TIDMSCE

RNS Number : 0557R

Surface Transforms PLC

26 February 2019

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

26 February 2019

Surface Transforms plc.

("Surface Transforms" or the "Company")

Half-year financial results for the six months ended 30 November

2018

Surface Transforms (AIM:SCE) manufacturers of carbon fibre

reinforced ceramic materials, announces its half-year financial

results for the six months ended 30 November 2018.

Financial highlights

-- Revenue decreased 3% to GBP509k (H1-2017: GBP524k)

-- Gross profit increased 13% to GBP322k (H1-2017: GBP286k)

-- Loss before and after tax increased 15% to GBP1,482k (H1-2017: GBP1,294k)

-- Cash at 30 November 2018 was GBP745k (31 May 2018: GBP923k)

-- Successful equity placing raising GBP1,466k (net of expenses) in the period

-- Capital expenditure on property, plant and equipment of

GBP156k (H1-2017: GBP684k) mainly related to the installation of

OEM Production Cell One

-- Inventory of GBP1,062k (31 May 2018: GBP855k)

Sales and Operational Highlights

-- Successful testing for OEM5 with all the key engineering

tests completed satisfactorily and also received approved supplier

status to OEM5 including confirmation that the Company meets VDA

6.3 (and IATF 16949) standards

-- Continuing progress on testing for OEM3

-- Delay of six months to SOP confirmed by OEM6 but no impact on

lifetime revenues and discussions started for follow on OEM6

vehicle

-- Capital expenditure on OEM Production Cell One virtually

completed with phase one capacity expected to be operational in

summer 2019

-- Company secured accreditation to new quality standard IATF

16949 and Environmental standard ISO 14001

-- Post balance sheet date, Company migrated its computer

systems to a new enterprise system compatible with the needs of the

German automotive OEMs.

Financial Review

Revenue in the period decreased slightly to GBP509k (H1-2017:

GBP524k) and the split between retrofit and near OEM was comparable

to last year. Sales to OEM6 were due to commence in March 2019 but

as previously announced, SOP has been delayed by six months.

However, this has no impact on sales in this reporting period.

Gross profit increased to GBP322k (H1-2017: GBP286k) and gross

profit margin was 63% (H1-2017: 55%), the movement resulting from

cost reduction activities beginning to have an effect at the new

plant.

Administrative expenses increased to GBP730k (H1-2017: GBP547k)

primarily due to higher insurance costs, upgrades to the IT

infrastructure in the business and increased headcount.

Research expenses increased slightly to GBP1,073k (H1-2017:

GBP1,033k) due to continuing focus on delivering final product to

target OEM customers. The continued high spend was primarily due to

increased cost of engineers and extensive external testing together

with material costs to deliver these programmes.

Cash at the end of the half-year was GBP745k (31 May 2018:

GBP923k). In the period the Company successfully placed 9 million

shares at 17 pence each in an oversubscribed placing raising net

proceeds of GBP1,461k.

Loss per share was 1.22p (H1-2017: 1.17p).

Progress with potential OEM Customers

The Company continues to test products with customers as

described in recent announcements

OEM5: Further progress has been made with German OEM5 during the

period. The customer has advised that they intend to select the

disc supplier for the target car in the spring.

As previously notified, the customer is approving the Company's

disc with both a slightly modified "traditional" pad as well as a

more environmentally friendly pad. This has slightly delayed

testing; nonetheless the tests have gone well, with the products

comfortably passing all the key criteria on the critical tests.

However because the pad-disc configuration is now different from

the original testing some regulatory tests need to be repeated in

February and March 2019; the Board is not concerned about the time

implications on the overall project of these relatively minor

repeat tests.

Additionally OEM5 has reviewed the Company's quality processes,

logistics capability, financial strength and capacity plan and has

approved Surface Transforms as a potential supplier to them. The

Company has been informed, "... it is now officially possible for

(OEM5) to place orders under the condition that the development

department is happy with the required performance of ST discs". As

part of this process their quality team completed an onsite brief

review of the Company's compliance with VDA 6.3 (and IATF 16949)

and confirmed compliance.

The Company has broadly agreed initial pricing and is in the

process of agreeing commercial terms.

