ECB To Maintain Status Quo Amid Growth Risks

23 Gennaio 2019 - 7:23AM

RTTF2

The European Central Bank is set to leave its interest rates and

forward guidance unchanged on Thursday, after ending its massive

asset purchase programme in December, as a myriad of risks

including the persistent slowing of the economy, global trade

tensions and the Brexit chaos mar the outlook for Eurozone

growth.

The Governing Council, led by ECB President Mario Draghi, is set

to announce its latest policy decision at 7.45 am ET in Frankfurt.

The main refi rate is currently at a record-low zero percent and

the deposit rate at -0.40 percent. The marginal lending facility

rate is at 0.25 percent.

Eurozone interest rates were raised last in July 2011 by 25

basis points. The current forward guidance of the ECB suggests that

an interest rate hike is likely only in late 2019.

Given the weaker growth and inflation outlook, and the

persistent uncertainties linked to global trade and politics, some

economists now expect the bank to raise interest rates only in

2020.

That would make Draghi, the only ECB President thus far who did

not raise interest rates during his tenure. ECB Chief Economist

Peter Praet's term is set to end in May and Draghi's tenure in

October.

Draghi is set to hold his customary post-decision press

conference at 8.30 am ET in Frankfurt.

The bank ended its four-year long massive EUR 2.6 trillion Asset

Purchase Programme in December.

Saying that it is "enhancing its forward guidance on

reinvestment", the central bank stated that it will reinvest bond

sale proceeds "for an extended period of time past the date when it

starts raising the key ECB interest rates."

Policymakers chose to adopt a cautious stance towards terming

the risks to the euro area economic outlook as "downside", minutes

from December policy session showed. Instead, the ECB said the

risks remained "broadly balanced".

"The recent news has been so disappointing that policymakers are

likely to go further this time in acknowledging that the risks to

their economic forecasts (which will not be revised again until

March) are now tilted to the downside," Capital Economics economist

Andrew Kenningham said.

"Indeed, rather than providing a steer about the timetable for

further policy tightening, the Governing Council may soon have to

dust off its past language hinting at further policy loosening,"

the economist added.

In December, the ECB rate-setters assessed the risk situation as

"fragile and fluid", saying that risks could quickly regain

prominence or new uncertainties could emerge, the minutes said.

However, some members cited the emergence of new upside risks

and said the recent negative news have been factored into the

downward revision of the staff projection.

The ECB Staff trimmed the growth and inflation projections for

this year in December. The euro area growth forecast for this year

was trimmed to 1.7 percent from 1.8 percent. The inflation forecast

for this year was lowered to 1.6 percent from 1.7 percent.

Headline inflation eased to an eight-month low of 1.6 percent in

December, while core price growth held steady at 1 percent. "For

the time being,...being a cool dude who is on high alert rather

than panicking into impulsive action seems to be the right

strategy," ING economist Carsten Brzeski said.

The economist stressed that the situation is not yet threatening

enough for the ECB to return to crisis mode, nor was there a

quick-win instrument left in the bank's policy toolbox.

"Consequently, we expect ECB President Mario Draghi to leave the

ECB's forward-guidance on rates unchanged, while at the same time,

adding a dovish note by stressing the ECB's data-dependency and

downside risks to growth," said Brzeski, who thinks the bank will

wait at least until the June meeting before changing its forward

guidance on rates.

In the December meeting, the Governing Council also debated,

re-launching its offering of cheap loans with longer duration to

businesses. Under the ECB's earlier tool named the targeted

longer-term refinancing operations, or TLTRO, the ECB gives

longer-term loans to financial institutions at attractive rates to

boost lending in the real economy.

Draghi is likely to face several questions on the likelihood of

re-launching TLTRO during his post-decision press conference.

Reporters are also expected to pose questions on topics ranging

from trade protectionism, China slowdown to those on the domestic

front such as the the Italian budget crisis and the "yellow vests"

protests in France. Recent economic data such as confidence

indicators and the purchasing managers' survey measures have also

been relatively weak and suggested a broad-based slowdown across

the big four euro economies.

That said, the German economy ministry said the biggest euro

area economy likely avoided slipping into a technical recession in

the fourth quarter.

On Monday, the International Monetary Fund trimmed its growth

projections for this year and next to3.5 percent iand 3.6 percent,

respectively, saying that risks to the global growth are tilted to

the downside. The lender said euro area growth is set to slow from

1.8 percent last year to 1.6 percent this year, which is 0.3

percentage points less than the previous projection. Growth was

forecast to ease further in 2020 to 1.7 percent.

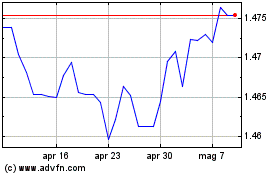

Grafico Cross Euro vs CAD (FX:EURCAD)

Da Mar 2024 a Apr 2024

Grafico Cross Euro vs CAD (FX:EURCAD)

Da Apr 2023 a Apr 2024