Rio Tinto Scales Back Pilbara Iron Ore Guidance

16 Aprile 2019 - 1:41AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Rio Tinto PLC (RIO.LN) scaled back its

2019 target for iron ore production after operations in Australia's

remote Pilbara region were slugged by cyclones that compounded the

earlier hit to shipments from a port fire at the start of the

year.

The British-Australian company, one of the world's biggest

mining companies and top exporters of steel ingredient iron ore,

said it is braced for ongoing disruptions to shipments after

Tropical Cyclone Wallace hindered recovery work from the damage to

its port facilities caused by the earlier Tropical Cyclone Veronica

last month.

As a result of a further assessment of the damage to the port,

the mining company said shipments from the Pilbara operations in

northwest Australia were now expected to be between 333 million and

343 million metric tons. It cautioned that a recovery in the second

quarter of the year remained subject to weather conditions.

The company has maintained a focus on raising iron ore output

after a multiyear expansion, betting it can make strong margins

over the long run from a market it relies on for the bulk of its

earnings. Disruptions to Australian exports in recent weeks have

helped support spot-market prices for the commodity, which had been

buoyed by disruptions to Vale SA's (VALE) mines in Brazil in the

wake of a dam disaster in January.

Rio Tinto late last month cautioned annual iron ore shipments

from the Pilbara would be at the low end of a 338 million-350

million tons target range after operations at its Cape Lambert A

port facility were disrupted by Tropical Cyclone Veronica. That

compounded a hit of roughly 14 million tons in lost production at

Cape Lambert in January after facilities were damaged by fire.

Shipments of iron ore from operations controlled by Rio Tinto in

the Pilbara dropped by 14% year-over-year to 69.1 million tons in

the first quarter, while production was down 9% on year at 76

million tons.

Still, Chief Executive Jean-Sebastien Jacques said the

first-quarter operational performance in Rio Tinto's other products

was solid and generally higher than last year.

Among other products, the company's aluminum production for the

quarter was broadly flat on a year earlier, while mined copper

output was up 3% on-year at 143,900 tons. On Monday, Rio Tinto

committed US$302 million in additional capital to its Resolution

copper project in Arizona, which counts BHP Group Ltd. (BHP.AU) as

a partner, to fund further drilling, ore-body studies and improving

infrastructure. When fully operational, the company expects

Resolution will have the potential to supply almost 25% of U.S.

copper demand.

First-quarter production from Rio Tinto's Iron Ore Co. of Canada

was 5% higher at 2.5 million tons, which the company said was

despite adverse weather denting output in February.

Less than two months ago, Rio Tinto offered up bumper returns to

its shareholders with plans to hand out US$13.5 billion in capital

for 2018, including a special dividend of US$4 billion. The payout

was underpinned by a 56% jump in annual net profit, thanks in part

to the sale of assets including a stake in an Indonesian copper

mine.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

April 15, 2019 19:26 ET (23:26 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

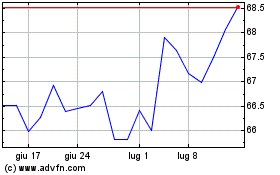

Grafico Azioni Rio Tinto (NYSE:RIO)

Storico

Da Mar 2024 a Apr 2024

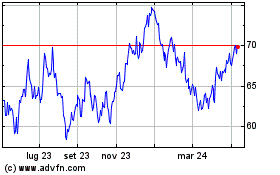

Grafico Azioni Rio Tinto (NYSE:RIO)

Storico

Da Apr 2023 a Apr 2024