TIDM88E

RNS Number : 5052W

88 Energy Limited

18 April 2019

18(th) April 2019

QUARTERLY REPORT AND APPIX 5B

Report on Activities for the Quarter ended 31 March 2019

The Directors of 88 Energy Limited ("88 Energy" or the

"Company", ASX & AIM:88E) provide the following report for the

quarter ended 31 March 2019.

Highlights

Project Icewine

-- The Conventional farm-out campaign continued in the quarter,

with the deadline for bids extended to end January due to demand

from multiple parties. After consideration, a preferred bidder was

selected by the Company in March 2019;

-- Subject to the negotiation of terms and conditions, the

Conventional portfolio farm-out deal is targeted in Q2 2019, with

the intention to drill an exploration / appraisal well in 2020;

and

-- Unconventional portfolio evaluation work continued in Q1,

with a farm-out launch planned mid 2019.

Western Blocks - Winx-1

-- The Permit to Drill for the Winx-1 exploration well was

approved by the Alaska Oil and Gas Conservation Commission (AOGCC)

on the 16th January;

-- The Winx-1 exploration well spudded on schedule on 15th

February, with the well intersecting all the of the pre-drill

targets safely and efficiently;

-- Total Depth of 6,800' was reached on the 3rd March 2019,

having intersected all targets, including the primary Nanushuk

Formation Topset objective;

-- Petrophysical analysis of the wireline logging program

indicated low oil saturations in both the primary Nanushuk Topset

objectives and the Torok objective, with testing and fluid sampling

indicating that reservoir quality and fluid mobility at this

location are considered insufficient to warrant production

testing;

-- The Winx-1 well was successfully plugged and abandoned on the 18(th) March,2019 (AK time);

-- Both the Nordic#3 rig and associated services were fully

demobilised prior to the end of the quarter; and

-- Drilling operations were completed on time and without

incident, and it is anticipated that well costs will be on or

slightly under budget.

Yukon Acreage

-- Processing of the Yukon 3D seismic is complete, with

interpretation and resource evaluation currently underway on the

inversion product.

Project Icewine

-- Project Icewine Conventional

A fast track farm-out campaign commenced in August 2018, whilst

processing of newly acquired 3D seismic (March 2018) was still

underway. Processing was finalised in October 2018, including

inversion, marking the first time that potential farminees could

comprehensively assess the mapped conventional resource potential

on the Western Play Fairway at Project Icewine. Consequently,

requests were made by potential farminees for more time to evaluate

the opportunity, which the Company granted.

The farm-out process has now progressed to the next stage, with

a preferred bidder selected and discussions underway. The Company

advises that there is no guarantee that the parties will agree

terms and close out the transaction. A further announcement will be

made in due course on the outcome of the ongoing negotiations,

which are currently confidential in nature.

-- Exploration/transactional activity near Icewine highlights potential of the acreage

The last 18 months have seen a significant increase in interest

in the acreage to the west of Project Icewine and on the same

latitude, marking a southerly trend in exploration focus.

ConocoPhillips acquired 3D seismic in 2018, 15 miles west of the

Project Icewine Western Margin Leases. The Company is also aware of

a multi-client 3D seismic acquisition planned immediately to the

west of, and adjacent to, the Project Icewine acreage.

Additional near term transactional activity by others is

expected associated with the on sale of an option acquired by Oil

Search in 2017. This option expires in June 2019 and includes

acreage immediately to the south of the Western Blocks (where

Winx-1 was recently drilled) and immediately west of Project

Icewine (where the multi-client 3D seismic acquisition is

planned).

-- Project Icewine Unconventional

Baker Hughes and the United States Geological Society (USGS)

continue to apply advanced evaluation techniques to the HRZ shale

play, including additional tests on both core and cuttings obtained

from the drilling of the Icewine-1 and Icewine-2 wells.

The Company continues to receive third party interest in the HRZ

shale project and anticipates being able to integrate the data from

the current evaluation into a dataroom by mid-2019 in order to

commence a formal farm-out process.

