By Rhiannon Hoyle

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 28, 2019).

SYDNEY -- Rio Tinto PLC pledged record returns to shareholders

as the mining industry's cash bonanza continues, even as executives

signal concern over the global outlook.

Rio Tinto, the world's second-biggest mining company by market

value, said Wednesday annual capital returns would total $13.5

billion for 2018, including a final dividend valued at $3.1 billion

and a special dividend amounting to $4.0 billion.

That was underpinned by a 56% surge in annual net profit, mostly

linked to the sale of operations, including a $3.5 billion stake in

an Indonesian copper mine.

Rio Tinto, which handed investors a handsome $9.7 billion in

2017, joins a parade of global mining companies delivering cash to

shareholders as they reap the benefits of asset sales and strong

balance sheets, repaired after a commodity slump a few years back.

The companies have also been reluctant to substantially increase

spending on growth and particularly acquisitions, even as profits

rise, after writing off megadeals struck at the peak of the

previous boom that later soured.

"We said we would reward our shareholders," said Rio Tinto Chief

Executive Jean-Sébastien Jacques.

For investors, this earnings season has offered a generous

bounty of often record payouts.

BHP Group Ltd., the world's biggest mining company by value,

pledged $13.2 billion to investors for the first half of its fiscal

year, via share buybacks and dividends, funded largely by the sale

of its U.S. shale business, mostly to BP PLC. The Melbourne,

Australia-based company said as it released its midyear results it

would pay $2.8 billion as an interim dividend.

Glencore PLC outlined plans for a new $2 billion share buyback,

which it signaled it could increase later in the year. It said

strong cash generation underpinned $5.2 billion in shareholder

returns and buybacks for 2018.

Anglo American PLC's payout, while steady, was bigger than the

market had expected. South32 Ltd. -- the metals- and coal-mining

company spun out of BHP in 2015 -- raised its midyear payout and

said it would hand out another special dividend.

Rio Tinto, which has also been buying back shares, Wednesday

reported a net profit of $13.64 billion for 2018, up from $8.76

billion a year earlier.

The company, one of the world's top iron-ore suppliers, said

profit before one-off items was up 2% at $8.81 billion, underpinned

by steady prices for commodities. That exceeded a consensus

expectation for an underlying profit of $8.53 billion, based on the

median of seven analyst forecasts compiled by The Wall Street

Journal.

While Rio Tinto, which has benefited from a jump in iron-ore

prices early in 2019, was broadly upbeat on the commodities it

sells, Mr. Jacques said the economic and geopolitical backdrop gave

reasons to be cautious.

"The risk of a trade war is still there," he told reporters. "It

is a very volatile environment."

BHP's chief executive, Andrew Mackenzie, this month also sounded

a warning over the U.S.-China trade conflict and raised concerns

about how that might affect growth, particularly in the U.S., this

year.

Mining companies insist the trade dispute -- which has included

tariffs on some commodities -- hasn't yet hurt sales, although they

say it has made the outlook for prices more unpredictable

Still, "I am the optimist in the room," said Rio Tinto's Mr.

Jacques. "I believe common sense will prevail at some stage."

A fine balancing act is also emerging as companies look to

satisfy yield-hungry investors and set their businesses up for

another stage of growth.

Though gold-mining giants are pursuing a new wave of megadeals,

most of the world's major diversified mining companies have been

adhering to strict spending rules, pleasing investors.

"I think the market would be concerned if there's any sign that

discipline will be abandoned," said Prasad Patkar, head of

qualitative investments at Platypus Asset Management, in a recent

interview.

However, others said companies might be sacrificing

opportunities for valuable growth. It can take five to 10 years for

new mines to start up, so companies risk being unable to capitalize

on any sudden rally in commodity prices.

"We are trying to just find the right balance between our

balance sheet, the compelling growth options we have and further

returns to our shareholders," Rio Tinto Chief Financial Officer

Jakob Stausholm said in an interview.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

February 28, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

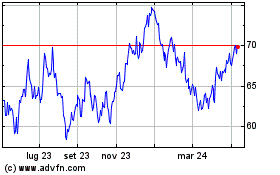

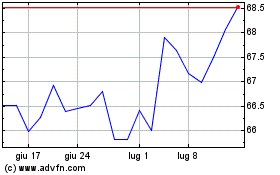

Grafico Azioni Rio Tinto (NYSE:RIO)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Rio Tinto (NYSE:RIO)

Storico

Da Apr 2023 a Apr 2024