U.S. Tariffs Power World's Biggest Steelmaker

07 Febbraio 2019 - 3:43PM

Dow Jones News

By Alistair MacDonald

ArcelorMittal SA, the world's largest steelmaker, posted its

highest annual profit in almost decade on Thursday, helped by the

U.S. steel tariffs that boosted revenue in the company's large

North American business.

ArcelorMittal predicted growth in global steel consumption would

fall this year and many analysts believe that the industry faces

challenges as the global economy slows. Demand in China, in

particular, is expected to contract, which could also mean the

country's own steel products will end up competing abroad.

Lakshmi Mittal, the company's chairman and CEO, said he remains

confident that measures put in place by the U.S. and Europe will

continue to protect those markets from excess imports.

Mr. Mittal said President Trump's 25% tariff on steel imports,

enacted last March, improved pricing in the U.S., where the

Luxembourg-based company is the second-largest steel producer.

He added there is little reason for the U.S. or Europe to remove

protections on their steel industries, given other markets have

unfair advantages, such as state subsidies.

"This (global steel) overcapacity will always be a

challenge...this has to be addressed all the time," Mr. Mittal

said.

U.S. steel prices rose by as much as 41% from the start of 2018

when buyers began to anticipate tariffs, according to S&P

Global Platts. ArcelorMittal said the average selling price of

steel in North America was $852 a ton, up 15% from the year

before.

"ArcelorMittal is a leading (U.S.) steelmaker and therefore has

clear direct benefit from the higher U.S. steel price, aided by

trade protections," said Seth Rosenfeld, a senior research analyst

covering European and U.S. steel at the investment bank Jefferies

in London.

ArcelorMittal reported full-year earnings of $10.3 billion

before interest, taxes, depreciation and amortization, an increase

of 22% from the year before. Annual net income was $5.1 billion, up

12.7% on 2017.

Operating income in the company's North American business, which

includes the U.S., Canada and Mexico, was up almost 60% in 2018.

Around two thirds of steel production in the region is in the U.S.,

the company said.

The company's Mexican and Canadian businesses, though, have had

to pay the 25% tariff on some products being exported into the

U.S., offsetting at least some of the benefits in the U.S.

The increases in steel prices have made the tariffs unpopular

with manufacturers and foreign steel producers.

Mr. Mittal, though, said steel was a small component of his

customers' costs.

The company was also boosted by increased demand in Brazil, one

of its core markets.

For 2019, the company predicted global apparent steel

consumption, which doesn't take into account changes in stocks,

would be 0.5 to 1%, versus 2.8% last year.

Although the company's quarterly results aligned closely with

analysts' consensus, ArcelorMittal's share price was down 3.35% at

midday in London.

"Following very robust recent days of equity performance, we are

not wildly surprised by the modest pullback in (the company's)

shares on the back of relatively uneventful results today," said

Mr. Rosenfeld.

Some analysts complained that the company had not managed to

reduce its net debt, which was $10.2 billion.

Write to Alistair MacDonald at alistair.macdonald@wsj.com

(END) Dow Jones Newswires

February 07, 2019 09:28 ET (14:28 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

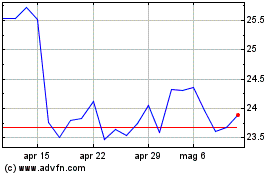

Grafico Azioni ArcelorMittal (EU:MT)

Storico

Da Mar 2024 a Apr 2024

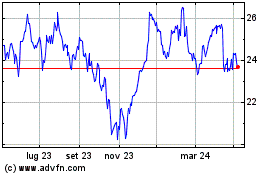

Grafico Azioni ArcelorMittal (EU:MT)

Storico

Da Apr 2023 a Apr 2024