-- Purchase of Outstanding Tax Credits and an Additional Tax Credit Certificate Granted

On the 9th of January the Alaskan Department of Revenue ("DoR")

informed the Company of the purchase of US$1.57 million in tax

credits, with the funds received directly applied against the

Brevet debt facility. Debt outstanding at the end of the quarter

totalled US$15.4 million.

Further, on the 26th of March, the Company was informed by the

Alaska DoR that it had issued a Credit Certificate to Accumulate

Energy Alaska Inc., (100% owned subsidiary of 88 Energy Ltd), for

US$2.35m related to CY2016 2D seismic expenditure. The total

expected cashable credits owed by the State to 88E at quarter end

was US$19.1 million, which is far in excess of debt outstanding of

US$15.4 million.

Western Blocks

-- Operations

The Permit to Drill for the Winx-1 exploration well was approved

by the Alaska Oil and Gas Conservation Commission (AOGCC) on the

16(th) January 2019, and with the completion of the construction of

the 11 mile ice road in late January the Nordic#3 rig was mobilised

and arrived at the drill site location as planned on the 7th

February.

Spud of the Winx-1 exploration well occurred on schedule on 15th

February 2019, with the well intersecting all the of the pre-drill

targets safely and efficiently. Total Depth of 6,800' was reached

on the 3rd March 2019, with multiple potential pay zones identified

in the Nanushuk Formation Topset Play (primary targets) and Torok

Formation (secondary targets).

The Winx-1 well was plugged and abandoned on the 18(th) March

2019, with the rig and associated services fully demobilised prior

to the end of the quarter. Drilling operations were completed on

time and without incident, and it is anticipated that well costs

have come in on or slightly under budget

-- Winx-1 Results

Petrophysical interpretation of the LWD data at Winx-1 indicated

elevated resistivities associated with increased mud gas ratios (C1

- C5) in the distinctive Nanushuk Topset sequence, comparable with

other successful neighbouring wells in the Nanushuk play fairway.

Early indications were encouraging and, on this basis, a

comprehensive wireline program was undertaken to further evaluate

the interval of interest.

The wireline program was designed to fully evaluate and quantify

the reservoir potential and associated shows in the Nanushuk

Topsets. The suite comprised specialist logging tools capable of

quantifying laminated pay zones, including nuclear magnetic

resonance; a triaxial induction tool that measures both horizontal

and vertical resistivity, and an MDT program to determine pressure

gradients and sample fluids from the zones of interest.

Wireline results indicate low oil saturations in the Nanushuk

Topsets not conducive to successfully flowing the formation, as

borne out by the MDT sampling results, which did not retrieve

hydrocarbon samples. Reservoir properties appear to be compromised

by dispersed clay in the matrix at Winx-1. This clay is often

present in other successful Nanushuk wells but in discrete

laminations with decent quality, high resistivity, oil saturated

sandstones in between. The dispersed clay in the Nanushuk at Winx

impacts both fluid mobility and oil saturations. The clay serves to

bind much of the fluid present in place so that it cannot flow. It

also occupies pore space within the formation, resulting in a lower

relative hydrocarbon saturation. This means that, whilst oil is

present in the reservoir, there is less of it and it is not mobile.

Further evaluation will be undertaken post drill to fully

understand the implications of the petrophysical results

The reservoir performance in the Torok Channel Sequence was

better than the Nanushuk in the Winx-1 well, as evidenced by

relatively faster influx of fluid during MDT sampling. On

completion of the wireline logging program it is apparent that the

oil saturations in the Torok zone of interest are also low and not

conducive to hydrocarbon flow. The oil saturations are evidence of

an active petroleum system / charge and further work is required to

determine whether there is an effective trapping mechanism at this

location or elsewhere on the leases.

-- Performance Bond

In consideration for acquiring a working interest from Great

Bear Petroleum in the Western Blocks the Company, and Consortium

partners, provided a US$3.0 million Performance Bond to the State

of Alaska in July 2018 as part of the commitment to drilling an

exploration well by May 31 2019.

