Rio Tinto to Deliver Record Returns

27 Febbraio 2019 - 3:05PM

Dow Jones News

By WSJ City

Rio Tinto pledged record returns to shareholders as the mining

industry's cash bonanza continues, even as executives signal

concern over the global outlook.

KEY FACTS

--- Rio Tinto said annual capital returns would total $13.5bn

for 2018.

--- That includes a final dividend valued at $3.1bn and a

special dividend amounting to $4.0bn.

--- That was underpinned by a 56% surge in annual net profit,

mostly linked to the sale of operations.

Why This Matters

Rio Tinto, which handed investors a handsome $9.7bn in 2017,

joins a parade of global mining companies delivering cash to

shareholders as they reap the benefits of asset sales,

belt-tightening and strong balance sheets, repaired after a

commodity slump a few years back.

--- BHP, the world's biggest mining company by value, pledged

$13.2bn to investors for the first half of its fiscal year.

--- Glencore outlined plans for a new $2bn share buyback, which

it signaled it could increase later in the year.

--- Anglo American's payout, while steady, was bigger than the

market had expected.

A fuller story is available on WSJ.com

WSJ City: The news, the key facts and why it matters. Be deeply

informed in less than five minutes. You can find more concise

stories like this on the WSJ City app. Download now from the App

Store or Google Play, or sign up to newsletters here

http://www.wsj.com/newsletters?sub=356&mod=djemwsjcity

(END) Dow Jones Newswires

February 27, 2019 08:50 ET (13:50 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

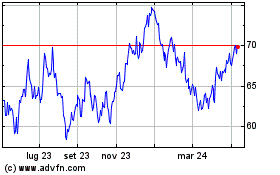

Grafico Azioni Rio Tinto (NYSE:RIO)

Storico

Da Mar 2024 a Apr 2024

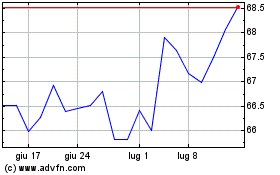

Grafico Azioni Rio Tinto (NYSE:RIO)

Storico

Da Apr 2023 a Apr 2024