By William Mauldin

WASHINGTON -- American steel-making is on a roll -- and so are

its hired guns in the nation's capital.

Lobbying by steel producers, including some foreign firms,

jumped last year to $12.2 million, up 20% from 2017 and the highest

in at least two decades, according to the Center for Responsive

Politics.

Major steel companies pushed the Trump administration to impose

tariffs under Section 232 of U.S. trade law, leading to higher

prices in the U.S., higher profits and plans to expand capacity.

For example, U.S. Steel Corp. said Monday that it plans to resume

construction of a new furnace in Alabama.

Tom Gibson, president of the American Iron and Steel Institute,

the industry's main trade group, said tariffs and subsequent quotas

on imports have helped the U.S. steel industry rebound, but that

those gains could evaporate if tariffs are lifted too soon.

"Our job is to keep making our case on this," he said of the

industry's lobbying efforts.

Nucor Corp. had the highest lobbying spending among steel

producers last year, at $2.23 million, including $730,000 paid to

Washington law firm Wiley Rein LLP.

Public records show Nucor lobbied last year in connection with

President Trump's nomination of two trade officials with ties to

the steel industry: Commerce Undersecretary Gilbert Kaplan and

Jeffrey Gerrish, a deputy to U.S. trade representative Robert

Lighthizer.

Both men were confirmed, joining a roster of high-ranking

officials in the Trump administration with industry ties.

Mr. Lighthizer, the U.S. trade representative, worked for years

as an outside trade lawyer for U.S. Steel, and general counsel of

his office, Stephen Vaughn, lobbied on trade laws for U.S.

Steel.

Wilbur Ross was on the board of Luxembourg-based ArcelorMittal,

the world's largest steel producer, which has mills in the U.S.,

until his confirmation as Commerce secretary in 2017. After his

appointment, he led the administration's steel probe that ended in

tariffs.

"Drawing so many senior government officials from one side of

the equation raises concerns," said Richard Chriss, a former U.S.

trade official who is president of the American Institute for

International Steel, which represents some foreign producers and is

suing to overturn the steel and aluminum tariffs.

Mr. Ross said in a statement that "President Trump imposed

tariffs to prevent imported steel from threatening our own domestic

industry that is critical to our national security."

Steel executives also have contributed to Mr. Trump, with Nucor

Chief Executive John Ferriola giving $25,000 to the Trump Victory,

a joint fundraising committee, weeks after the steel tariffs were

implemented.

A spokeswoman for Nucor, which is based in Charlotte, N.C.,

didn't respond to a request for comment.

The effectiveness of the steel lobby has led to counter efforts

by manufacturers who rely on steel, who say tariffs are raising

their costs and forcing them to pass them on to consumers.

Last month, more than 40 industry groups, including auto

suppliers, wrote to Messrs. Ross and Lighthizer to ask for the

removal of import duties on steel and aluminum from Canada and

Mexico.

And U.S. senators from Mr. Trump's own party have reintroduced

legislation in recent weeks to rein in presidential powers on such

tariffs.

Opponents of the steel tariffs are looking for leverage as the

White House seeks congressional ratification of a modified version

of the North American Free Trade Agreement -- even as it continues

to levy 25% duties on steel from Mexico and Canada, citing national

security grounds.

Tariffs on Canada are opposed even by lawmakers who have

defended the steel tariffs on imports from China and other

countries, as well as by the United Steelworkers Union, which has

members on both sides of the border.

"If there are policy advisers around the president that are

saying this is great for his base, we would vastly disagree," said

Rufus Yerxa, president of the National Foreign Trade Council.

Mr. Lighthizer has signaled he will remove the tariffs on U.S.

neighbors but so far hasn't struck a deal to do so.

Domestic steel producers warn it is too early to remove the

tariffs, with the industry operating only at about 80% of its

capacity, a level identified by the Trump administration as

essential to avoid deterioration but not enough to rebuild.

Some industry executives worry that the steel tariffs likely

won't last forever, with some companies facing potential hardship

when low-priced imports return at higher levels.

"This is an existential battle, and everybody's got to get on

the same page and minimize the damage to all industries," said Dan

DiMicco, the former Nucor CEO who helped the Trump campaign develop

tariff plans during the 2016 presidential campaign.

Mr. Trump is hoping that his support for steel and other

industries translates into political backing in the 2020 election

campaign, advisers and political observers say. The administration

has repeatedly highlighted that U.S. Steel's unionized workers

negotiated a raise last year and that the company reopened

long-idled blast furnaces in Granite City, Ill.

Rep. Mike Bost, the Illinois Republican whose district includes

U.S. Steel's Granite City operation, says the background of Mr.

Trump's advisers is a "real advantage."

Write to William Mauldin at william.mauldin@wsj.com

(END) Dow Jones Newswires

February 12, 2019 11:27 ET (16:27 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

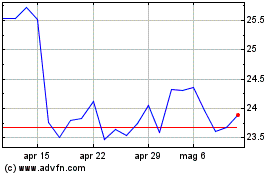

Grafico Azioni ArcelorMittal (EU:MT)

Storico

Da Mar 2024 a Apr 2024

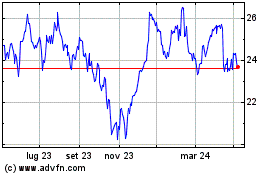

Grafico Azioni ArcelorMittal (EU:MT)

Storico

Da Apr 2023 a Apr 2024