OEM3: Work on passing the OEM3 rig test continues with good

progress having been made in the period on understanding the reason

for process variability and reducing the variability in subsequent

tests. Whilst results have improved, the Company is not yet

consistently meeting the performance criteria of OEM3. However,

this work is expected to complete in the next few months,

consistent with the next round of nomination dates.

OEM6: As signalled in the trading update on 4 December 2018

there is a delay (now confirmed) of six months to the SOP of the

car originally scheduled for SOP in June 2019 - which implied SOP

in March 2019 for Surface Transforms. The delay has nothing to do

with any brake system parts. Discussions are continuing on both the

precise new SOP date and amelioration of the cost of this delay to

the Company. In the meantime, the Board is not changing the

previous advice provided regarding the risk to current year sales

of GBP500k but with no impact on lifetime revenues from the project

itself.

The Company has also begun discussions with this customer on the

next car model that is expected to have significantly higher

volumes than the current model. Unsurprisingly (as it involves the

same customer personnel) the delays on the current model are

slowing discussions on the new model; nonetheless the customer has

told us of their wish to keep the "blood line" between the two

cars, a statement the Board believes to be promising for ultimate

selection.

Aerospace: The Company is still awaiting the outcome of

discussions between the landing gear manufacturer, airframe builder

and the US DOD on its request for pre funding before undertaking

any further work on this project.

Knowsley facility

OEM Production Cell One: Capital expenditure on OEM Production

Cell One is virtually complete. The final furnace for this cell has

successfully completed a number of production runs at the

supplier's premises but as a further risk mitigation exercise the

decision has been made to complete the manufacture of the OEM6

production parts in Germany and then ship the furnace in Q2 of the

calendar year. This would then give the Company time to

successfully commission the new furnace before the production is

required from this furnace for the next series of new

programmes.

The other furnaces are either in production or finalising

software installation. The Company continues to expect OEM

Production Cell One to be operational in summer 2019.

Environmental awards and permits: The Company was awarded the

environmental standard ISO 14001 in November 2018. The Company is

concluding its discussions with the Environmental Agency on

securing all the necessary permits for full capacity volume

production of OEM Production Cell One.

VDA 6.3 and IATF 16943: As previously notified, conformance with

the stand-alone German VDA certification has always been a pre

requisite to supply to the German automotive industry.

Historically, Surface Transforms conformed with TS 16949, which

many German OEMs considered to be less demanding than the German

developed VDA 6.3. TS 16949 has been superseded by the new

International Automotive Task Force (IATF) quality standard 16949,

which German OEMs now see as equivalent to VDA 6.3. Surface

Transforms secured accreditation to this standard in July 2018.

This does not remove the need for on-going customer quality audits

but they are much more "light touch" looking for evidence of

continuing conformance with the standards. The first of these

audits was conducted by OEM5 in the period and was completed to

their satisfaction.

Computer Systems: German OEMs require their suppliers to have

computer compatibility with their computer systems; in practice

this has meant the Company migrating to the SAP computer system.

After extensive work this transition took place, post balance sheet

date, in December 2018. There were some inevitable disruptions in

December and January but the factory and internal processes are now

running smoothly again.

Outlook

The Company signalled a change in the outlook for the current

financial year in a trading update on 4 December, reflecting a

concern on the SOP date for OEM6. This slippage has now been

confirmed as being six months, in line with the concerns expressed

at that time. There are no further changes to expectations for the

current year.

The outlook for the next financial year ending 31 May 2020 is

unchanged in respect of automotive sales but the on-going lack of

clarity on the potential aerospace contract, hazards GBP600k of

forecast sales in that year, albeit there is still time to resolve

the financial discussions between the key parties.

The Company reaches cash break even when OEM 6 enters production

in the financial year 2019-20. Thereafter the outlook is clearly

dependent upon winning the expected OEM contracts described above

which are scheduled for start of volume production in the 2021 to

2022 calendar years. The Board remains optimistic about being

awarded these potential contracts.

Summary

The Company continues its journey from a development company to

a mainstream volume automotive supplier with a site capable of

revenues of GBP50m per year in a market that could ultimately reach

GBP1 billion.

The delay on SOP for OEM6 is frustrating but has no medium-long

term impact on the fortunes of the Company and, indeed, the Company

continues to expect follow on orders on new models from this

customer. Equally importantly, after a number of frustrating years

and delays, the past six months has seen particular progress on

testing at both OEM5 and OEM3.

