88 Energy Limited Alaska Projects Update (3105T)

20 Marzo 2019 - 8:00AM

UK Regulatory

TIDM88E

RNS Number : 3105T

88 Energy Limited

20 March 2019

20(th) March 2019

88 Energy Limited

Alaska Projects Update

88 Energy Limited ("88 Energy" or the "Company", ASX:88E, AIM

88E) advises the following in relation to its oil and gas

operations on the North Slope of Alaska.

Highlights:

-- Project Icewine Conventional: farm-out process advances - preferred bidder selected

-- Project Icewine Unconventional: evaluation work continues - farm-out launch planned mid 2019

-- Yukon Leases: inversion finalised - interpretation nearing completion

-- Western Blocks: integration of Winx-1 result underway

Project Icewine Conventional

A fast track farm-out process commenced in August 2018, whilst

processing of newly acquired 3D seismic (March 2018) was still

underway. Processing was finalised in October 2018, including

inversion, marking the first time that potential farminees could

assess comprehensively the mapped conventional resource potential

on the Western Play Fairway at Project Icewine. Consequently,

requests were made by potential farminees for more time to evaluate

the opportunity, which the Company granted.

The farm-out process has now progressed to the next stage, with

a preferred bidder selected and discussions underway. The Company

advises that there is no guarantee that the parties will agree

terms and close out the transaction. A further announcement will be

made in due course on the outcome of the ongoing negotiations,

which are currently confidential in nature.

A map of the exploration/transactional activity near Icewine can

be viewed at the link below:

http://www.rns-pdf.londonstockexchange.com/rns/3105T_1-2019-3-19.pdf

The last 18 months have seen a significant increase in interest

in the acreage to the west of Project Icewine and on the same

latitude, marking a southerly trend in exploration focus.

ConocoPhillips acquired 3D seismic in 2018, 15 miles west of the

Project Icewine Western Margin Leases. The Company is also aware of

a multi-client 3D seismic acquisition planned immediately to the

west of, and adjacent to, the Project Icewine acreage (see

image).

Additional near term transactional activity is expected

associated with the on sale of an option acquired by Oil Search in

2017. This option is due to expire in June 2019 and includes

acreage immediately to the south of the Western Blocks (where

Winx-1 was recently drilled) and immediately west of Project

Icewine (where the multi-client 3D seismic acquisition is

planned).

Project Icewine Unconventional

Baker Hughes and the United States Geological Society (USGS)

continue to apply advanced evaluation techniques to the HRZ shale

play, including additional tests on both core and cuttings obtained

from the drilling of the Icewine-1 and Icewine-2 wells.

The Company continues to receive third party interest in the HRZ

shale project and anticipates being able to integrate the data from

the current evaluation into a dataroom by mid-2019 in order to

commence a formal farm-out process.

Yukon Leases

Final processing of the Yukon 3D seismic is now complete, with

interpretation and resource evaluation currently underway on the

inversion product. As previously reported, a number of prospective

horizons have been identified on the acreage, including the Cascade

lead, which was intersected peripherally by Yukon Gold-1, drilled

in 1994, and classified as an historic oil discovery. The Yukon

Leases are located adjacent to ANWR and in close proximity to

existing infrastructure.

Western Blocks

Data obtained from the drilling of the Winx-1 exploration well

will now be integrated into the existing dataset to develop our

understanding of the Nanushuk depositional model and further

evaluate the remaining resource potential of the acreage. There are

several working theories that will be assessed over the coming

months, including whether there is potential for better developed

sands updip and in closer proximity to the successful

Horseshoe-1/1A and Stony Hill-1 wells.

A map of the area of focus for post Winx-1 evaluation can be

viewed at the link below:

http://www.rns-pdf.londonstockexchange.com/rns/3105T_1-2019-3-19.pdf

88 Energy Ltd's Managing Director, Dave Wall, commented: "The

progression of the farm-out process to the preferred bidder phase

is encouraging but no deal is done until it is done.

The team at 88 Energy continues to advance the status of all our

Alaskan projects resulting in substantial value add activity

throughout 2019."

Media and Investor Relations:

88 Energy Ltd

Dave Wall, Managing Director Tel: +61 8 9485 0990

Email: admin@88energy.com

Finlay Thomson, Investor Relations Tel: +44 797 624 8471

Hartleys Ltd

Dale Bryan Tel: + 61 8 9268 2829

Cenkos Securities

Neil McDonald/Derrick Lee Tel: +44 131 220 6939

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DRLJLMMTMBTBBTL

(END) Dow Jones Newswires

March 20, 2019 03:00 ET (07:00 GMT)

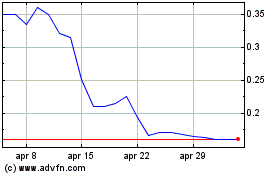

Grafico Azioni 88 Energy (LSE:88E)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni 88 Energy (LSE:88E)

Storico

Da Apr 2023 a Apr 2024