U.S. Stocks Set to Follow European Markets Higher

16 Gennaio 2019 - 12:51PM

Dow Jones News

By David Hodari

Global stocks wavered Wednesday as investors absorbed a fresh

dose of uncertainty over the U.K.'s attempts to leave the European

Union.

The Stoxx Europe 600 was up 0.3% with mild, broad-based gains in

morning trading. The index's banking sector climbed 0.9% after its

Italian constituents came under pressure Tuesday, following reports

that the European Central Bank wants them to clean up their bad

loans more effectively.

In the U.S., futures pointed to gains of 0.3% for the S&P

500 and the Dow Jones Industrial Average. On Tuesday tech stocks

had led Wall Street higher following the People's Bank of China's

move to reassure markets of its intention to support waning

economic growth in the world's second-largest economy.

British assets gave a tepid reaction to the U.K. parliament's

overwhelming rejection of Prime Minister Theresa May's proposed

Brexit deal late Tuesday. The defeat was the largest suffered by a

sitting British government in modern times.

The FTSE 100 fell 0.4%, underperforming other European

benchmarks, as the British pound edged up 0.1% against the U.S.

dollar and fell by the same amount against the euro. Market

participants saw a lower likelihood of the country leaving the

European Union without a deal.

"The probability of a softer Brexit or remaining in the EU has

gone up more than anything else as a result of the vote in

parliament last night, and that offsets persistent uncertainty,"

said John Wraith, head of U.K. rates strategy and economics at

UBS.

The yield on 10-year U.K. government debt was rose to 1.318%

from 1.259% late Tuesday. Yields rise as prices fall.

Gentle gains for most European indexes followed mixed trading in

Asia. Japan's Nikkei benchmark ticked 0.6% lower after hitting a

four-week high Tuesday, while the Shanghai Composite Index was flat

and the Shenzhen A-Share fell 0.1%. Hong Kong's Hang Seng gained

0.3%.

A slew of gloomy economic figures out of China in recent weeks

has concerned investors about the state of broader global growth,

although an acceleration in the rise of Chinese house prices and

reports that the Chinese central bank had injected liquidity into

the country's banking system helped soothe those jitters

Wednesday.

While markets have recently focused on those growth concerns, as

well as precarious trade negotiations, a positive start to

fourth-quarter corporate earnings season has also provided a balm

to markets.

In the current earnings season, "we expect some growth, and if

the current geopolitical issues abate, we'll see the move back to

fundamentals that investors want," said Christian Nolting, chief

investment officer at Deutsche Bank Wealth Management.

A raft of financial-sector results expected later in the day,

including from Bank of America, BlackRock and Goldman Sachs, will

be closely watched.

Market participants will continue to watch British politics,

with a no-confidence vote against Prime Minister Theresa May

planned. Mrs. May is widely expected to survive the vote, which is

due to take place later Wednesday.

That growing consensus was a factor behind the uptick in the

pound, according to Stephen Gallo, European head of FX strategy at

BMO Financial Group.

"People could see the situation moving to a confidence motion

that they think the prime minister will win," Mr. Gallo said.

In commodities, Brent crude oil was flat at $60.63 a barrel,

while gold climbed 0.1% to $1,289.20 a troy ounce.

Write to David Hodari at David.Hodari@dowjones.com

(END) Dow Jones Newswires

January 16, 2019 06:36 ET (11:36 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

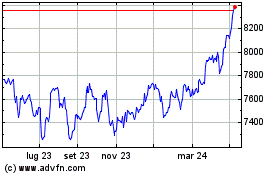

Grafico Indice FTSE 100

Da Mar 2024 a Apr 2024

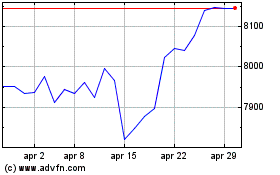

Grafico Indice FTSE 100

Da Apr 2023 a Apr 2024