The task in the remainder of the financial year is to turn this

progress on testing into firm orders. The Board remains confident

of delivering this objective.

In respect to operations, the improvement in gross margin

percentage demonstrates the impact of the investment and cost

reduction programme over recent years. The new, cost competitive,

first commercial cell of the factory will be operational mid year -

consistent with the capacity needs of target customer programmes.

Additionally the Board is now confident that that the factory has

the quality systems, computer infrastructure and internal processes

required to be successful as a mainstream automotive supplier.

Finally may I conclude by recording the Board's appreciation of

the outstanding contribution by all members of staff. Thank

You!

David Bundred

Chairman

For enquiries, please contact:

Surface Transforms plc.

Kevin Johnson, CEO +44 151 356 2141

Michael Cunningham CFO

David Bundred, Chairman

Cantor Fitzgerald Europe (Nomad & Joint-Broker) +44 20 7894 7000

David Foreman / Richard Salmon/ Michael Boot (Corporate

Finance)

Caspar Shand-Kydd/ Gregor Paterson / Maisie Atkinson (Sales)

finnCap Ltd (Joint-Broker) +44 20 7220 0500

Ed Frisby / Giles Rolls (Corporate Finance)

Richard Chambers (ECM)

For further Company details, visit www.surfacetransforms.com

Statement of Total Comprehensive Income

For the six months ended 30 November 2018

Six Months Six Months

Ended Ended Year Ended

Note 30 Nov 2018 30 Nov 2017 31 May 2018

GBP'000 GBP'000 GBP'000

---------------- ----- -------------------------------- -------------------------------- --------------------------------

Unaudited Unaudited Audited

---------------- ----- -------------------------------- -------------------------------- --------------------------------

Revenue 509 524 1,363

Cost of Sales (187) (238) (445)

---------------- ----- -------------------------------- -------------------------------- --------------------------------

Gross Profit 322 286 918

Administrative

Expenses:

Before research

and

development

costs (730) (547) (1,083)

Research and

development

costs (1,073) (1,033) (2,002)

---------------- ----- -------------------------------- -------------------------------- --------------------------------

Total

administrative

expenses (1,803) (1,580) (3,085)

---------------- ----- -------------------------------- -------------------------------- --------------------------------

Other operating

income - - -

---------------- ----- -------------------------------- -------------------------------- --------------------------------

Operating loss

before

exceptional

items (1,480) (1,294) (2,167)

Exceptional

items (3) - (133)

Financial

income 1 - 1

Financial

expenses - - -

---------------- ----- -------------------------------- -------------------------------- --------------------------------

Loss before tax (1,482) (1,294) (2,299)

Taxation 2 - - 465

---------------- ----- -------------------------------- -------------------------------- --------------------------------

Loss for the

year after tax (1,482) (1,294) (1,834)

Other

comprehensive

income - - -

---------------- ----- -------------------------------- -------------------------------- --------------------------------

Total

comprehensive

loss for the

year

attributable

to members (1,482) (1,294) (1,834)

---------------- ----- -------------------------------- -------------------------------- --------------------------------

Loss per

ordinary share

Basic and

diluted 3 (1.22)p (1.17)p (1.66)p

---------------- ----- -------------------------------- -------------------------------- --------------------------------

EBITDA

(including tax

credits

and excluding

share-based

payments*) (1,244) (1,107) (1,514)

---------------- ----- -------------------------------- -------------------------------- --------------------------------

* EBITDA numbers, including that for the year ended 31 May 2018,

are unaudited

Statement of Financial Position

As at 30 November 2018

Six Months Six Months

Ended Ended Year Ended

30 Nov 2018 30 Nov 2017 31 May 2018

GBP'000 GBP'000 GBP'000

------------------------------------- ------------ ------------ ------------

Unaudited Unaudited Audited

------------------------------------- ------------ ------------ ------------

Non-current Assets

Property, plant and equipment 4,069 2,962 4,096

Intangibles 218 136 192

------------------------------------- ------------ ------------ ------------

4,286 3,098 4,288

Current assets

Inventories 1,062 735 855

Trade and other receivables 619 510 776

Cash and cash equivalents 745 3,275 923

------------------------------------- ------------ ------------ ------------

2,425 4,520 2,554

------------------------------------- ------------ ------------ ------------

Total assets 6,711 7,618 6,842

Current liabilities

Other interest bearing loans

and borrowings (65) (2) (29)

