TIDMEME

RNS Number : 6036P

Empyrean Energy PLC

11 February 2019

This announcement contains inside information

Empyrean Energy PLC / Index: AIM / Epic: EME / Sector: Oil &

Gas

Empyrean Energy PLC ("Empyrean" or the "Company")

Reduction of Interest in Duyung PSC, Indonesia, for Cash and

Shares

11 February 2019

Empyrean, the oil and gas development company with interests in

China, Indonesia and the United States, is pleased to announce that

it has entered into a binding, conditional purchase agreement (the

"Agreement") pursuant to which AIM listed Coro Energy plc ("Coro")

will acquire a 15% interest in the Duyung Production Sharing

Contract ("Duyung PSC") from West Natuna Exploration Limited

("WNEL") for aggregate consideration in cash and Coro shares of

US$4.8 million and the contribution of US$10.5 million by Coro

toward the 2019 drilling campaign at the Mako gas field (the

"Consideration"). The cash and share component of the Consideration

will be paid pro rata to the existing owners of WNEL, being

Empyrean, which currently has a 10% effective interest in the

Duyung PSC, and Conrad Petroleum Ltd ("Conrad"), which currently

has a 90% effective interest in the Duyung PSC, each through

shareholding in WNEL.

WNEL is the owner and operator of the Duyung PSC in the West

Natuna basin, offshore Indonesia which contains the Mako gas

field.

Highlights

-- The Consideration will be paid US$2.95 million in cash and

US$1.85 million in the form of new ordinary shares in Coro (the

"Consideration Shares")

-- Empyrean will receive cash consideration of US$295,000 and

Consideration Shares with a value of US$185,000 for the transfer to

Coro of 1.5% of its current 10% interest in the Duyung PSC

-- Following completion of the transaction, including the

payment by Coro of US$10.5 million in partial funding of the 2019

drilling programme at the Mako gas field and subject to necessary

Government and regulatory approvals, WNEL will make a direct

transfer of interest in the Duyung PSC to Empyrean and the other

owners. Empyrean's interest will be a direct ownership and no

longer held through WNEL. The owners of the Duyung PSC will be

Conrad (76.5%), Empyrean (8.5%) and Coro (15%)

-- Details of the 2019 drilling campaign will be set out in an

agreed work programme and budget for the year (the "2019 Work

Programme")

-- Coro has today paid US$2.95 million in cash comprising

US$1.75 million of the cash consideration (of which US$175,000 has

been paid to Empyrean) and US$1.2 million of drilling campaign

contribution, which shall be treated as a break fee in the event

Coro fails to complete

-- Gross 2C (contingent) resources certified by Gaffney Cline

& Associates in the field of 276 Bcf (48.78 MMboe) of

recoverable dry gas with gross 3C resources of 392 Bcf (69.3 MMboe)

representing additional field upside

-- Identified exploration targets, both above and beneath the

field, include the Tambak (formerly 'Mako Deep') prospect

(scheduled for 2019 drilling) and the 'Mako Shallow' prospect

-- The field development plan has been submitted to the Indonesian authorities for approval

-- The field is located close to the West Natuna Transportation

System, offering the potential to sell gas into the Singapore

market, where an MOU has been signed with a gas buyer earlier this

year

-- Favourable gas price in Singapore, with piped gas complementing LNG import supply

Tom Kelly, CEO of Empyrean, commented:

"The sale to Coro Energy Plc of a 15% interest in the Duyung PSC

is mutually beneficial for all parties concerned. The Mako Gas

discovery is such an exciting project with appraisal wells planned

for 2019 that are low risk with potential to improve the

understanding of the Mako discovery, add proven reserves and at the

same time potentially unlock further transformational value if the

Tambak Prospect (formerly Mako Deep) is successful. Rarely do you

get such a unique mix of low risk appraisal coupled with a

potentially high reward exploration target. Empyrean will now be

largely funded for the majority of the 2019 appraisal programme and

whilst Empyrean will sell 15% of its interest and drop from 10%

currently to 8.5% at completion, the potential uplift in valuation

of the asset will come with minimal financial risk to Empyrean.

Empyrean looks forward to continuing to work closely with Conrad

Petroleum and Coro Energy Plc to unlock value from the Duyung

PSC."

The Transaction

Pursuant to the terms of the Agreement, Empyrean will receive

cash consideration of US$295,000 on signing and Consideration

Shares in Coro with a value of US$185,000 in consideration for the

transfer to Coro of 1.5% of its current 10% interest in the PSC.

