By Denise Roland and Robert Wall

British Prime Minister Theresa May's failure to get U.K.

parliamentary approval for a deal to split the country from the

European Union adds significant pressure on companies as they plan

for the now greater possibility of an abrupt and disorderly

exit.

Lawmakers on Tuesday soundly rejected Mrs. May's agreement with

Brussels and approved by her cabinet, putting the process in

jeopardy ahead of a March 29 deadline to leave. The repudiation has

opened up a variety of possible outcomes considered unlikely until

recently, from Britain crashing out of the EU without a deal to a

new referendum on whether to leave at all.

With the deadline just weeks away, many big companies find

themselves making contingency plans for disaster.

"The worst case for us is not that we sell a little less fizzy

pop," said Hugo Fry, managing director of Sanofi SA's U.K.

operations. "It's patients don't get medicine." He has spent almost

two years planning how to insulate the French drugmaker from a

messy Brexit.

Many British business leaders never liked Mrs. May's deal.

Executives from large, international firms with big operations in

the U.K. or Europe had pushed for no exit at all in the 2016

referendum and then lobbied for the U.K. to at least remain in a

customs union with the EU, its major trade partner. But that didn't

happen.

Still, executives viewed Mrs. May's agreement with Brussels as

better than no deal because it would end 2 1/2 years of uncertainty

that has made investment decisions difficult and raised the threat

of major new obstacles and costs for exports and imports. Now, even

that is at risk, as Ms. May tries to cobble together a new

compromise Brexit deal after surviving a no-confidence vote on

Wednesday. The EU has given no indication it would make further

concessions.

"There are no more words to describe the frustration,

impatience, and growing anger amongst business," said Adam

Marshall, director general of the British Chamber of Commerce in a

statement after the vote. "Basic questions on real-world

operational issues remain unanswered."

A no-deal Brexit threatens time-consuming customs checks and

potentially expensive tariffs on goods that now move across the

English Channel seamlessly and tax-free. Many big companies have

already spent millions of dollars locking in extra parts and

storage space ahead of time, and planning out alternative supply

lines in case all the confusion overwhelms British and European

ports.

"You have to check every eventuality," said Mr. Fry of Sanofi.

"Is there something that, taking a certain route, [might] upset a

medicine?"

Mr. Fry technically runs the French company's U.K. business, but

he's taken on the unofficial role of chief Brexit officer. He, and

a team that now numbers 20 dedicated to Brexit, have been planning

since soon after Britons voted in June 2016 to exit from the EU how

to avoid catastrophe.

Sanofi supplies drugs and vaccines to the U.K. mostly from

plants located in the rest of Europe. Mr. Fry's biggest worry is

that without a deal, that medicine will now be subject to

time-consuming border checks. Among other medicines, Sanofi

contributes around a fifth of Britain's insulin.

Take Lantus, one of Britain's most widely prescribed brands of

insulin, which Sanofi makes in Frankfurt. Once a week, doses

destined for Britain travel by refrigerated truck to Calais,

France. Those trucks then cross to Dover in the south of England,

either by ferry or the Channel Tunnel, and then drive to a

distribution center in the north of England that supplies every

pharmacy in the U.K. That journey takes two or three days.

Mr. Fry set Sanofi's contingency plans in motion more than a

year ago to keep it that way, and to prevent any shortages. Ahead

of the Brexit deadline, Sanofi ramped up its production of Lantus

in Germany, sending an extra six weeks' worth of supply to the U.K.

The U.K. government has ordered all drugs makers to do so.

The company is also testing out alternative ferry routes so that

it has other options if the Dover port, currently the busiest in

Europe, becomes jammed up. It has started sending some containers

through Harwich in eastern England and Newhaven, south of Dover.

Dozens of other Sanofi products destined for the U.K. market are

made in Sanofi plants in various parts of Europe. Mr. Fry has

overseen the same process for all of these.

The Brexit bite also goes the other way. Until recently, Sanofi

used its U.K. plant in Haverhill, in eastern England, as a hub for

final packaging and quality testing for most of its rare-disease

drugs. Mr. Fry now uses a Sanofi site in Waterford, Ireland,

instead because it is unclear whether quality tests performed in

the U.K. will be recognized in the rest of Europe after Brexit.

"A lot of these decisions are not reversible," Mr. Fry said.

British aircraft engine maker Rolls-Royce Holdings PLC is

considering bypassing British ports altogether. The company

ordinarily dispatches its big aircraft engines by truck to European

plane maker Airbus SE on the continent. One option to avoid any

Brexit-related disruptions is trucking the engines -- which can

each weigh more than 16,000 pounds -- to an Airbus facility in

Wales, part of the U.K. There it would hitch a ride on a giant

Beluga cargo aircraft that Airbus uses to ferry other large parts

from its wing-production facility to Toulouse, France, said a

person familiar with the planning.

Airbus is now building its A350 long-haul jets at a record pace

of 10 a month. All are supplied with British-made wings and powered

by Rolls-Royce engines. Problems getting the engines on time risks

delayed plane deliveries and angry airline customers.

Last week, Airbus Chief Executive Tom Enders said "the

uncertainty is pretty unbearable."

Write to Denise Roland at Denise.Roland@wsj.com and Robert Wall

at robert.wall@wsj.com

(END) Dow Jones Newswires

January 17, 2019 07:01 ET (12:01 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

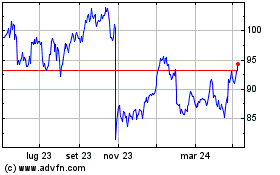

Grafico Azioni Sanofi (EU:SAN)

Storico

Da Mar 2024 a Apr 2024

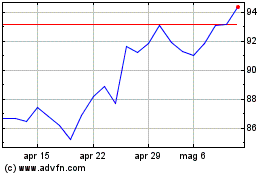

Grafico Azioni Sanofi (EU:SAN)

Storico

Da Apr 2023 a Apr 2024