Walgreens Tests Digital Cooler Doors With Cameras to Target You With Ads

11 Gennaio 2019 - 12:59PM

Dow Jones News

By Lara O'Reilly

Walgreens Boots Alliance Inc. is testing a technology that

embeds cameras, sensors and digital screens in the cooler doors in

its stores, a new network of "smart" displays that marketers can

use to target ads for specific types of shoppers.

The refrigerator and freezer doors act as a digital

merchandising platform that depicts the food and drinks inside in

their best light, but also as an in-store billboard that can serve

ads to consumers who approach, based on variables such as the

approximate age the technology believes they are, their gender and

the weather.

This new technology could provide brick-and-mortar stores with a

marketplace similar to online advertising. Ice cream brands could

duke it out to get the most prominent placement when it is 97

degrees outside; an older man could see ads for different products

than a younger woman.

Cameras and sensors inside the coolers connected to

face-detection technology also can determine which items shoppers

picked up or looked at, giving advertisers insight into whether

their on-screen promotions worked -- and can let a retailer know

quickly if a product has gone out of stock.

The system is provided by Chicago-based Cooler Screens Inc., the

brainchild of Arsen Avakian, the startup's co-founder and chief

executive and the former CEO of Argo Tea Inc. The idea was born in

part out of his frustration spending hours in store cooler aisles

trying to figure out how to promote Argo's bottled ice teas, he

said.

Cooler Screens' other co-founders include former Walgreens Boots

Alliance Chief Executive Gregory Wasson; Glen Tullman, executive

chairman of health technology company Livongo Health Inc.; and

Jamie Koval, former president of brand and marketing agency VSA

Partners Inc.

Founded in 2017, the company has raised around $10 million in

funding. Its most recent round of financing was led by Microsoft

Corp., which is offering software to power the Cooler Screens

technology and infrastructure.

Around 15 large advertisers have signed up to test the Cooler

Screens platform, including Nestlé SA, MillerCoors LLC and Conagra

Brands Inc.

A big barrier for MillerCoors is that half of shoppers aren't

aware beer is available in drugstores, said Brooke Roller, senior

marketing manager of the small format channel for MillerCoors, in a

statement. The Cooler Screens technology "gives us the ability to

dynamically influence the shopper at the point of purchase and get

them to add beer to the basket, " she said.

Cooler Screens is hoping to tap into ad budgets that are

traditionally spent outside of stores, primarily in television and

digital, rather than just scrapping over so-called trade marketing

spending that helps get products on shelves in desirable locations

and with the best promotion.

Morgan Stanley analysts estimated in a January 2018 research

note that trade marketing spending in the U.S. reached $178 billion

in 2017. Media-buying agency GroupM estimated U.S. media

advertising investment, a figure that doesn't include trade

marketing spending, was $188 billion in 2017.

Ad revenue will be split between participating retailers and

Cooler Screens on a sliding scale, with each side's take ranging

from around 25% to 75%, Mr. Avakian said.

Walgreens began testing Cooler Screens in a Chicago store in

November and plans to extend the pilot to five more stores in San

Francisco, and to Manhattan and Seattle by the end of January,

according to Walgreens. Cooler Screens also is looking to expand

beyond Walgreens.

Brands have had some opportunities to use sensors and cameras in

and outside of stores for advertising before. Last November, in one

example, the Movember Foundation men's health charity ran a digital

billboard campaign in Australia and the U.K. that served different

messages to passersby, depending on whether or not they had facial

hair.

Still, the idea of being targeted in-store with digital ads is

unfamiliar to most consumers. Its success depends on balancing

"what's appropriate targeting and what's potentially on the edge of

being a bit intrusive," said Jane Ostler, global head of media at

the insights division of WPP PLC research company Kantar.

Mr. Avakian said a survey during the Chicago pilot found

consumers strongly preferred the digital doors to standard ones and

thought they made the products inside seem more appealing.

"The business model is not built on selling consumer data," said

Mr. Avakian. "The business model is built on providing intelligence

to brands and to the retailers to craft a much better shopping

experience."

The company says it only produces and stores anonymous metadata

that describes the size and demographics of an audience, and

doesn't store or transmit image data or unique identifying

information about shoppers. Walgreens also is posting a privacy

statement and a concierge to answer customer questions near the

coolers in its stores that test them, a Walgreens spokesman

said.

Write to Lara O'Reilly at lara.oreilly@wsj.com

(END) Dow Jones Newswires

January 11, 2019 06:44 ET (11:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

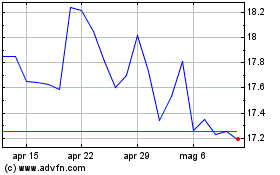

Grafico Azioni Walgreens Boots Alliance (NASDAQ:WBA)

Storico

Da Mar 2024 a Apr 2024

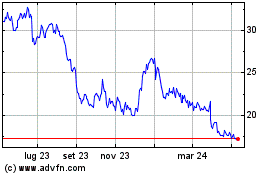

Grafico Azioni Walgreens Boots Alliance (NASDAQ:WBA)

Storico

Da Apr 2023 a Apr 2024