Conrad will receive initial cash consideration of US$2.655 million

and Consideration Shares with a value of US$1.665 million in

consideration for the transfer to Coro of 13.5% of its current 90%

interest in the PSC.

The number of Consideration Shares to be issued has been

determined according to the volume weighted average price of Coro's

shares for the 30 days prior to the Agreement being entered into

(being 2.3492 pence per share). 60,905,037 shares of 0.1p each will

therefore be issued to the WNEL owners as the share element of the

consideration of the transaction. The balance of the consideration

will be paid on first closing (within thirty-four business days).

Transfer to PSC title, which requires Indonesian regulatory

approval, is expected to follow with a long stop date of 31

December 2019, failing which Coro will receive transfers of 15% of

the shares of WNEL instead.

Following completion of the transaction, the owners in the PSC

will be Conrad (76.5%), Empyrean (8.5%.) and Coro (15%).

Further announcements will be made in due course, as

appropriate.

The Mako Gas Field, Duyung PSC, Offshore Indonesia

The Mako gas field is an extremely large, shallow structural

closure, with an area extent of over 350 square km. The reservoir

is a Pliocene-age sandstone, with a gas-water contact at

approximately 391m true vertical depth sub-sea. The field has

excellent seismic definition with direct hydrocarbon indicators

being very evident.

Having been drilled but not tested by prior operators of the

acreage, the commercial viability of the Mako gas field was

demonstrated by the Mako South-1 well drilled by WNEL in 2017. The

well was drilled to core and test the Mako reservoir, flowing up to

10.8 MMscf/d of dry gas on test. Overall four wells have penetrated

the reservoir section, and while further appraisal is planned given

the huge areal extent of the field, the reservoir distribution is

reasonably well understood.

The Mako field is located in the prolific West Natuna basin,

approximately 16 km from the WNTS pipeline system which delivers

gas from Indonesia to Singapore. A plan of development has been

submitted to the Indonesian authorities and initial gas marketing

discussions have commenced, resulting in a Heads of Agreement being

signed with a buyer in Singapore for the Mako gas.

An independent report on the field's potential was carried out

by Gaffney Cline & Associates earlier this year, resulting in

the following gross resource certification:

Category Gas Recoverable

(Bcf)

1C 184

2C 276

3C 392

The operator's current field development plan envisages an

initial four well development scheme, a small platform with

compression facilities and an additional four wells as a second

phase to be drilled later in the field's life. The plateau

production rate is envisaged to be up to 90 MMscf/d.

Near Field Exploration Potential, To Be Tested in 2019

A series of prospects both beneath and above the Mako field have

been mapped. Of particular note is the Tambak (formerly 'Mako

Deep') prospect, a Lower Gabus structure that sits beneath the

northern end of the Mako field. The target interval within Tambak

exhibits seismic amplitude brightening, conformable with structural

closure. The prospect has a prospective resource range of 200 to

300 Bcf with a mid-case 250 Bcf and a CoS of 45%.

At the southern end of the field, over the structure's crest,

sits the Mako Shallow prospect. This again shows a very strong

direct hydrocarbon indicators on seismic, conformable with closure

in shallow Muda sandstones. The Shallow Muda prospect has potential

to add a further 100 Bcf of recoverable resources and a very high

CoS of 75%.

A drilling campaign is being planned for 2019 and a test of the

Tambak prospect is expected to be a part of the 2019 Work

Programme.

**ENDS**

For further information:

Empyrean Energy plc

Tom Kelly Tel: +61 8 9380 9920

Cenkos Securities plc

Neil McDonald Tel: +44 (0) 131 220 9771

Beth McKiernan Tel: +44 (0) 131 220 9778

Pete Lynch Tel: +44 (0) 131 220 9772

St Brides Partners Ltd

Priit Piip Tel: +44 (0) 20 7236 1177

Frank Buhagiar Tel: +44 (0) 20 7236 1177

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCGGUPAPUPBUAG

(END) Dow Jones Newswires

February 11, 2019 02:00 ET (07:00 GMT)

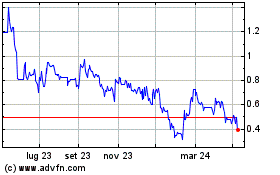

Grafico Azioni Empyrean Energy (LSE:EME)

Storico

Da Mar 2024 a Apr 2024

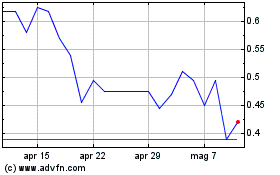

Grafico Azioni Empyrean Energy (LSE:EME)

Storico

Da Apr 2023 a Apr 2024