On satisfying the requirement of drilling an exploration well on

the acreage 88 Energy have earnt the rights to a 36% working

interest on the acreage. Well data was submitted to the Department

of Natural Resources, Division of Oil and Gas in March to initiate

the release of the US$3.0 million performance bond, (US$1.2 million

net to 88E), having fulfilled the requirement of drilling an

exploration well by May 31 2019.

-- Forward Plan

The forward plan is to further evaluate and integrate the

valuable data acquired at Winx-1, reprocess the Nanuq 3D seismic

(2004) in order to evaluate the remaining prospectivity on the

Western Leases including the Nanushuk Fairway potential.

Yukon Leases

Final processing of the Yukon 3D seismic was completed in the

quarter, with interpretation and resource evaluation currently

underway on the inversion product. As previously reported, a number

of prospective horizons have been identified on the acreage,

including the Cascade lead, which was intersected peripherally by

Yukon Gold-1, drilled in 1994, and classified as an historic oil

discovery. The Yukon Leases are located adjacent to ANWR and in

close proximity to existing infrastructure.

Corporate

The ASX Appendix 5B attached to this report contains the

Company's cash flow statement for the quarter. The significant cash

flows for the period were:

-- Exploration and evaluation expenditure totalled A$8.3m

(gross), primarily associated with the Winx-1 drilling

operations;

-- Payments in relation to the debt facility interest totalled A$0.6m (US$0.6m); and

-- Administration and other operating costs A$0.6m (Dec'18 Quarter A$1.0m).

At the end of the quarter, the Company had cash reserves of

A$19.6m, including cash balances held in Joint Venture bank

accounts relating to Joint Venture Partner contributions totalling

$7.0m.

Information required by ASX Listing Rule 5.4.3:

Project Name Location Area (acres)

-------------- ----------------

Interest at

beginning of Interest at

Quarter end of Quarter

----------------- ---------------------- ------------- -------------- ----------------

Onshore, North Slope

Project Icewine Alaska 528,000 66% 66%

Onshore, North Slope

Yukon Gold Alaska 15,312(1) 100% 100%

Onshore, North Slope

Western Blocks Alaska 22,711 0% 36%

(1) 1,118 acres subject to formal award

Pursuant to the requirements of the ASX Listing Rules Chapter 5

and the AIM Rules for Companies, the technical information and

resource reporting contained in this announcement was prepared by,

or under the supervision of, Dr Stephen Staley, who is a

Non-Executive Director of the Company. Dr Staley has more than 35

years' experience in the petroleum industry, is a Fellow of the

Geological Society of London, and a qualified Geologist /

Geophysicist who has sufficient experience that is relevant to the

style and nature of the oil prospects under consideration and to

the activities discussed in this document. Dr Staley has reviewed

the information and supporting documentation referred to in this

announcement and considers the prospective resource estimates to be

fairly represented and consents to its release in the form and

context in which it appears. His academic qualifications and

industry memberships appear on the Company's website and both

comply with the criteria for "Competence" under clause 3.1 of the

Valmin Code 2015. Terminology and standards adopted by the Society

of Petroleum Engineers "Petroleum Resources Management System" have

been applied in producing this document.

Media and Investor Relations:

88 Energy Ltd

Dave Wall, Managing Director Tel: +61 8 9485 0990

Email: admin@88energy.com

Finlay Thomson, Investor Relations Tel: +44 7976 248471

Hartleys Ltd

Dale Bryan Tel: + 61 8 9268 2829

Cenkos Securities

Neil McDonald/Derrick Lee Tel: +44 131 220 6939

This announcement contains inside information.

