim Hackett has embarked on in an industry facing the

challenges of electric vehicles and a push toward autonomous

driving.

In October, Ford informed employees of a global reorganization

that could affect salaried jobs, part of Mr. Hackett's push to

improve profits and boost its sagging stock price.

Steven Armstrong, the company's president of Europe, Middle East

and Africa, declined to provide details on the planned job cuts

during a call with reporters Thursday. He said they would be made

across the board throughout Europe and were still being negotiated

with trade unions, as local labor laws often mandate.

However, he said the belt-tightening would "have a substantial

impact," with details expected to be available by the end of June.

"It will be a significant number within the 50,000 we employ," he

added.

The restructuring is the latest sign that waning demand and

weaker profits in Europe -- amid concerns around Brexit, trade

tensions, the gradual death of diesel engines and an economic

slowdown in China -- are forcing car manufacturers to aggressively

prune their businesses after years of steady growth.

From January to November, the most recent data available, Ford

sold 910,391 vehicles in the European Union, down 2.3% from the

same period of 2017. That left the company with a 6.4% share of the

European market.

In November, new-car sales in the EU fell 8% from a year

earlier, following a 7.3% decline in October and a 23.5% plunge in

September. During the first 11 months of 2018, 14.2 million new

cars were sold in the EU, an increase of 0.8%.

In a separate announcement Thursday, Jaguar Land Rover, the

British premium car maker owned by India's Tata Motors Inc., said

it would cut 4,500 jobs world-wide. JLR has been struggling with

weaker demand in China and a dramatic decline in diesel vehicle

sales in Europe.

Ford rival General Motors Co. said in 2018 that it would close

five plants in the U.S. and Canada, after selling its European

business in 2017 to France's Peugeot SA, to boost profitability and

focus investment on new technology.

Unlike GM, Ford said it would stick it out in Europe, at least

for now.

"We decided the best option is to stay in Europe as long as we

can reset the business and make it profitable," Ford's Mr.

Armstrong said.

Ford, he said, has had trouble making money in Europe for

decades. But a convergence of global trends -- including pressure

to invest in new technology and consumer preferences shifting away

from traditional sedans to sport-utility vehicles and light trucks

-- coupled with a mandate from Ford headquarters to increase

profits were driving the restructuring decision.

The move in Europe is among the first elements of a broad,

multiyear revamping of Ford's global operations. Last summer, the

Dearborn, Mich., company said it would take up to five years to

execute an $11 billion restructuring, but has offered few details

about what parts of the business might be scrapped or sold, leading

to some frustration among analysts and investors.

In October, Mr. Hackett, the CEO, cited an "unexpected

deterioration" in Europe as a key reason why Ford cut its goal of

achieving an 8% global operating-profit margin by 2020. Ford's

losses in Europe widened to $245 million in the third quarter.

The new plan aims to boost its operating-profit margin in Europe

to about 6% in the midterm, still shy of Mr. Hackett's global

target.

To get there, Ford plans to stop making models that aren't

profitable. The first to go are the company's C-Max compact car and

Grand C-Max family sedan. As a result, Ford will curtail a shift at

its factory in Saarlouis, Germany, eliminating 1,600 jobs. The

company has already stopped making those models in the U.S.

"The industry has spent years chasing unprofitable business,"

Mr. Armstrong said. "Portions of our business are profitable. We

need to address the portion of our business which isn't

profitable."

Ford will also shut down production at its Ford Aquitaine plant

in Bordeaux, France, where it makes transmissions, clutches and

other components.

In the U.K., where Ford's operations are suffering from the

political uncertainty surrounding Britain's planned exit from the

EU, Ford is merging some administrative offices and functions. For

now, Mr. Armstrong said, no decision has been made on whether to

close its engine and components plants in Dagenham and Bridgend.

But, he said: "Nothing is off the table."

Mr. Armstrong said Ford still believes the U.K. will negotiate a

smooth transition out of the EU, but added that the restructuring

would likely be more severe if there is there is no agreement on

the departure.

Corrections & Amplifications The most recent data on

European new-car sales are for November. An earlier version of this

article incorrectly said October figures were the latest available.

(Jan. 10, 2019).

Write to William Boston at william.boston@wsj.com

(END) Dow Jones Newswires

January 11, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

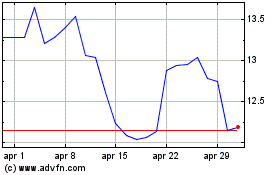

Grafico Azioni Ford Motor (NYSE:F)

Storico

Da Mar 2024 a Apr 2024

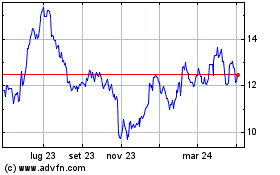

Grafico Azioni Ford Motor (NYSE:F)

Storico

Da Apr 2023 a Apr 2024