Panoply Holdings PLC (The) Acquisition of D/SRUPTION & Total voting rights (9417M)

14 Gennaio 2019 - 8:00AM

UK Regulatory

TIDMTPX

RNS Number : 9417M

Panoply Holdings PLC (The)

14 January 2019

14 January 2019

The Panoply Holdings PLC

("The Panoply", or the "Group")

Acquisition of D/SRUPTION to become a Group marketing

platform

and

Total voting rights

The Panoply Holdings PLC, the digitally native technology

services company, is pleased to announce the acquisition of the

entire issued share capital of iDisrupted Ltd ("D/SRUPTION") for an

initial consideration of GBP50,000 in shares (the "Acquisition").

D/SRUPTION provides a platform for The Panoply's Group companies to

increase awareness of the Group's capabilities amongst digital

transformation decision-makers in large organisations. It also

provides the opportunity to turn Group marketing into a profit

rather than a cost centre.

D/SRUPTION is an established thought-leader with over 17,500

subscribers, including representatives from 88 of the FTSE100,

numerous Government departments, Fortune 500 companies and other

large organisations.

The Panoply has acquired D/SRUPTION to support expansion and

further development as a business and with the intention for it to

become a key marketing platform for its Group companies. Through

its magazine, newsletter, research papers and events, D/SRUPTION

currently reaches the senior management within many large

organisations involved in digital transformation. Going forward,

Group companies will be able to leverage content, sponsorship and

advertising opportunities at limited or no cost. In order to

preserve integrity and to maintain the high level of quality

content it currently creates, D/SRUPTION will retain editorial

independence.

D/SRUPTION

The Acquisition of D/SRUPTION delivers on the Group's objective

to provide a marketing platform for its Group companies to leverage

and, in so doing, supports the proposition that The Panoply

provides a powerful marketing umbrella.

Neal Gandhi, Chief Executive Officer of The Panoply said:

"One of the key reasons that companies join The Panoply is our

ability to provide them with a marketing platform that smaller

services companies are not typically able to create for themselves,

driving further growth. Our plan has always been to build a content

platform for our Group companies to leverage. The creation of that

platform along with a subscriber base of a similar size to

D/SRUPTION's would have taken many years and cost hundreds of

thousands of pounds. By acquiring D/SRUPTION, we have made that

platform immediately available and saved a considerable amount of

money."

Rob Prevett, Chief Executive Officer of D/SRUPTION said:

"We have spent close to four years building D/SRUPTION to where

it is today and are pleased to have a subscriber base that offers

unparalleled access to digital disruption decision-makers in large

organisations. We look forward to working with The Panoply to

expose that base to Group companies, significantly increasing their

awareness amongst this traditionally hard to reach group. We've

long held an ambition to expand our proposition both in the UK and

Europe and The Panoply provides us with the platform to fulfil that

goal."

Additional information on the acquisition

The initial consideration for the Acquisition is GBP50,000 and

will be satisfied through the issue of 57,142 ordinary shares in

the Panoply at a price of 87.5 pence per share (the "Initial

Consideration Shares"). The sellers of D/SRUPTION may be entitled

to receive deferred earn-out consideration based on the performance

of the business during the four financial years from 1 April 2019

to 31 March 2023. Any such shares will be issued over a 24 month

period following the determination of the accounts in respect of

the relevant financial period and will be issued at the higher of

87.5 pence per ordinary share and the 30 day VWAP prior to the

issue of such earn-out shares.

The total consideration payable by The Panoply in respect of the

Acquisition is capped at a maximum of GBP3.6m.

All Panoply shares allotted and issued under the SPA (including

the Initial Consideration Shares) are subject to customary lock-in

arrangements and subject to claw-back by the Panoply if

D/SRUPTION's EBITDA decreases over the 4 year earn-out period.

There are no proposed changes to The Panoply's board members as

a result of the Acquisition.

Total voting rights

An application has been made for the admission of the Initial

Panoply Shares to trading on AIM which is expected to take place on

or before 18 January 2019. Following this issue, the Company's

issued share capital will comprise 42,295,147 Ordinary Shares and

this is the total number of voting rights in the Company. There are

no shares held in treasury.

This figure may be used by shareholders as the denominator for

the calculation by which they may determine if they are required to

notify their interest in, or change to their interest in, the

Company under the FCA's Disclosure Guidance and Transparency

Rules.

Enquiries:

The Panoply Holdings

Neal Gandhi (CEO) Via Alma PR

Oliver Rigby (CFO)

Stifel Nicolaus Europe Limited +44 (0)207 710 7600

(Nomad and Broker)

Fred Walsh

Alex Price

Neil Shah

Luisa Orsini Baroni

Alma PR panoply@almapr.co.uk

(Financial PR) +44(0)203 405 0206

Josh Royston 07780 901979

Susie Hudson

About The Panoply

The Panoply is a digitally native technology services company,

built to service clients' digital transformation needs. Founded in

2016, with the aim of identifying and acquiring best-of-breed

specialist information technology and innovation consulting

businesses across Europe, the Group collaborates with its clients

to deliver the technology outcomes they're looking for at the pace

that they expect and demand.

About D/SRUPTION

More information about D/SRUPTION is available at

https://disruptionhub.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQKMGMMLFKGLZM

(END) Dow Jones Newswires

January 14, 2019 02:00 ET (07:00 GMT)

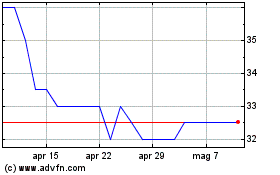

Grafico Azioni Tpximpact (LSE:TPX)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Tpximpact (LSE:TPX)

Storico

Da Apr 2023 a Apr 2024