Appendix 5B

Mining exploration entity and oil and gas exploration entity

quarterly report

Introduced 01/07/96 Origin Appendix 8 Amended 01/07/97,

01/07/98, 30/09/01, 01/06/10, 17/12/10, 01/05/13, 01/09/16

Name of entity

-----------------------------------------------------

88 Energy Limited

ABN Quarter ended ("current quarter")

--------------- ----------------------------------

80 072 964 179 31 March 2019

----------------------------------

Consolidated statement of cash Current quarter Year to date

flows $A'000 (3 months)

$A'000

1. Cash flows from operating

activities

1.1 Receipts from customers - -

1.2 Payments for

(a) exploration & evaluation (8,273) (8,273)

(b) development - -

(c) production - -

(d) staff costs (329) (329)

(e) administration and corporate

costs (262) (262)

1.3 Dividends received (see note - -

3)

1.4 Interest received 7 7

Interest and other costs of

1.5 finance paid (610) (610)

1.6 Income taxes paid - -

1.7 Research and development refunds - -

1.8 Other (JV Partner Contributions) 7,362 7,362

---------------- -------------

Net cash from / (used in)

1.9 operating activities (2,105) (2,105)

----- ------------------------------------- ---------------- -------------

2. Cash flows from investing

activities

2.1 Payments to acquire:

(a) property, plant and equipment - -

(b) tenements (see item 10) - -

(c) investments - -

(d) other non-current assets - -

2.2 Proceeds from the disposal

of:

(a) property, plant and equipment - -

(b) tenements (see item 10) - -

(c) investments - -

(d) other non-current assets - -

2.3 Cash flows from loans to - -

other entities

2.4 Dividends received (see note - -

3)

2.5 Other: a) Bond - State of - -

Alaska - -

b) JV Partner Contribution

- Bond

---------------- -------------

2.6 Net cash from / (used in) - -

investing activities

------- ----------------------------------- ---------------- -------------

3. Cash flows from financing

activities

3.1 Proceeds from issues of shares - -

3.2 Proceeds from issue of convertible - -

notes

3.3 Proceeds from exercise of - -

share options

3.4 Transaction costs related - -

to issues of shares, convertible

notes or options

3.5 Proceeds from borrowings - -

3.6 Repayment of borrowings - -

3.7 Transaction costs related - -

to loans and borrowings

3.8 Dividends paid - -

3.9 Other (Fees for debt refinancing) - -

---------------- -------------

3.10 Net cash from / (used in) - -

financing activities

------- ----------------------------------- ---------------- -------------

4. Net increase / (decrease)

in cash and cash equivalents

for the period

Cash and cash equivalents

4.1 at beginning of period 21,723 21,723

Net cash from / (used in)

operating activities (item

4.2 1.9 above) (2,105) (2,105)

4.3 Net cash from / (used in) - -

investing activities (item

2.6 above)

4.4 Net cash from / (used in) - -

financing activities (item

3.10 above)

Effect of movement in exchange

4.5 rates on cash held (22) (22)

---------------- -------------

Cash and cash equivalents

4.6 at end of period 19,596 19,596

------- ----------------------------------- ---------------- -------------

5. Reconciliation of cash and Current quarter Previous quarter

cash equivalents $A'000 $A'000

at the end of the quarter

(as shown in the consolidated

statement of cash flows) to

the related items in the accounts

5.1 Bank balances 19,596 21,723

5.2 Call deposits - -

5.3 Bank overdrafts - -

5.4 Other (provide details) - -

---------------- -----------------

Cash and cash equivalents

at end of quarter (should

5.5 equal item 4.6 above) 19,596 21,723

---- ----------------------------------- ---------------- -----------------

6. Payments to directors of the entity and Current quarter

their associates $A'000

Aggregate amount of payments to these parties

6.1 included in item 1.2 170

----------------

6.2 Aggregate amount of cash flow from loans -

to these parties included in item 2.3

----------------

6.3 Include below any explanation necessary to understand

the transactions included in items 6.1 and 6.2

----- -----------------------------------------------------------------

6.1 Payments relate to Director and consulting fees paid to

Directors. All transactions involving directors and associates

were on normal commercial terms.

