VINCI : VINCI successfully issued a €950 million bond at 10 years

14 Gennaio 2019 - 8:30AM

Rueil-Malmaison, 14 January 2019

VINCI successfully

issued a €950 million bond at 10 years

VINCI has successfully issued a

€950 million bond maturing in September 2029 and carrying an annual

coupon of 1.625%

The issue was oversubscribed

almost 3 times, confirming investor confidence in VINCI's credit

quality. The company is rated A- by Standard & Poor's with

positive outlook, and A3 by Moody's with stable outlook.

Part of its EMTN programme, this

issue enabled VINCI to benefit from the market reopening in order

to continue decreasing the cost of its debt and extend its average

maturity despite a volatile market environment.

The joint bookrunners for the deal

are: BBVA and Natixis (Global Coordinators), Banca IMI, MUFG and

Natwest Markets.

PRESS CONTACT

VINCI Press department

Tel.: +33 1 47 16 31 82

Media.relations@vinci.com

About

VINCI

VINCI is a global player in concessions and construction, employing

more than 190, 000 people in some 100 countries. We design,

finance, build and operate infrastructure and facilities that help

improve daily life and mobility for all. Because we believe in

all-round performance, above and beyond economic and financial

results, we are committed to operating in an environmentally and

socially responsible manner. And because our projects are in the

public interest, we consider that reaching out to all our

stakeholders and engaging in dialogue with them is essential in the

conduct of our business activities.

www.vinci.com

PDF

This

announcement is distributed by West Corporation on behalf of West

Corporation clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: VINCI via Globenewswire

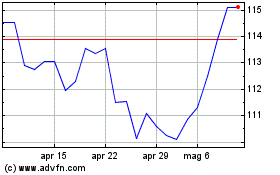

Grafico Azioni Vinci (EU:DG)

Storico

Da Mar 2024 a Apr 2024

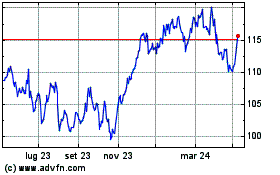

Grafico Azioni Vinci (EU:DG)

Storico

Da Apr 2023 a Apr 2024