Santos Swings to Annual Profit

20 Febbraio 2019 - 11:44PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Santos Ltd. (STO.AU) returned to profit

last year, boosted by improved energy prices and absent the big

impairment loss that squeezed it the year before.

Net profit soared to US$630 million in 2018 from a loss of

US$360 million a year ago when it absorbed further impairment

charges of US$938 million.

Stripping out one-time items, impairments and commodity hedging,

Santos's earnings more than doubled year-over-year to a record for

the company of US$727 million from US$318 million a year

earlier.

Over the year, sales revenue climbed 18% to US$3.66 billion as

higher average realized prices more than offset lower sales volumes

and a 1% dip in production to 58.9 million barrels of oil

equivalent.

Santos last year laid out ambitious plans to almost double

production to more than 100 million barrels a year by 2025,

leveraging existing oil and gas assets in Australia and Papua New

Guinea. In late November, it completed the US$1.93 billion

acquisition of Quadrant Energy, giving it ownership of a portfolio

of conventional natural gas assets in Western Australia and

diversifying its revenue base to include long-term gas supply

contracts at a time of volatile oil prices.

The company said it would pay a final dividend of 6.2 U.S. cents

a share, taking the full-year dividend to 9.7 cents. It resumed

half-yearly dividends in the first half after swinging back to a

profit, roughly two years after freezing payouts.

"Santos is now on a firm path to grow production and reserves,"

Chief Executive Kevin Gallagher said.

Since taking over early 2016, Mr. Gallagher has sold off a

string of assets to tie Santos's future to the GLNG gas-export

operation in east Australia that counts Total SA among its

partners, the Exxon Mobil-led PNG LNG operation in Papua New

Guinea, the Darwin LNG project in northern Australia and assets

including in the Cooper Basin straddling South Australia and

Queensland states.

The company's struggles in recent years have attracted takeover

approaches the company has rebuffed as too low. The latest came in

May when Santos rejected a more than US$10 billion takeover offer

from private equity-backed Harbour Energy Ltd.

Mr. Gallagher said Santos's disciplined operating model

continued to deliver cost cuts and efficiencies, with underlying

production costs down 6% last year.

The company in the last year reached a net debt reduction target

of US$2 billion, more than a year ahead of plan.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

February 20, 2019 17:29 ET (22:29 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

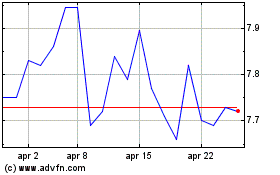

Grafico Azioni Santos (ASX:STO)

Storico

Da Mar 2024 a Apr 2024

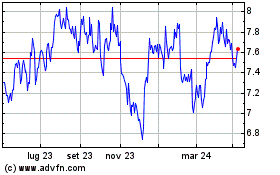

Grafico Azioni Santos (ASX:STO)

Storico

Da Apr 2023 a Apr 2024