Trade and other payables (478) (1,024) (790)

------------------------------------- ------------ ------------ ------------

(543) (1,026) (819)

Non-current liabilities

Government Grants (200) (196) (200)

Other interest bearing loans

and borrowings (357) (294) (275)

------------------------------------- ------------ ------------ ------------

Total liabilities (1,100) (1,516) (1,294)

------------------------------------- ------------ ------------ ------------

Net assets 5,611 6,102 5,548

------------------------------------- ------------ ------------ ------------

Equity

Share capital 1,230 1,140 1,140

Share premium 18,972 17,592 17,596

Capital reserve 464 464 464

Retained loss (15,055) (13,094) (13,652)

------------------------------------- ------------ ------------

Total equity attributable to

equity shareholders of the company 5,611 6,102 5,548

------------------------------------- ------------ ------------ ------------

Statement of Cash Flow

For the six months to 30 November 2018

Six Months Six Months

Ended Ended Year Ended

30 Nov 2018 30 Nov 2017 31 May 2018

GBP'000 GBP'000 GBP'000

--------------------------- -------------------------------- -------------------------------- ---------------------

Unaudited Unaudited Audited

--------------------------- -------------------------------- -------------------------------- ---------------------

Cash flow from operating

activities

Loss after tax for the

year (1,482) (1,294) (1,834)

Adjusted for:

Depreciation and

amortisation charge 158 137 287

Equity settled share-based

payment

expenses 80 51 33

Financial expense/(income) 1 - (1)

Taxation - - (465)

--------------------------- -------------------------------- -------------------------------- ---------------------

(1,244) (1,106) (1,980)

Changes in working capital

Increase in inventories (206) (228) (348)

Decrease/(increase) in

trade and

other receivables 157 (145) (411)

(Decrease)/increase in

trade and

other payables (252) 339 106

--------------------------- -------------------------------- -------------------------------- ---------------------

(1,544) (1,140) (2,633)

Taxation received - - 465

--------------------------- -------------------------------- -------------------------------- ---------------------

Net cash used in operating

activities (1,544) (1,140) (2,168)

--------------------------- -------------------------------- -------------------------------- ---------------------

Cash flows from investing

activities

Acquisition of tangible

and intangible

assets (156) (684) (2,024)

Capital Government grants

received - 55 -

Net cash used in investing

activities (156) (629) (2,024)

--------------------------- -------------------------------- -------------------------------- ---------------------

Cash flows from financing

activities

Proceeds from issue of

share capital,

net of expenses 1,466 3,439 3,443

Payment of finance lease

liabilities (5) (10) (8)

Proceeds from other loans 62 83 148

Net cash generated from

financing

activities 1,523 3,512 3,583

--------------------------- -------------------------------- -------------------------------- ---------------------

Net (decrease)/increase in

cash

and cash equivalents (178) 1,743 (609)

Cash and cash equivalents

at the

beginning of the period 923 1,532 1,532

--------------------------- -------------------------------- -------------------------------- ---------------------

Cash and cash equivalents

at the

end of the period 745 3,275 923

--------------------------- -------------------------------- -------------------------------- ---------------------

Statement of Changes in Equity

For the six months to 30 November 2018

Share

Share premium Capital Retained

capital account reserve loss Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- ------------------ ------------------ ------------------ --------- --------

Balance as at 31 May 2018 1,140 17,596 464 (13,652) 5,548

Comprehensive income for the

year

Loss for the year - - - (1,482) (1,482)

----------------------------------- ------------------ ------------------ ------------------ --------- --------

Total comprehensive income

for the year - - - (1,482) (1,482)

----------------------------------- ------------------ ------------------ ------------------ --------- --------

Transactions with owners,

recorded directly to equity

Shares issued in the year 90 1,445 - - 1,535

Cost of issue off to share

premium - (69) - - (69)

Equity settled share based

payment transactions - - - 79 79

----------------------------------- ------------------ ------------------ ------------------ --------- --------

Total contributions by and

distributions to the owners 90 1,376 - 79 1,545

----------------------------------- ------------------ ------------------ ------------------ --------- --------

Balance at 30 November 2018 1,230 18,972 464 (15,055) 5,611

----------------------------------- ------------------ ------------------ ------------------ --------- --------