7. Payments to related entities of the entity Current quarter

and their associates $A'000

Aggregate amount of payments to these parties

7.1 included in item 1.2 13

----------------

7.2 Aggregate amount of cash flow from loans -

to these parties included in item 2.3

----------------

7.3 Include below any explanation necessary to understand

the transactions included in items 7.1 and 7.2

----- -----------------------------------------------------------------

7.1 Payments relate to consulting fees paid to Director related

entities. Consultant fees paid to associated entities were

on normal commercial terms.

8. Financing facilities available Total facility Amount drawn

Add notes as necessary for amount at quarter at quarter end

an understanding of the position end $US'000

$US'000

8.1 Loan facilities 15,405 15,405

------------------- ----------------

8.2 Credit standby arrangements - -

------------------- ----------------

8.3 Other (please specify) - -

------------------- ----------------

8.4 Include below a description of each facility above, including

the lender, interest rate and whether it is secured or

unsecured. If any additional facilities have been entered

into or are proposed to be entered into after quarter

end, include details of those facilities as well.

---- -------------------------------------------------------------------------

* On the 23rd of March 2018, 88 Energy Lt's 100%

controlled subsidiary Accumulate Energy Alaska Inc

entered into a US$ 16.5 million debt refinancing

agreement to replace the existing Bank of America

debt facility. The key terms to the facility are

noted in the ASX announcement released on 26th of

March 2018. The facility is secured by available

Production Tax Credits.

9. Estimated cash outflows for next $A'000

quarter

9.1 Exploration and evaluation* (5,700)

9.2 Development -

9.3 Production -

9.4 Staff costs (350)

9.5 Administration and corporate costs (380)

9.6 Other (provide details if material)** (550)

--------

9.7 Total estimated cash outflows (6,980)

---- -------------------------------------- --------

* Includes amounts relating to lease rentals, 3D seismic

inversion, G&A, G&G, expenditure on Winx-1 drilling

operations which are net of anticipated JV partner contributions

and return of the Alaskan DnR Bond.

** Includes amounts relating to costs associated with the Brevet

debt interest costs.

10. Changes in tenements Tenement Nature of interest Interest Interest

(items 2.1(b) reference at beginning at end

and 2.2(b) above) and location of quarter of quarter

10.1 Interests in N/A

mining tenements

and petroleum

tenements lapsed,

relinquished

or reduced

----- --------------------- -------------- ------------------- -------------- ------------

10.2 Interests in N/A

mining tenements

and petroleum

tenements acquired

or increased

----- --------------------- -------------- ------------------- -------------- ------------

1.1 Compliance statement

1 This statement has been prepared in accordance with accounting

standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Sign here: ............................................................ Date: .............................................

(Company Secretary)

Print name: Sarah Smith

Notes

1. The quarterly report provides a basis for informing the

market how the entity's activities have been financed for the past

quarter and the effect on its cash position. An entity that wishes

to disclose additional information is encouraged to do so, in a

note or notes included in or attached to this report.

2. If this quarterly report has been prepared in accordance with

Australian Accounting Standards, the definitions in, and provisions

of, AASB 6: Exploration for and Evaluation of Mineral Resources and

AASB 107: Statement of Cash Flows apply to this report. If this

quarterly report has been prepared in accordance with other

accounting standards agreed by ASX pursuant to Listing Rule 19.11A,

the corresponding equivalent standards apply to this report.

3. Dividends received may be classified either as cash flows

from operating activities or cash flows from investing activities,

depending on the accounting policy of the entity.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DRLGMGMDVRMGLZG

(END) Dow Jones Newswires

April 18, 2019 02:05 ET (06:05 GMT)

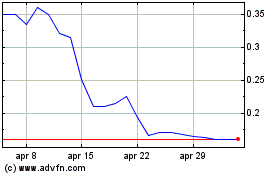

Grafico Azioni 88 Energy (LSE:88E)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni 88 Energy (LSE:88E)

Storico

Da Apr 2023 a Apr 2024