Societe Generale 4Q Performance Hit by Challenging Environment

17 Gennaio 2019 - 8:12AM

Dow Jones News

By Anthony Shevlin

Societe Generale SA France (GLE.FR) said Thursday that its

fourth quarter was affected by a challenging environment in global

capital markets, and this will cause a decline in revenue in its

Global Markets and Investor Services business.

The French bank expects revenue in this business to fall by

around 20% in the fourth quarter and by 10% for 2018.

Market-weighted risks should increase significantly, too, said the

company.

Soc Gen said the performance of its Retail Banking and Financial

Services as well as its Advisory business should be solid in the

fourth quarter. French Retail Banking's performance is expected to

be in line with expectations, said the company.

Soc Gen said its cost of risk is expected to be within the 0.2%

to 0.25% range, as guided for in 2018.

The company proposed a 2018 dividend of 2.20 euros ($2.5) a

share and shareholders have the option of a dividend payment in

shares.

Furthermore, the company said an exceptional charge of EUR240

million will be booked in its Corporate Centre in the fourth

quarter due to a result of the IFRS 5 accounting of disposals by

the group.

Taking into account both disposals and acquisitions, Soc Gen

said its CET1 ratio, on a pro forma basis, is expected to be

between 11.4% and 11.6% as of the fourth quarter.

Write to Anthony Shevlin at anthony.shevlin@dowjones.com;

@anthony_shevlin

(END) Dow Jones Newswires

January 17, 2019 01:57 ET (06:57 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

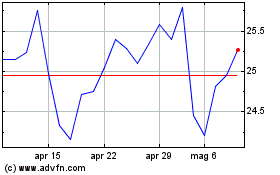

Grafico Azioni Societe Generale (EU:GLE)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Societe Generale (EU:GLE)

Storico

Da Apr 2023 a Apr 2024