Ferrari announces voting results from its Annual General Meeting

12 Aprile 2019 - 4:11PM

Ferrari N.V. (NYSE/MTA: RACE) announced today that all

resolutions proposed to Shareholders at the Ferrari’s Annual

General Meeting of Shareholders (the “AGM”) held today in

Amsterdam, the Netherlands, were passed.

The Shareholders approved the 2018 Annual

Accounts and a dividend in cash1 of Euro 1.03 per outstanding

common share, totalling approximately Euro 194 million. The

outstanding common shares will be quoted ex-dividend from April 23,

2019. The record date for the dividend will be April 24, 2019 on

both MTA and NYSE and the dividend on the outstanding common shares

will be paid on May 2, 2019. Shareholders holding the Company’s

common shares on the record date that are traded on the NYSE will

receive the dividend in U.S. dollars at the official European

Central Bank EUR/USD exchange rate of April 17, 2019.

The Shareholders elected all nominees directors

of Ferrari. John Elkann and Louis C. Camilleri were elected as

executive directors of Ferrari. Piero Ferrari, Delphine Arnault,

Giuseppina Capaldo, Eduardo H. Cue, Sergio Duca, Maria Patrizia

Grieco, Adam Keswick and Elena Zambon were elected as non-executive

directors of Ferrari.

The Shareholders appointed Ernst & Young

Accountants LLP as Ferrari’s independent auditor until the 2020

Annual General Meeting of Shareholders.

The Shareholders delegated to the Board of

Directors authority to purchase common shares in the capital of

Ferrari up to a maximum of 10% of Ferrari’s issued common shares as

of the date of the AGM. Pursuant to the authorization, which does

not entail any obligation for Ferrari but is designed to provide

additional flexibility, Ferrari may purchase shares of its own

common stock from time to time in the 18 months following the AGM,

at a purchase price per share between, on the one hand, an amount

equal to the par value of the shares and, on the other hand, an

amount equal to 110% of the market price of the shares on the New

York Stock Exchange and/or the Mercato Telematico Azionario (as the

case may be), the market price being the average of the highest

price on each of the five days of trading prior to the date on

which the acquisition is made, as shown in the Official Price List

of the New York Stock Exchange and/or the Mercato Telematico

Azionario (as the case may be).

The Shareholders approved to cancel all special

voting shares in the share capital of the Company, currently held

by the Company in treasury. The cancellation may be executed in one

or more tranches, such to be determined by the Chief Executive

Officer.

The Shareholders further approved the awards

(and the metrics and targets applicable thereto) to the Chairman

and the Chief Executive Officer under the Company’s equity

incentive plans.

Details of the resolutions submitted to the AGM

are available on the Company’s corporate website at

http://corporate.ferrari.com.

Concurrently with the AGM, the Company published

its 2018 Sustainability Report. This Report was prepared in

accordance with the GRI Standards, the main international framework

for reporting on governance, environmental and social themes.

To view the 2018 Sustainability Report online,

please visit the following link:

http://corporate.ferrari.com/en/investors/results/reports.

1 The coupon number of the dividend is 4 (four).

- FNV 2018 AGM PR (ENG) 12.4.2019 Final

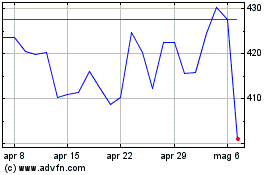

Grafico Azioni Ferrari NV (NYSE:RACE)

Storico

Da Mar 2024 a Apr 2024

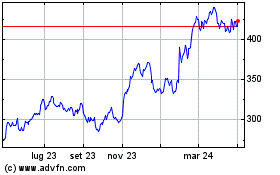

Grafico Azioni Ferrari NV (NYSE:RACE)

Storico

Da Apr 2023 a Apr 2024