For the six months to 30 November

2017

Share

Share premium Capital Retained

capital account reserve loss Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- ------------------ ------------------ ------------------ --------- --------

Balance as at 31 May 2017 903 14,390 464 (11,851) 3,906

Comprehensive income for the

year

Loss for the year - - - (1,294) (1,294)

----------------------------------- ------------------ ------------------ ------------------ --------- --------

Total comprehensive income

for the year - - - (1,294) (1,294)

----------------------------------- ------------------ ------------------ ------------------ --------- --------

Transactions with owners,

recorded directly to equity

Shares issued in the year 237 3,677 - - 3,914

Cost of issue off to share

premium - (475) - - (475)

Equity settled share based

payment transactions - - - 51 51

----------------------------------- ------------------ ------------------ ------------------ --------- --------

Total contributions by and

distributions to the owners 237 3,202 - 51 3,490

----------------------------------- ------------------ ------------------ ------------------ --------- --------

Balance at 30 November 2017 1,140 17,592 464 (13,094) 6,102

----------------------------------- ------------------ ------------------ ------------------ --------- --------

For the year to 31 May 2018

Share

Share premium Capital Retained

capital account reserve loss Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- ------------------ ------------------ ------------------ --------- --------

Balance as at 31 May 2017 903 14,390 464 (11,851) 3,906

Comprehensive income for the

year

Loss for the year - - - (1,834) (1,834)

----------------------------------- ------------------ ------------------ ------------------ --------- --------

Total comprehensive income

for the year - - - (1,834) (1,834)

----------------------------------- ------------------ ------------------ ------------------ --------- --------

Transactions with owners,

recorded directly to equity

Shares issued in the year 237 3,681 - - 3,918

Cost of issue off to share

premium - (475) - - (475)

Equity settled share based

payment transactions - - - 33 33

----------------------------------- ------------------ ------------------ ------------------ --------- --------

Total contributions by and

distributions to the owners 237 3,206 - 33 3,476

----------------------------------- ------------------ ------------------ ------------------ --------- --------

Balance at 31 May 2018 1,140 17,596 464 (13,652) 5,548

----------------------------------- ------------------ ------------------ ------------------ --------- --------

SURFACE TRANSFORMS PLC

NOTES

1. Accounting policies

The interim financial statements are the responsibility of the

Directors and were authorised and approved by the Board of

Directors for issuance on 26 February 2019.

Basis of preparation

The Company is a public limited liability Group incorporated and

domiciled in England & Wales. The financial information is

presented in Pounds Sterling (GBP) which is also the functional

currency. The Company's accounting reference date is 31 May.

These interim condensed financial statements are for the six

months to 30 November 2018. They have not been prepared in

accordance with IAS 34, Interim Financial Reporting that is not

mandatory for UK AIM listed companies, in the preparation of this

half-yearly financial report. While the financial information

included has been prepared in accordance with the recognition and

measurement criteria of International Financial Reporting Standards

(IFRS), as adopted by the European Union (EU), these interim

results do not contain sufficient information to comply with

IFRS.

These interim results for the period ended 30 November 2018,

which are not audited; do not comprise statutory accounts within

the meaning of section 435 of the Companies Act 2006.

Full audited accounts of the Company in respect of the year

ended 31 May 2018, which received an unqualified audit opinion and

did not contain a statement under section 498(2) or (3) (accounting

record or returns inadequate, accounts not agreeing with records

and returns or failure to obtain necessary information and

explanations) of the Companies Act 2006 and have been delivered to

the Registrar of Companies.

The accounting policies used in the preparation of the financial

information for the six months ended 30 November 2018 are in

accordance with the recognition and measurement criteria of IFRS as

adopted by the EU and are consistent with those which will be

adopted in the annual statutory financial statements for the year

ending 31 May 2019.

Segmental reporting

IFRS 8 "Operating Segments" requires that the segments should be

reported on the same basis as the internal reporting information

that is provided to, and regularly reviewed by, the chief operating

decision-maker, whom the Group has identified as the CEO.

The Board has reviewed the requirements of IFRS 8, including

consideration of what results and information the CEO reviews

regularly to assess performance and allocate resources, and

concluded that all revenue falls under a single business

segment.

The Directors consider that the Group does not have separate

divisional segments as defined under IFRS 8. The CEO assesses the

commercial performance of the business based upon consolidated

revenues; margins and operating costs and assets are reviewed at a

consolidated level.

