Pound Drops Amid Risk Aversion

04 Aprile 2019 - 8:31AM

RTTF2

The pound declined against its major counterparts in the early

European session on Thursday, as European shares fell, with bank

mergers, Brexit developments, and ongoing U.S.-China talks in

focus.

Investors also digested data showing that German factory orders

plunged by 4.2 percent month-on-month in February, marking their

sharpest fall since January 2017.

Elsewhere, White House economic adviser Larry Kudlow said

Wednesday the U.S. and China hope to get closer to a trade deal

this week.

President Donald Trump is due to meet with Chinese Vice Premier

Liu He in Washington today.

In a significant move, U.K. lawmakers approved a legislation

that forces Prime Minister Theresa May to seek for Brexit extension

beyond April 12.

The bill will be proceeded to the House of Lords for debate and

approval today.

The government and Labour will continue in-depth talks today to

break the Brexit deadlock.

The currency has been trading in a positive territory in the

Asian session as UK Parliament approved a bill to avoid no-deal

exit.

The pound edged down to 1.3141 against the greenback, from a

high of 1.3191 hit at 2:45 am ET. On the downside, 1.30 is likely

seen as the next support for the pound.

Pulling away from a high of 146.96 touched at 1:45 am ET, the

pound weakened to 146.40 against the yen. If the pound declines

further, 144.00 is likely seen as its next support level.

The pound retreated to 1.3124 against the Swiss franc, from a

high of 1.3167 touched at 3:45 am ET. Next key support for the

pound is likely seen around the 1.29 region.

The pound reversed from an early high of 0.8518 against the

euro, dropping to 0.8546. The pound is likely to find support

around the 0.87 region.

Survey from IHS Markit showed that the German construction

sector grew the most in 14 months in March, led by strong gains in

residential and commercial activity that boosted job creation.

IHS Markit's purchasing managers' index for the German

construction sector rose to 55.6 in March from 54.7 in February,

marking the highest reading since January 2018.

Looking ahead, at 7:30 am ET, the European Central bank

publishes the accounts of the monetary policy meeting of the

Governing Council held on March 6-7.

In the New York session, U.S. weekly jobless claims for the week

ended March 30 and Canada Ivey PMI for March are slated for

release.

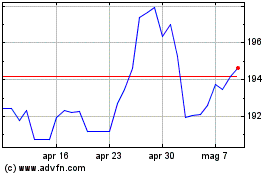

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Mar 2024 a Apr 2024

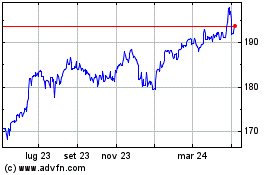

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Apr 2023 a Apr 2024