Estimates

The preparation of half-yearly financial statements requires

management to make judgments, estimates and assumptions that affect

the application of accounting policies and the reported amounts of

assets and liabilities, income and expense. Actual results may

differ from these estimates. In preparing these condensed

consolidated half-yearly financial statements, the significant

judgments made by management in applying the Group's accounting

policies and the key sources of estimation uncertainty which will

be adopted in the annual statutory financial statements for the

year ending 31 May

Seasonality of operations

The Company expects to continue the historic norm of unequal

split of sales between the two halves of the year with higher sales

in the second half of the year.

Going concern

The financial statements have been prepared on a going concern

basis that the Directors believe to be appropriate. Whilst the

Group incurred a net loss of GBP1,482k during the period, the

Directors are satisfied that sufficient cash is available to meet

the Company's liabilities as and when they fall due for at least 12

months from the date of signing the half yearly report.

2. Taxation

Analysis of credit in the period

Six months Six months Year ended

ended ended ended

30-Nov 30-Nov 31-May

2018 2017 2018

GBP'000 GBP'000 GBP'000

(unaudited) (unaudited) (audited)

UK Corporation tax

Current tax on income - - -

for the period

Research and development

tax repayment - - 465

- - 465

-------------- ----------------------------------------- -----------

The effective rate of tax for the period/year is lower than the

standard rate of corporation tax in the UK of 20 per cent,

principally due to losses incurred by the Company.

The potential deferred tax asset relating to losses has not been

recognised in the financial statements because it is not possible

to assess whether there will be suitable taxable profits from which

the future reversal of the underlying timing differences can be

deducted.

3. Loss per share

Six months Six months Year

ended ended ended

30-Nov 30-Nov 31-May

2018 2017 2018

(unaudited) (unaudited) (audited)

Pence Pence Pence

Loss per share:

Basic and diluted (1.22) (1.17) (1.66)

------------- ------------- -----------

Loss per ordinary share is based on the Company's loss for the

financial period of GBP1,482k (30 November 2017: GBP1,294k loss; 31

May 2018: GBP1,834k loss). The weighted average number of shares

used in the basic calculation is 121,461,646 (31 May 2018:

110,280,735; 30 November 2017: 110,071,506).

The calculation of diluted loss per ordinary share is identical

to that used for the basic loss per ordinary share. This is because

the exercise of share options would have the effect of reducing the

loss per ordinary share and is therefore not dilutive under the

terms of International Accounting Standard 33 "Earnings per

share".

4. Segment reporting

Due to the startup nature of the business, the Company is

currently focused on building revenue streams from a variety of

different markets. As there is only one manufacturing facility, and

as this has capacity above and beyond the current levels of trade,

there is no requirement to allocate resources to or discriminate

between specific markets or products. As a result, the Company's

chief operating decision maker, the Chief Executive, reviews

performance information for the Company as a whole and does not

allocate resources based on products or markets. In addition, all

products manufactured by the Company are produced using similar

processes. Having considered this information in conjunction with

the requirements of IFRS 8, as at the reporting date the Board of

Directors has concluded that the Company has only one reportable

segment that being the manufacture and sale of carbon fibre

materials and the development of technologies associated with

this.

The Company considers it offers product technology namely carbon

fibre re-enforced ceramic material which is machined into different

shapes depending on the intended purpose of the end user.

Revenue by geographical destination is analysed as follows:

Six months ended Six months ended

30 Nov 2018 30 Nov 2017 Year ended

(unaudited) (unaudited) 31 May 2018 (audited)

GBP'000 GBP'000 GBP'000

United Kingdom 111 132 504

Rest of Europe 178 113 294

United States of America 208 175 529

Rest of World 12 104 36

----------------- ----------------- ------------------------

509 524 1,363

----------------- ----------------- ------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR SEIFMIFUSESE

(END) Dow Jones Newswires

February 26, 2019 02:00 ET (07:00 GMT)

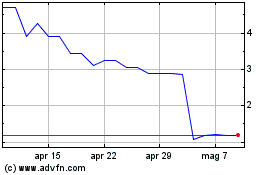

Grafico Azioni Surface Transforms (LSE:SCE)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Surface Transforms (LSE:SCE)

Storico

Da Apr 2023 a Apr 2024